Are you feeling the weight of hard inquiries on your credit report? It's no secret that these inquiries can impact your credit score, making it essential to address them promptly. In this article, we'll guide you through a simple letter template designed to help you remove those pesky inquiries with ease. So, if you're ready to take control of your credit health, keep reading!

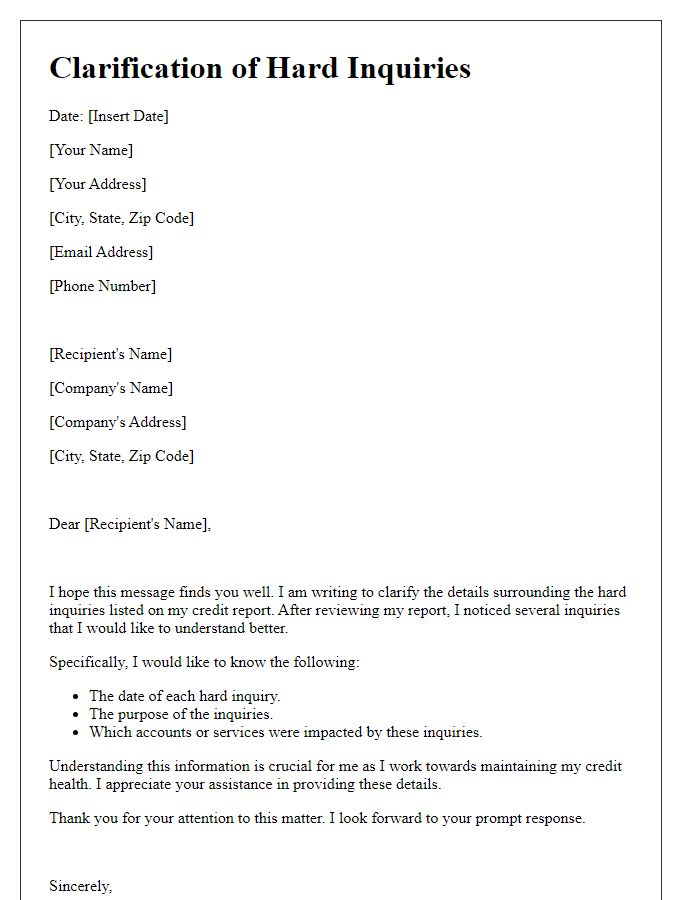

Identification Information

Inquiring into hard inquiries can significantly impact credit scores, particularly after recent events such as applying for a new credit card or mortgage. Various lending institutions, including banks like Chase or credit unions, may conduct a hard inquiry (a detailed examination of credit history) that remains on credit reports for two years. Each hard inquiry can lower a credit score by several points (often 5-10 points). Timely removal of erroneous inquiries can help improve creditworthiness. Procedures for disputing hard inquiries include contacting credit bureaus such as Experian, Equifax, or TransUnion, providing personal identification information, and submitting a formal request for review.

Explanation of Inaccuracy

Hard inquiries, often resulting from credit applications, can negatively impact credit scores by up to five points for each request. For instance, a hard inquiry remains on a credit report for two years, influencing creditors' decisions on future loans. Discrepancies arise when inquiries are reported that were not authorized, potentially due to identity theft or clerical errors. To address such inaccuracies, individuals should gather relevant documentation, such as identity theft reports or account statements, and submit a formal dispute to credit reporting agencies like Equifax, Experian, and TransUnion. Ensuring accurate records is crucial, as incorrect hard inquiries can hinder access to essential credit products, including mortgages and car loans, significantly affecting financial opportunities.

