When it comes to managing your finances, being in control of your credit cards is essential. Canceling a credit card can be a significant decisionâwhether it's to avoid high fees, simplify your wallet, or move towards better financial habits. In this article, we'll explore the key steps in confirming your credit card cancellation, ensuring that you stay informed and empowered throughout the process. So, let's dive in and discover everything you need to know!

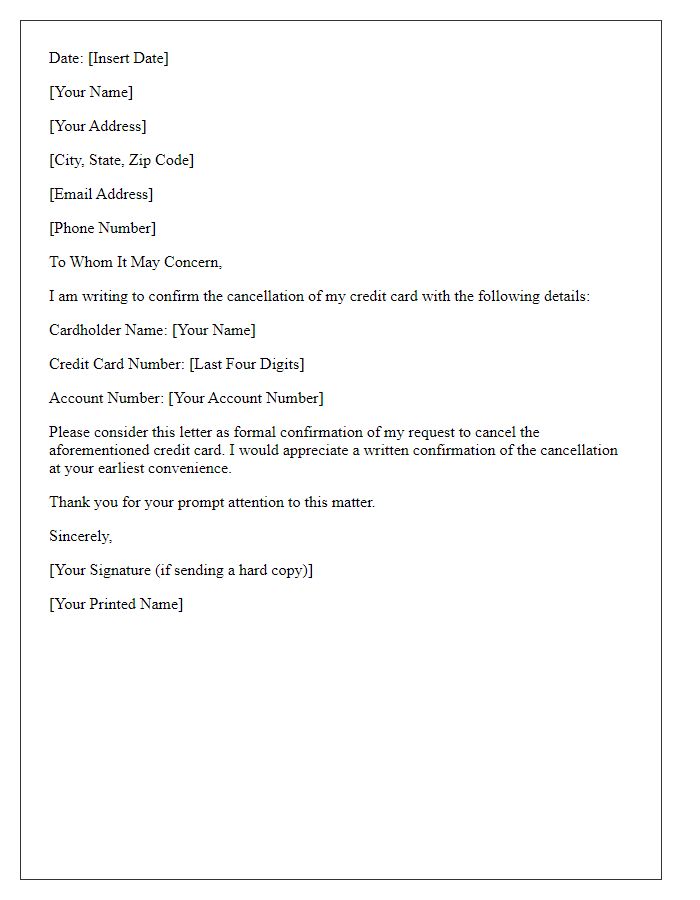

Account Holder's Information

The cancellation of a credit card account can impact an individual's credit score and financial history, particularly for major issuers like Visa or MasterCard. Upon confirming the cancellation request, the account holder typically receives a confirmation notice, detailing the account number, cancellation date, and any remaining balance, if applicable. It is crucial for the account holder to monitor their credit report from bureaus such as Experian, TransUnion, or Equifax to ensure the account status is accurately reflected. Additionally, account holders may want to check if any rewards points or benefits associated with the card, particularly those from travel or cashback programs, will expire upon cancellation.

Credit Card Details

The confirmation of credit card cancellation occurs through a structured process, emphasizing important details such as the credit card number (often obscured for security reasons) and the issuing bank's name (e.g., Chase, Bank of America). Following the cancellation request, a confirmation number is typically provided to track the cancellation effectively. The date of cancellation serves as a key reference point for any disputes related to outstanding charges or fees. Additionally, a note about the credit balance, if any, explains how the remaining funds will be processed, whether through a refund or transfer to a bank account. This documentation is crucial for maintaining financial records and ensuring accountability.

Cancellation Request Confirmation

A credit card cancellation confirmation email serves as a formal notification from a financial institution to an account holder regarding the successful termination of their credit card account. This confirmation typically includes key information such as the cancellation date, account number (partially masked for security), and a statement of remaining balances. For instance, a notice dated October 15, 2023, may state that the credit card associated with account number ****1234 has been cancelled as of the same date. Additionally, it may advise the account holder on final payment amounts, including any outstanding charges or fees that require settlement before closure is fully effective. Important customer service contact information for any inquiries or clarifications is also usually provided in such correspondence.

