Are you feeling overwhelmed by an unexpected charge on your credit card? You're not alone, and it's essential to know you have the power to dispute those charges. In this article, we'll guide you through a simple and effective letter template to help you articulate your appeal clearly and professionally. So, let's dive in and empower you to take control of your financial situation!

Clear identification of disputed charge

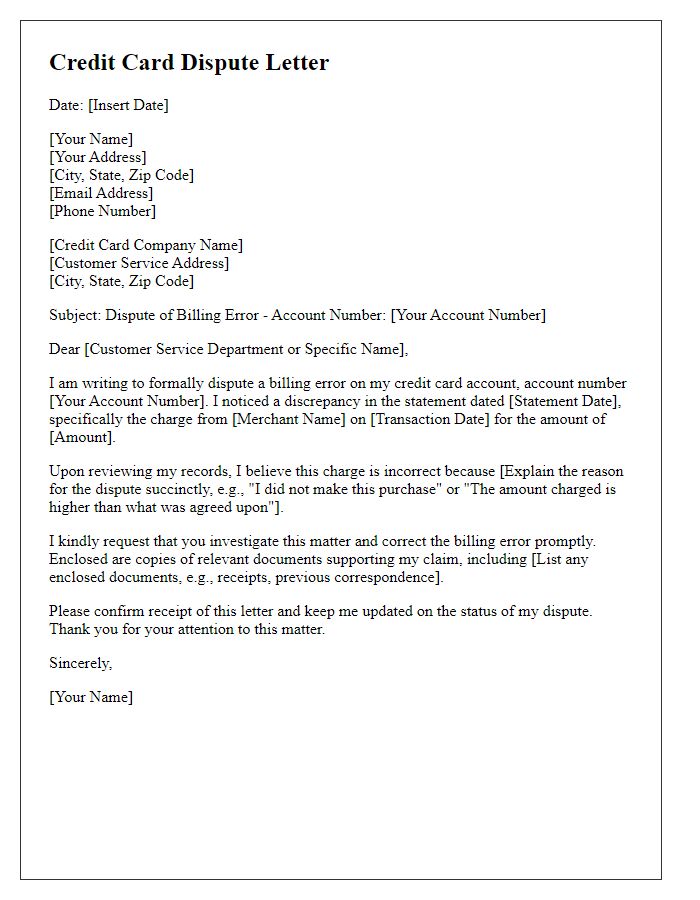

