If you've ever found yourself puzzled by unexpected charges on your credit card after a trip abroad, you're not alone. Many travelers are taken by surprise when it comes to foreign transaction fees and currency conversions. Understanding these costs can feel overwhelming, but it doesn't have to be! Dive into our comprehensive guide to learn how to handle and inquire about foreign transaction issues like a pro!

Account Holder Information

Credit card foreign transactions frequently involve complexities related to international exchange rates and additional fees. Account holder information must include personal identifiers such as name, address, and contact number. Transaction details should encompass the date of purchase, merchant name, and transaction amount presented in local currency. Additionally, it may be crucial to reference specific terms outlined in the cardholder agreement, particularly those addressing foreign transaction fees, which can impact the final billing amount. Awareness of varying international banking policies can help in understanding discrepancies on statements.

Transaction Details

Inquiring about foreign transaction details on credit card statements is crucial for financial management. Transactions often list specific amounts in foreign currencies, like Euros or Yen, typically showing conversion rates and fees associated with international purchases. For instance, a transaction made in Paris at a Cafe may display an original charge of 20 Euros, converted to $22.50 USD, reflecting a service fee from the credit card issuer. Dates are essential; unwarranted charges may arise weeks post-purchase due to delayed posting. Additionally, merchants' names and contact information help in identifying potential unauthorized transactions. Maintaining accurate records ensures accountability and helps resolve disputes effectively.

