Are you curious about how credit card cash advances work and what policies you should be aware of? Understanding the nuances of cash advances can save you from unexpected fees and challenges down the road. With the right information, you can navigate this financial tool effectively and make informed decisions. Dive in to learn more about our credit card cash advance policy and get all the insights you need!

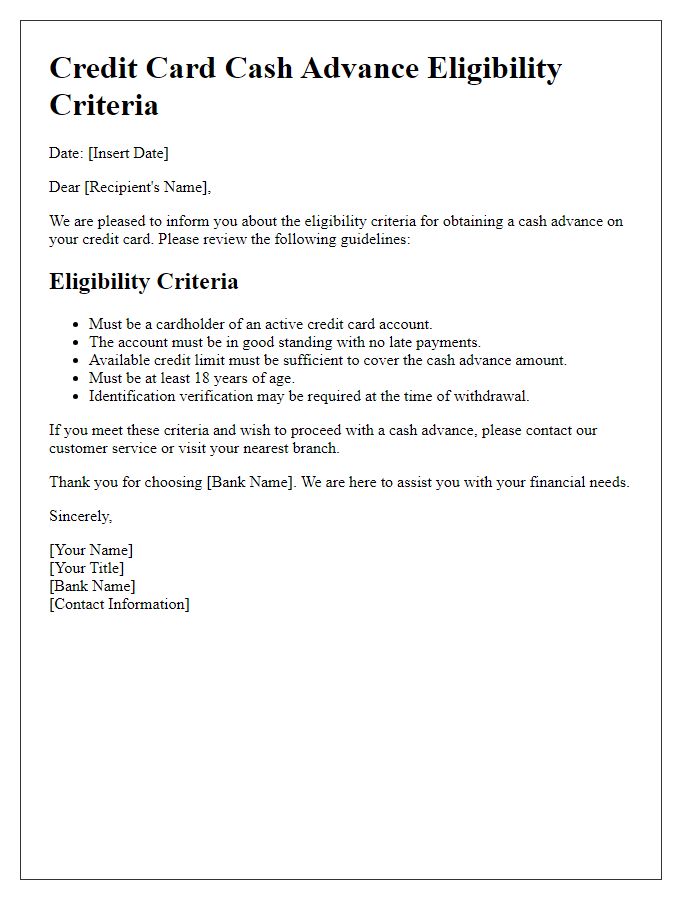

Eligibility requirements

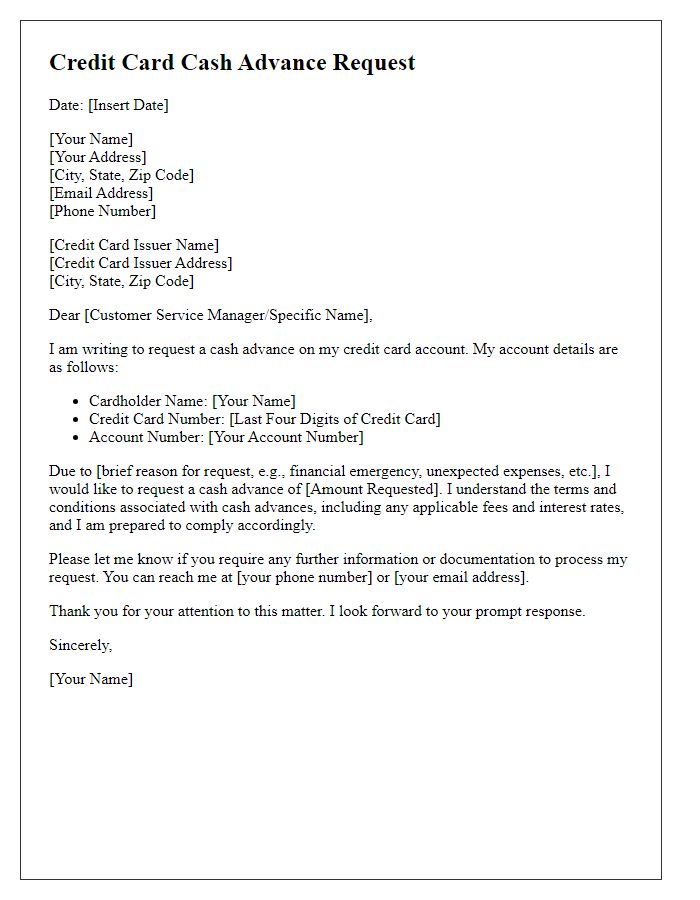

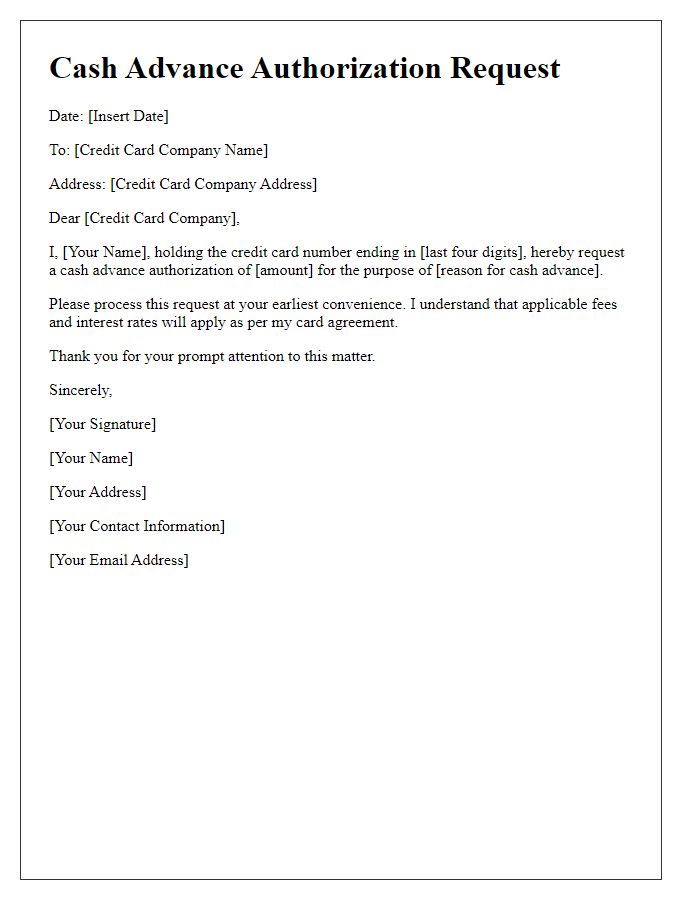

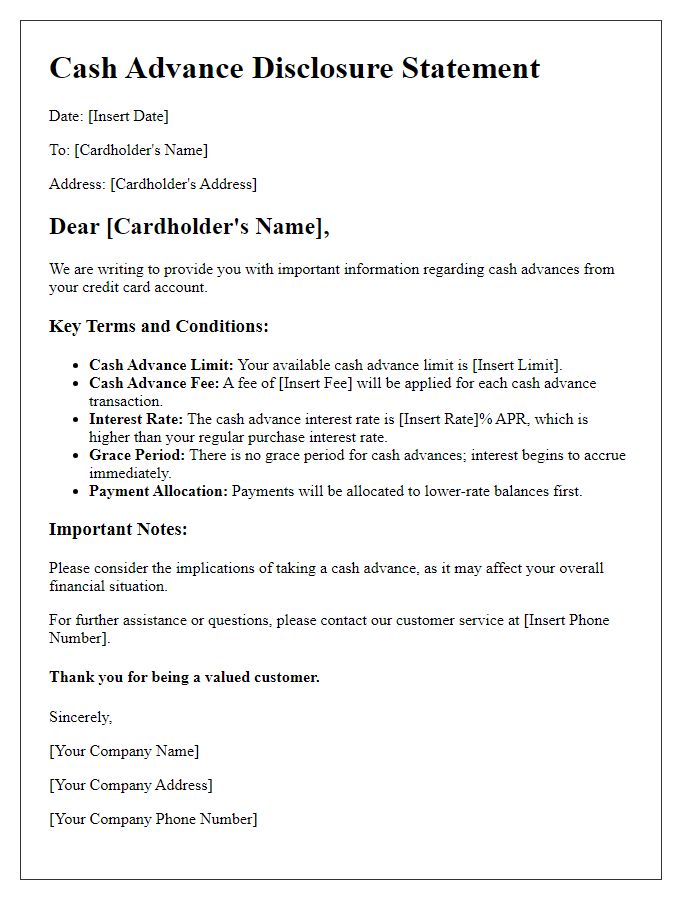

Credit card cash advance policies encompass various eligibility requirements that determine a cardholder's ability to withdraw cash against their credit limit. Typically, cardholders