Are you feeling frustrated after receiving a declined credit card application? You're not alone; many people face similar situations, and understanding the reasons behind such decisions can help clear the air. Banks consider various factors like credit history, income level, and existing debt before approving an application. Want to dive deeper into the common reasons and learn how to boost your chances next time? Read more!

Credit Score

A declined credit card application often results from an unsatisfactory credit score, typically below 650 in many institutions' assessments. Credit scores are numerical representations of creditworthiness, influenced by factors such as payment history (35% of the score), credit utilization (30%), length of credit history (15%), types of credit in use (10%), and recent inquiries (10%). Specific events like missed payments or defaults can significantly impact scores, potentially disqualifying applicants from receiving credit products. Financial institutions, such as Chase or Bank of America, utilize these scores in their decision-making process, highlighting the significance of maintaining a healthy credit profile.

Income Level

Many credit card applications face rejection due to insufficient income levels, which financial institutions often define based on specific thresholds, such as a minimum annual income of $30,000 for entry-level cards. Lenders assess applicants' income stability and monthly expenses, ensuring a sufficient debt-to-income ratio that typically should not exceed 40%. Applicants without stable income sources, such as full-time employment, consistent freelance work, or alternative revenue streams, often find their credit requests denied. Factors like fluctuating job status or inadequate documentation of income can further contribute to the decline in approval, emphasizing the importance of complete financial profiles.

Debt-to-Income Ratio

A declined credit card application often results from a high debt-to-income (DTI) ratio, an essential financial metric used by lenders. The DTI ratio is calculated by dividing an individual's monthly debt payments by their gross monthly income, with a recommended maximum of 36% for optimal creditworthiness. A higher percentage may indicate to creditors that an applicant carries excessive financial burdens, limiting their ability to manage additional credit responsibly. Mortgage payments, student loans, personal loans, and credit card payments contribute to this ratio, which can lead to potential financial strain if not monitored carefully. Understanding the implication of a DTI ratio exceeding the benchmark can aid individuals in managing debt levels and presenting a stronger credit profile in future applications.

Credit History

A declined credit card application often stems from an individual's credit history, specifically issues like high credit utilization ratios and recent missed payments. Credit scores (ranging from 300 to 850) reflect an individual's borrowing behavior, with scores below 580 categorized as poor. Lenders evaluate this history to assess risk, impacting approval rates. Factors such as multiple hard inquiries and bankruptcies in the past five to seven years can also hinder creditworthiness, limiting access to various financial products. Understanding the implications of poor credit history is crucial for improving future applications and securing credit opportunities.

Employment Stability

Employment stability plays a crucial role in credit card applications, as issuers assess the applicant's ability to manage financial obligations. A stable employment history typically indicates consistent income, showcasing reliability in making timely payments. For instance, individuals with more than two years of service in the same field or company are viewed favorably. Fluctuations in employment, such as frequent job changes or gaps in employment, can raise red flags for issuers. Those with temporary positions or part-time jobs may face increased scrutiny, especially if their income doesn't align with their credit requests. Overall, a demonstrated track record of job stability significantly influences creditworthiness assessments.