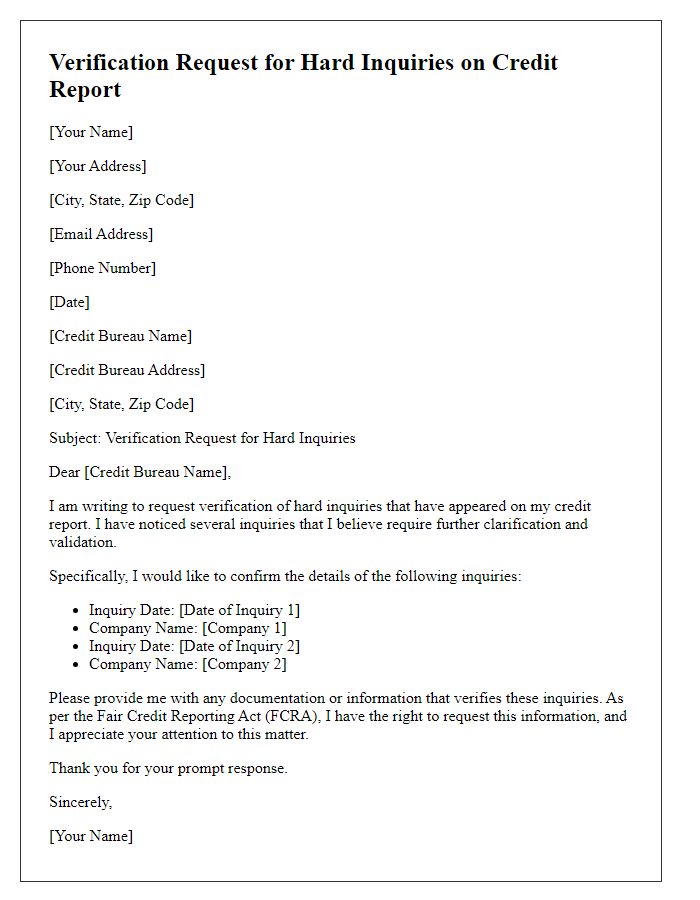

Request for Removal

Hard inquiries on credit reports can significantly impact credit scores. These inquiries occur when lenders assess a borrower's creditworthiness before approving loans or credit cards, typically resulting in a temporary decrease in credit scores, sometimes by up to five points. An excessive number of inquiries, often exceeding three in a short period, can signal increased risk to lenders. Credit reporting agencies such as Experian, Equifax, and TransUnion keep these records for two years, making it critical for consumers to monitor their reports regularly. Removing hard inquiries can improve credit scores by promoting better credit utilization ratios and improving the likelihood of loan approvals in the future.

Supporting Documentation

Hard inquiries on credit reports, particularly from multiple financial institutions within a short period, can negatively impact credit scores. These inquiries, often resulting from applications for credit cards or loans, typically remain on credit reports for two years. Individuals seeking to remove hard inquiries must provide supporting documentation, such as a copy of the credit report highlighting the inquiries, evidence of identity theft (if applicable), and samples of communication with dispute resolution departments of relevant entities. Additionally, proof of account statements or loan agreements may help substantiate claims about unauthorized or erroneous inquiries. A meticulous approach ensures that proper requests are submitted, increasing the chance for successful removal from credit records.

Contact Information and Follow-up Plan

A hard inquiry on credit reports, also known as hard pull, can impact credit scores significantly. Authorized lenders, such as banks and financial institutions, typically conduct these inquiries when assessing creditworthiness during loan or credit applications. The impact can last up to two years, with a potential score drop of 5 to 10 points. Consumers should monitor their credit reports regularly, available through Experian, TransUnion, and Equifax, to identify unauthorized inquiries. Removing hard inquiries involves contacting the credit bureaus directly, providing detailed evidence such as application details and relevant dates. Following up promptly with a phone call or written request ensures timely resolutions. Maintaining organized documentation and tracking responses fosters successful communication with credit reporting agencies.