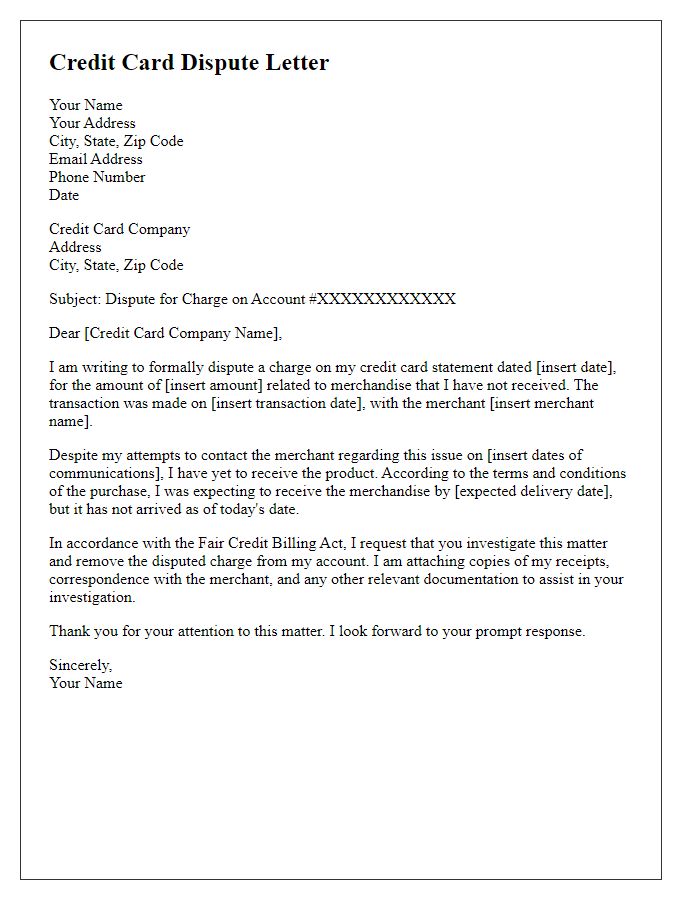

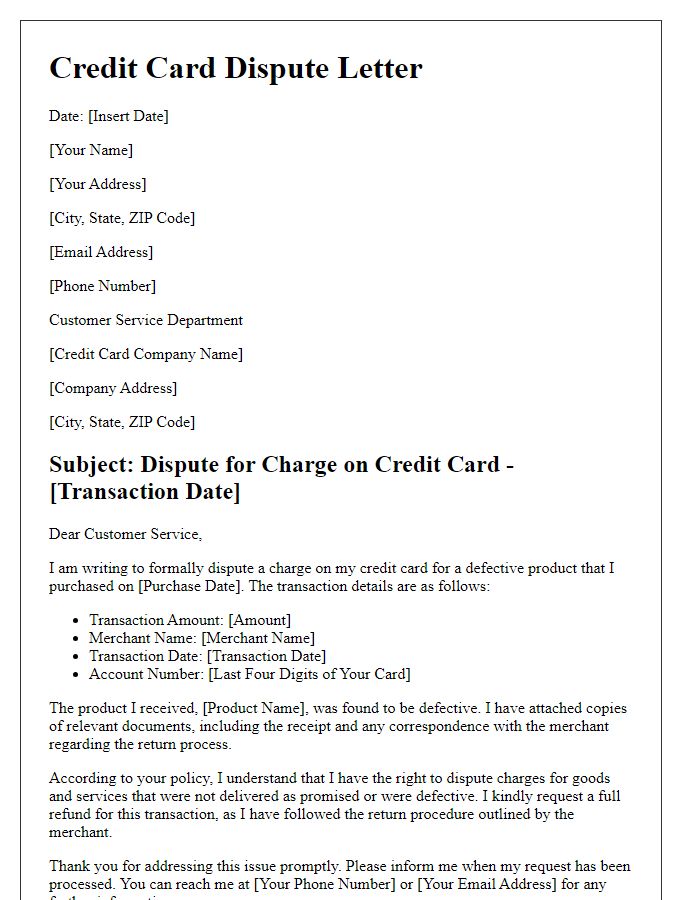

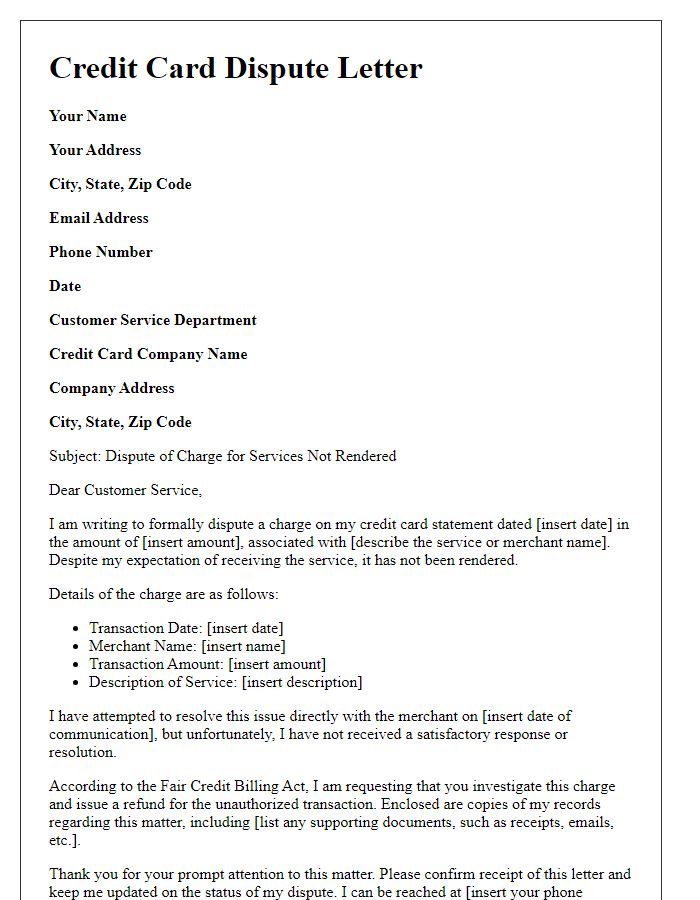

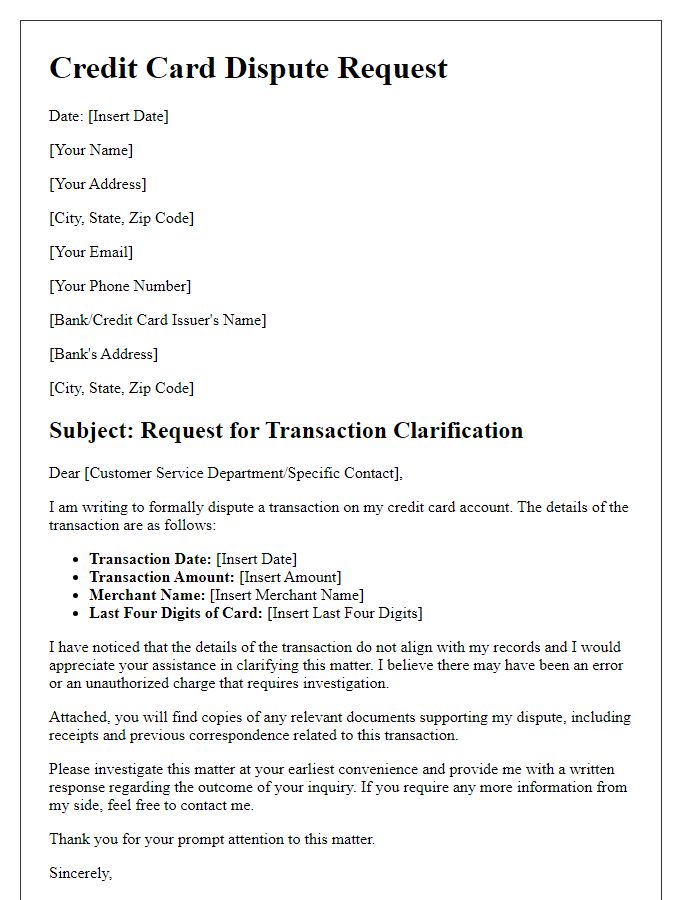

Disputed charges on credit card statements can lead to financial discrepancies for consumers. For instance, if a customer notices an unauthorized transaction of $150 on their Bank of America credit card statement dated October 1, 2023, immediate action is necessary. The process involves clearly identifying the transaction, including the name of the merchant (such as Amazon), the transaction date (September 29, 2023), and the exact amount. Supporting documents, including purchase receipts or bank statements, should be gathered. It's critical to submit a formal dispute appeal to the credit card issuer within 60 days of the statement date, following the established procedures outlined by the Fair Credit Billing Act (FCBA) to protect consumer rights in such situations.

