Hey there! If you've recently received a notice about your credit card holder agreement being updated, you might be wondering what this means for you. These updates often contain important changes that can affect your account terms, fees, and benefits. Don't worry; we're here to break it all down for you and make sure you know what to expect moving forward. Keep reading to discover how these updates may impact your finances and what steps you can take!

Important changes and updates

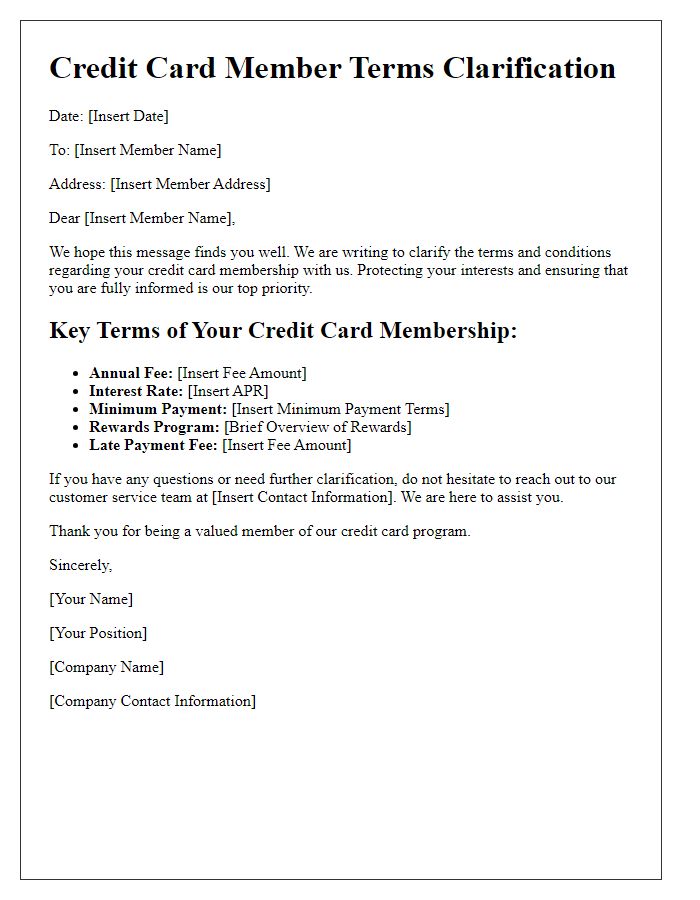

Credit cardholder agreements undergo periodic updates to reflect changes in terms and conditions. These agreements detail important parameters, including annual percentage rates (APRs), fees, and rewards programs. Recent revisions may address alterations in late payment fees, typically ranging from $25 to $39, and foreign transaction fees, often averaging 3%, which can impact international users. Changes to reward structures could enhance cash back offers, increasing from 1% to as much as 5% in specific categories. Additionally, new provisions could include adjustments to the grace period, which is typically 21 days, affecting payment timelines. Keeping abreast of these modifications ensures cardholders understand their rights and responsibilities while maximizing their card benefits.

Terms and conditions

The updated credit cardholder agreement incorporates significant revisions to the terms and conditions governing the use of credit cards issued by financial institutions such as Visa and Mastercard. Key adjustments include changes to interest rates, which may now range from 15% to 25% annually based on creditworthiness, and the introduction of new late fees amounting to $35 for payments received after the due date. Additionally, cardholders must note the updated rewards program, allowing for points accumulation on purchases at grocery stores, travel bookings, and online retail, with bonus offers for spending thresholds that can enhance rewards by up to 5%. Privacy policies have also been refined to strengthen protections against unauthorized transactions, following guidelines established by the Gramm-Leach-Bliley Act. Also important is the updated disclosure regarding penalty APRs, which can spike to 29.99% under certain conditions, underscoring the importance of timely payments. All cardholders should review these changes carefully to fully understand their rights and responsibilities under this agreement.

Interest rates and fees

Credit card agreements often undergo updates to reflect changes in interest rates and fees. These adjustments can affect cardholders, particularly regarding annual percentage rates (APRs), which may now range from 15% to 30% based on creditworthiness. Additionally, fees for late payments, typically around $39, might increase or decrease and can influence overall debt management. Cardholders should closely review these changes and their impacts on monthly payments and total repayment amounts. Financial institutions, such as major banks like JPMorgan Chase or Bank of America, regularly issue notifications detailing these modifications to ensure transparency and maintain compliance with regulations.

Privacy and data protection

The recent update to the credit cardholder agreement emphasizes enhanced privacy and data protection measures for personal information, ensuring compliance with the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). Key improvements include clearer consent protocols for data sharing, allowing cardholders to understand how their financial transaction data is used by financial institutions, and providing options for opting-out of unnecessary data collection. Additionally, robust encryption techniques safeguard sensitive information during online transactions, further minimizing risks associated with identity theft and fraud. Regular audits and assessments will ensure ongoing compliance with data security standards, reflecting a commitment to protecting consumer privacy in an increasingly digital financial landscape.

Customer support information

Credit card holder agreements often include essential information regarding customer support to assist users in managing their accounts. For cardholders of major institutions like Visa or MasterCard, accessing support is crucial. Contact channels typically include dedicated customer service phone numbers, often found on the back of the card, available 24/7. Online support options may encompass live chat or email support systems through the card issuer's website. Users might also find FAQs and resource guides to troubleshoot common issues. In certain cases, mobile app features may facilitate immediate account access and support ticket submission. Keeping these resources updated helps ensure customer satisfaction and efficient problem resolution.

Comments