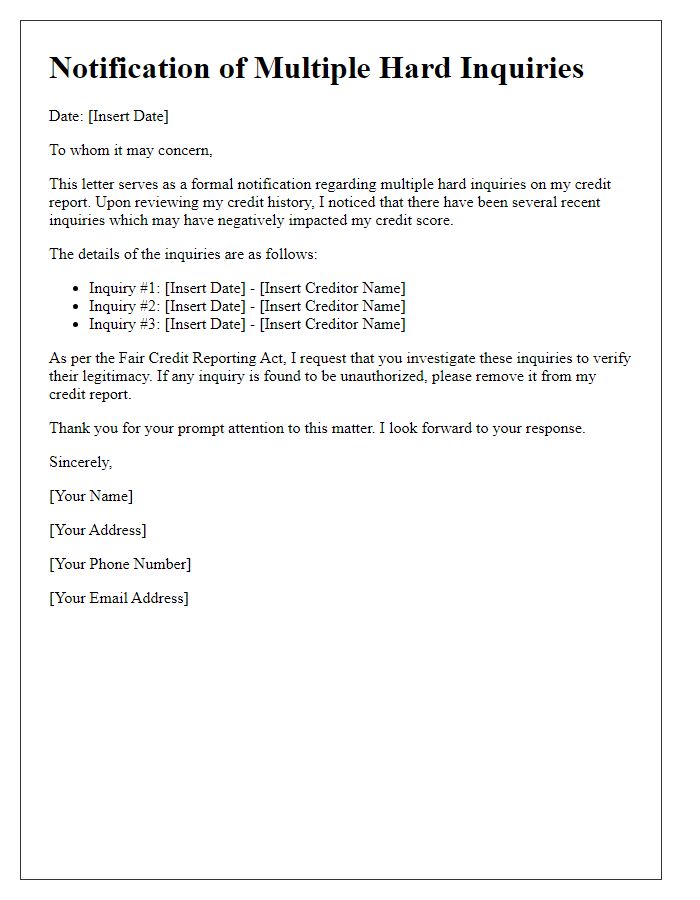

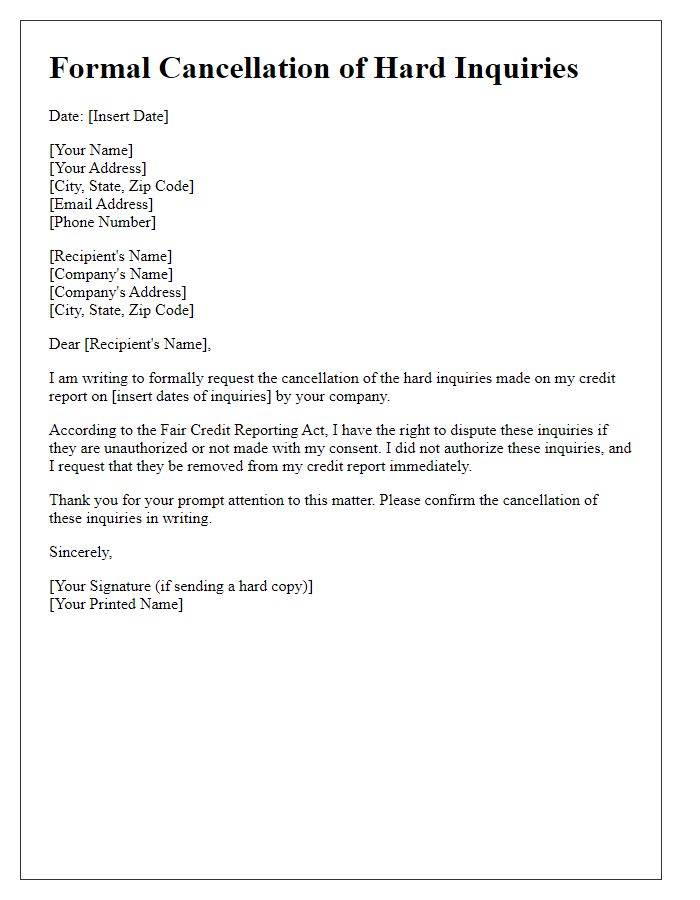

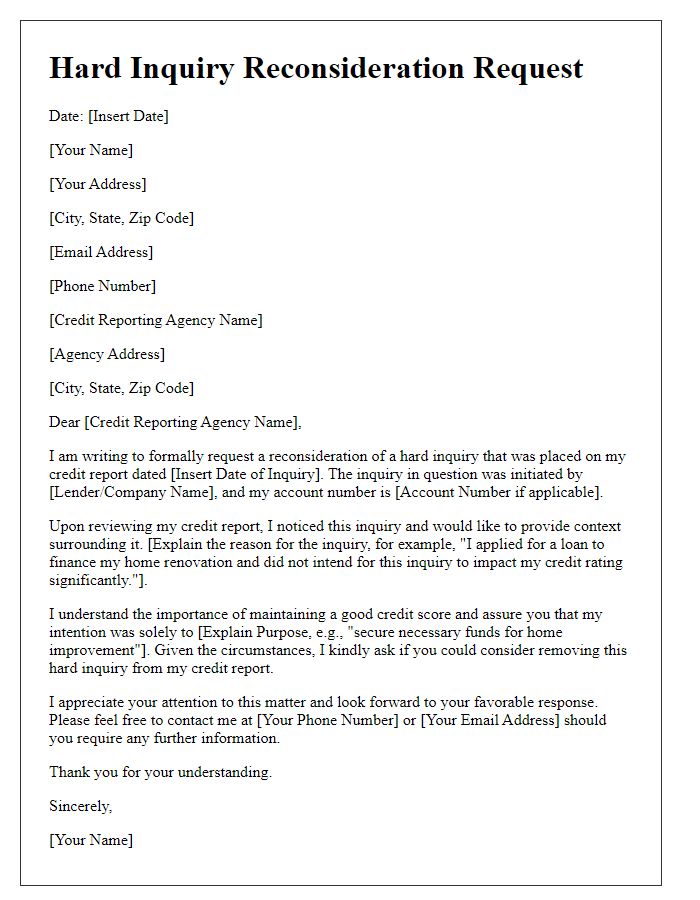

