Are you feeling the pressure of a credit card overdue payment? We understand how overwhelming it can be to manage finances, especially when unexpected expenses arise. However, acknowledging your overdue payment is the first step towards regaining control of your financial health. If you'd like to navigate this situation with ease and explore effective solutions, keep reading to find out more!

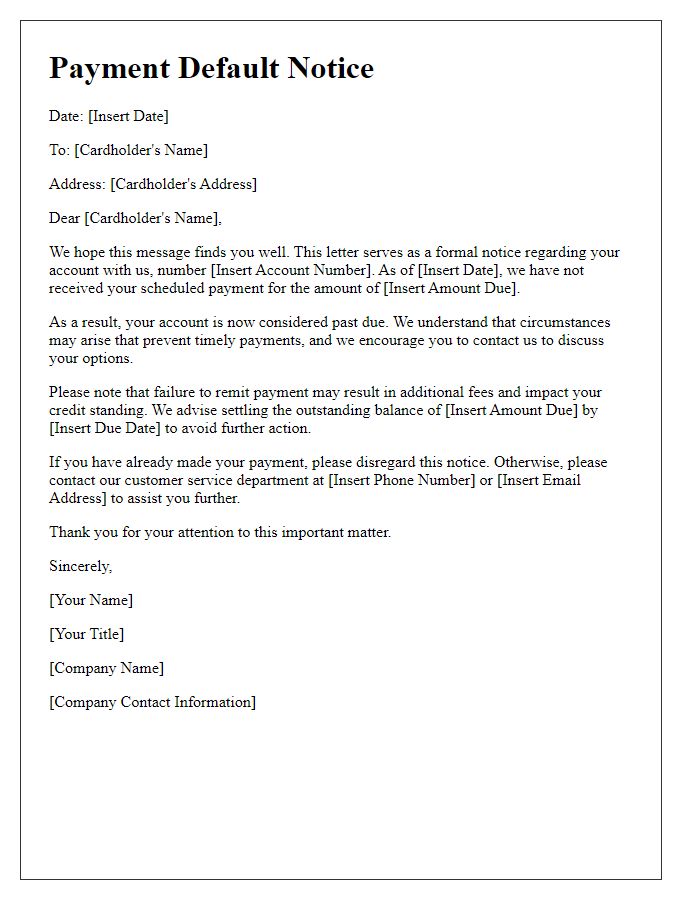

Account Information

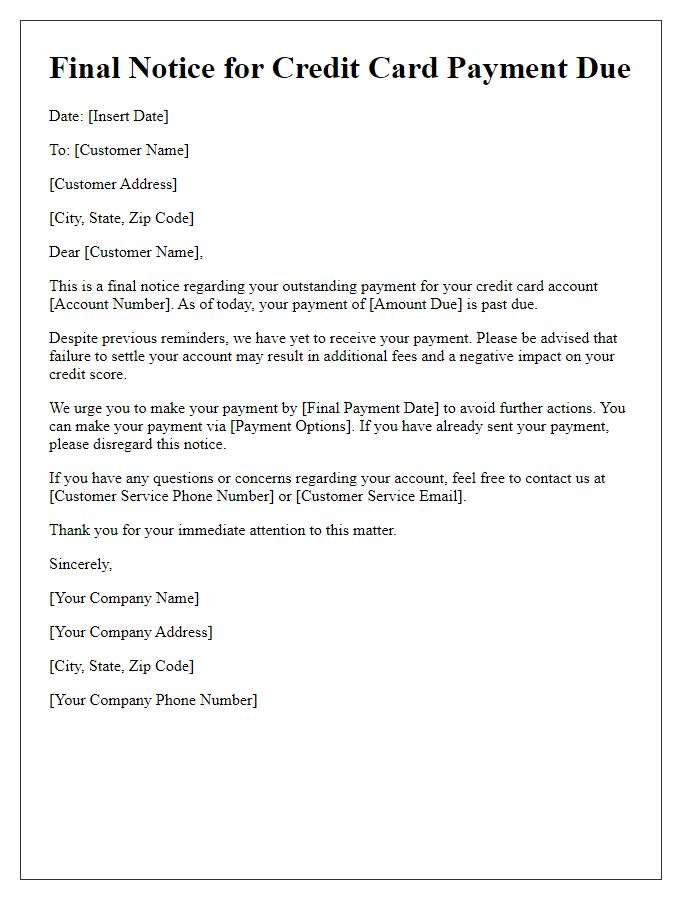

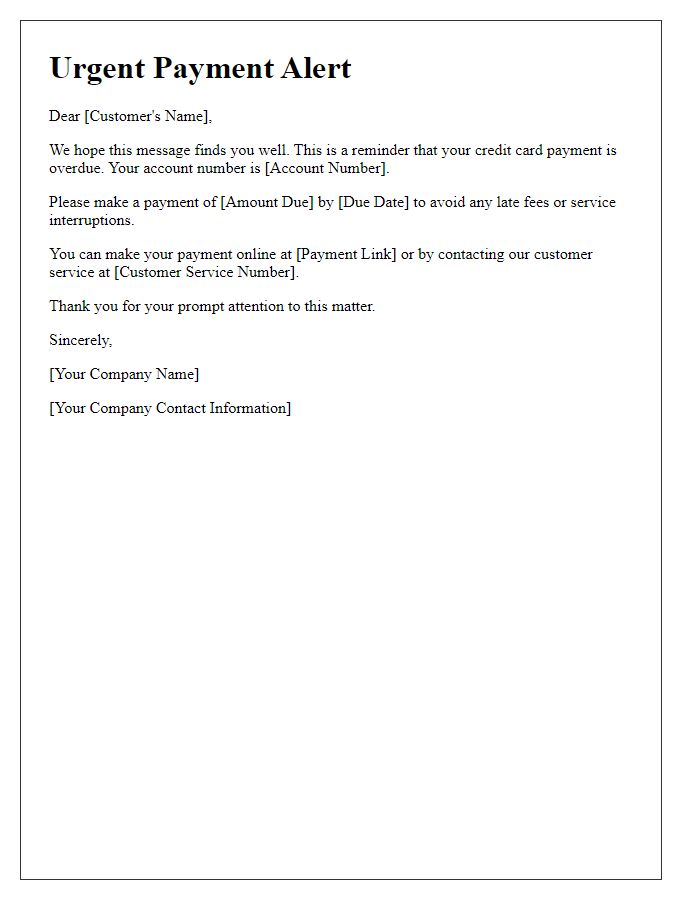

The overdue payment notice serves as a crucial reminder for cardholders regarding their credit card account status. Specifically, it outlines critical information such as the account number, typically a 16-digit sequence unique to each cardholder. The notice emphasizes the outstanding balance, which may include recent transactions, late fees, and interest charges, increasing the total amount due. Additionally, payment due dates, usually a pivotal date each month, are highlighted to encourage timely payment and avoid further penalties. Contact details for customer service representatives, typically available 24/7 for assistance, provide a necessary resource for inquiries related to payment options or account management. Addressing these elements ensures that cardholders are well-informed of their financial responsibilities and potential repercussions of non-payment, such as negative impacts on credit scores or additional fees.

