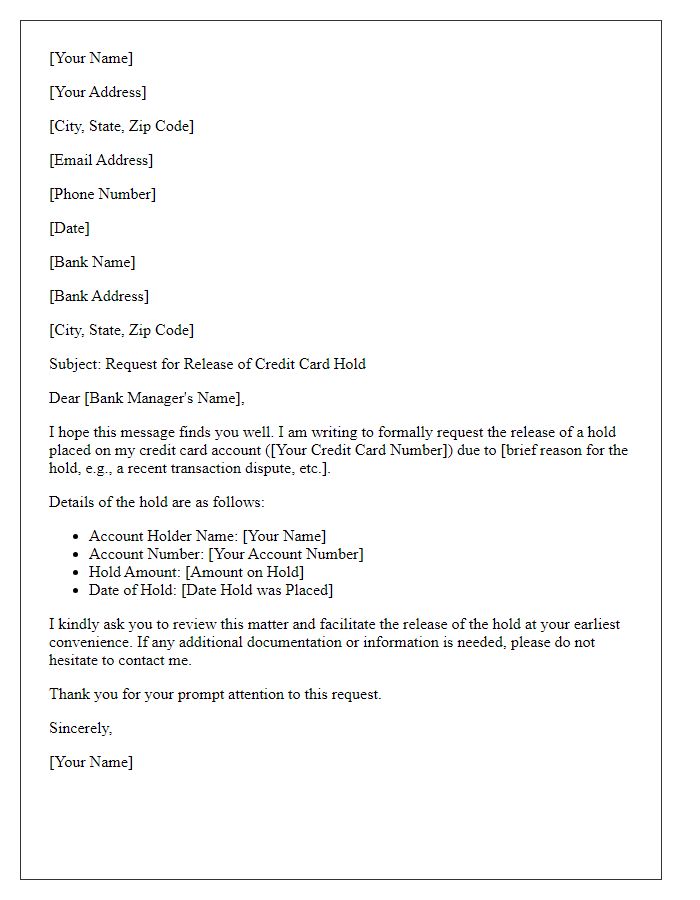

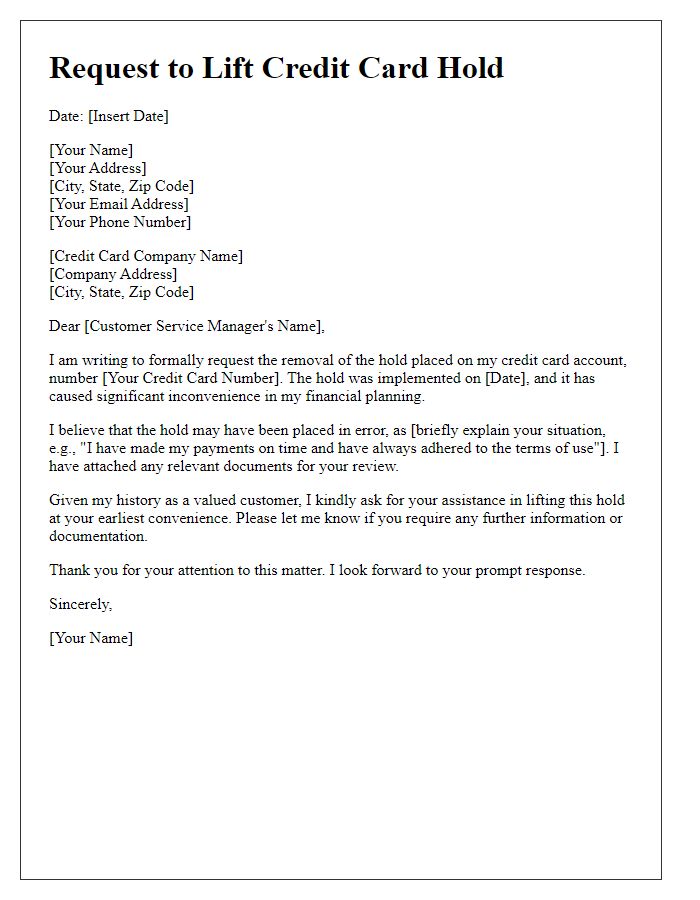

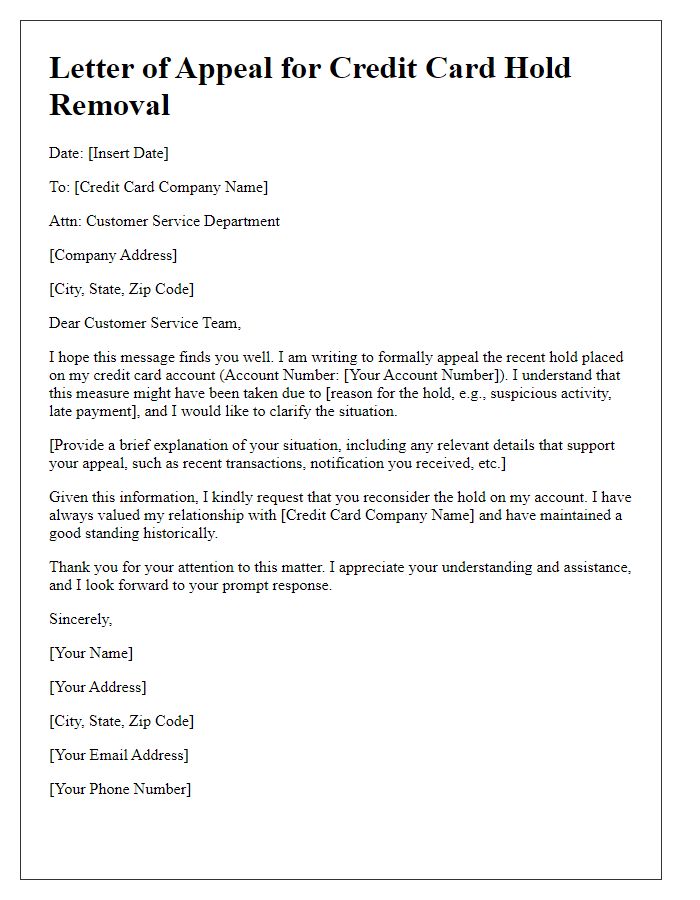

Are you feeling overwhelmed by a credit card hold that's putting a damper on your finances? You're not alone! Many individuals encounter similar issues, and navigating the process of removal can be tricky. In this article, we'll guide you step-by-step through crafting the perfect letter to request a credit card hold removal â so stay tuned for some helpful tips and templates!

Account Information

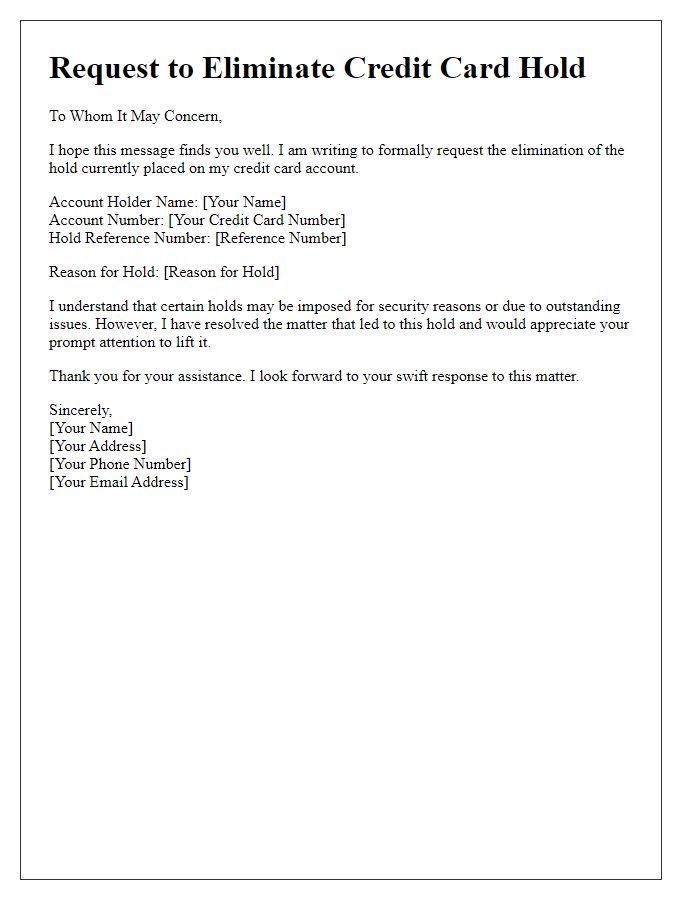

Credit card hold removal requests often relate to specific account information. Customers may experience temporary holds on their accounts for various reasons, including suspected fraud, exceeding credit limits, or verification processes. Properly addressing such requests requires accurate details. Essential details include the account number, typically a 16-digit number identifying the user's credit card account, and the cardholder's name as it appears on the card. Additionally, the request should mention contact information, such as phone numbers or email addresses, to facilitate prompt communication. Users should also specify the reason for requesting the hold removal to ensure swift action from the card issuer.

Reason for Hold Removal

Understanding the removal of a credit card hold is crucial for financial management. A hold, often placed for various reasons such as suspected fraud or pending transactions, can restrict access to funds. For instance, a hold might occur when a credit card is used for a significant purchase, causing a temporary freeze until the transaction is confirmed. Customers often seek removal of these holds to regain the use of their funds, particularly in situations where unexpected travels or emergencies arise. Addressing holds quickly ensures continuous access to credit, bolstering both personal finances and peace of mind.

