Are you facing financial hardships and need to explain your situation in writing? Crafting the right letter can make all the difference in gaining understanding and support. It's important to convey your circumstances clearly and empathetically, highlighting the challenges you're facing while maintaining a respectful tone. Ready to learn how to effectively communicate your financial struggles? Let's dive in!

Personal Information

Individuals facing financial hardship often need to provide a comprehensive explanation of their circumstances. Personal information such as names, addresses, and contact numbers play a crucial role in identifying the individual's unique situation. Financial factors include job loss, reduced income, unexpected medical expenses (with potential costs exceeding thousands of dollars), or divorce implications. In addition, external events like economic downturns (e.g., a recession that impacted many sectors in 2020) further exacerbate difficulties. Documentation may include bank statements, medical bills, or layoff notices, forming a tangible narrative of these challenges. The rationale behind seeking support or understanding from financial institutions, lenders, or government agencies often hinges on compassion and transparency regarding one's specific struggles.

Description of Financial Hardship

Financial hardship often arises due to unexpected events such as job loss, medical emergencies, or significant repairs. For instance, an individual may face unemployment, resulting in a 20% decrease in monthly income, causing difficulty in meeting essential expenses like housing costs. Medical emergencies can lead to thousands of dollars in unpaid medical bills, straining finances further. Additionally, unexpected car repairs can result in expenses exceeding $1,000, making it challenging to maintain daily commuting needs. This cumulative impact creates an overwhelming burden, leading to an inability to manage existing debts and cover basic living necessities.

Impact on Financial Obligations

Experiencing financial hardship can profoundly impact an individual's ability to meet financial obligations, such as mortgage payments, personal loans, and utility bills. A significant reduction in income, often due to job loss or unexpected medical expenses, may lead to missed payments, resulting in possible late fees. Families may resort to utilizing credit cards for essential needs, leading to mounting debt levels. Additionally, individuals may face the risk of foreclosure (legal process whereby a lender seeks to recover the balance of a loan from a defaulted borrower) on their homes, particularly in states such as California and Florida with high housing market values. Furthermore, financial hardship can severely affect mental health (overall psychological well-being), increasing stress and anxiety levels, ultimately complicating efforts to regain financial stability.

Supporting Documentation

Families facing financial hardship due to sudden job loss or unexpected medical expenses often require detailed documentation to support their claims. Essential documents might include termination letters from employers, medical bills detailing treatment costs, and bank statements reflecting changes in income. Specific events, such as the COVID-19 pandemic, which led to widespread layoffs and business closures in March 2020, have significantly impacted many households. Personal testimonies regarding the struggle to meet monthly expenses, along with records of any assistance sought, can provide additional context. Tax returns from the previous year may also illustrate prior income levels, demonstrating the contrast with current financial struggles.

Request for Assistance or Adjustments

Financial hardship can severely impact individuals and families, particularly during unexpected events such as job loss or medical emergencies. Many people face challenges meeting monthly obligations like rent (average rent prices in the U.S. exceed $2,000) or mortgage payments. Increased expenses from healthcare (with out-of-pocket costs reaching thousands annually) can further strain budgets. Accessing assistance programs (such as SNAP or local nonprofit support) can provide crucial relief. Financial literacy resources, including budgeting workshops and credit counseling services, are essential for navigating these difficult times. Engaging with lenders or service providers to discuss potential adjustments can alleviate stress and promote stability during challenging financial periods.

