Having trouble with your credit card company can be frustrating, but knowing how to escalate your complaint can make all the difference. In this article, we'll guide you through the process of effectively addressing your concerns and ensuring your voice is heard. Whether you're dealing with billing issues or unauthorized charges, understanding the escalation procedure is crucial for a satisfactory resolution. So, let's dive in and explore the steps you can take to escalate your complaint with confidence!

Account Information and Personal Details

Escalating a credit card complaint involves providing specific account information and personal details to ensure proper handling. The credit card account number serves as the primary identifier, allowing customer service representatives to access account history. Including full name, address (city, state, ZIP code) ensures identification and correspondence accuracy. Contact information such as phone number and email address provides additional channels for communication. A detailed description of the complaint, including transaction dates, amounts, and any relevant reference numbers, enhances clarity and aids in resolution. Keeping a record of all correspondence, including dates and representatives spoken to, contributes to a comprehensive account of the issue.

Transaction Details and Dispute Description

A credit card dispute may arise when a cardholder identifies unauthorized charges on their account. In instances involving transactions, it is crucial to note specific details such as the transaction date (e.g., January 15, 2023), merchant name (e.g., Amazon.com), transaction amount ($129.99), and the nature of the dispute (e.g., non-receipt of purchased goods or services). Documentation such as receipts or order confirmations can enrich the dispute context. The cardholder should initiate contact with customer service representatives, often through dedicated hotlines listed on the back of the card, to report the incident. Following the initial report, an escalation procedure may involve submitting a formal written complaint to a higher authority within the credit card company's resolution department, typically including relevant reference numbers and detailed descriptions of the incidents. Keeping meticulous records of communication and timelines aids in effective resolution and accountability.

Previous Communication Summary

Credit card complaint escalation procedures are essential for managing customer grievances effectively. Customers often express frustrations related to unauthorized charges, high fees, or poor customer service experiences. In previous communications, a customer may have reported an issue on October 5, 2023, regarding a $150 fraudulent transaction at an online retailer named TechGadgets.com. Despite multiple attempts to resolve this with customer support, including phone calls and written correspondence, the issue remained unresolved as of October 20, 2023. This lack of resolution, coupled with the feeling of dissatisfaction with the customer service team, has prompted the request for escalation to a supervisor or dedicated complaint resolution team. A detailed summary of the transaction history, communication logs, and previous resolutions sought will be critical in addressing the customer's concerns efficiently.

Requested Resolution and Timeframe

When seeking resolution for credit card issues, following a structured escalation procedure is essential. Initially, document all interactions, including dates and representative names, ensuring clear communication history. Clearly state the problem, whether it's billing discrepancies, unauthorized charges, or service issues, providing specific details such as transaction dates and amounts. Request an appropriate resolution, like a refund or account correction, and specify a reasonable timeframe for response, generally 7 to 14 business days, allowing for thorough investigation. Highlight potential consequences of inaction, like reporting to regulatory bodies or seeking legal advice, to emphasize urgency. Ending with a formal expression of expectation for prompt attention signals the seriousness of the complaint.

Contact Information for Further Correspondence

Credit card complaint escalation procedures involve a systematic approach to ensure customer issues are adequately addressed. The initial step includes contacting the customer service department, typically available via a toll-free number (e.g., 1-800-123-4567) or the official website. If unresolved, the next level involves reaching out to a dispute resolution department, often accessible through emails specifically designated for such cases, like disputes@creditcardcompany.com. Escalation also requires written correspondence, ideally through certified mail, sent to a corporate address (e.g., 123 Financial Way, Suite 100, City, State, ZIP) to ensure delivery confirmation. Each correspondence should include essential information such as account numbers, reference numbers from previous interactions, and a detailed summary of the complaint to facilitate efficient handling. Documenting all communication is crucial in the process.

