Setting up recurring payments for your credit card can be a game-changer in managing your finances more effectively. Instead of worrying about missed deadlines and late fees, automating your payments ensures that your bills are always paid on time, freeing you to focus on what really matters. Whether you're handling subscriptions or monthly expenses, this simple setup can provide peace of mind and better control over your budget. Curious about how to get started? Read on to discover the step-by-step process to set up your recurring payments hassle-free!

Payee Information

Credit card recurring payment setup involves entering specific payee information, crucial for seamless transaction processing. The payee's name, such as a service provider or subscription company, must be accurately recorded to ensure proper billing. An account number, typically unique to the payee and customer, is essential for linking the payment to the correct service. The billing address, consisting of the street name, city, state, and postal code, is required to validate the transaction and comply with regulatory requirements. Additionally, the payee's contact information, including email and phone number, is vital for any follow-up or billing inquiries, ensuring clear communication channels for discrepancies or confirmations.

Payer Information

Setting up a recurring payment for credit card transactions requires clear payer information, ensuring seamless billing and transaction accuracy. Key details include the payer's full name (indicating the account holder associated with the credit card), billing address (including street address, city, state, and zip code for accurate invoicing), email address (for transaction confirmations and notifications), and phone number (for customer service follow-ups). Additionally, card information is required, such as the credit card number (the 16-digit account identifier), expiration date (indicating the month and year the card is valid until), and the CVV (three-digit security code on the back of the card for fraud protection). Essential details about the payment schedule include frequency (weekly, monthly, annually), start date, and any specific instructions regarding payment limits. This comprehensive data is vital for maintaining accurate and efficient recurring billing processes, reducing potential payment disruptions.

Authorization Consent

Recurring credit card payments offer a convenient method for settling bills, subscriptions, and memberships automatically on a predetermined schedule. Customers authorize businesses to charge their credit cards regularly, such as monthly or annually, streamlining the payment process. For instance, a Netflix subscription costs approximately $15.49 per month, allowing users uninterrupted access to streaming services. Careful consideration of terms, including cancellation policies, is essential for consumers to avoid unexpected charges. Additionally, security measures, such as data encryption, are critical for protecting sensitive credit card information during each transaction. Regularly reviewing credit card statements remains important to ensure accuracy and detect any unauthorized charges promptly.

Payment Details

Recurring payment setups often involve critical details such as credit card information and billing cycles. For credit card transactions, valid card numbers (typically 16 digits for Visa and MasterCard) are required along with the expiration date (usually formatted as MM/YY). The CVV (Card Verification Value), a 3-digit number found on the back of the card, enhances security. Payment frequency can vary; common options include monthly, bi-monthly, or quarterly intervals. Clear terms regarding the total amount charged, any potential fees, and conditions for cancellation must also be outlined to ensure transparency for the cardholder. Additionally, providing a secure link for entering sensitive credit card details protects against fraud.

Terms and Conditions

Recurring credit card payments for subscription services involve automated billing agreements that align with specific terms and conditions. Important details include the billing cycle, typically monthly or annually, and the fixed amount charged to the designated credit card (MasterCard, Visa, etc.). Terms often specify renewal dates, outlining when the next charge will occur, enabling users to manage their finances effectively. Cancellation policies must be clear, detailing how and when a user can opt out of ongoing payments, typically requiring written notice a specified number of days before the next billing cycle. Additionally, security measures regarding the storage of credit card information are crucial, adhering to PCI DSS (Payment Card Industry Data Security Standard) compliance, ensuring user data protection. Infrequent changes to the subscription fees should require confirmation and notification timelines, keeping users informed and agreements transparent.

