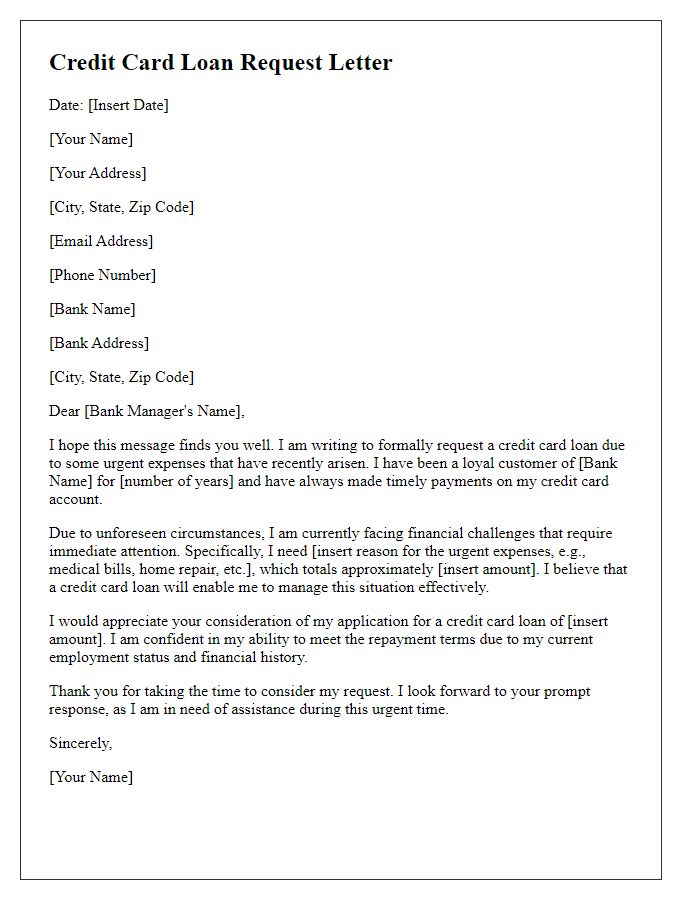

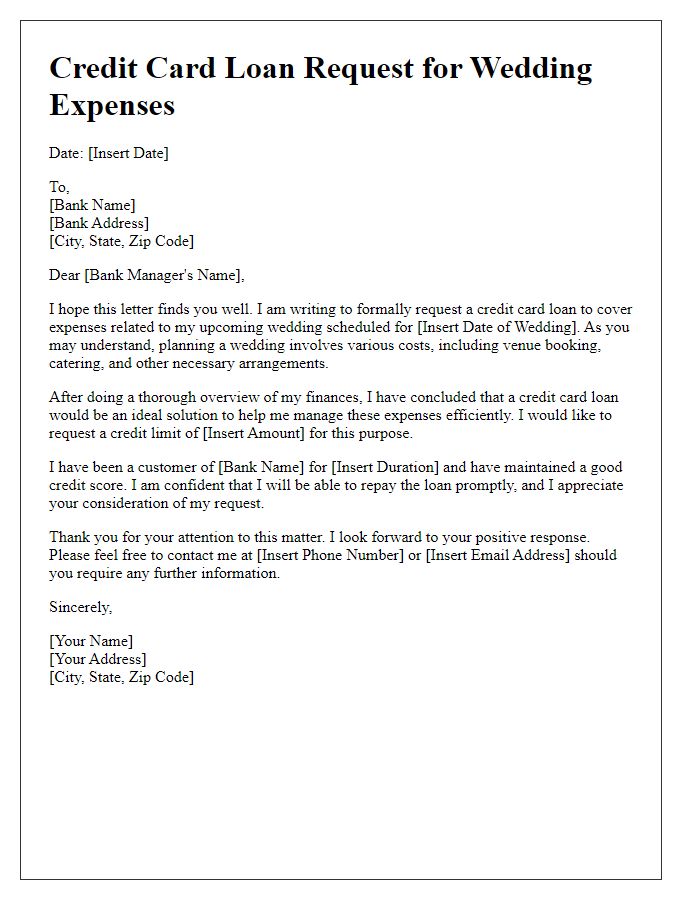

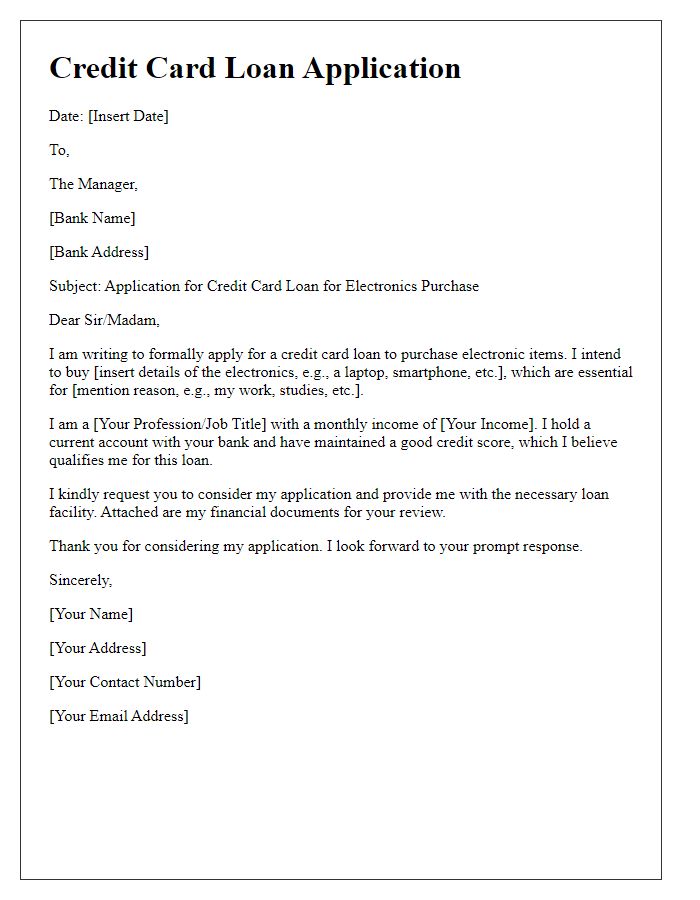

Are you considering a credit card loan but unsure about how to approach the request? Crafting the perfect letter can be key to securing the funds you need, and it's easier than you think. In this article, we'll explore a simple yet effective template you can use to formally request a loan against your credit card. So, if you're ready to take the next step towards financial flexibility, keep reading for expert tips and a customizable template!

Personal and Contact Information

Personal information, crucial for credit approval, includes full name, address (which may include street name, city, state, and ZIP code), date of birth for identity verification, and Social Security number for credit history checks. Contact information should encompass phone numbers (mobile and home) for communication and email addresses for digital correspondence. Accurate details ensure efficient processing of the credit card loan request, impacting factors such as loan amount eligibility and interest rates. Providing reliable information builds trust with financial institutions, leading to smoother transactions and approvals.