Letter Template For Credit Card Reason For Declined Application Samples

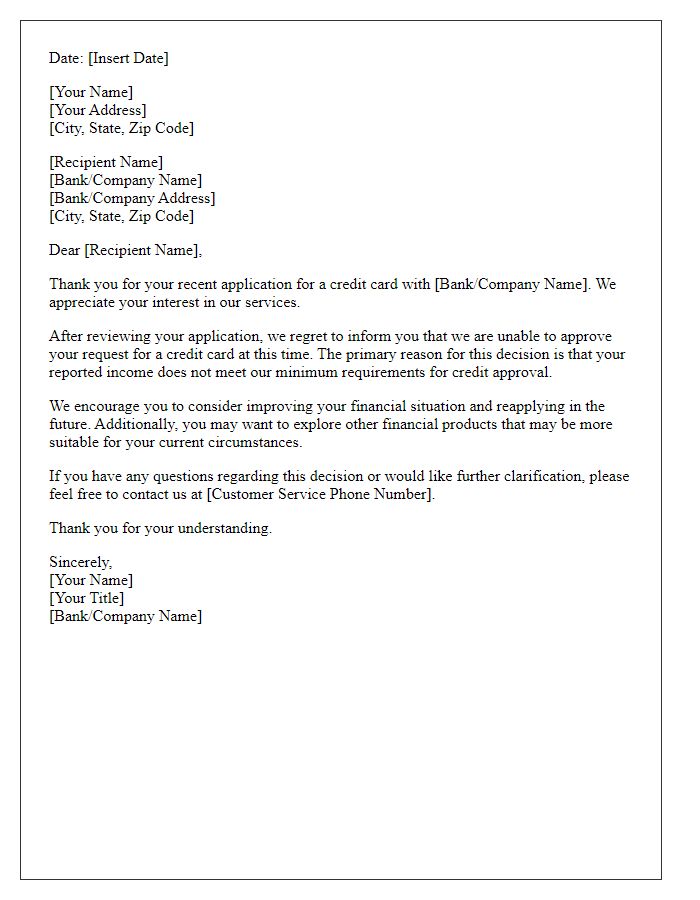

Letter template of credit card application decline due to insufficient income.

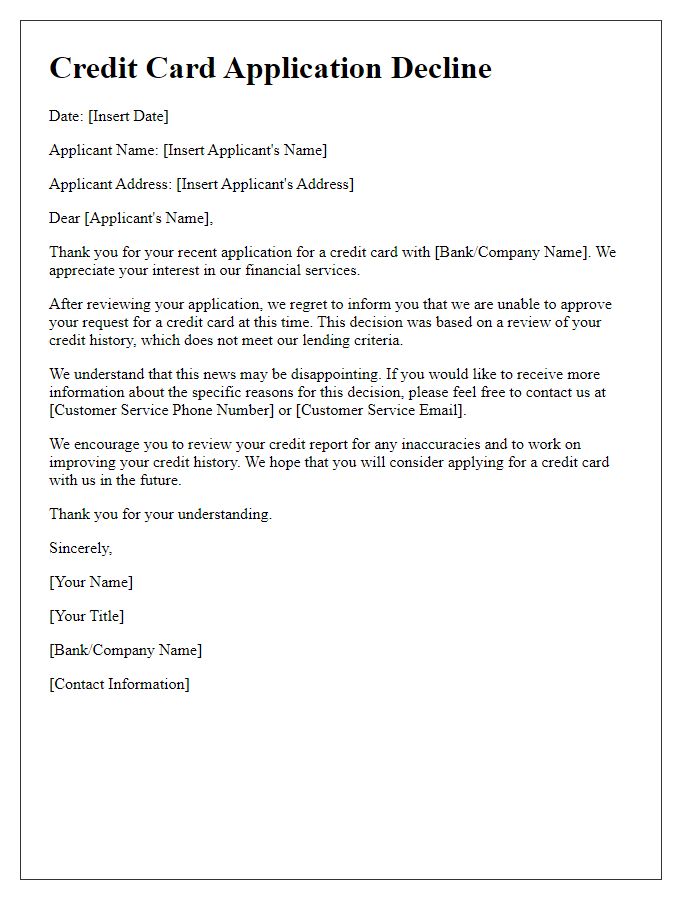

Letter template of credit card application decline because of poor credit history.