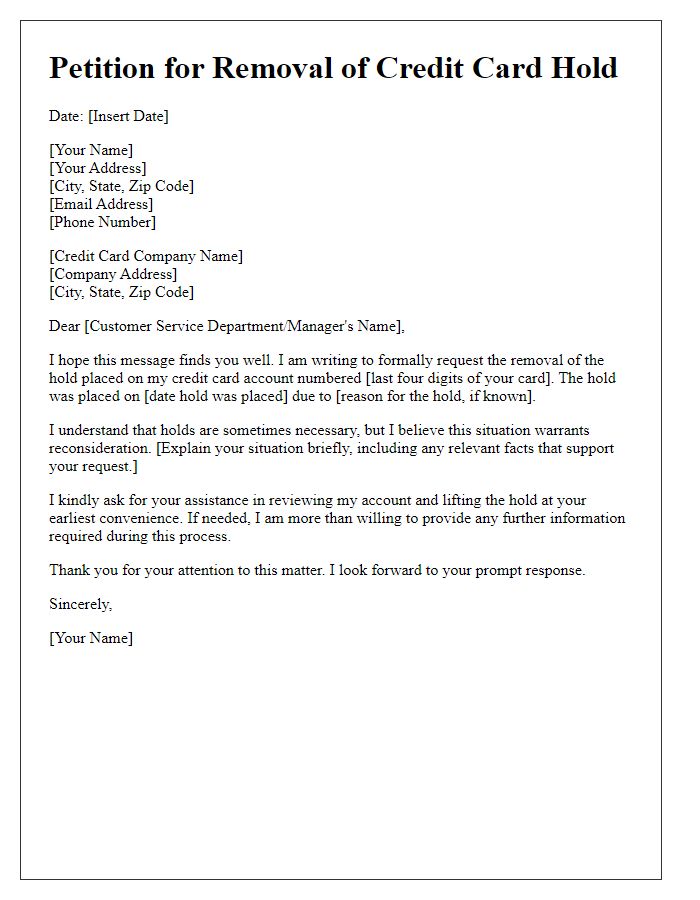

Supporting Documentation

Requesting the removal of a credit card hold involves providing supporting documentation that clearly outlines the situation. Affected individuals may present original transaction receipts from the date of the unauthorized hold, showing the amount and details of the charge. Transaction history statements from the credit card issuer may also be included, highlighting any discrepancies or issues caused by the hold. Identity verification documents like a government-issued ID or utility bill can demonstrate the current address of the cardholder, validating their request. Furthermore, a formal letter, written on business letterhead in cases of corporate cards, expressing the reasoning behind the hold removal may enhance clarity and urgency in the resolution process.

Contact Details

Credit card holds can significantly impact available credit limits, especially for individuals managing monthly budgets. A hold typically occurs after transactions in the hospitality industry (hotels, rental cars) or during pre-authorizations, often lasting several days. Timely communication with the financial institution, such as contacting customer service at 1-800-123-4567, is crucial for an expedited hold removal. Providing essential details including card number, transaction reference, and reasons for the release request can facilitate prompt action. Additionally, noting the timeline for hold duration can aid in assessing financial impacts.

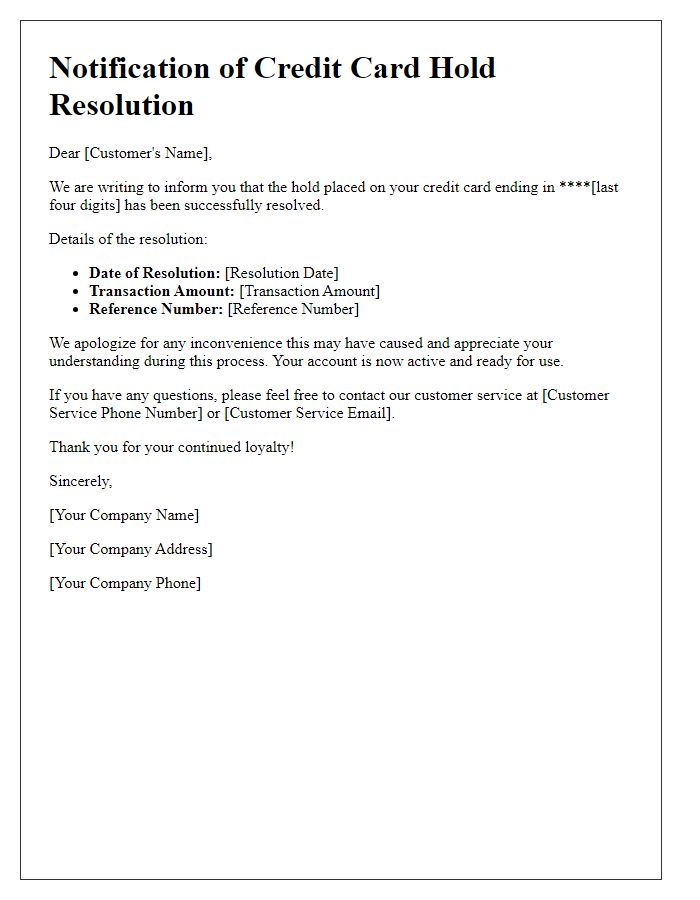

Request for Confirmation

Credit card holds can significantly impact available credit for consumers, often resulting from hotel reservations, rental car bookings, or merchant transactions. These holds may vary in amount, typically ranging from 10% to 100% of the total transaction value, and can last from a few days to several weeks. In order to expedite the release of a hold, customers are often required to contact their credit card issuer, providing details such as transaction dates, merchant names like Marriott or Hertz, and the hold amount. Effective communication, documenting request dates, and understanding issuer turnaround times can enhance the chances of a swift hold removal, allowing consumers to regain full access to their available credit.

Comments