Have you ever found yourself scratching your head over a mysterious charge on your credit card statement? It's more common than you think, and addressing these billing errors quickly is essential for maintaining your financial health. In this article, we'll guide you through crafting a clear and concise letter to dispute discrepancies with your credit card company. So, let's dive in and ensure you know exactly how to tackle those pesky billing mistakes!

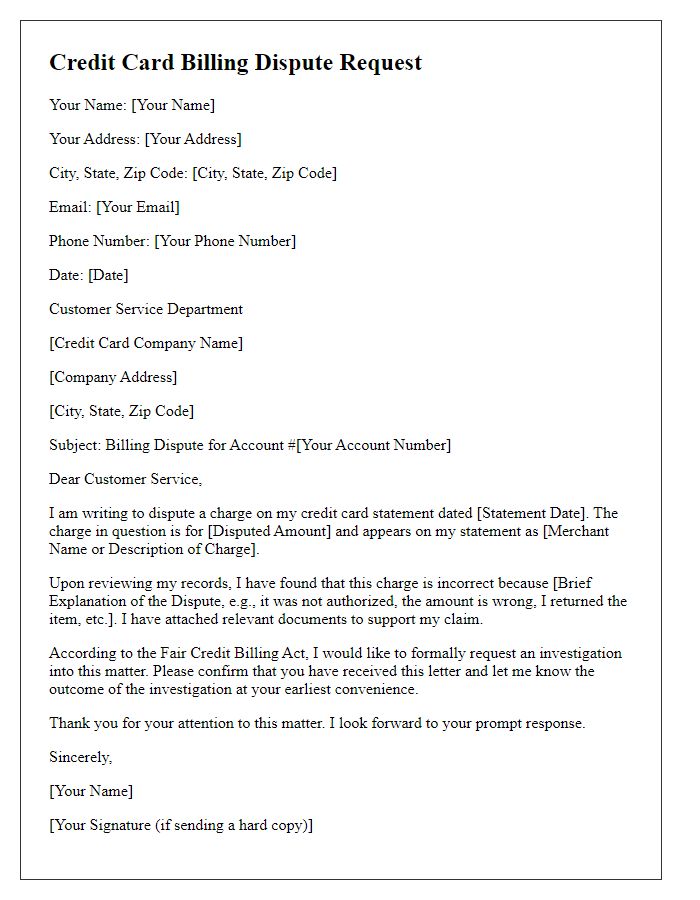

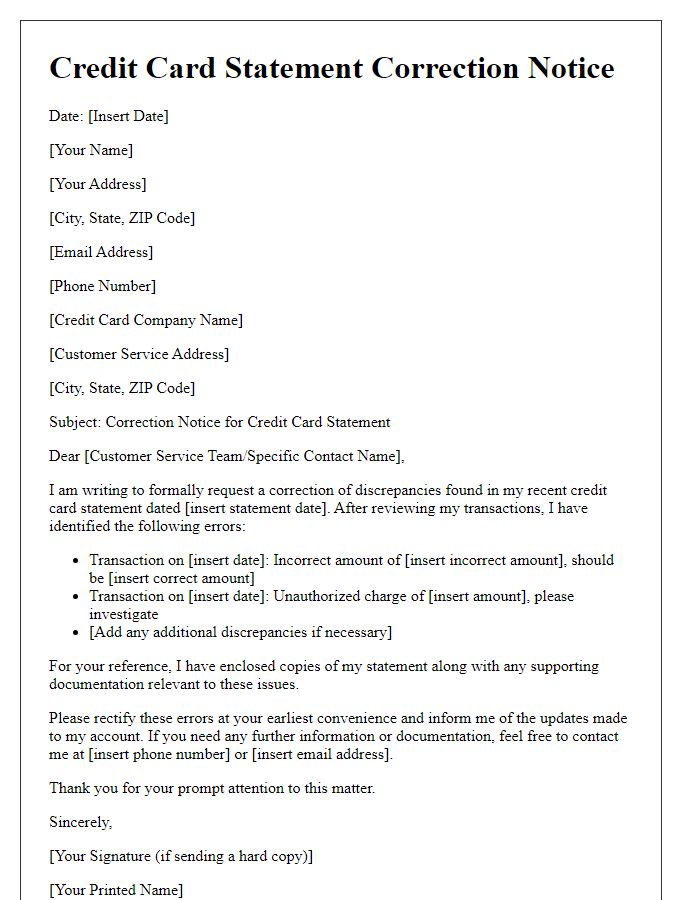

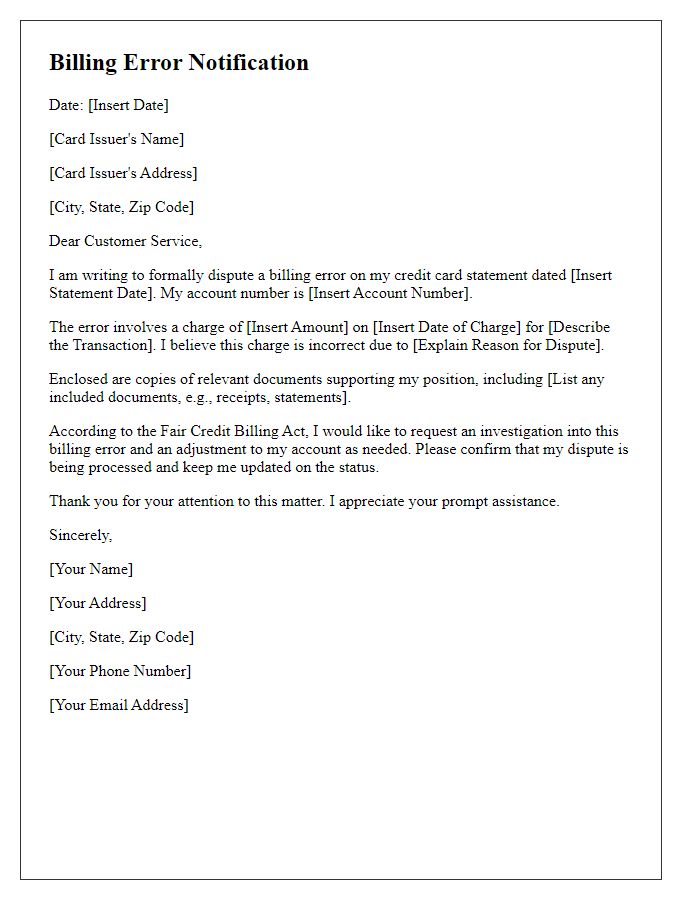

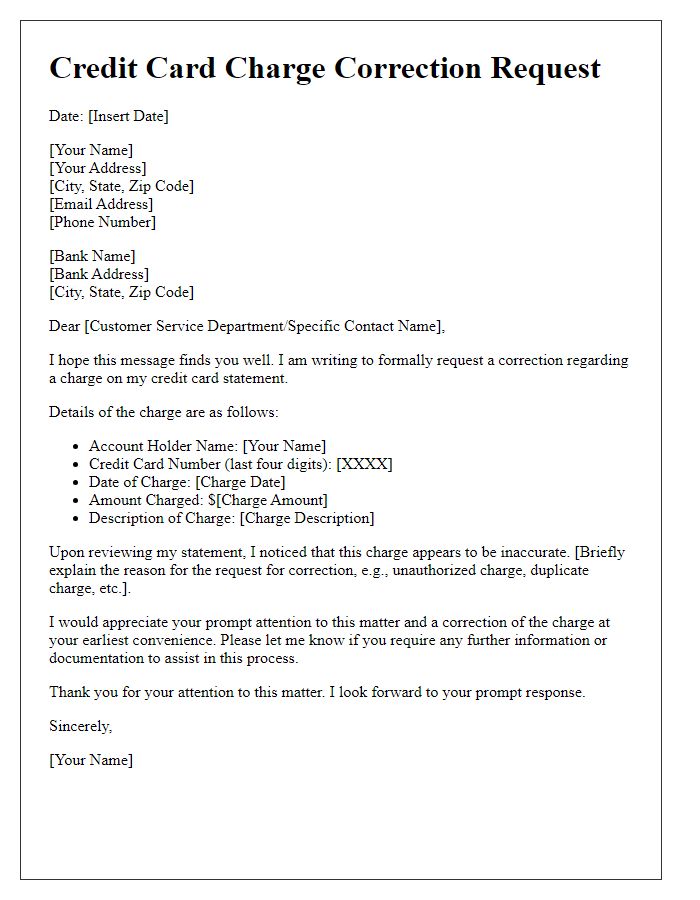

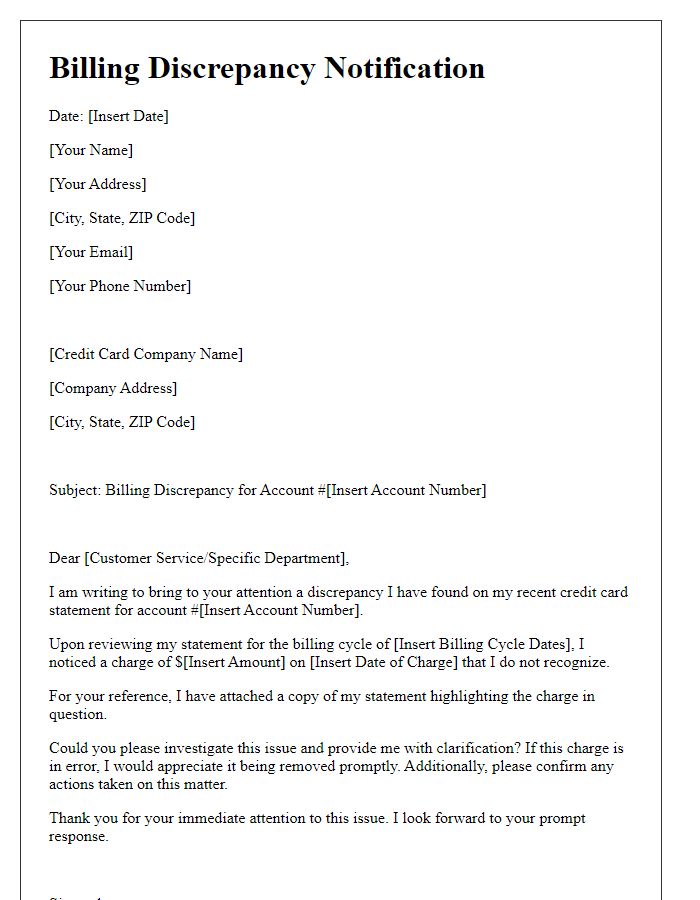

Clear description of the billing error.