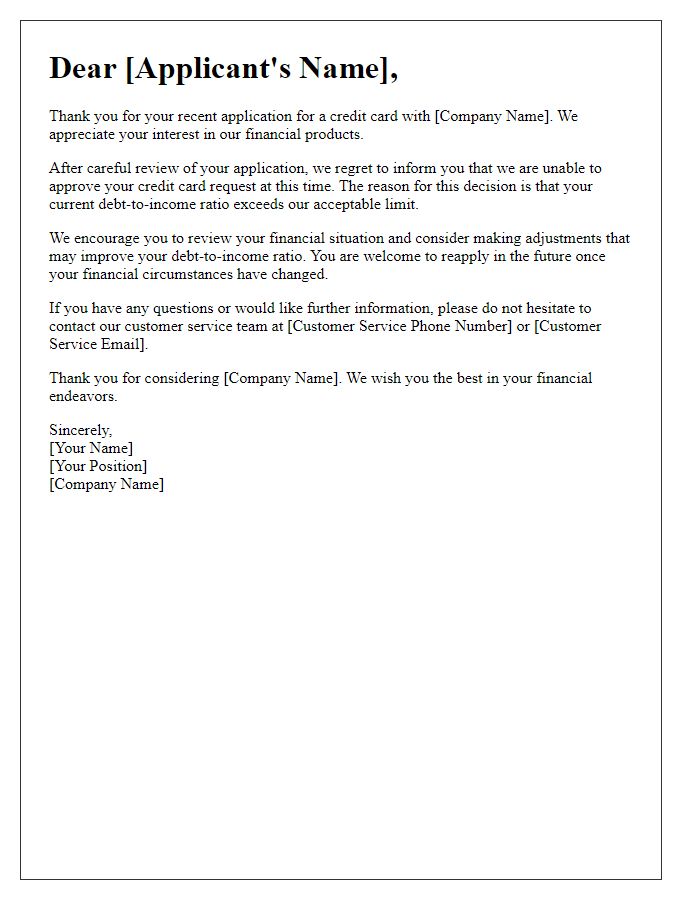

Letter template of credit card application decline for exceeding debt-to-income ratio.

Letter template of credit card application decline due to recent bankruptcy.

Letter template of credit card application decline linked to multiple recent credit inquiries.

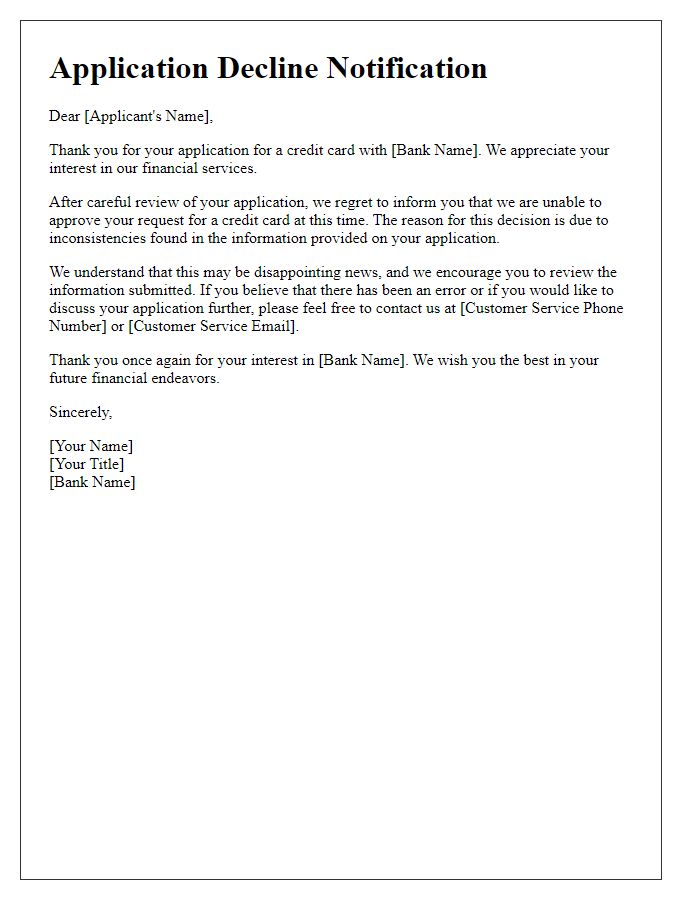

Letter template of credit card application decline due to missing required documentation.

Letter template of credit card application decline related to unverifiable employment status.

