Have you ever found yourself in a frustrating situation due to a flawed credit assessment? It's disheartening when an error affects your financial opportunities and peace of mind. In this article, we'll walk you through how to effectively address and correct these inaccuracies, so you can regain control of your credit score. Stick around as we delve deeper into the steps you can take to make your voice heard and rectify your credit report!

Accurate Personal Information

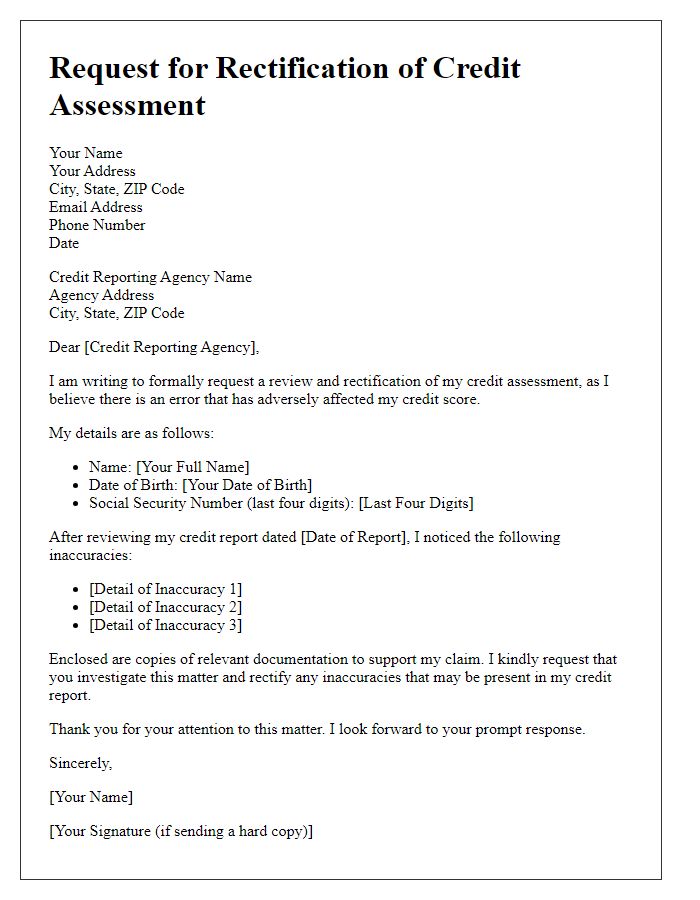

Inaccurate personal information can significantly impact credit assessments conducted by agencies such as Experian, Equifax, and TransUnion. Errors could include misspellings of names, incorrect addresses, or wrong date of birth details, all of which can lead to misleading credit scores. For example, a misreported address may cause overlaps with another individual's credit profile, resulting in erroneous negative marks. Personal information corrections, tracked via their respective systems, can typically improve credit scores by providing a clearer picture of an individual's financial history. Updating this information is essential for obtaining favorable loan terms from lenders such as banks or mortgage companies.

