Are you tired of feeling overwhelmed by your credit card bills each month? A staggered billing agreement might be the perfect solution for you, allowing you to manage your payments more effectively and ease that financial stress. This approach breaks down your total balance into manageable chunks, giving you flexibility and control over your finances. Curious to learn more about how this can benefit you? Keep reading!

Account Holder Information

A staggered billing agreement for credit card payments allows account holders to manage their expenses more effectively. Credit card companies, such as Visa or Mastercard, provide flexibility in payment schedules, allowing individuals to spread payments over multiple months instead of a lump sum. This approach can be invaluable during periods of financial strain, enabling users to avoid late fees and maintain a positive credit score. Key details for account holder information typically include the full name (e.g., John Smith), mailing address (e.g., 123 Main St, Springfield, IL), account number (e.g., 1234-5678-9012-3456), and contact information (e.g., john.smith@email.com, (555) 123-4567). It's crucial to ensure this information is accurate to facilitate proper billing and communication with the financial institution.

Credit Card Details

A staggered billing agreement can manage outstanding balances on credit cards efficiently, allowing for easier financial planning. Important credit card details include the credit limit (typically ranging from $500 to $10,000), annual percentage rate (APR, often between 15% to 25%), and payment due date (usually the same day each month). Cardholders must also consider minimum payment requirements, which usually range from 2% to 5% of the outstanding balance. In a staggered billing agreement, payments could be sourced from an associated bank account designated for this purpose, streamlining the repayment process and ensuring timely payments. Additionally, understanding the terms regarding promotional interest rates and late payment fees (which can reach up to $40) is essential for maintaining good credit standing.

Staggered Billing Plan Terms

A credit card staggered billing agreement provides flexibility for cardholders to manage payments over time. This agreement typically outlines specific terms, including the duration of the payment period, often ranging from three to twelve months, with fixed monthly installments. Interest rates may vary, usually between 10% to 25% APR, depending on the cardholder's credit score and issuer policies. Additionally, the plan may require a down payment of approximately 10% of the total balance. Each payment is due on the same date each month, usually aligned with the cardholder's billing cycle. Failure to comply with the payment schedule can result in late fees, which can average around $30 to $40, and may impact credit scores, often measured by the FICO score range of 300 to 850.

Agreement Date and Duration

A staggered billing agreement allows credit card holders to manage their payments more effectively over time, reducing the financial burden associated with large purchases. Typically, the agreement date marks the initiation of the staggered payment plan, often set on the first day of the billing cycle, as defined in the credit card issuer's policies. The duration of this agreement can range from three to twelve months, depending on the purchase amount and the specific terms negotiated between the cardholder and the financial institution. Payment amounts may vary based on the total balance and the interest rates applied, which typically range from 12% to 24% APR in the United States. Adhering to the timeline outlined in the agreement is crucial to avoid late fees, which can add up to $35 per occurrence, and to maintain a positive credit score.

Signature and Consent

A credit card staggered billing agreement allows cardholders to manage repayments effectively by spreading payments over an extended period. In this document, cardholders must provide their signature, signifying consent to the terms, such as interest rates (often ranging from 14% to 24% APR), payment schedules (typically spanning six to twelve months), and any associated fees (like late payment penalties). The agreement outlines the specifics regarding the amount owed, which can significantly impact monthly budgeting. A clear understanding of the rights and responsibilities under this agreement is crucial for maintaining good credit standing with entities like major credit card companies, such as Visa and Mastercard, within terms set forth by regulatory bodies.