Letter Template For Credit Card Complaint Escalation Procedure Samples

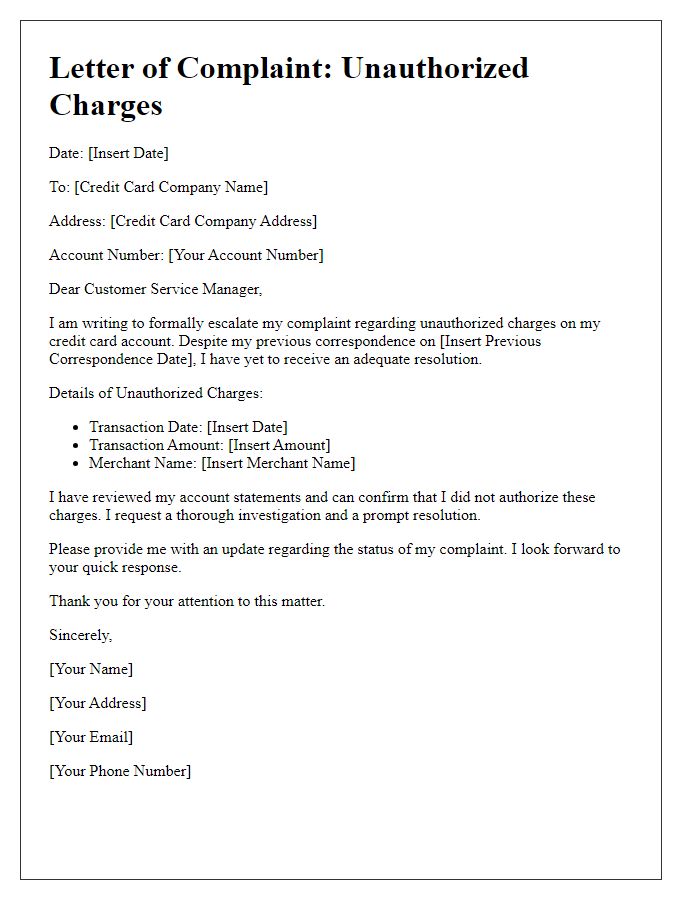

Letter template of credit card complaint escalation for unauthorized charges.