Closing Statement and Acknowledgment

When a credit card account is closed, the closing statement typically outlines the final balance, payments made, and any remaining rewards or benefits tied to the account. Acknowledgment signifies that the account holder has confirmed the cancellation request, ensuring that all personal and financial information is handled securely. Closing statements should clearly state the last transaction date and any applicable fees incurred until the end of the billing cycle. It's crucial for both parties to retain copies for their records, allowing for future reference in case of disputes or inquiries regarding the account closure.

Contact Information for Further Assistance

Credit card cancellation confirmation typically includes critical details to ensure clarity and ease of communication. Institutional representatives provide essential contact information for further assistance, such as customer service phone numbers, email addresses, and dedicated support resources. Registered Cardholders often find this information on official correspondence from banks like JPMorgan Chase, Bank of America, or Citibank, facilitating seamless follow-up inquiries. Specific service hours (for example, 8 AM to 8 PM EST) can enhance accessibility, ensuring customers receive timely assistance regarding their account status or any potential issues that may arise post-cancellation.

Letter Template For Credit Card Cancellation Confirmation Samples

Letter template of Credit Card Cancellation Confirmation for Personal Use

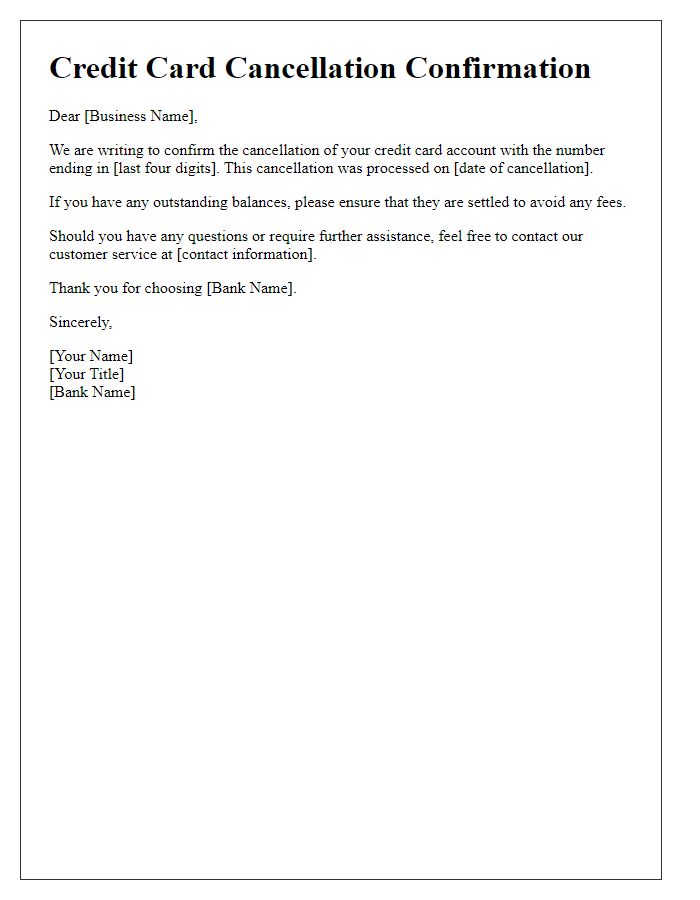

Letter template of Credit Card Cancellation Confirmation for Business Account

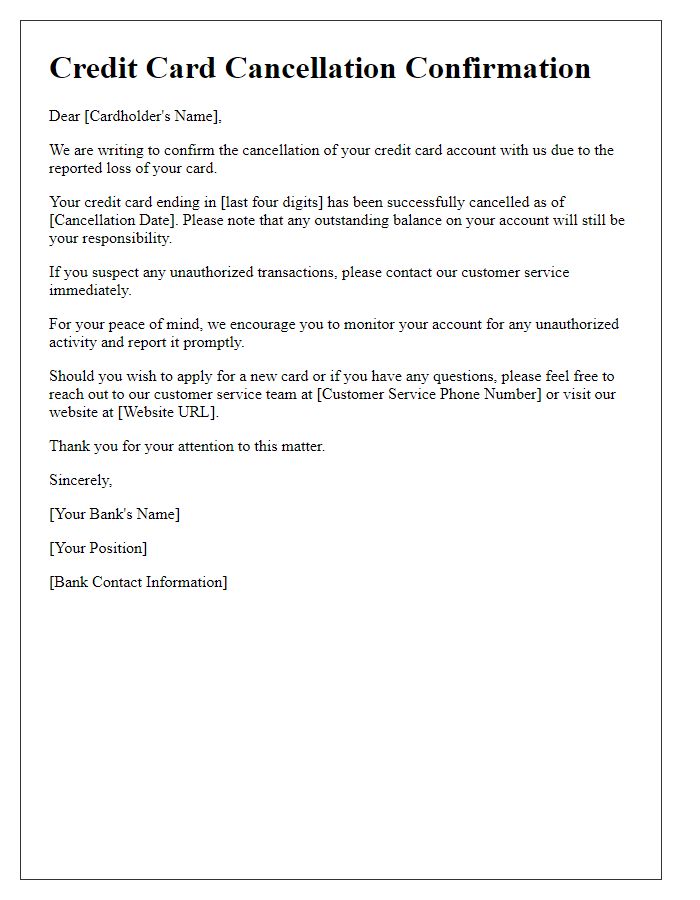

Letter template of Credit Card Cancellation Confirmation Due to Lost Card

Letter template of Credit Card Cancellation Confirmation for Account Closure

Letter template of Credit Card Cancellation Confirmation for Fraudulent Activity

Letter template of Credit Card Cancellation Confirmation for Switching to a Different Card

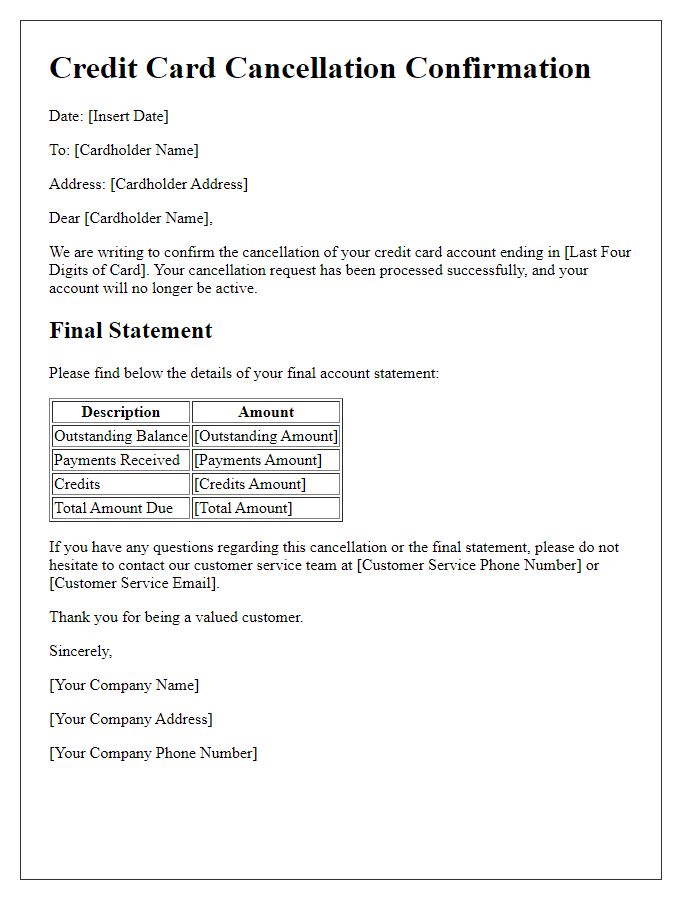

Letter template of Credit Card Cancellation Confirmation with Final Statement

Letter template of Credit Card Cancellation Confirmation for Customer Satisfaction

Letter template of Credit Card Cancellation Confirmation with Account Summary

Comments