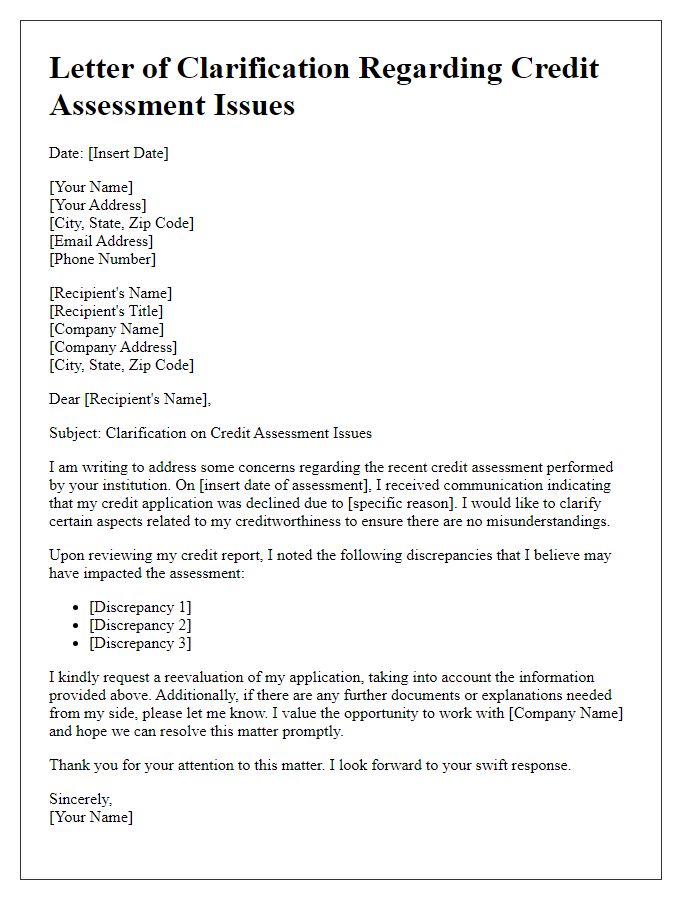

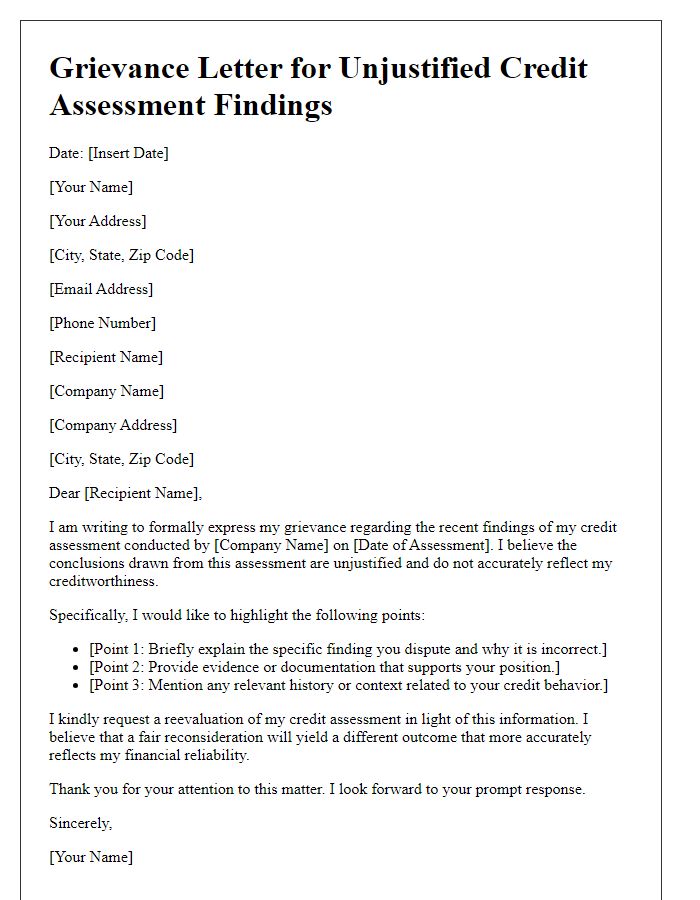

Specific Error Details

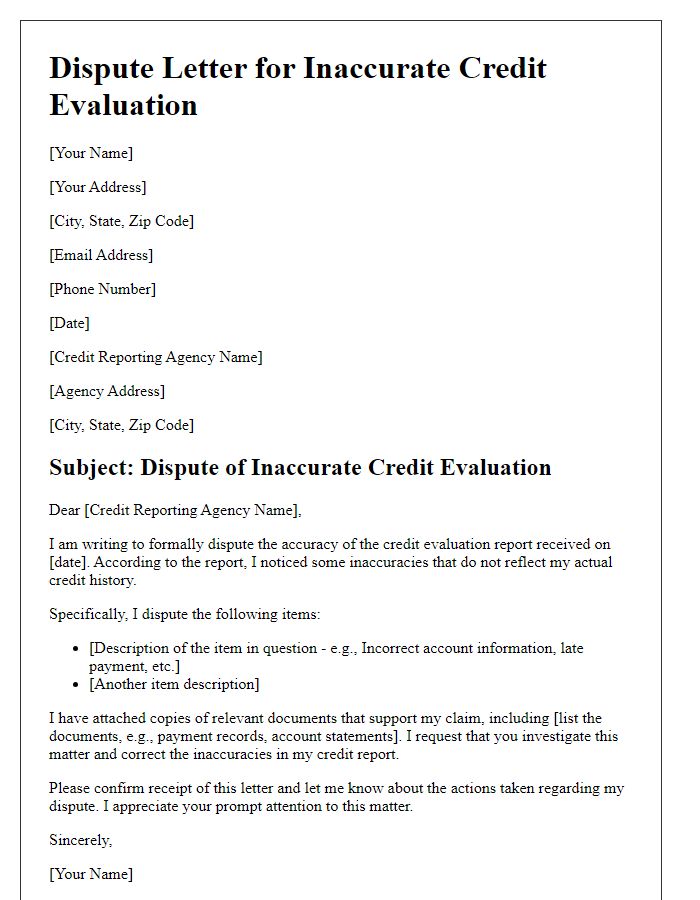

A flawed credit assessment can lead to significant impacts on financial opportunities for individuals. Common errors such as incorrect personal information (like name, address, or social security number) can stem from reporting discrepancies among credit agencies like Experian, Equifax, or TransUnion. Moreover, outdated account statuses, such as closed accounts listed as open, can misrepresent an individual's creditworthiness and overall credit score (with scores ranging from 300 to 850). Another prevalent issue includes erroneous late payments or defaults on loans or credit cards, which can mislead lenders about a borrower's reliability. Timely correction of these errors, often requiring documentation and formal requests, is crucial for ensuring accurate credit records and improving potential access to loans, mortgages, or credit cards in the future.

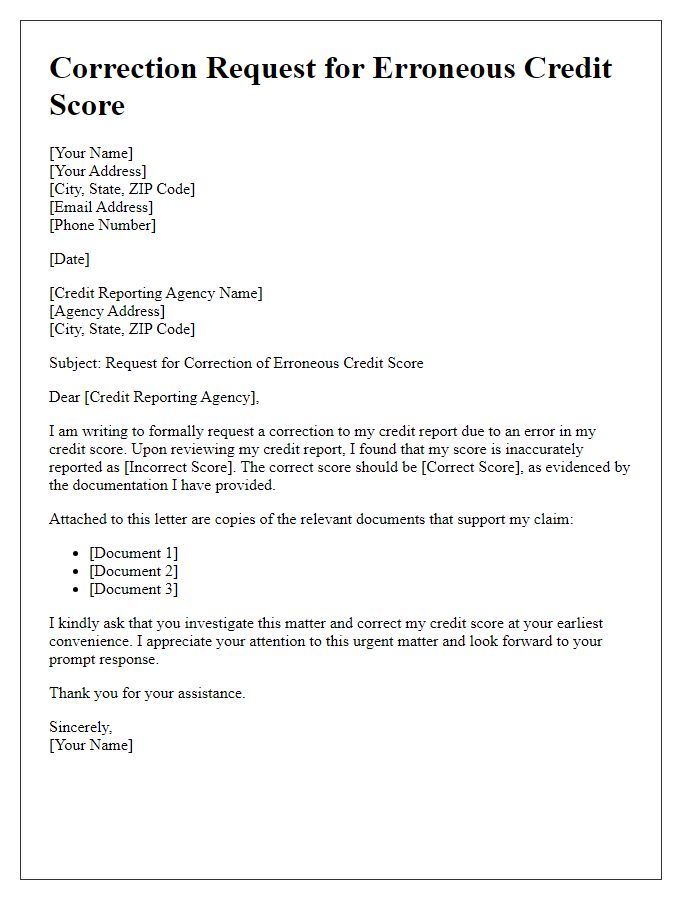

Corrected Information

Flawed credit assessments can significantly impact individuals' financial opportunities. Inaccurate reporting may arise from errors in credit scores, particularly those based on outdated data or incorrect account information. For instance, a 30-day late payment noted on a credit report can lower one's score by up to 100 points, affecting loan eligibility. To address these discrepancies, individuals must provide corrected information, such as proof of timely payments or documentation proving an account is closed. Submitting this evidence to credit bureaus like Experian or Equifax may lead to adjustments in credit reports, restoring financial credibility. Timely corrections are crucial, as they can influence interest rates on mortgages or personal loans and affect overall financial stability.

Supporting Documents

A flawed credit assessment can significantly impact an individual's financial opportunities, reflecting inaccuracies in credit reports obtained from major credit bureaus like Experian, TransUnion, and Equifax. Supporting documents such as bank statements (with recent transactions), pay stubs (showing monthly income), and letters from creditors (clarifying disputed debts) are essential for a comprehensive review. Additionally, personal identification documents, including government-issued IDs (passport or driver's license), and proof of residence (utility bills dated within the last three months) can offer further validation of identity and stability. These documents can help rectify errors in the credit assessment process, ensuring that financial institutions and lenders evaluate creditworthiness accurately, thus influencing loan approvals, interest rates, and overall financial health.

