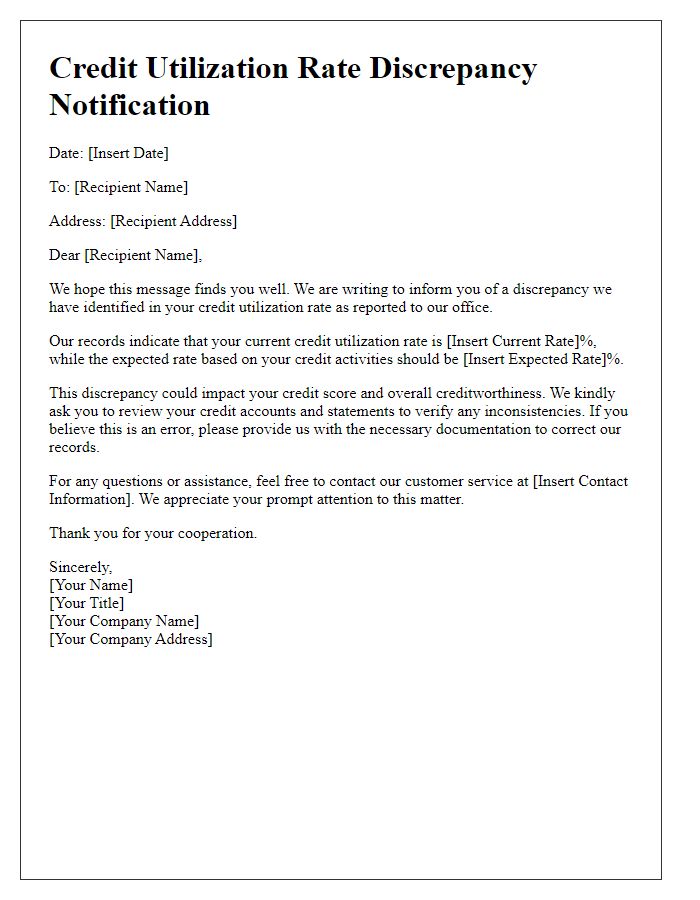

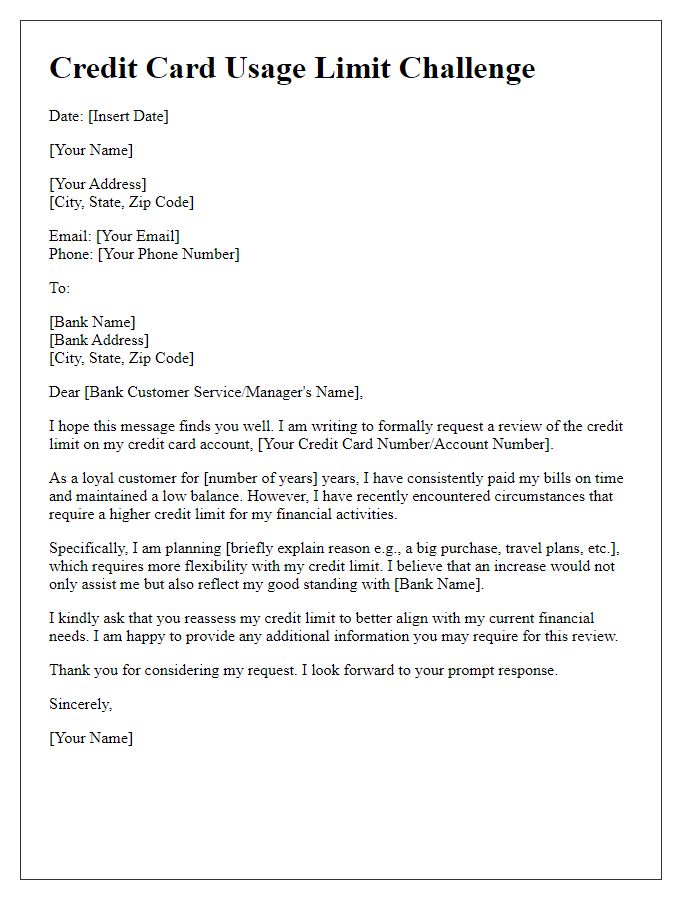

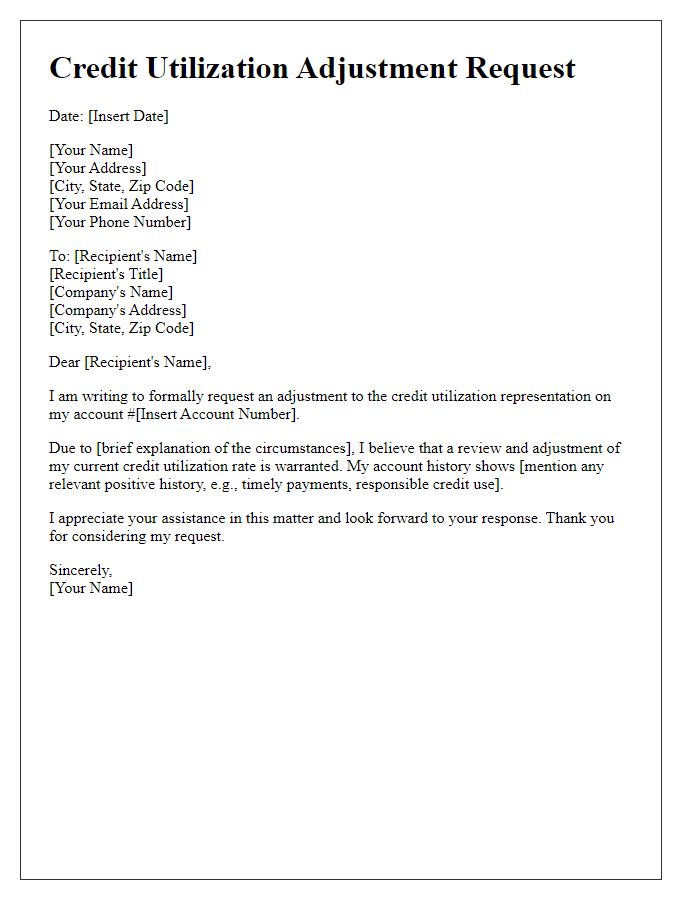

Are you feeling frustrated by an inaccurate credit utilization rate impacting your credit score? You're not alone! Many people find themselves in similar situations, often stemming from errors or miscommunication with creditors. In this article, we'll walk you through a step-by-step letter template to dispute these discrepancies and restore your credit standingâso let's dive in and empower you to take control of your financial future!

Accurate Account Information

Credit utilization rate reflects the proportion of credit a consumer is using compared to their total available credit. A lower rate, ideally below 30%, indicates good credit management and can boost credit scores significantly. Discrepancies in reported account information, such as inaccuracies in credit limits or outstanding balances, can negatively impact this crucial percentage. For instance, a $1000 limit with a $600 balance portrays a 60% utilization rate, which is detrimental. In contrast, correct reporting of a $2000 limit with that same balance indicates a 30% utilization