Detailed explanation for dispute

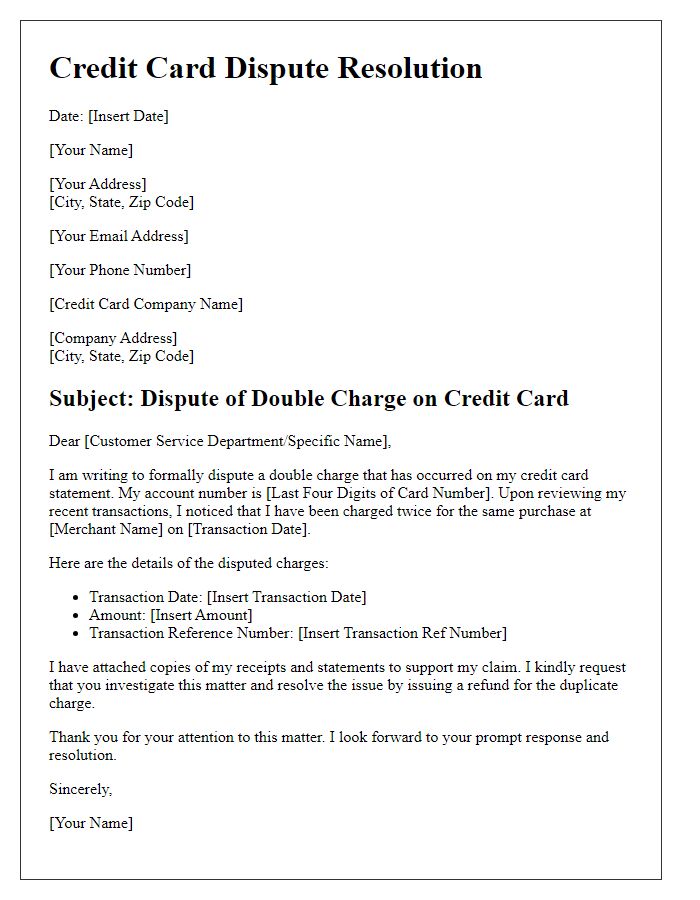

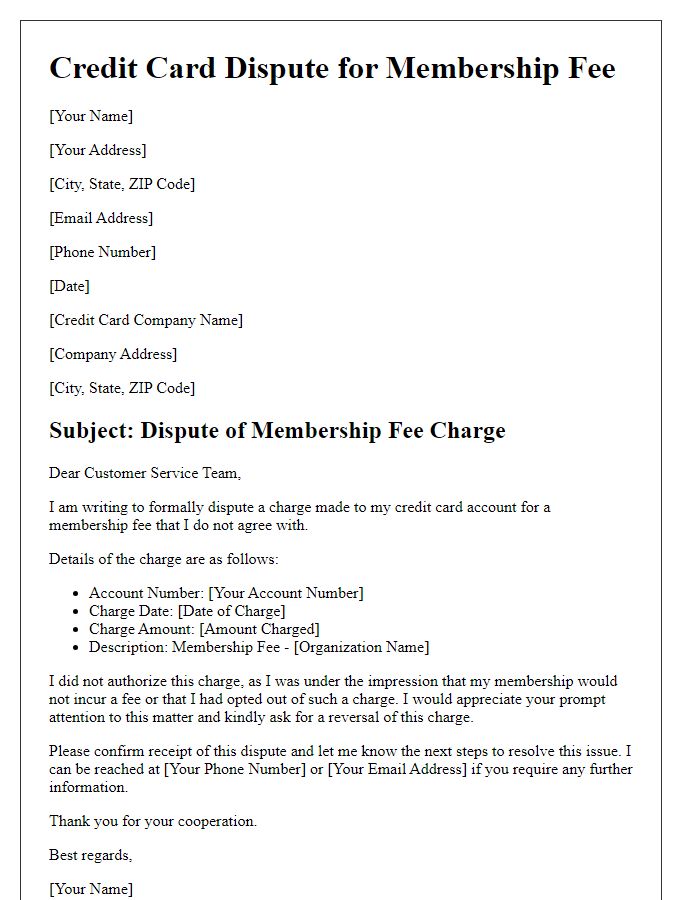

Disputing unauthorized charges on a credit card can be a critical financial action. An instance includes a transaction of $150 at a digital streaming service named XYZ Entertainment that occurred on September 15, 2023, which the cardholder did not authorize. The account statement indicates that the charge appeared unexpectedly without any prior notification. XYZ Entertainment's official records ought to confirm whether the cardholder has a registered account, yet this particular transaction does not align with any previously known services utilized. Moreover, the cardholder previously accessed related services on different platforms such as ABC Streaming and DEF Music, further cementing the assertion of this unauthorized activity. Detailed documentation, including bank statements evidencing the lack of corresponding subscription, can substantiate the claim, providing a clear rationale for the dispute with the financial institution involved.

Supporting documentation and evidence

A credit card dispute appeal involves providing detailed documentation and evidence to support the case against an erroneous charge. Key elements include the transaction date, which often falls within the last billing cycle, the merchant name (like a specific retailer or service provider), and the exact transaction amount. Supporting documentation can consist of bank statements highlighting the disputed charge, receipts or order confirmations to prove the legitimacy of the transaction, and correspondence with the merchant, if applicable. It is crucial to include a detailed explanation of why the charge is inaccurate, citing terms of service or warranty information. Submission of timely documentation, ideally within 60 days from the transaction date, aligns with consumer protections under the Fair Credit Billing Act, thereby ensuring the dispute is processed effectively.

Requested resolution and desired outcome

In the realm of credit card management, a charge dispute appeal often arises when a consumer identifies unauthorized transactions or billing errors. Documentation, such as transaction records and communication history with the merchant, plays a critical role in substantiating claims. Timeliness is crucial; consumers generally have 60 days from the billing statement date to report discrepancies. Financial institutions, such as Visa or Mastercard, adhere to the Fair Credit Billing Act (FCBA), which mandates they must investigate disputes within two billing cycles, ensuring transparency in resolution. Desired outcomes frequently include full refunds, reversal of charges, or potential waivers of late fees incurred due to disputed transactions.

Contact information and preferred communication method

Credit card dispute cases often require clear communication with financial institutions. Carefully document personal contact information, such as name, address, telephone number, and email address. Include details regarding the preferred communication method, such as phone calls during business hours or email responses. This ensures efficient resolution processes and allows for swift updates on the dispute's status. Providing specific times for the best availability can enhance responsiveness, facilitating direct and prompt dialogue with customer service representatives.