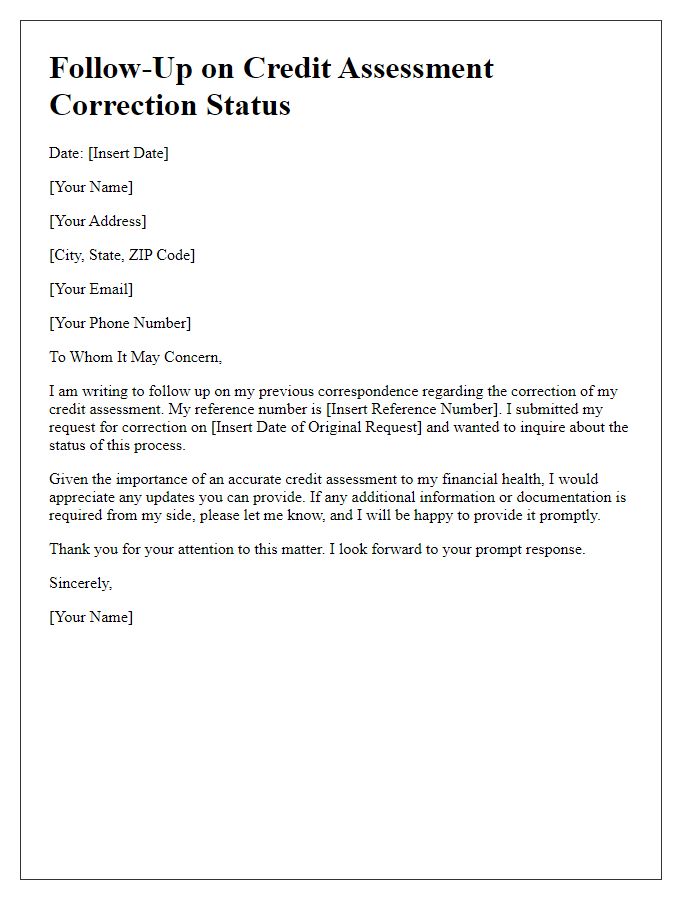

Request for Confirmation and Corrections

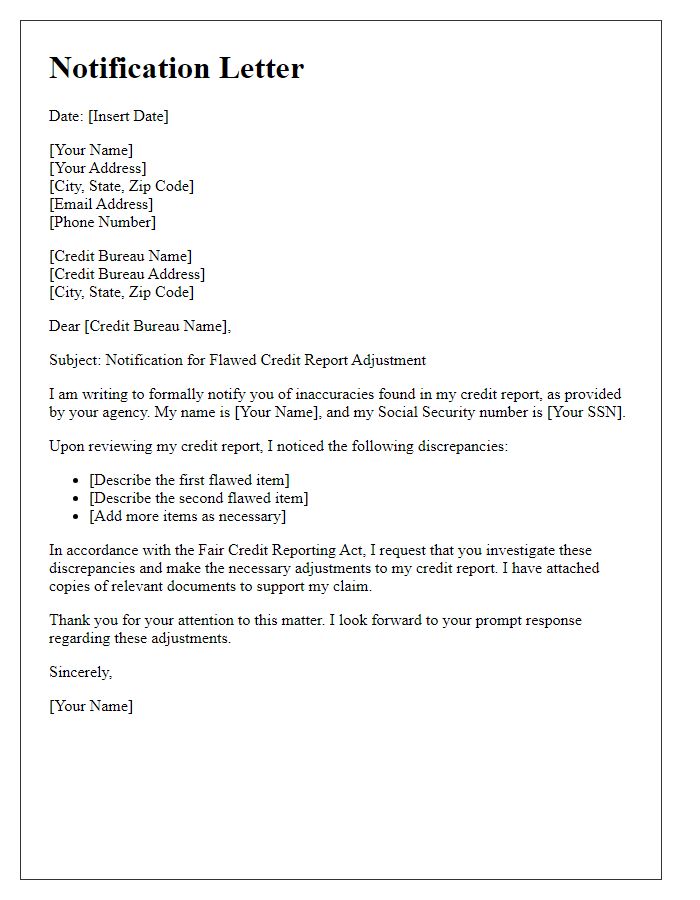

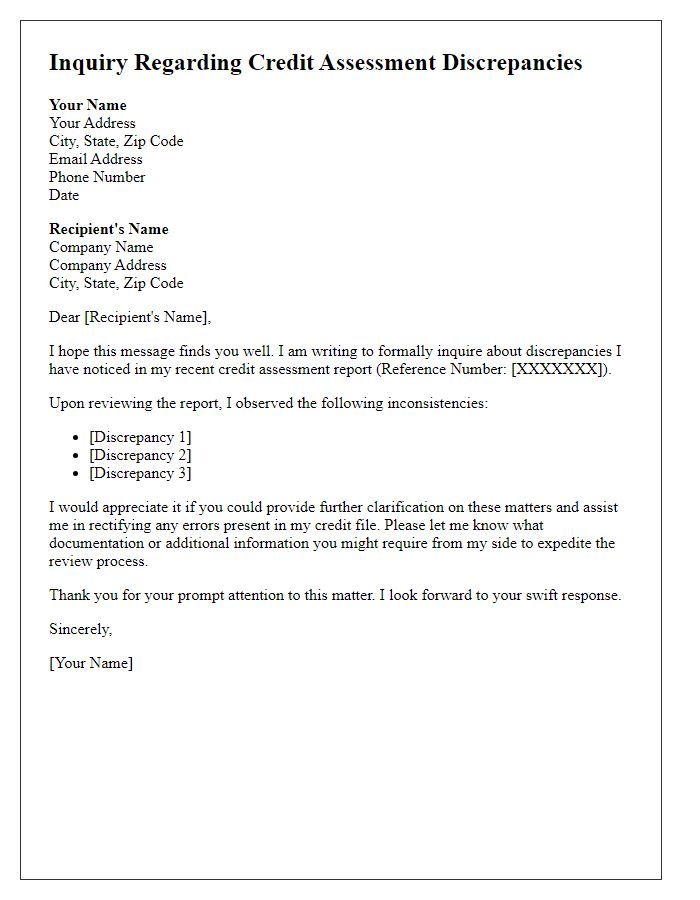

Credit assessments can significantly impact individuals' financial opportunities. An erroneous credit report from major agencies, such as Experian or Equifax, can lead to denied loans or high-interest rates for mortgages. Common errors, like incorrect account balances or late payment markings, can cause substantial financial harm. According to the Federal Trade Commission, about 25% of consumers have