Inquiry Purpose

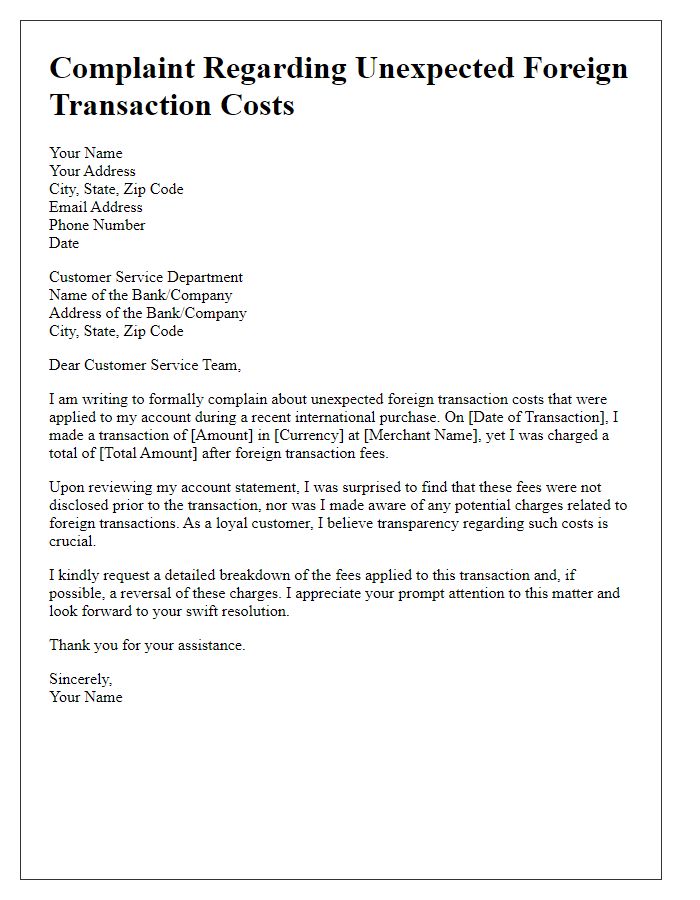

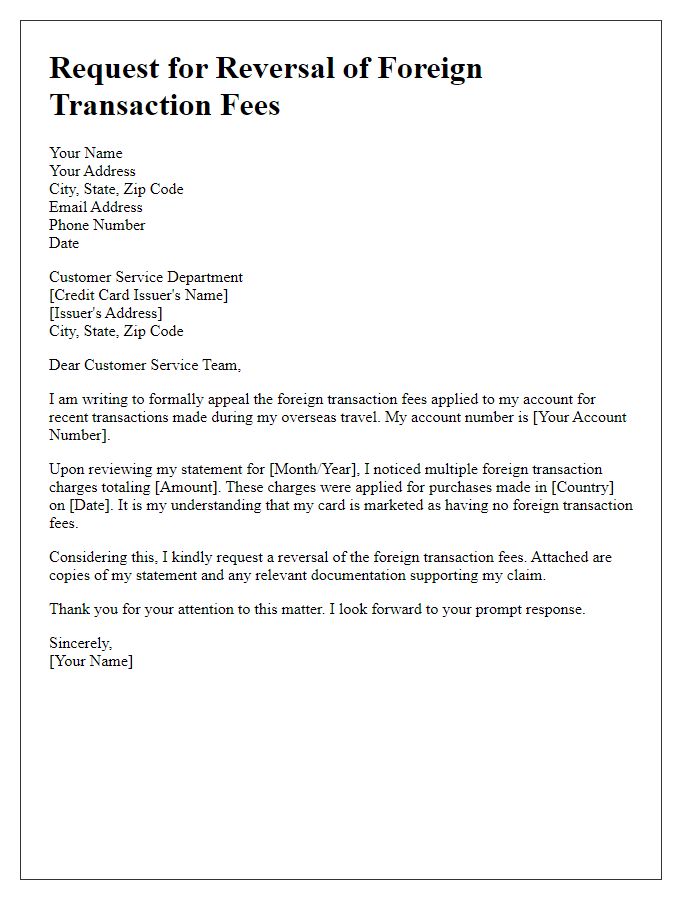

Inquiring about foreign transaction fees on credit cards, such as those issued by American Express, Visa, or Mastercard. Often, these fees range from 1% to 3% of the transaction amount, applying to charges made outside the United States. Specific countries may impose different surcharges based on regional banking regulations. Understanding these fees is crucial for travelers spending in foreign currencies, particularly in Europe, Asia, or Australia, where conversion rates and additional charges could significantly impact total costs. Requesting a detailed breakdown of these potential charges ensures informed spending while abroad.

Contact Information

When inquiring about foreign transaction fees related to credit card use, often associated with cards from major financial institutions like Visa, MasterCard, or American Express, it is important to prepare personal information accurately. Include full name (as it appears on the card), credit card number (last four digits for security), phone number (to facilitate contact), and email address (for official communication). Specify the dates of transactions, the merchant names, and the transaction amounts in the local currency to precisely address any discrepancies. In addition, mention the country where transactions occurred, as country-specific fees and exchange rates can significantly impact final charges. Collecting these details ensures a comprehensive inquiry, enhancing the efficiency of the review process by customer service representatives.

Signature and Date

Credit card foreign transaction inquiries often arise due to unfamiliar charges on monthly statements. Users might encounter fees related to currency conversion or foreign transaction surcharges, typically ranging from 1% to 3% of the transaction amount. The inquiry process is crucial for maintaining account accuracy and preventing potential fraud. Customers should provide their account number along with detailed information about the disputed charge, including transaction date, amount, and merchant name. Signature verification is essential for authorization, while providing a clear date ensures the bank can efficiently process the inquiry.