must be at least 18 years old, maintaining an active account in good standing, with no outstanding late payments or delinquencies. The credit limit available can significantly affect cash advance access, with most issuers allowing a percentage, often around 20-30%. Additionally, the cash advance might incur higher interest rates, typically ranging from 24% to 30% annually, along with transaction fees that could be a fixed amount or a percentage of the advance, such as 3-5%. Some providers impose a maximum withdrawal limit, frequently capped at $500 or lower for first-time users. Furthermore, certain restrictions may apply based on the card type and issuer, necessitating careful review of contract terms before proceeding.

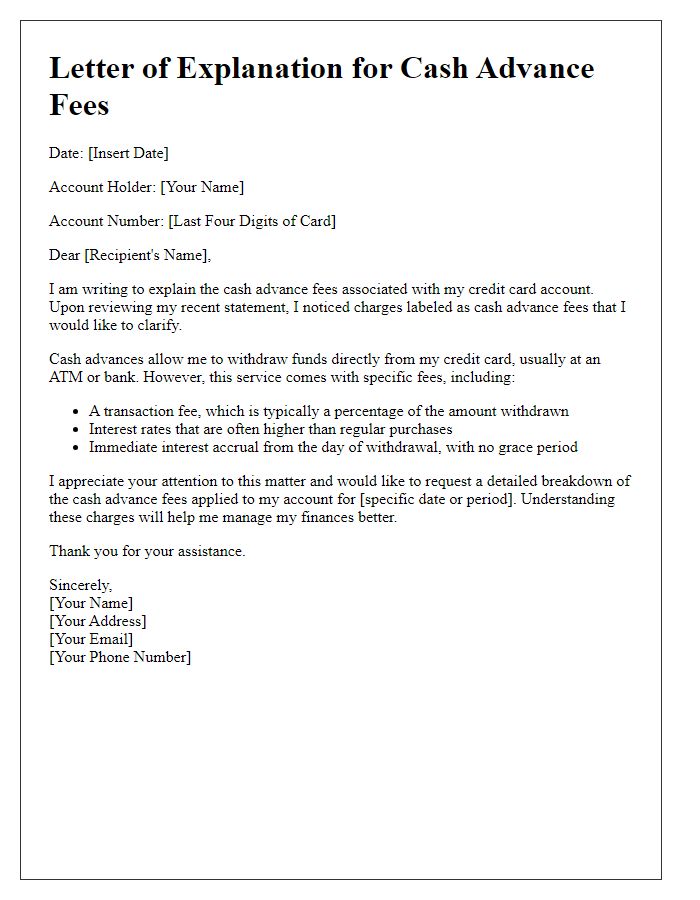

Interest rates and fees

Credit card cash advances can incur significant interest rates and fees, impacting overall financial responsibility. Standard cash advance APRs (Annual Percentage Rates) typically range from 20% to 30%, depending on the credit card issuer such as VISA or Mastercard. Cash advance fees often include a percentage of the amount withdrawn, usually 3% to 5%, or a flat fee, often around $10, whichever is higher. Additionally, interest on cash advances begins to accumulate immediately, without a grace period, making swift repayment crucial. Factors such as the cardholder's creditworthiness and the terms outlined in the cardholder agreement can further influence these rates and fees, emphasizing the importance of understanding specific policies before obtaining a cash advance.