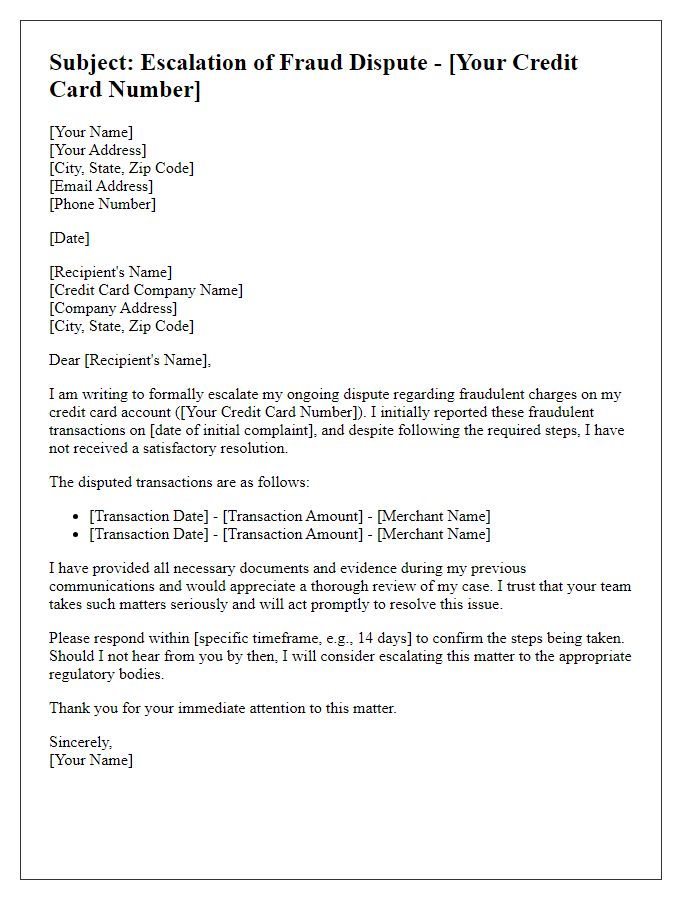

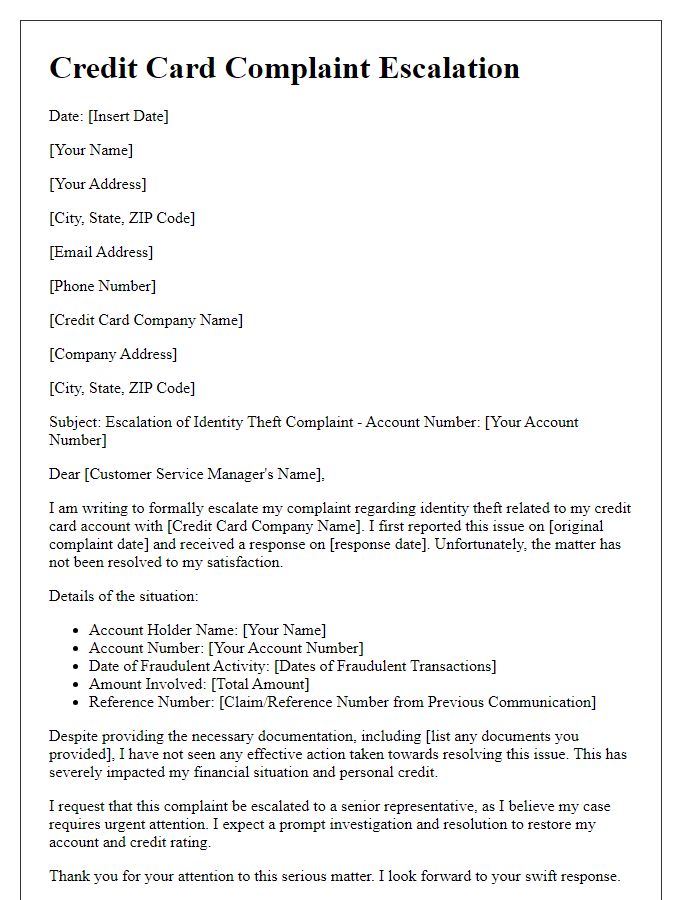

Letter template of credit card complaint escalation regarding fraud dispute.

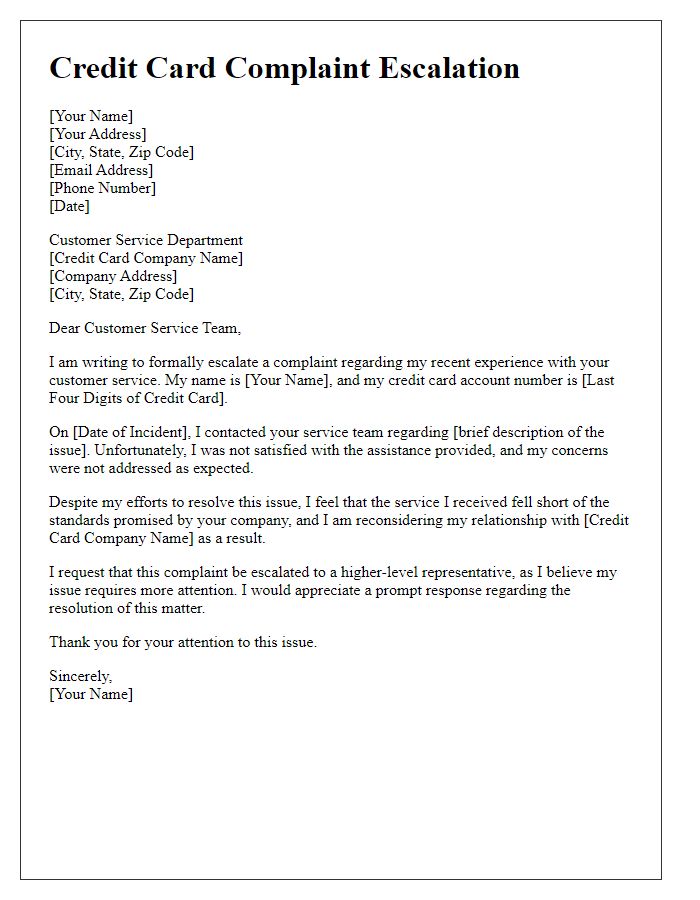

Letter template of credit card complaint escalation for poor customer service experience.