Letter Template For Credit Card Foreign Transaction Inquiry Samples

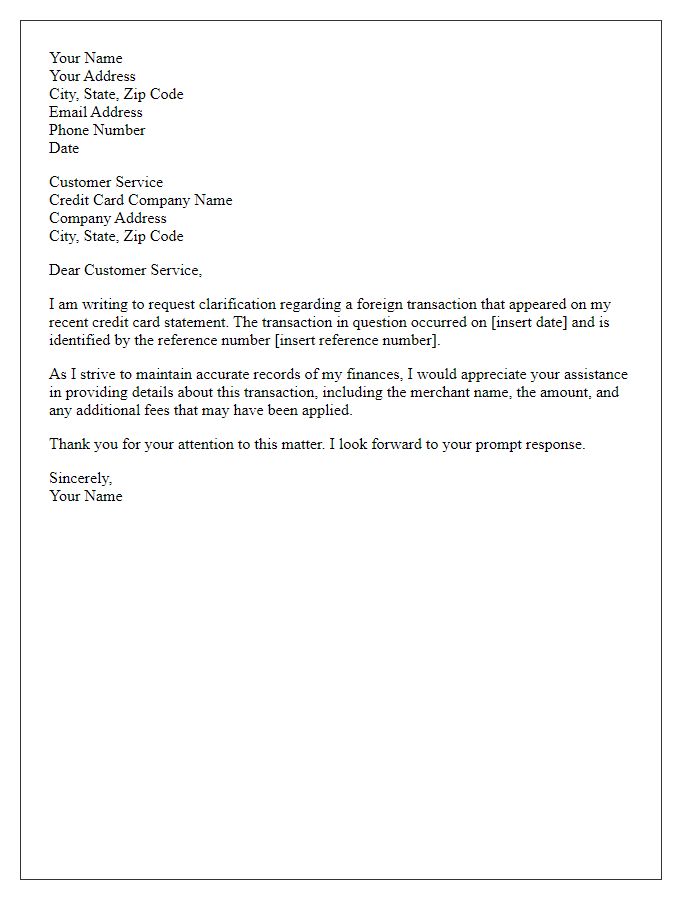

Letter template of request for credit card foreign transaction clarification

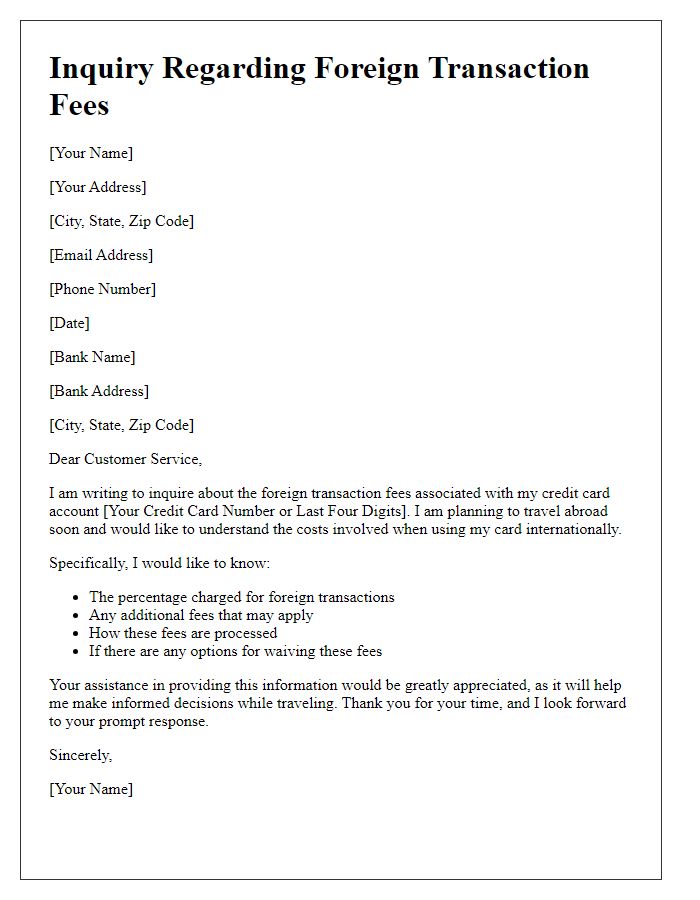