Letter Template For Credit Card Dispute Charge Appeal Samples

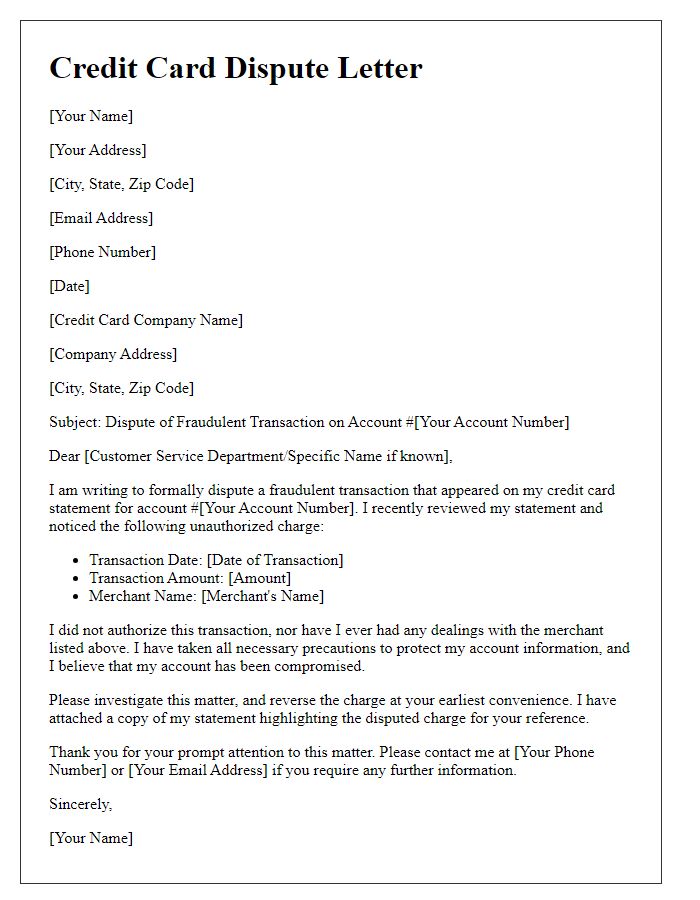

Letter template of credit card dispute for fraudulent transaction claim.

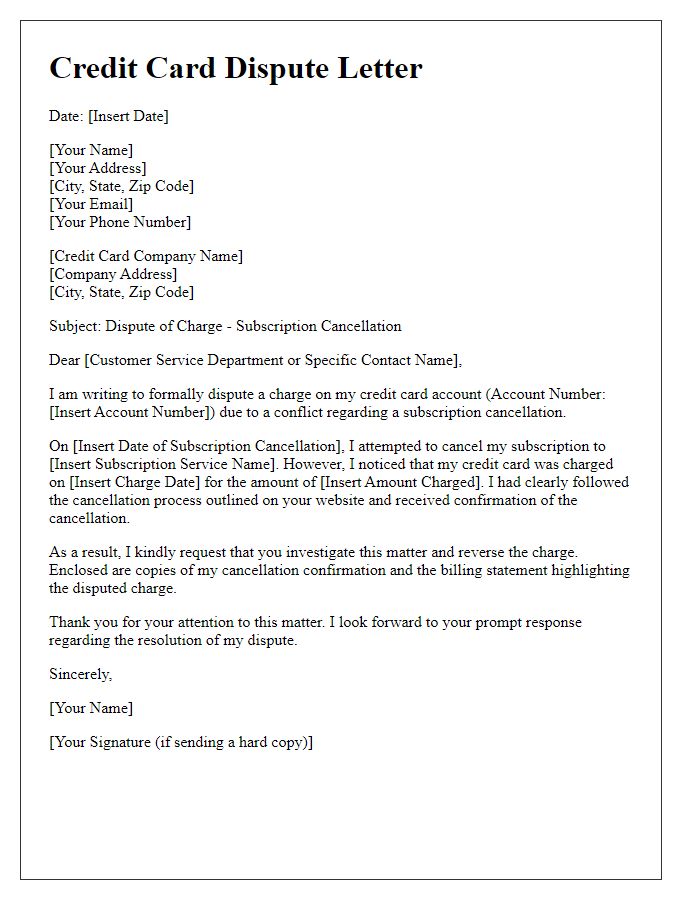

Letter template of credit card dispute for subscription cancellation conflict.

Comments