identified errors in their credit reports. Timely correction is crucial; under the Fair Credit Reporting Act, agencies are required to investigate disputes within 30 days. Individuals should provide clear documentation of discrepancies, such as bank statements or payment receipts, to facilitate this process and ensure their credit score accurately reflects their financial responsibility.

Letter Template For Flawed Credit Assessment Correction Samples

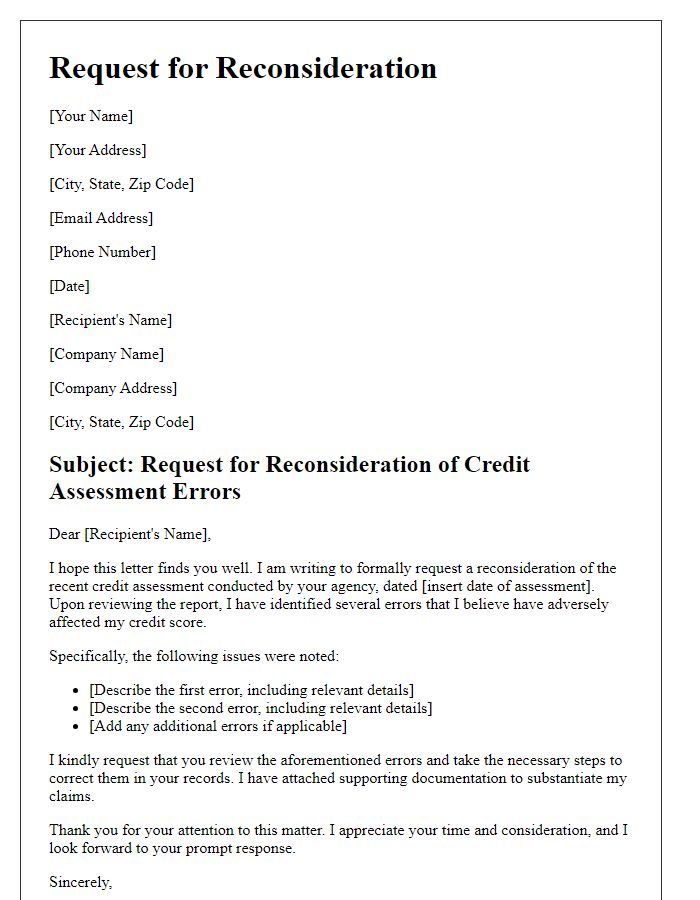

Letter template of request for reconsideration of credit assessment errors

Comments