Letter template of inquiry regarding foreign transaction fees on credit card

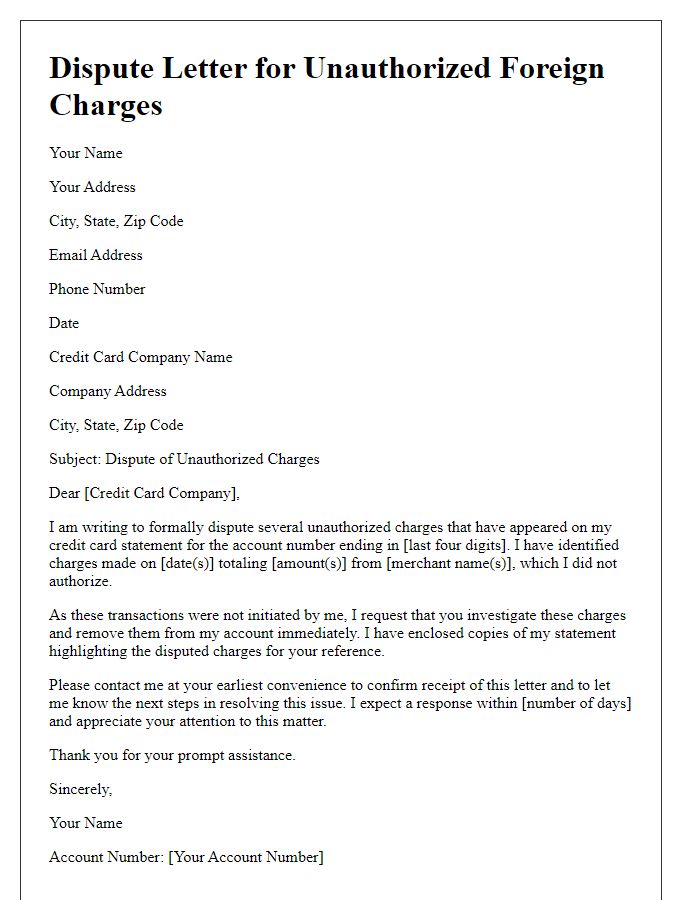

Letter template of dispute for unauthorized foreign charges on credit card

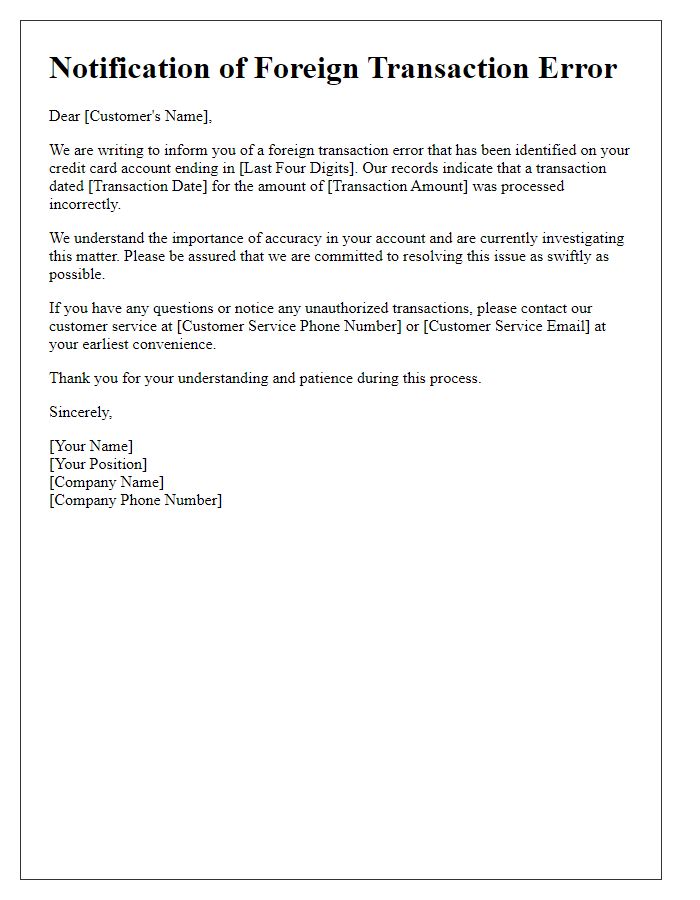

Letter template of notification of foreign transaction error on credit card