Letter Template For Credit Card Staggered Billing Agreement Samples

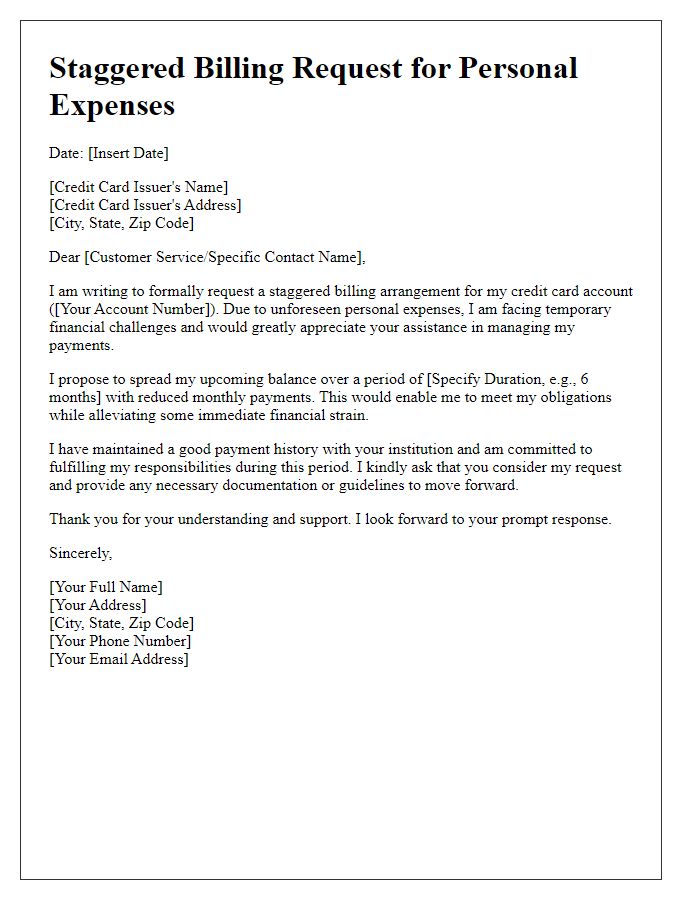

Letter template of credit card staggered billing request for personal expenses

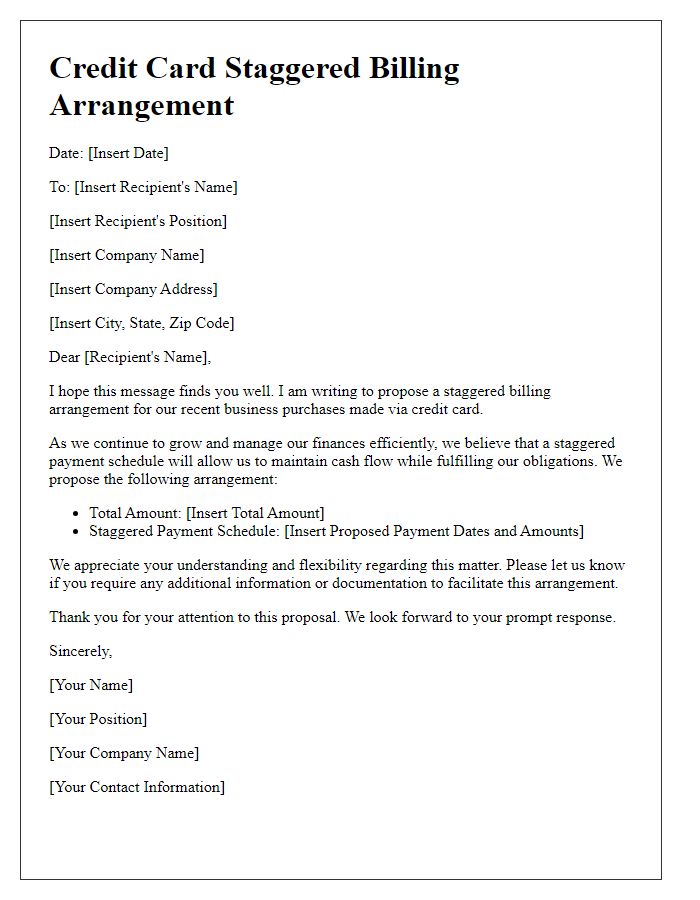

Letter template of credit card staggered billing arrangement for business purchases