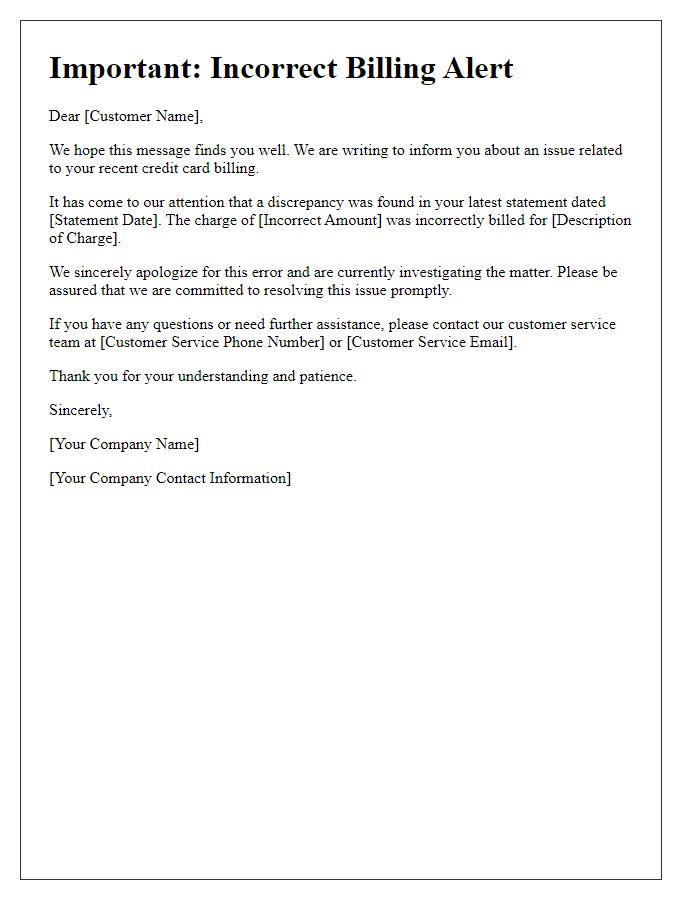

Inaccurate billing statements can lead to confusion and disputes for consumers. A recent analysis of billing errors revealed that charges made on a credit card, such as Visa or MasterCard, might reflect incorrect amounts or duplicate transactions due to technical glitches in processing systems. For example, a single $150 transaction at Target (official store name) could mistakenly appear twice, leading to an inflated total balance. Such discrepancies often stem from merchant processing errors or delays in transaction clearing. Immediate action is essential to rectify these errors, ensuring the correct amount is accurately reflected on the next billing statement, thereby maintaining consumer trust in financial institutions.

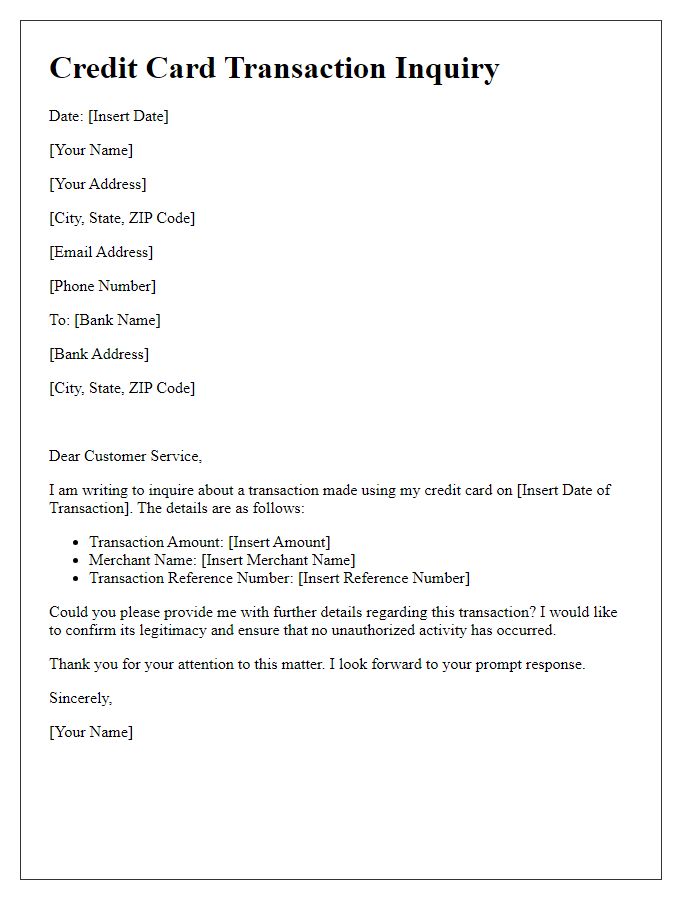

Account and transaction details.

Billing errors on credit card statements can lead to confusion and financial discrepancies for consumers. For instance, a transaction recorded on October 15, 2023, for $150 at a local grocery store may be inaccurately charged as $250. Such discrepancies often involve accounts with significant activities, impacting services and purchases. Each credit card issuer (like Visa or Mastercard) has specific protocols to address these errors. The account number, essential for identifying the customer, should be kept confidential yet precisely referenced in correction requests. Detailed information, including the transaction date, merchant name, and the exact amount charged versus the expected amount, facilitates swift resolution from the customer service department. Supporting documents, like receipts, strengthen the case for correction. Promptly reporting errors aids in maintaining accurate financial records and mitigating potential repercussions on credit scores.