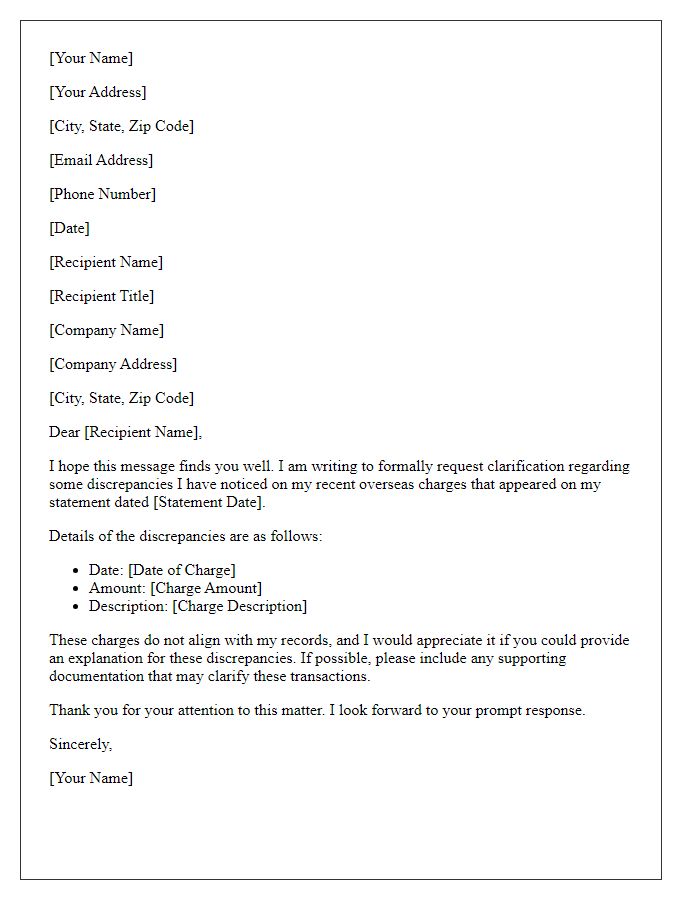

Letter template of explanation request for overseas charge discrepancies

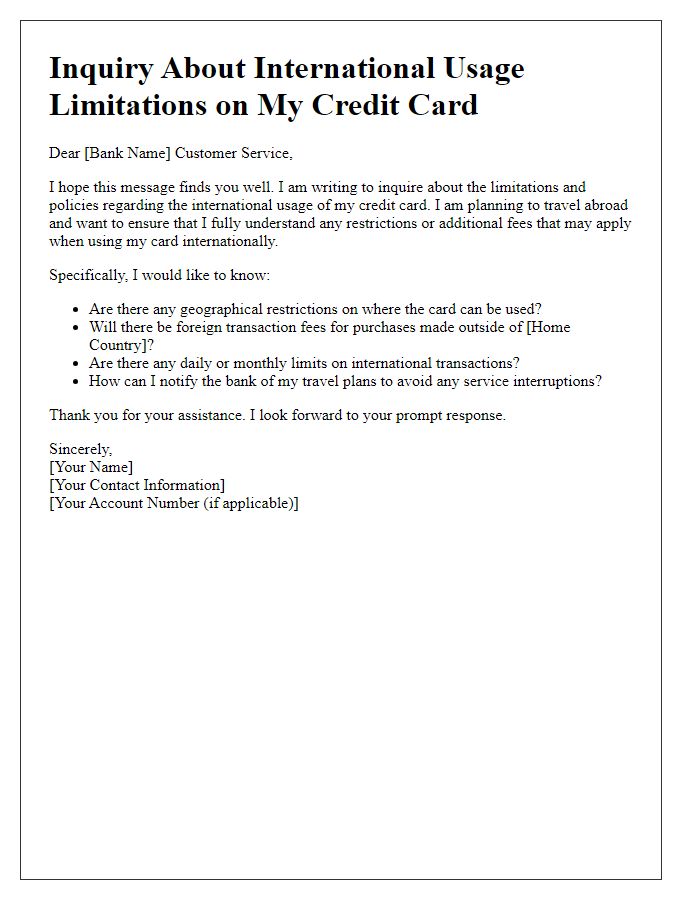

Letter template of question about credit card international usage limitations

Comments