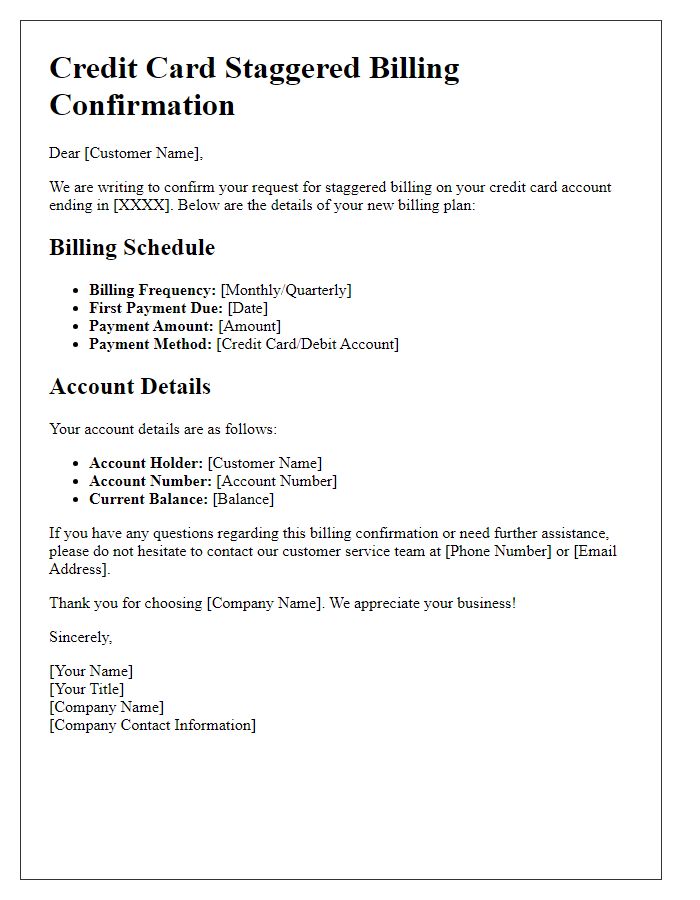

Letter template of credit card staggered billing confirmation for customer accounts

Letter template of credit card staggered billing proposal for financial relief

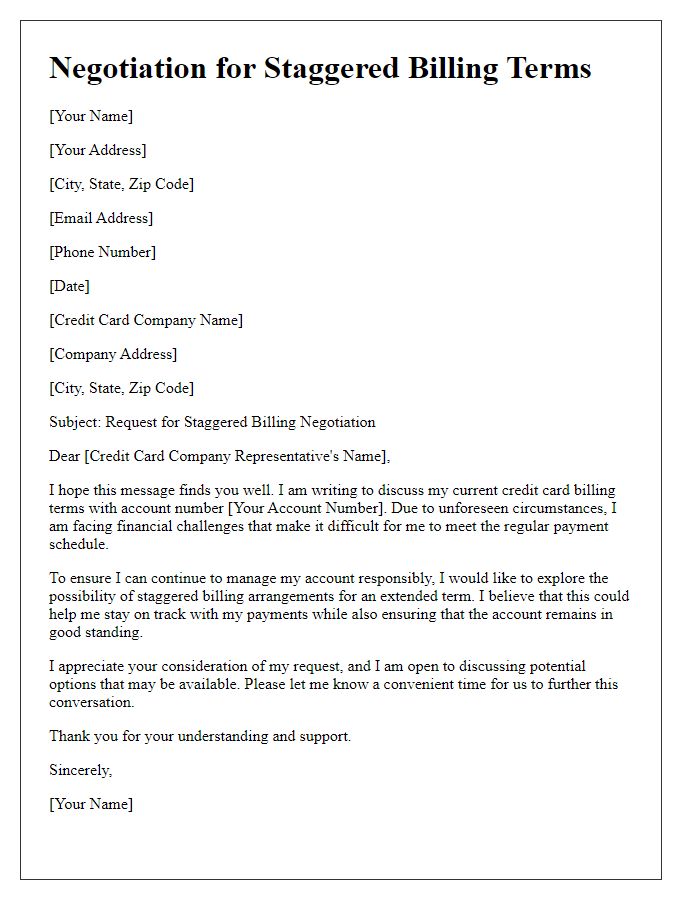

Letter template of credit card staggered billing inquiry for payment flexibility

Letter template of credit card staggered billing adjustment for special circumstances