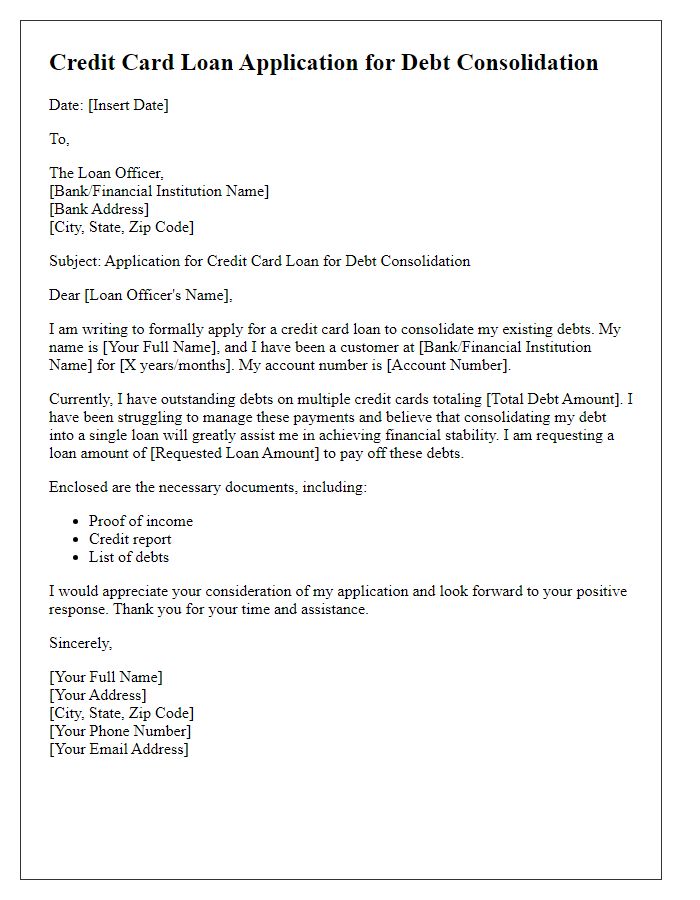

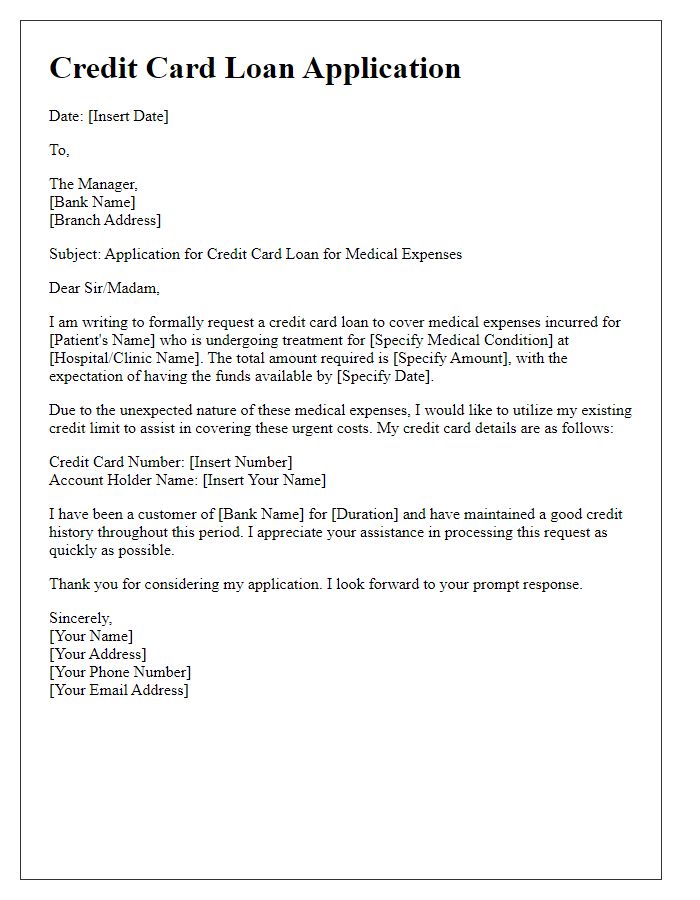

Account and Credit Card Details

Submitting a credit card loan application requires specific account and credit card details to facilitate processing. Essential account information includes the primary account holder's name, account number (typically a 16-digit number), and the associated bank branch. Credit card specifics include the card type (Visa, Mastercard, etc.), credit limit (the maximum amount that can be borrowed), outstanding balance (the current unpaid amount on the card), and payment history (recent payments and due dates). Providing accurate details ensures that lenders can assess eligibility, determine loan amounts, and evaluate terms based on the account holder's creditworthiness.

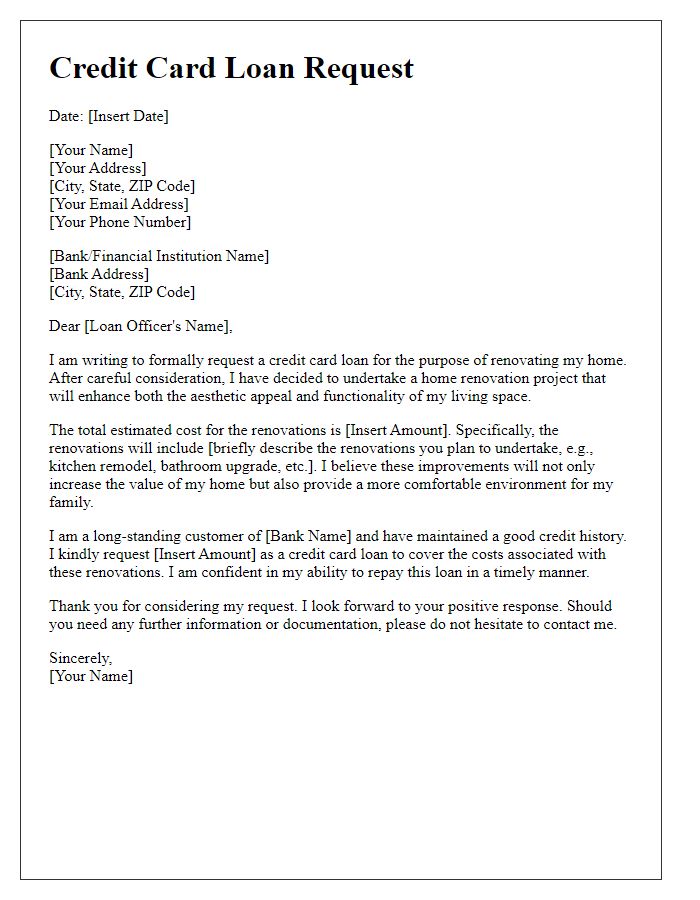

Specific Loan Amount and Purpose

Many individuals seek a credit card loan, also known as a credit card cash advance, to meet urgent financial needs. For example, a $5,000 loan can help cover unexpected medical expenses, such as hospital bills or urgent care visits due to unforeseen accidents. Credit card loans allow borrowers to access funds quickly, especially during emergencies, compared to traditional bank loans which often take longer to process. However, it is crucial to consider the higher interest rates associated with credit card cash advances, which can exceed 25% APR. This financial tool, while helpful in critical situations, requires careful evaluation of one's repayment ability to avoid accumulating significant debt.

Repayment Terms and Duration

A credit card loan against a card, typically issued by financial institutions, offers borrowers a way to access funds based on their credit limit. Repayment terms generally vary from 3 to 36 months, with interest rates often ranging from 10% to 30% APR based on creditworthiness. The monthly installment amount is calculated based on the total loan amount, with fixed or declining balance methods available. The duration for repayment will influence the total cost of borrowing, as longer terms can lead to higher interest accumulation. Borrowers should assess their financial situation carefully before committing to a repayment plan to ensure timely payments and avoid late fees.

Signature and Date

Credit card loan requests typically involve specific terms and details. A comprehensive credit card loan request involves vital information such as the cardholder's name, account number, loan amount, interest rate, repayment terms, and confirmation of the card issuer's policies. Signature indicates agreement to the terms, while the date affirms the request's submission. It's essential to include personal information security measures, such as partial account number displays, and adhere to compliance with regulations like the Fair Credit Reporting Act to protect consumer rights.

Comments