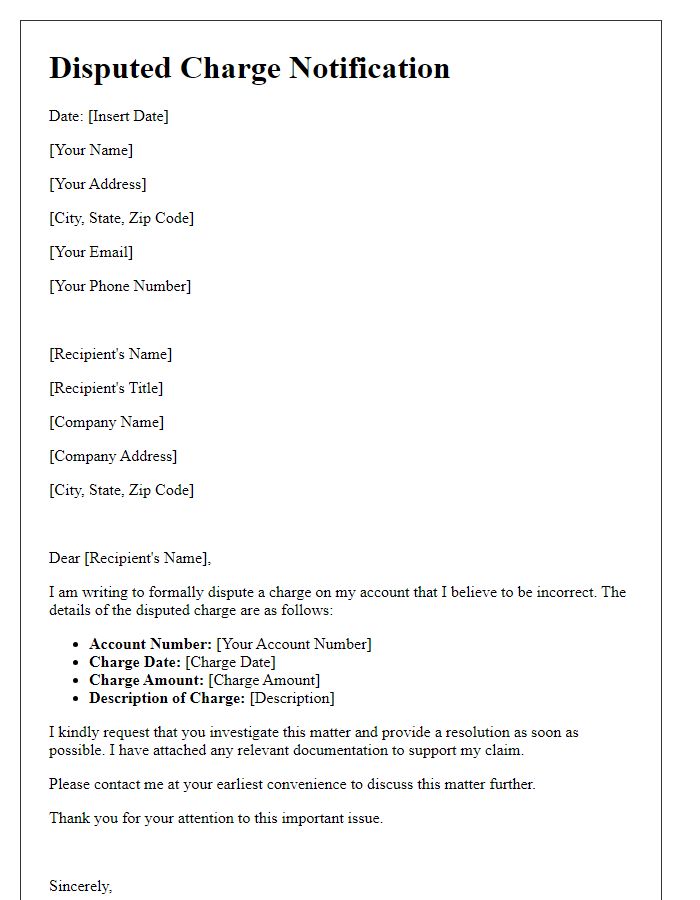

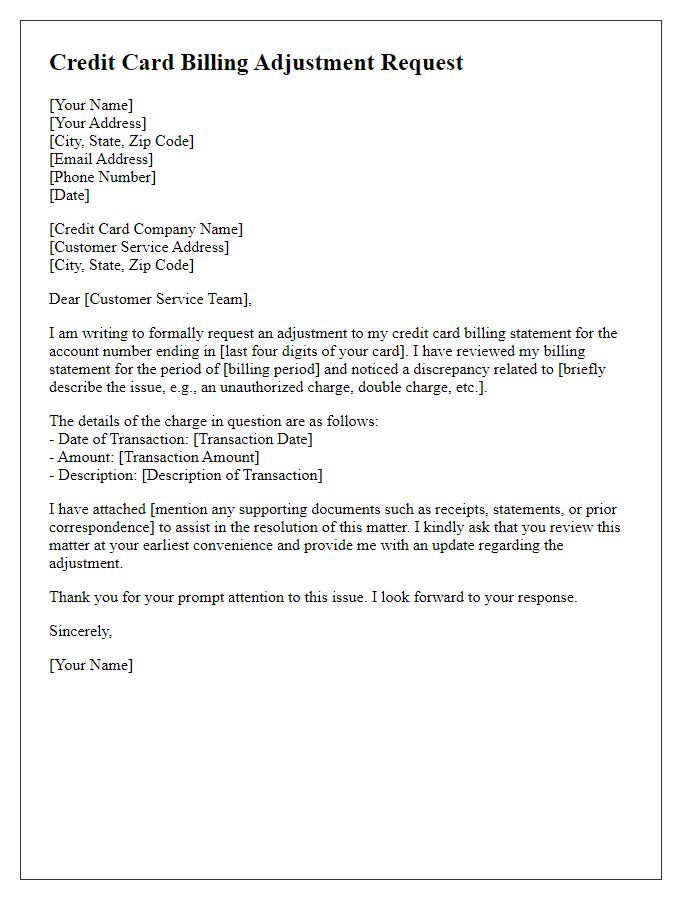

Supporting documents or evidence.