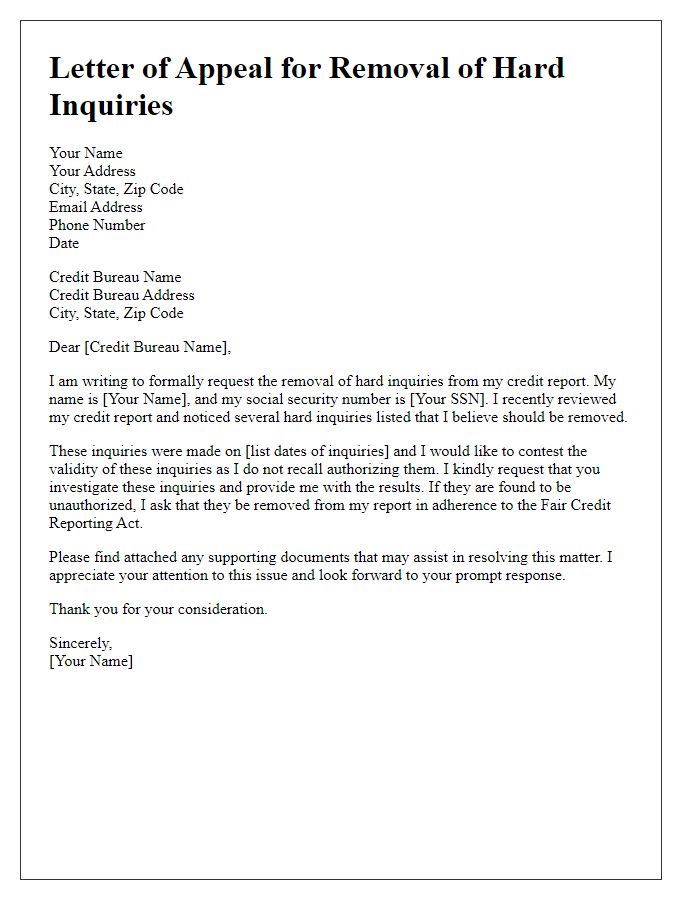

Letter Template For Removing Hard Inquiries Samples