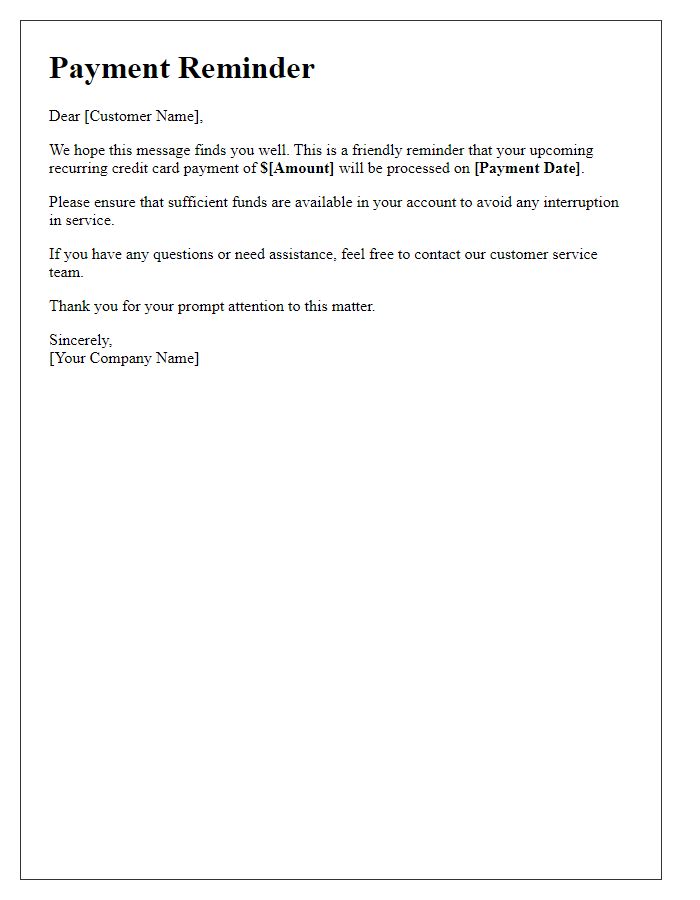

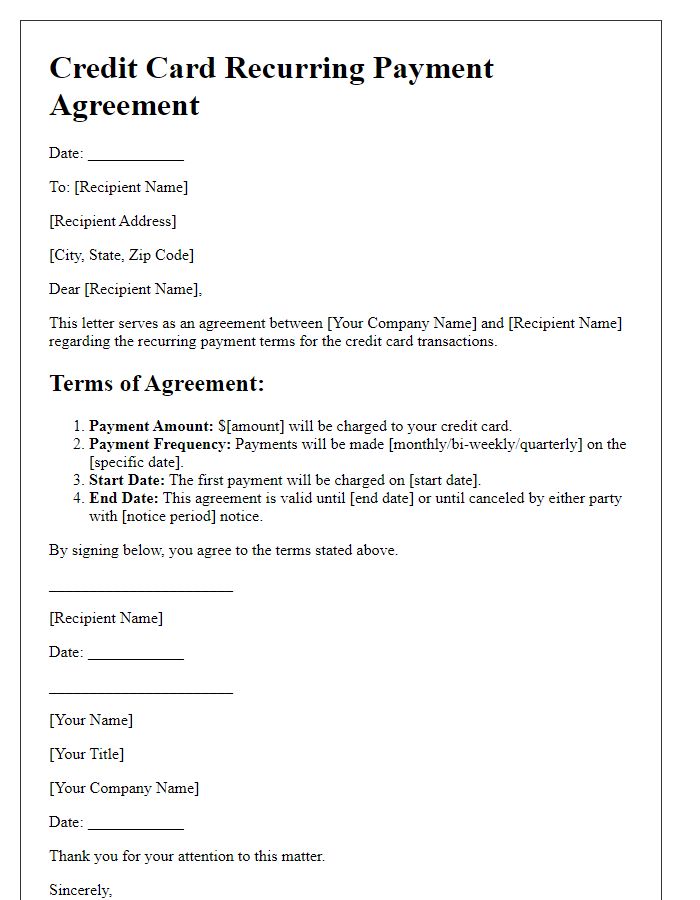

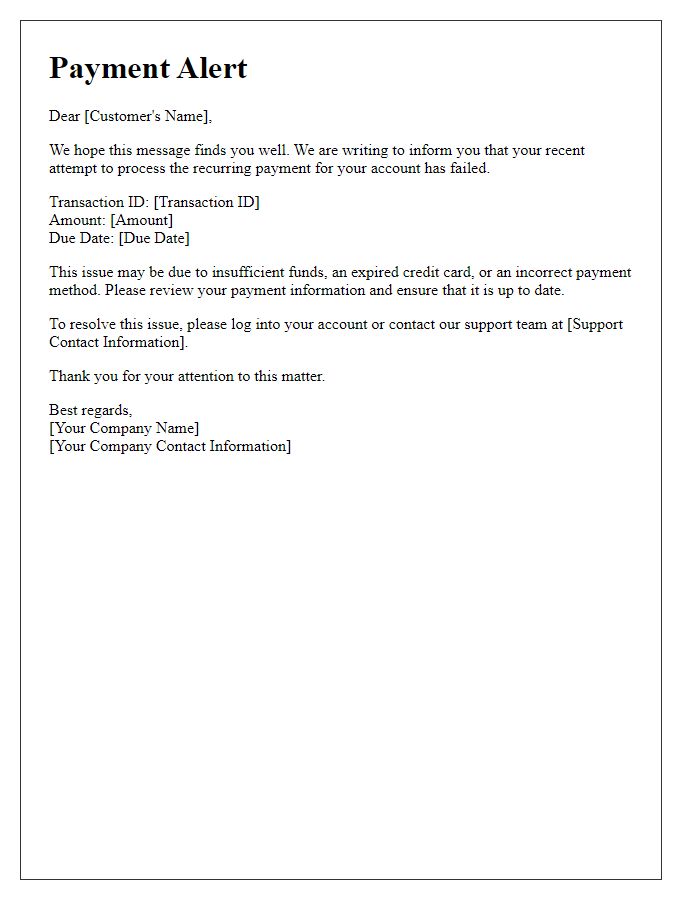

Letter Template For Credit Card Recurring Payment Setup Samples

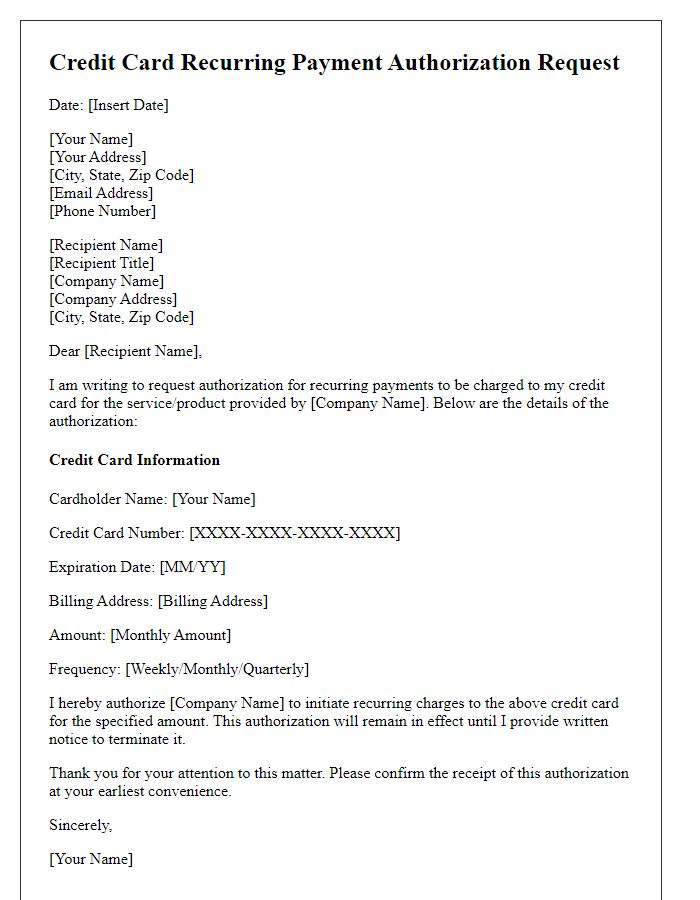