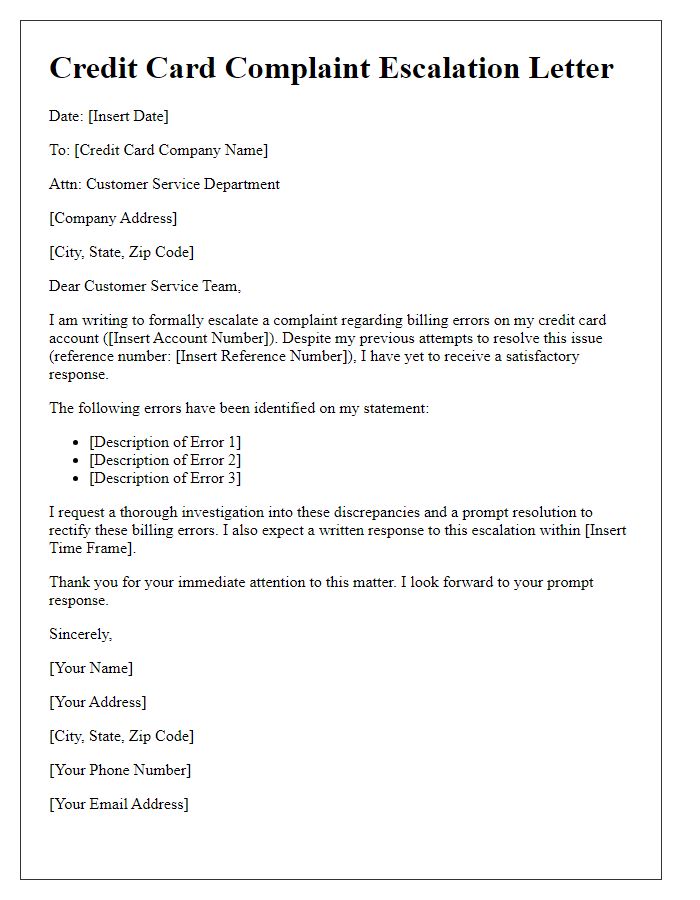

Letter template of credit card complaint escalation about billing errors.

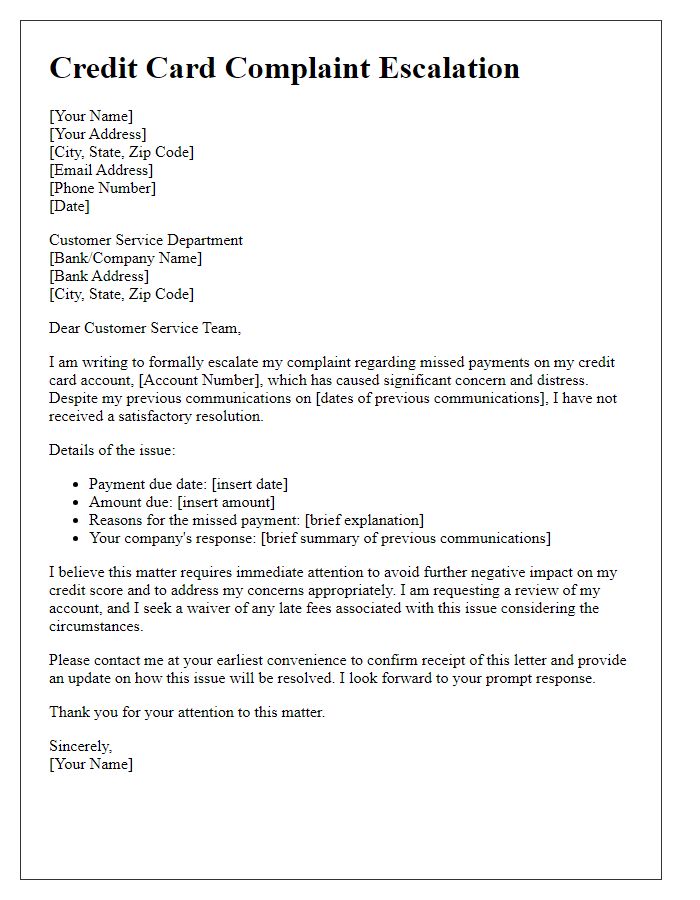

Letter template of credit card complaint escalation for missed payments resolution.