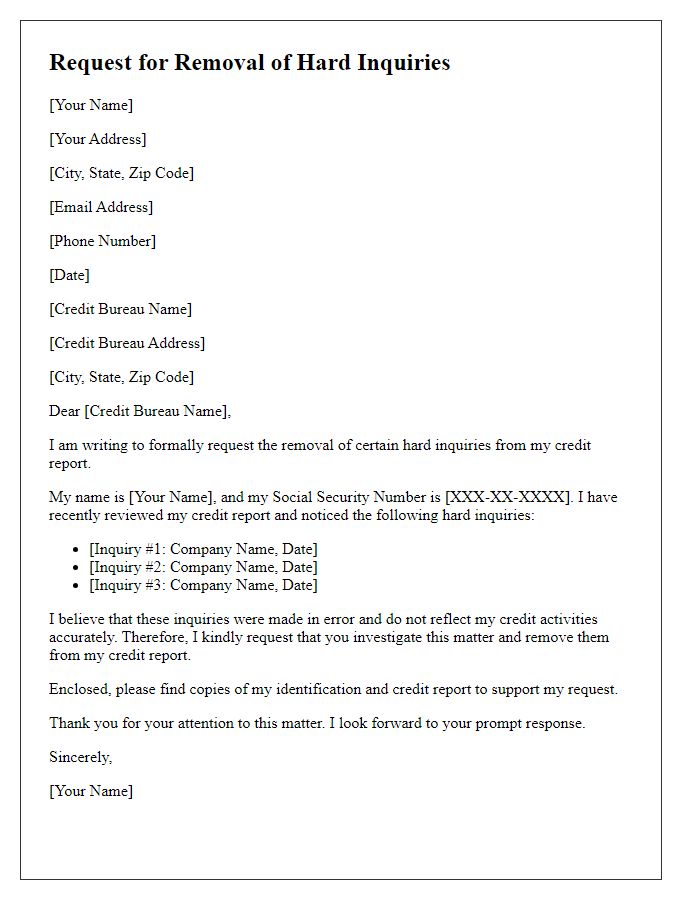

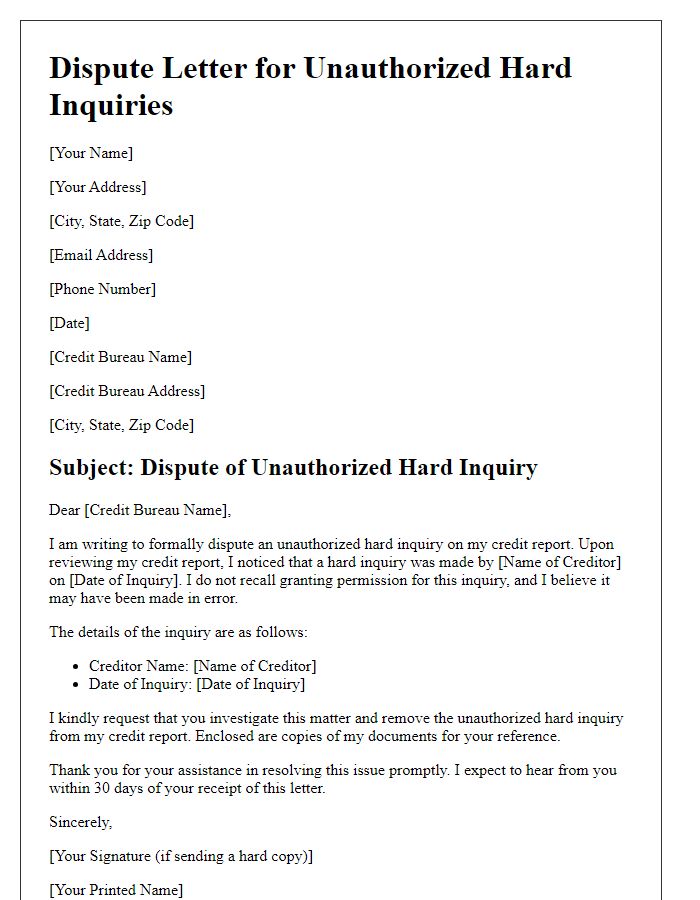

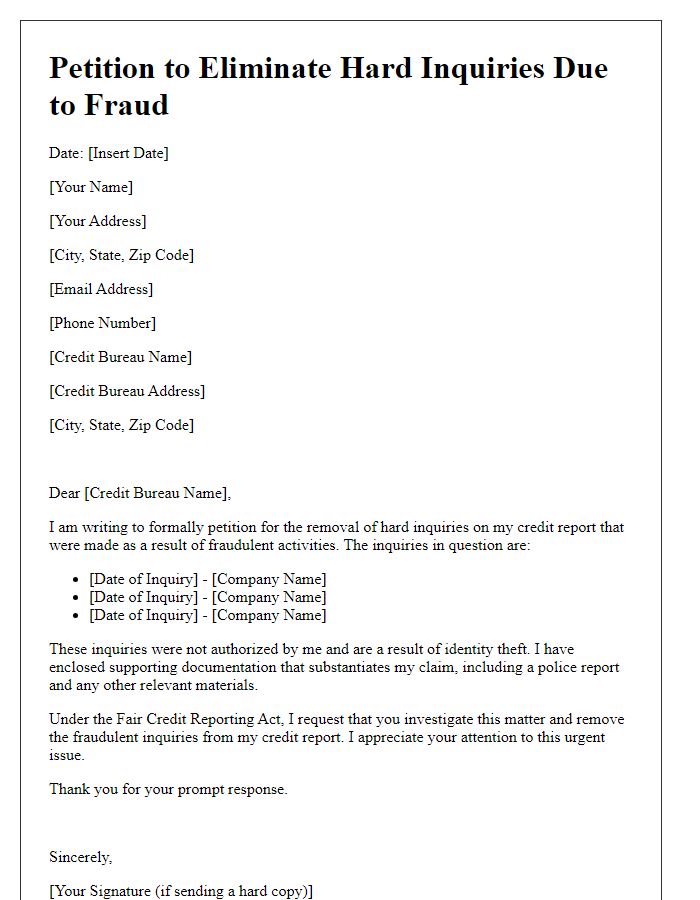