Payment Due Details

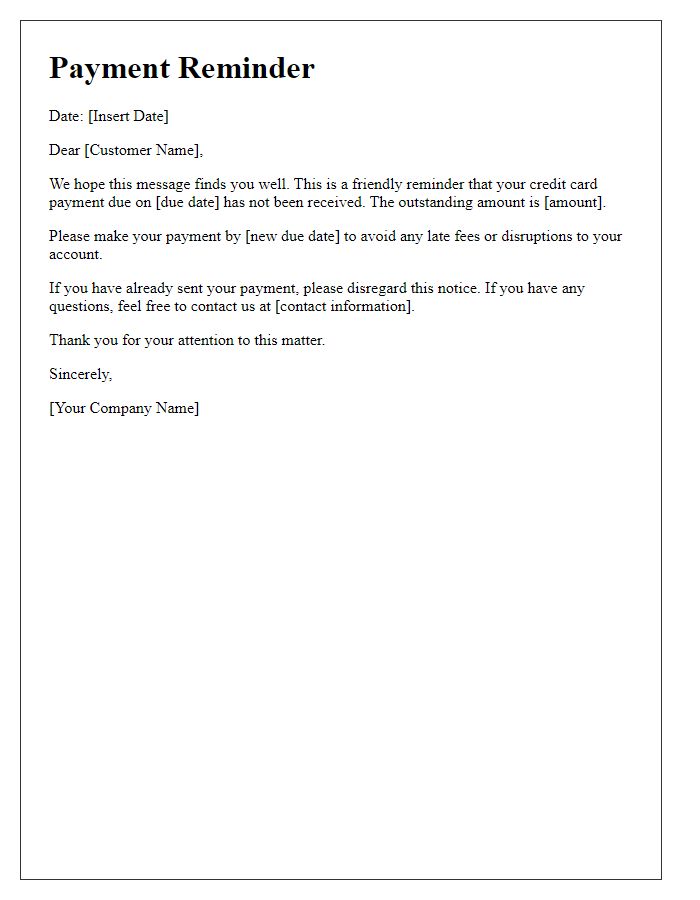

An overdue payment notice for credit cards banks often triggers a sense of urgency among cardholders. The statement typically highlights the specific payment amount due, which may include outstanding balances, recent transactions, and interest charges. Payment due dates are often emphasized, providing clear deadlines for remediation. For example, a cardholder might receive a notice detailing an overdue amount of $150 due by April 30, 2023. Additionally, any fees associated with late payments, such as a $35 late fee, are clearly outlined, potentially affecting the total owed. Cardholders are frequently reminded of the consequences of non-payment, which may include a decrease in credit score, increased interest rates, or account suspension, urging prompt action to resolve the issue.