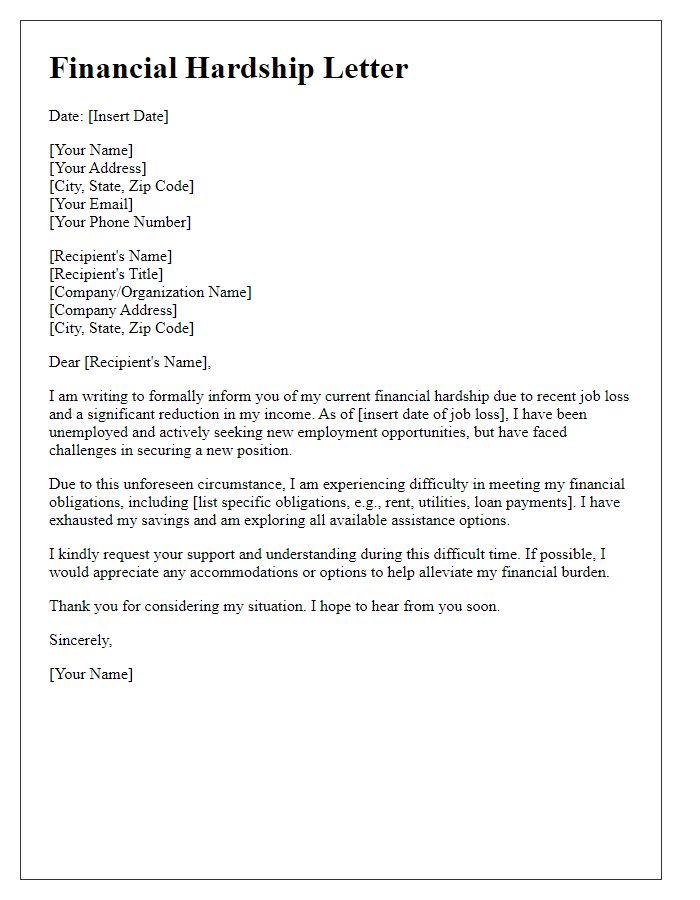

Letter Template For Financial Hardship Explanation Samples

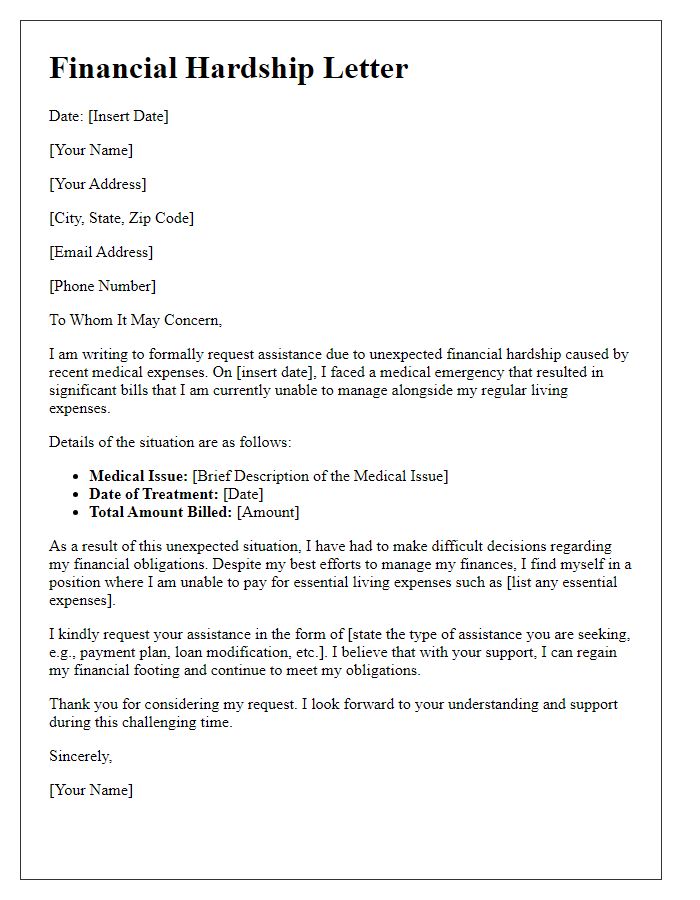

Letter template of financial hardship due to unexpected medical expenses.