rate, showcasing responsible credit behavior. Accurate account information from all three major credit bureaus--Experian, Equifax, and TransUnion--is vital in maintaining a favorable credit profile. Disputing errors promptly ensures improved credit scores and enhances opportunities for favorable lending terms.

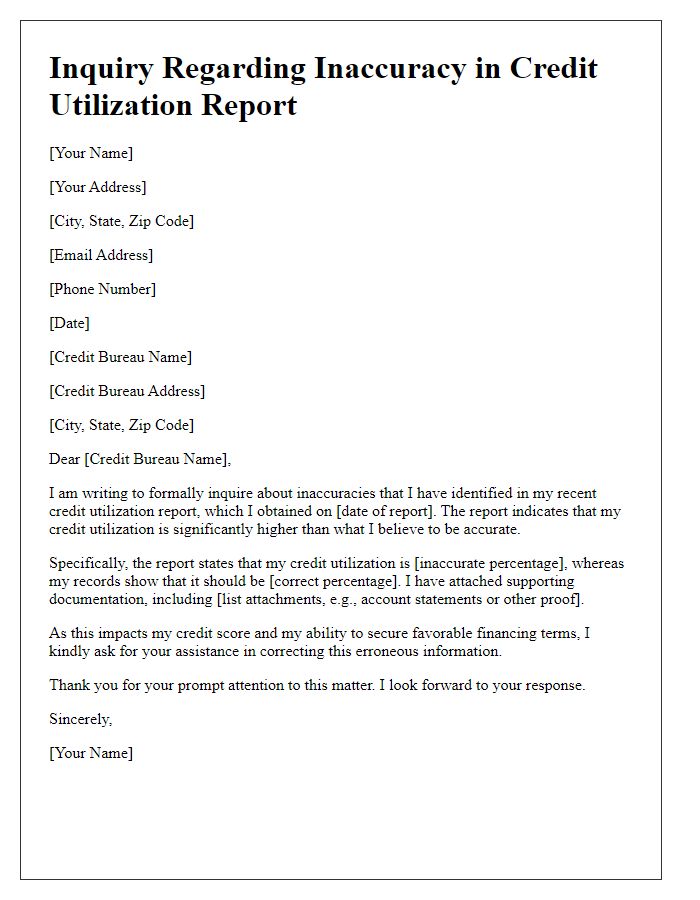

Disputed Amount and Reason

Credit utilization rate, a key factor in calculating credit scores, refers to the ratio of current revolving debt to total available credit limits. A high utilization rate, typically over 30%, can negatively impact scores significantly. Common issues arise from discrepancies, such as incorrect reporting by credit bureaus or errors from credit card issuers like American Express or Visa. Misreported amounts, like a recorded balance of $2,500 against a $5,000 limit instead of the accurate $1,000, can lead to inflated utilization rates. Addressing these disputes promptly ensures a more accurate reflection of financial responsibility and can improve credit standings. Timely resolution is critical, especially when applying for loans or mortgages, where credit scores influence terms and interest rates.

