Are you curious about how to make the most of your credit card benefits? Understanding the ins and outs of your credit card's interest-free period can help you save money and manage your finances more effectively. This feature allows you to enjoy your purchases without the immediate pressure of accruing interest, giving you a valuable financial cushion. If you're ready to dive deeper into the specifics and learn some tips and tricks, keep reading!

Duration of interest-free period

Many credit card providers offer an interest-free period lasting 21 to 55 days after the purchase date, often dependent on the billing cycle. During this timeframe, any new purchases do not incur interest charges, provided the cardholder pays the full balance by the due date. Missing this deadline can lead to interest accruing on outstanding amounts, typically at rates ranging from 15% to 25% annual percentage rate (APR). Cardholders should check specific terms outlined by financial institutions, such as Visa or Mastercard, to maximize financial management and maintain good credit standing. Proper understanding of this interest-free duration can lead to strategic spending and repayment, enhancing overall financial health.

Eligibility requirements

The eligibility requirements for an interest-free period on credit cards can vary significantly across different financial institutions, such as banks and credit unions. Generally, cardholders must possess a valid credit card, typically linked to a specific account type or tier. The minimum payment amount (often around 5% of the outstanding balance) must be paid by the due date to maintain the interest-free status. Additionally, a good payment history, characterized by on-time payments over several months, may be necessary to qualify. Some institutions may impose restrictions based on the credit score (usually above 650 is favorable) or the overall credit utilization ratio, which should ideally remain below 30%. It is also essential for consumers to check any promotional offers that may temporarily extend the interest-free period, often applicable to select purchases or balance transfers within a designated time frame.

Conditions for maintaining interest-free status

Maintaining an interest-free period on credit card balances requires adherence to specific conditions set by financial institutions. Key conditions often include full payment of the previous month's balance by the due date, which typically falls within a 21 to 25-day billing cycle. Additionally, making timely payments on new purchases is crucial, as any missed payments may lead to the loss of the interest-free status. Frequently, maintaining a low credit utilization ratio below 30% of the credit limit is recommended to enhance overall credit health and ensure eligibility for ongoing interest-free terms. Furthermore, avoiding cash advances or balance transfers may be necessary, as these transactions commonly incur immediate interest charges. Lastly, reviewing the cardholder agreement, which outlines all terms and conditions applicable to the interest-free period, is essential for compliance and understanding potential fees associated with late payments.

Methods for calculating billing cycles

Credit card interest-free periods allow cardholders to avoid finance charges on purchases made during a specified billing cycle. The billing cycle typically lasts between 28 to 31 days, depending on the credit card issuer, such as Visa or Mastercard. To determine the interest-free period, one must consider the statement closing date, which is usually the last day of the billing cycle. Payments made before this closing date ensure that new purchases made within the cycle are interest-free until the due date, typically 21 to 25 days later. Additionally, methods for calculating billing cycles vary; some institutions utilize fixed dates, while others may employ rolling cycles based on transaction dates. Understanding these calculations can help cardholders maximize their interest-free period and manage their finances more effectively.

Instructions for avoiding interest charges

An interest-free period on credit cards, commonly lasting around 21 to 25 days, allows consumers to pay off purchases without incurring interest charges. To avoid finance charges, it is essential to pay the balance in full by the payment due date, typically stated on the credit card statement. Timely payments can prevent unnecessary fees, which can average around $30. Additionally, a cardholder should ensure that new purchases are made after the previous month's payment has been processed to maintain the interest-free status. Awareness of the card's billing cycle, which might vary depending on the issuer, is crucial to maximize this benefit effectively. Maintaining a low credit utilization ratio, ideally under 30%, can also positively impact credit scores, providing further financial advantages.