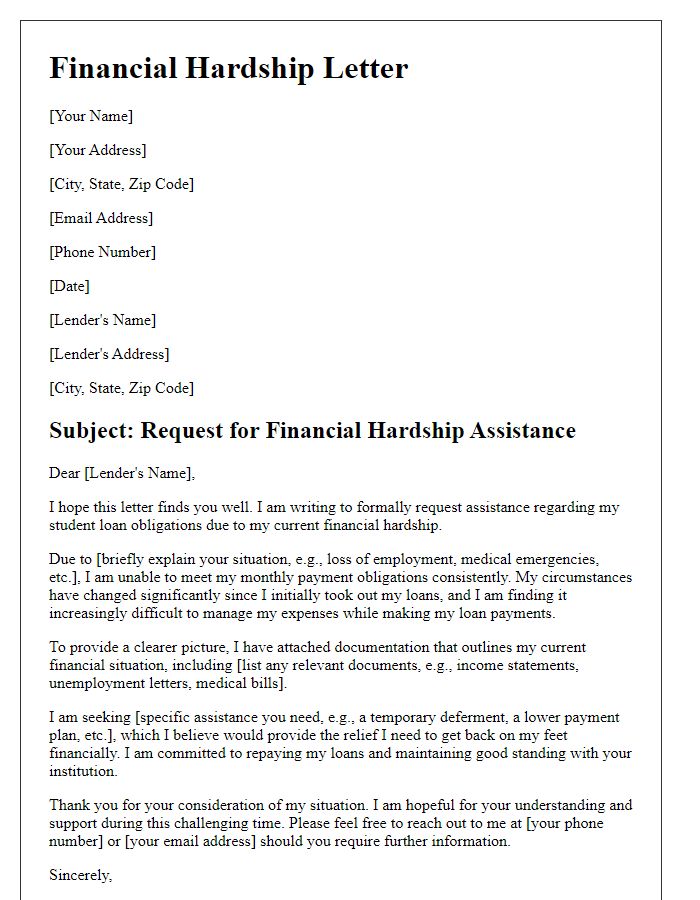

Letter template of financial hardship related to student loan obligations.

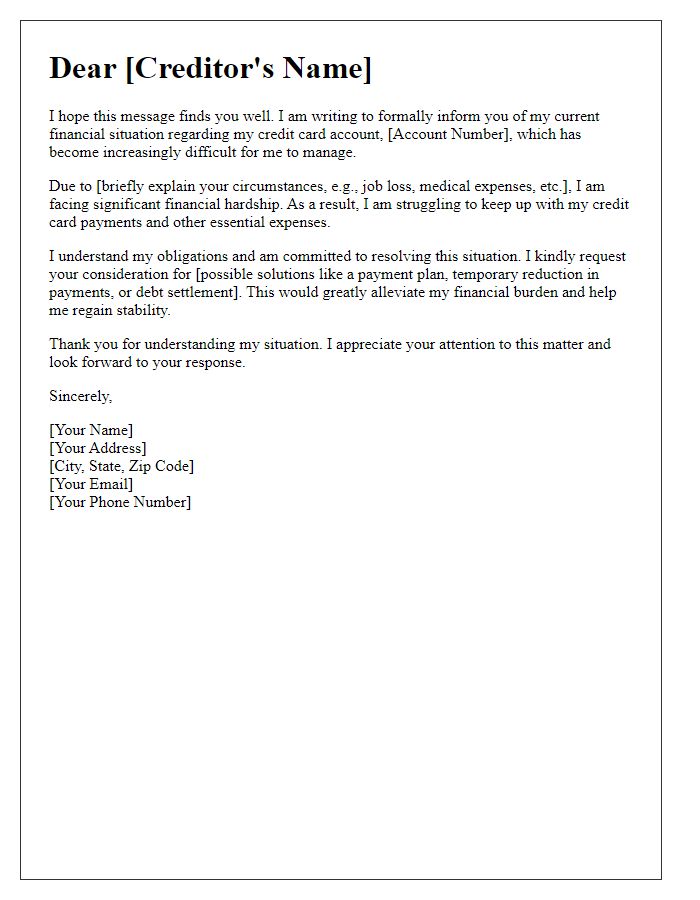

Letter template of financial hardship from credit card debt accumulation.

Comments