Credit card billing errors can occur due to various reasons, such as duplicate charges or incorrect amounts. In these instances, consumers must prepare supporting documents to validate their claims effectively. Essential evidence may include copies of previous billing statements, receipts from transactions (showing the exact amounts and dates), email correspondence with the merchant regarding the disputed charge, and any photographs of in-store receipts. Specific details, such as the date of dispute (e.g., October 15, 2023), the amount in question (for instance, $120.50), and the merchant's details (like Walmart), should be clearly highlighted. Gathering these documents allows for a comprehensive presentation of the case to the credit card issuer, promoting a smoother resolution process.

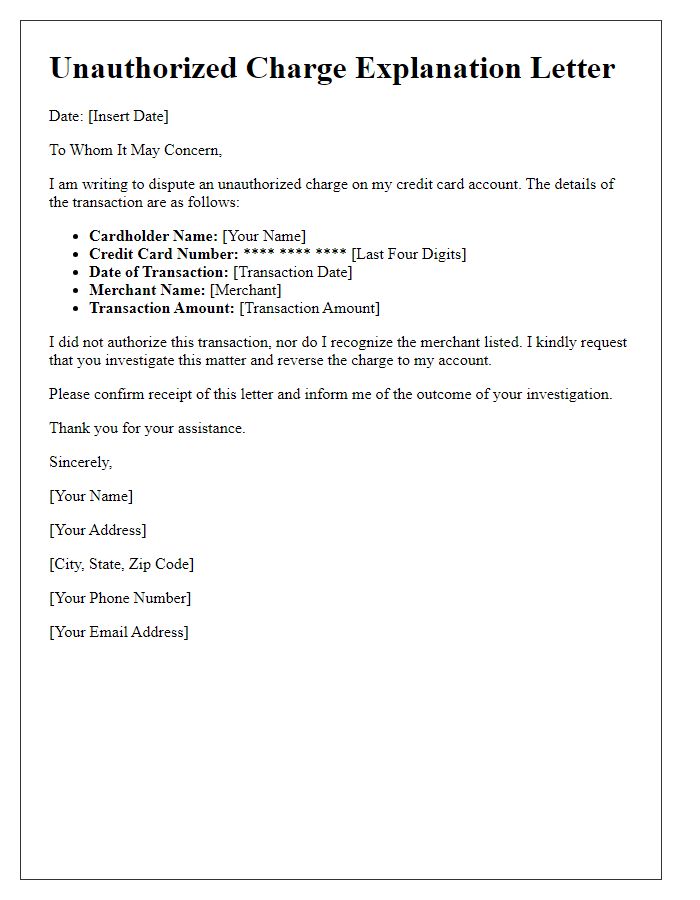

Request for correction and credit adjustment.

When encountering a credit card billing error, immediate action is essential to ensure accurate account management. Customers should contact their credit card issuer, such as Visa or MasterCard, providing details like account number, transaction date, and disputed amount. Documenting errors involves retaining receipts, transaction statements, and any prior communications related to the billing issue. An organized approach, clearly stating the request for correction and credit adjustment, helps in resolving discrepancies efficiently. Credit card issuers often adhere to a time frame (usually up to 30 days) for investigating disputes, ensuring accountability and transparency in the billing process. Clear communication with the issuer is crucial for successful resolution.

Contact information for follow-up.

A billing error on a credit card statement can lead to unexpected charges that disrupt personal finances. For instance, if a user receives a statement from Visa revealing an incorrect charge of $150 on a dining expense (which typically should reflect a $50 charge), it calls for immediate correction. Essential contact details for follow-up include the customer service number, often found on the back of the credit card (e.g., 1-800-VISA-911), and email support options available through the bank's website. Timely communication with the financial institution ensures discrepancies are corrected, maintaining a reliable credit history. Additionally, documenting the transaction details, such as the date, merchant name, and charge amount, supports the resolution process.

Comments