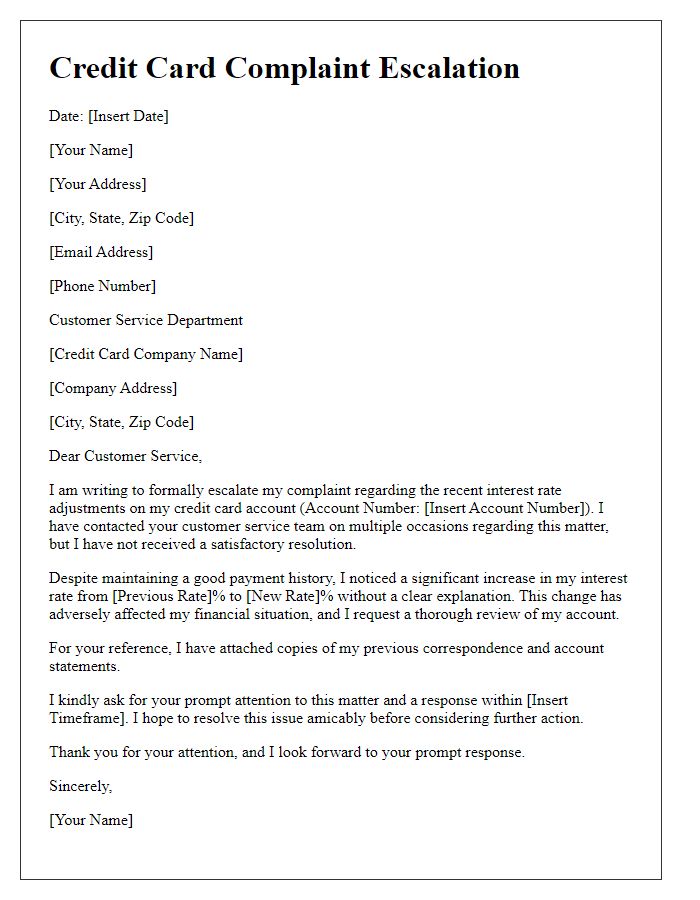

Letter template of credit card complaint escalation concerning interest rate disputes.

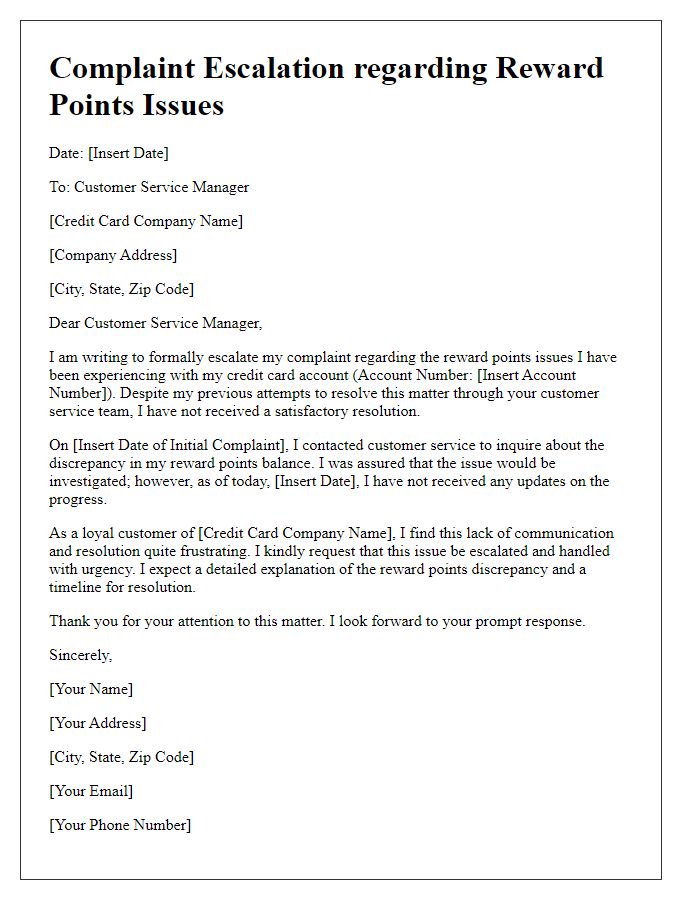

Letter template of credit card complaint escalation regarding reward points issues.