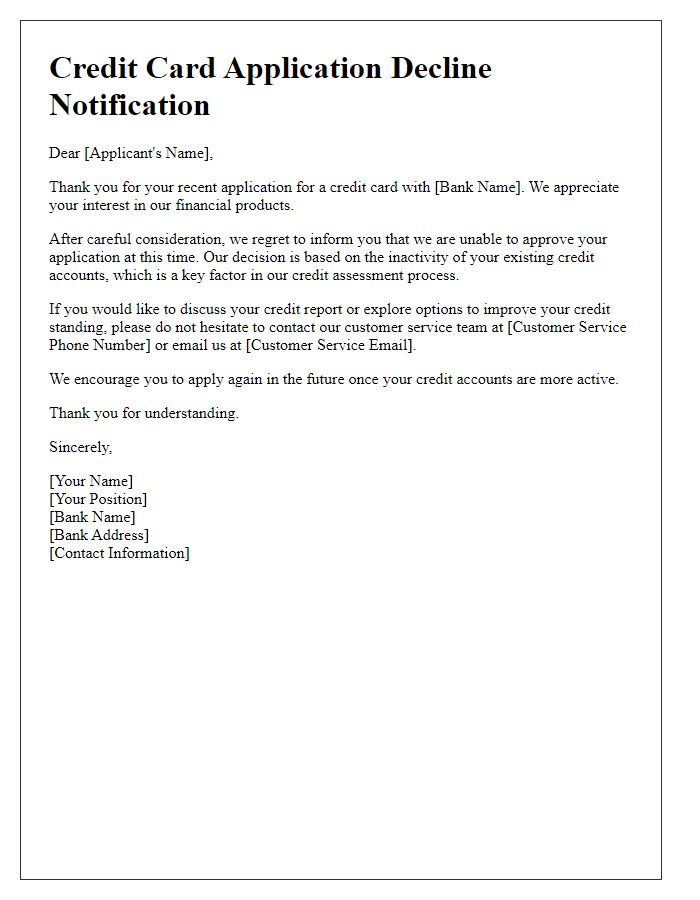

Letter template of credit card application decline stemming from inactive credit accounts.

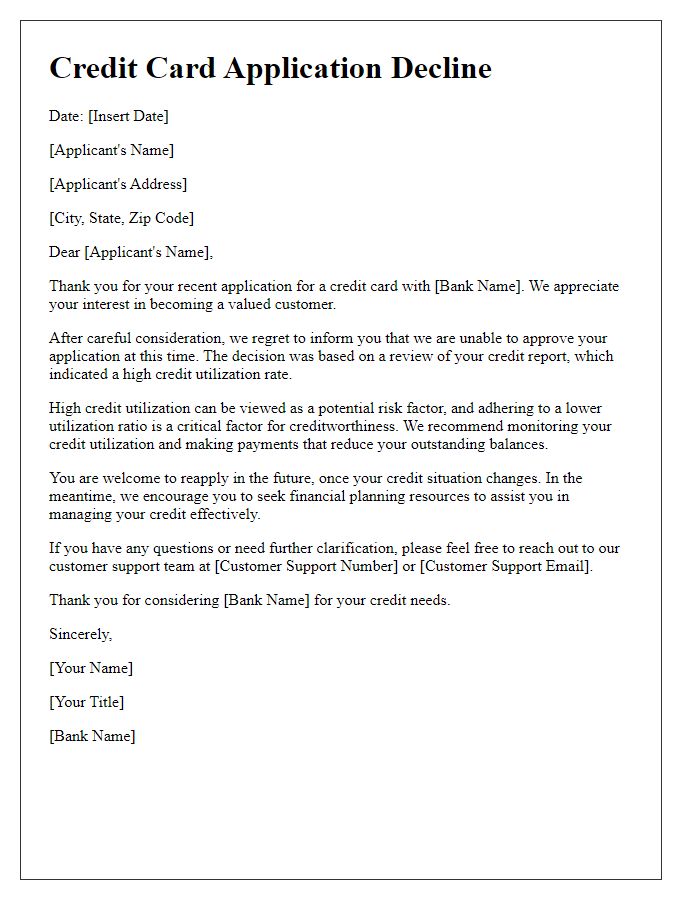

Letter template of credit card application decline based on high credit utilization rate.

Comments