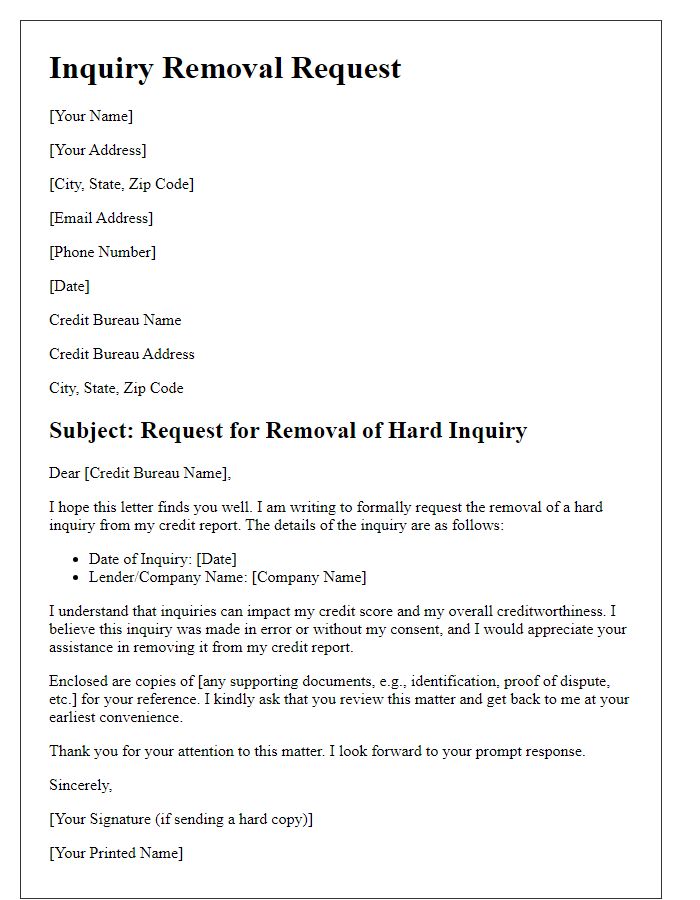

Letter template of request for removal of hard inquiries from credit report

Comments