Repayment terms

Credit card cash advances provide immediate access to funds but come with specific repayment terms that cardholders must understand. Typically, cash advances are subject to a higher interest rate compared to standard purchases, often ranging from 20% to 30% annually. Most credit card companies do not provide a grace period for cash advances, meaning interest starts accruing immediately upon withdrawal. Additionally, repayment towards cash advances usually occurs before payments toward other charges on the credit card bill, potentially resulting in significant interest accumulation if not managed carefully. The cash advance limit is often lower than the overall credit limit, commonly around 20-30% of the total credit limit. Cardholders should also be mindful of transaction fees, which can be as high as 5% of the advance amount, creating an additional cost factor to consider. Understanding these details is crucial for effective financial management and avoiding excessive debt.

Transaction limits

The policy governing credit card cash advances is designed to provide clarity and guidance on transaction limits. Most credit card issuers impose a cash advance limit, which typically ranges from 20% to 30% of the overall credit limit, impacting the maximum amount a cardholder can withdraw from ATMs or financial institutions. For example, if a credit card has a total limit of $5,000, the cash advance limit might be set between $1,000 and $1,500. Additionally, fees associated with cash advances can be significant, often ranging from 3% to 5% of the transaction amount, which may further influence the cardholder's decision to proceed with the advance. Interest rates applied to cash advances are generally higher than standard purchase APRs, with rates sometimes exceeding 25%, escalating financial burdens if not repaid quickly. It's critical for cardholders to be aware of these terms, ensuring informed financial decisions.

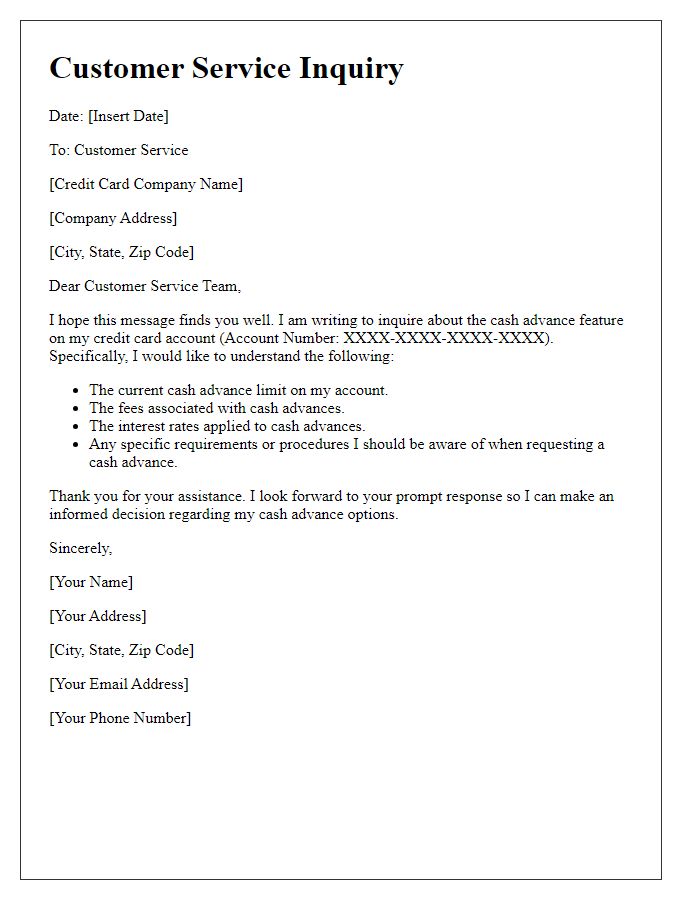

Processing and approval times

Credit card cash advances provide immediate access to funds but come with specific processing and approval times that vary by institution. Typically, cash advances are processed within minutes through ATMs or participating bank branches, allowing access to cash from personal credit limits. However, some financial institutions may impose additional verification steps, potentially extending approval times up to 24 hours for larger cash advance requests. Limitations may exist, including daily withdrawal caps (often ranging from $200 to $1,000, depending on the card issuer) and differing interest rates that can apply immediately upon the cash advance transaction. Therefore, understanding the intricacies of processing times and specific policies is essential for optimal utilization of cash advance features.

Comments