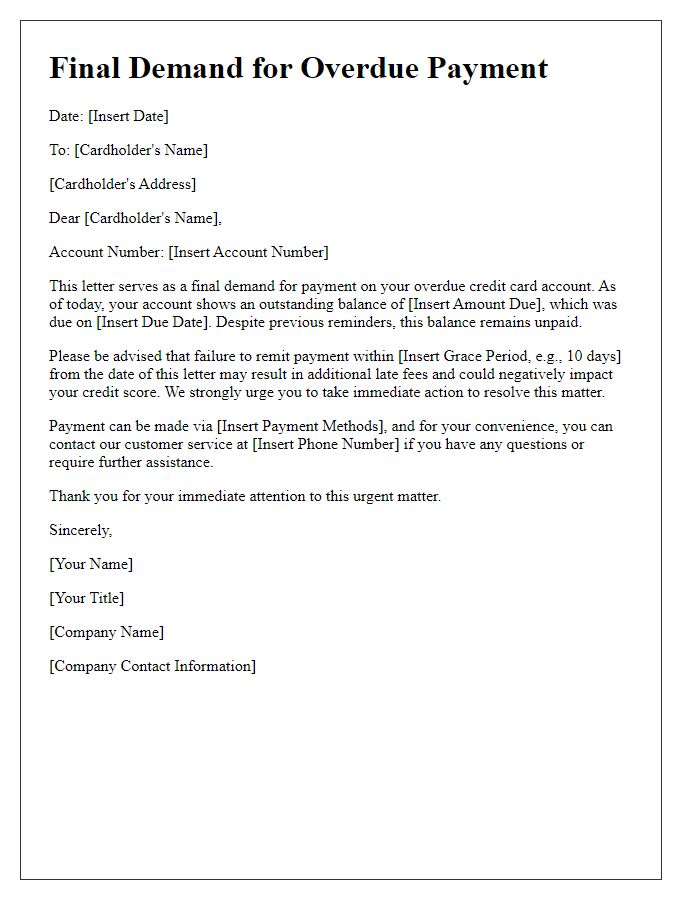

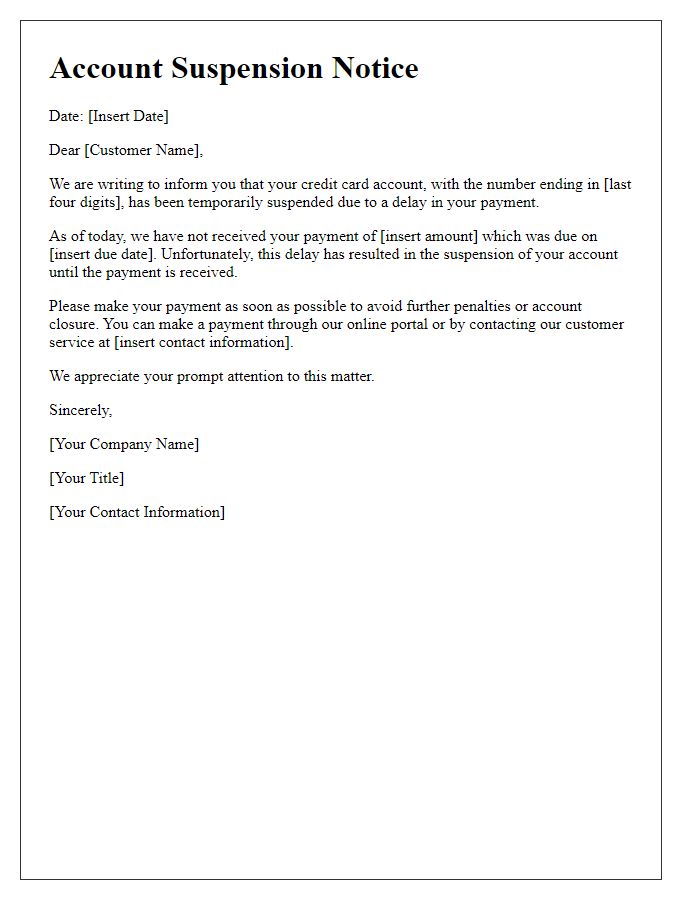

Consequences of Non-Payment

Failure to make timely credit card payments can lead to serious financial consequences for consumers. A missed payment may result in penalties, typically ranging from $25 to $40, depending on the credit card issuer's policies. This delay can also trigger an increase in the interest rate, sometimes escalating to 29.99% APR, significantly inflating the cost of future purchases. Furthermore, the account may be reported to credit bureaus like Experian, TransUnion, or Equifax after just 30 days of non-payment, negatively impacting credit scores (which can drop by 100 points or more) and making future lending more difficult or expensive. Persistent delinquency can escalate to collection actions, with potential legal repercussions or wage garnishments, ultimately damaging financial stability long-term.

Available Payment Options

Credit card overdue payments can lead to significant penalties and impact credit scores negatively. Timely payments are crucial for maintaining financial health. It is essential to consider various payment options available for settling overdue balances. Methods such as online banking allow for quick transfers, while mobile apps from financial institutions facilitate instant payments from smartphones. Payment through automated phone services offers a convenient alternative for users who prefer not to use online platforms. In-person payments at bank branches or retail locations provide a tangible method to address overdue amounts, with immediate receipt confirmation. Additionally, setting up automatic payments ensures that future dues are paid on time, preventing recurrence of overdue issues and fostering a stable credit history.

Contact Information for Assistance

Credit card companies often issue overdue payment notices to customers. These notices are crucial reminders about missed payments on accounts, potentially leading to late fees and negative credit score impacts. For assistance, customers can reach out to customer service departments, often available via toll-free phone numbers listed on the back of credit cards. Additionally, many credit card companies provide online support through secure websites or mobile applications, enabling customers to check account status, payment history, and options for making payments. Timely contact with customer service, preferably within days of receiving an overdue notice, can help prevent further penalties and restore account standing.

Comments