Letter template of request for credit card recurring payment authorization

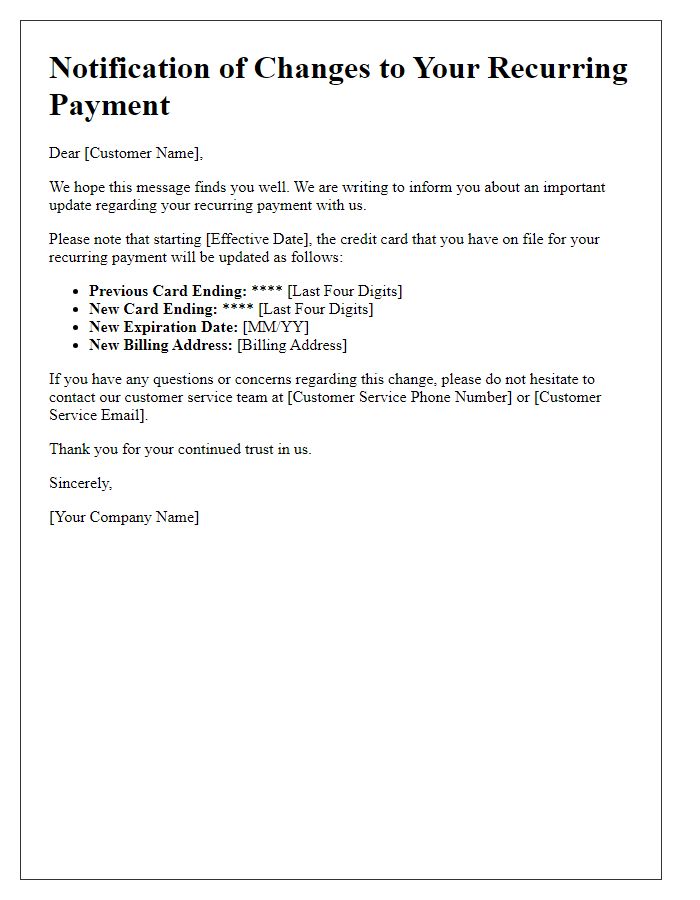

Letter template of notification for changes to credit card recurring payment

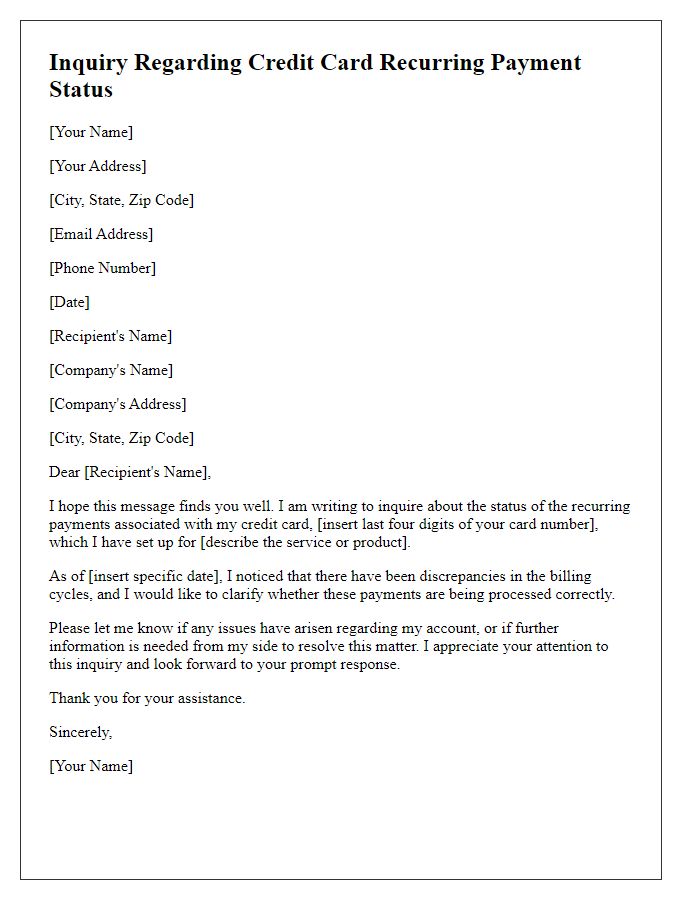

Letter template of inquiry regarding credit card recurring payment status

Letter template of update for credit card information for recurring payment

Letter template of dispute for unauthorized credit card recurring charge

Comments