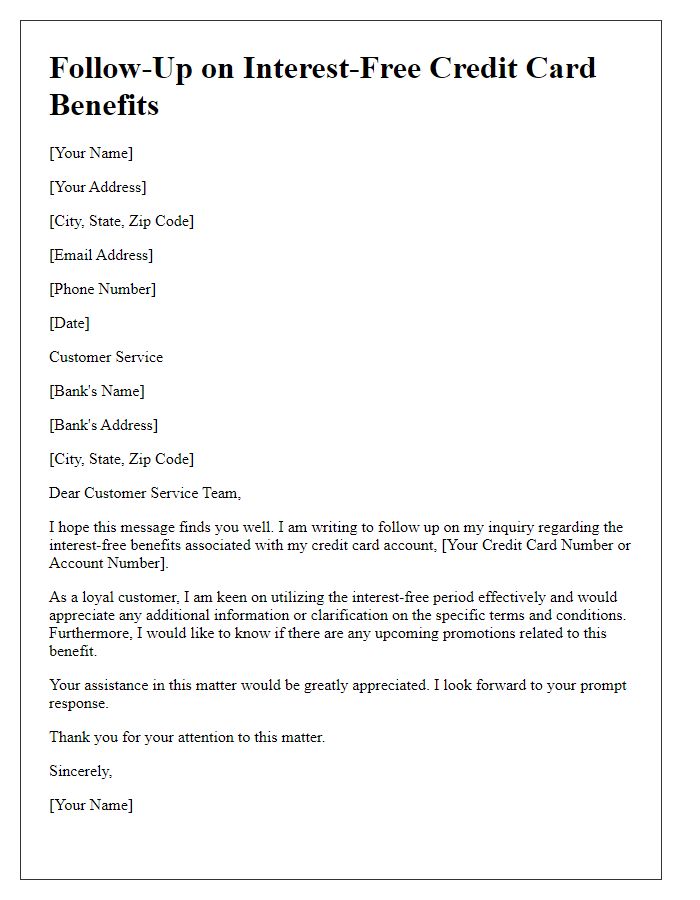

Letter Template For Credit Card Interest-Free Period Details Samples

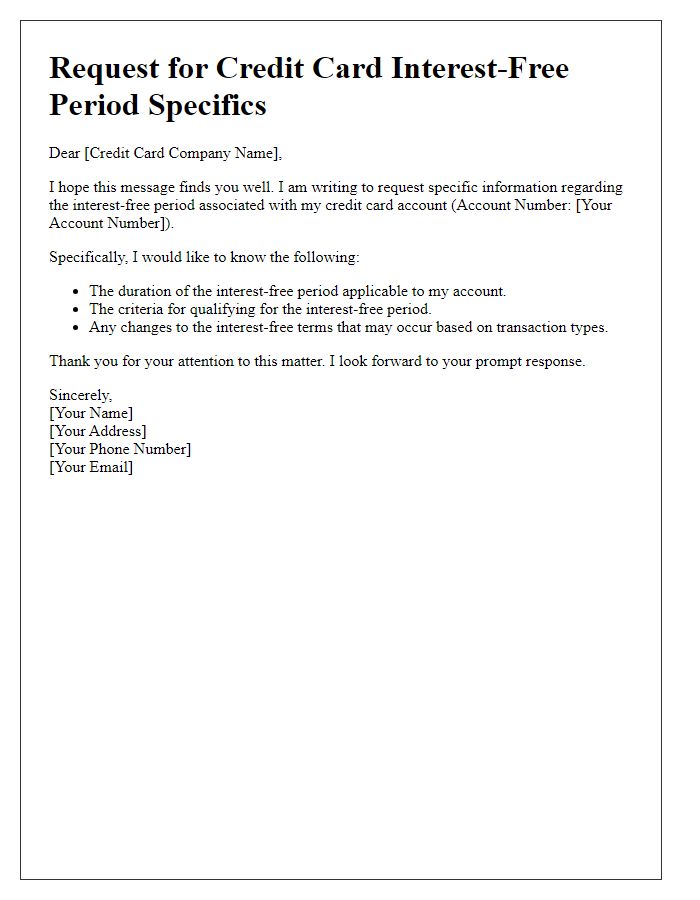

Letter template of request for credit card interest-free period specifics

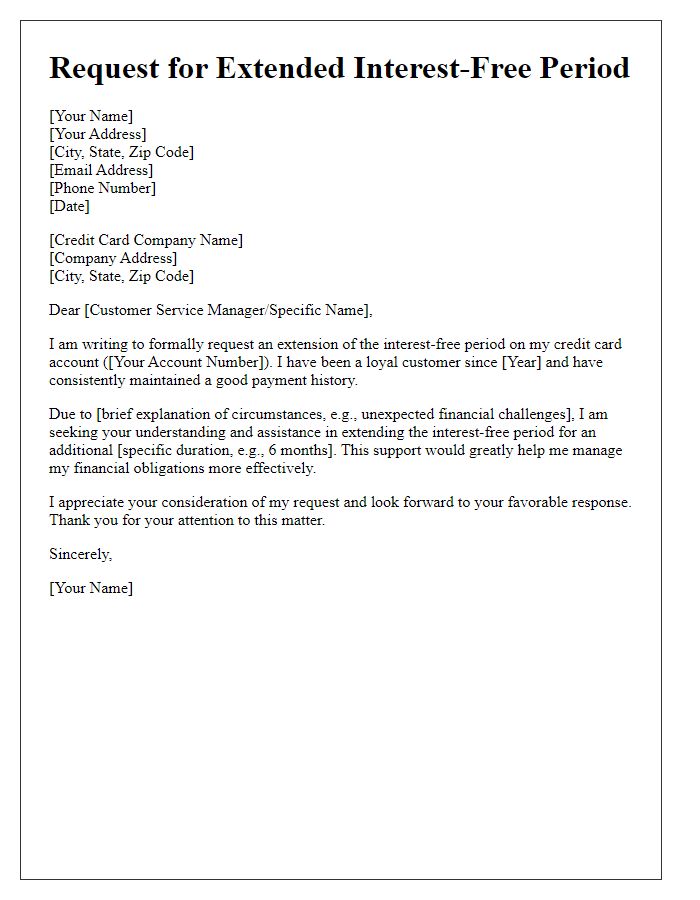

Letter template of appeal for extended interest-free period on credit card