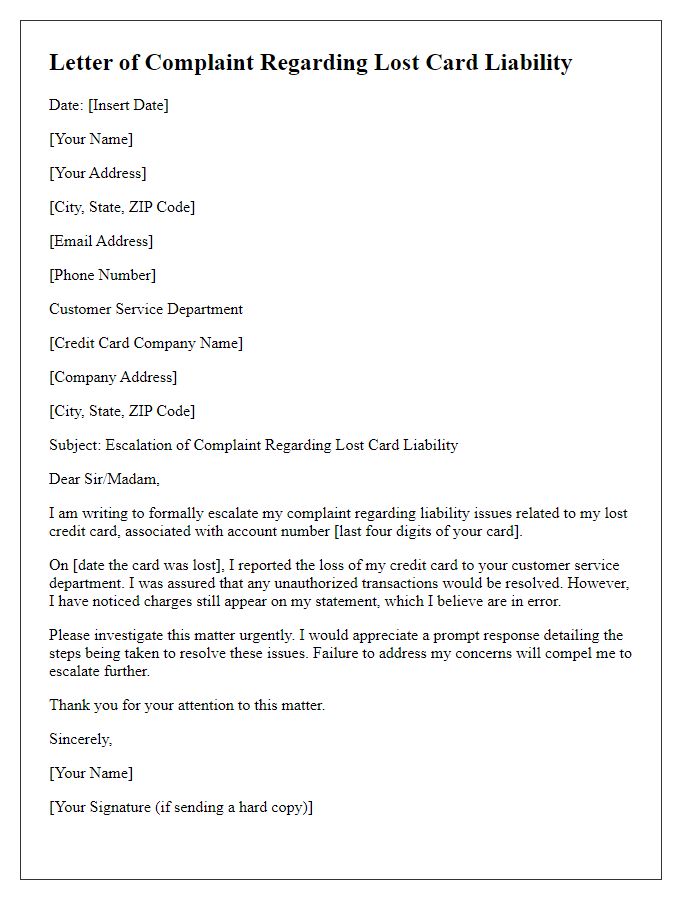

Letter template of credit card complaint escalation for lost card liability.

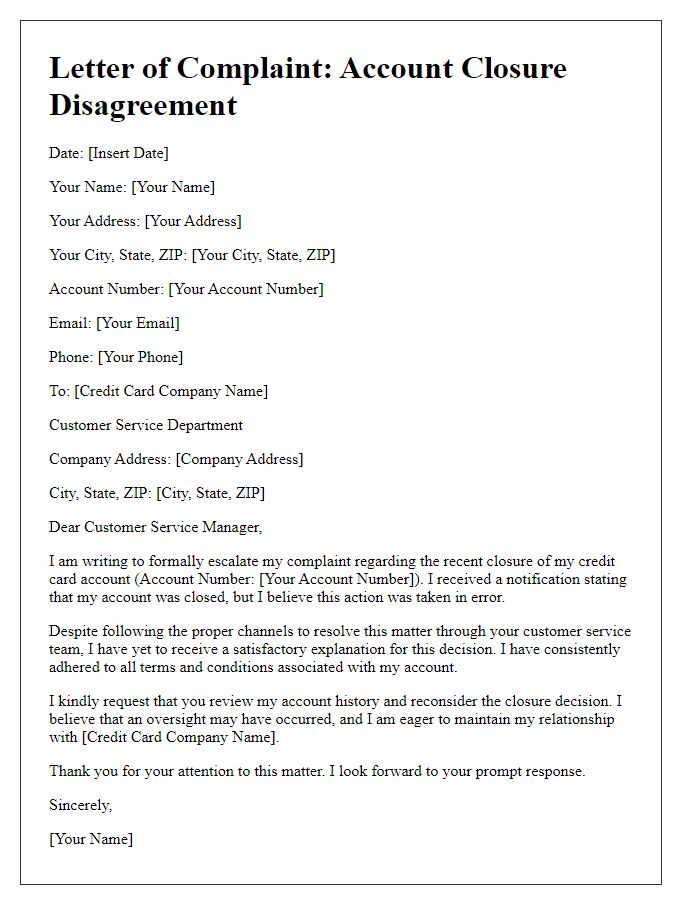

Letter template of credit card complaint escalation about account closure disagreements.

Comments