Letter template of credit card staggered billing approval for monthly payments

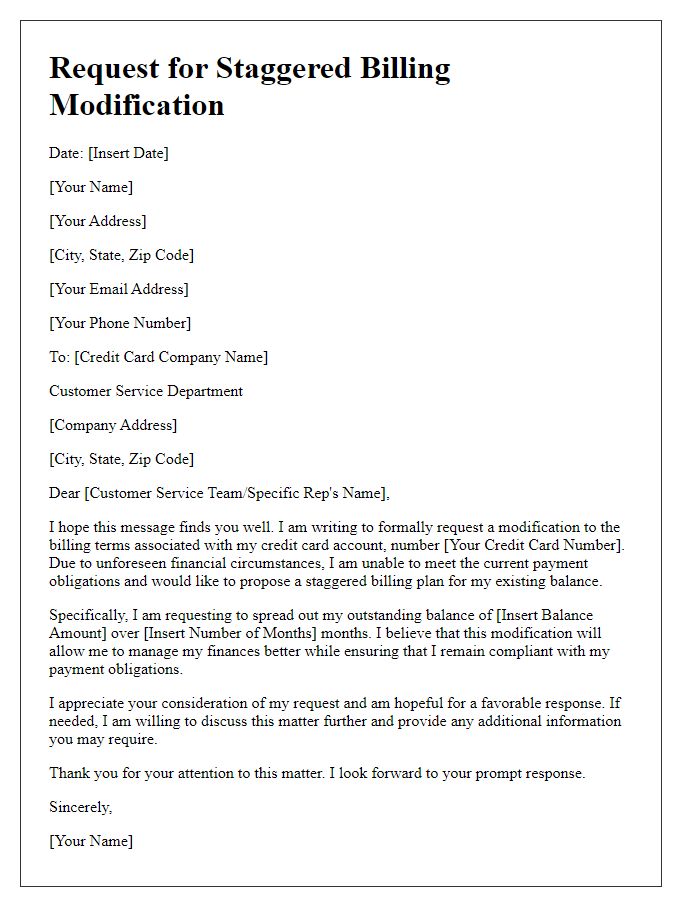

Letter template of credit card staggered billing modification for existing balances

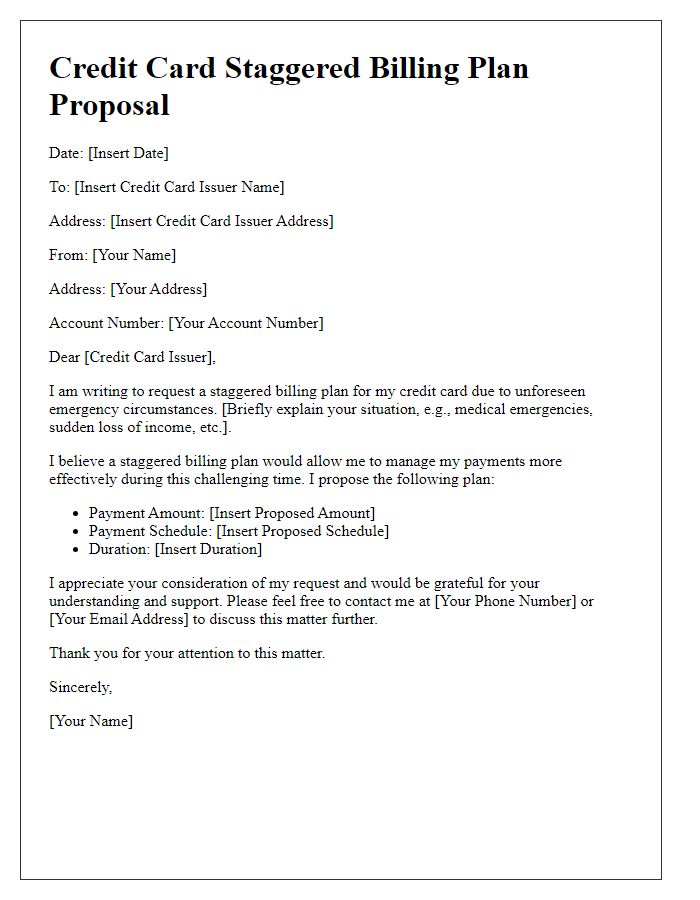

Letter template of credit card staggered billing plan for emergency situations

Comments