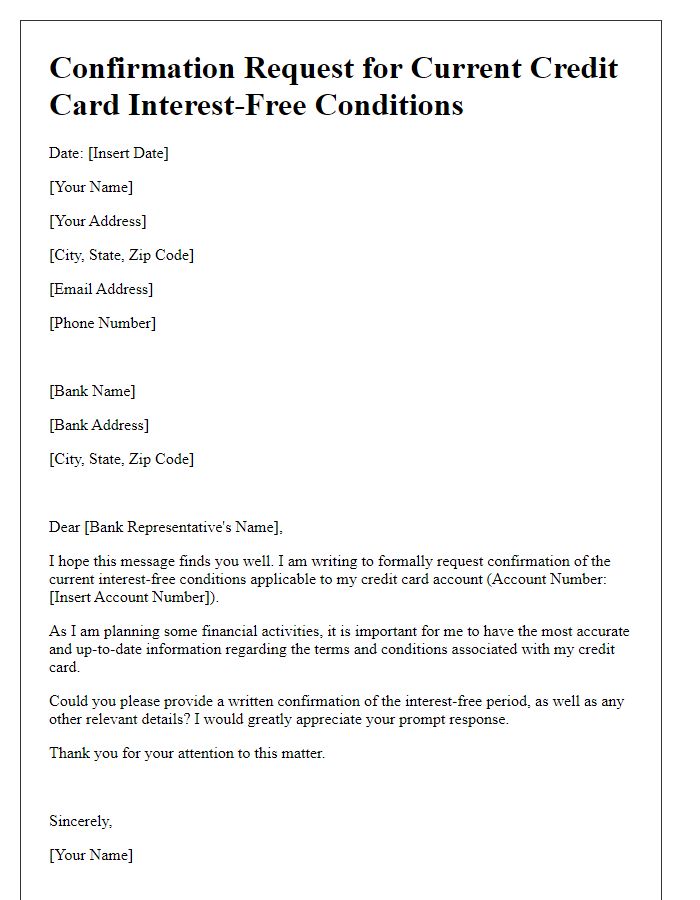

Letter template of confirmation request for current credit card interest-free conditions

Letter template of explanation needed for credit card interest-free eligibility

Letter template of notification about credit card interest-free promotional period

Comments