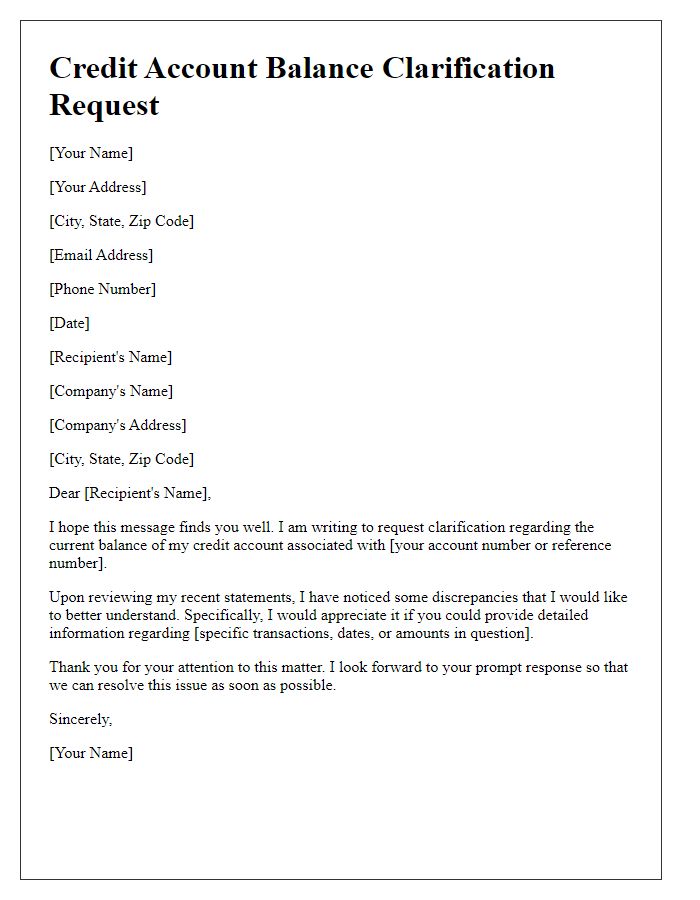

Supporting Documentation

Credit utilization rate plays a significant role in determining credit scores, particularly in the FICO scoring model, which considers the ratio of total credit used to total available credit. A high credit utilization rate, typically exceeding 30%, can negatively impact consumer credit scores. Supporting documentation for disputing inaccurate credit utilization rates may include statements from financial institutions, payment receipts, or credit bureau reports highlighting discrepancies. Each credit card account, delineated with its respective credit limit and balance, serves as essential comparison points during the resolution process. Timely resolution of such disputes is critical, as changes can improve credit scores, enhancing opportunities for loans, mortgages, or other financial services.

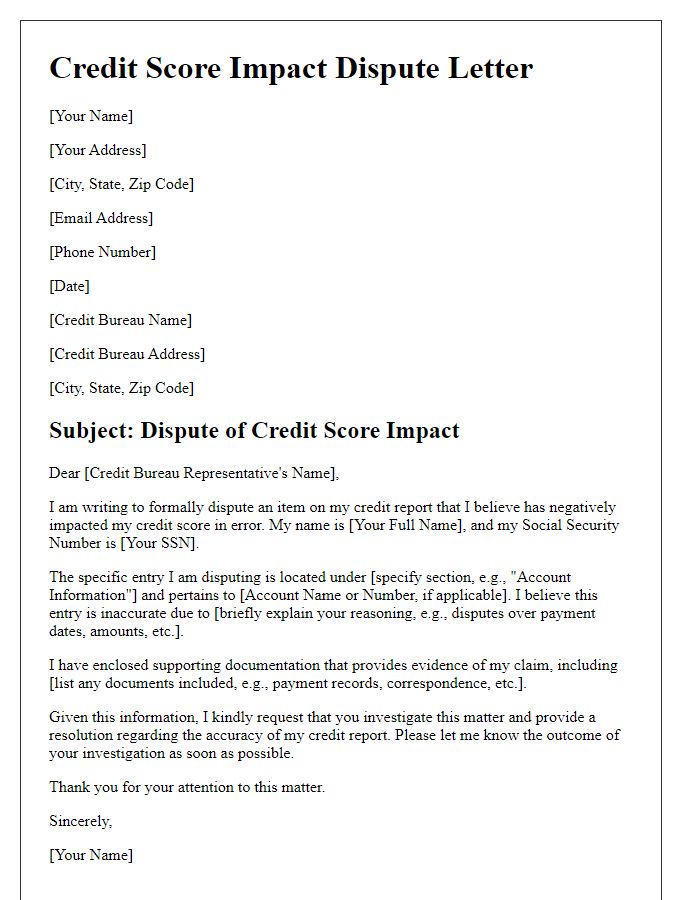

Request for Correction and Investigation

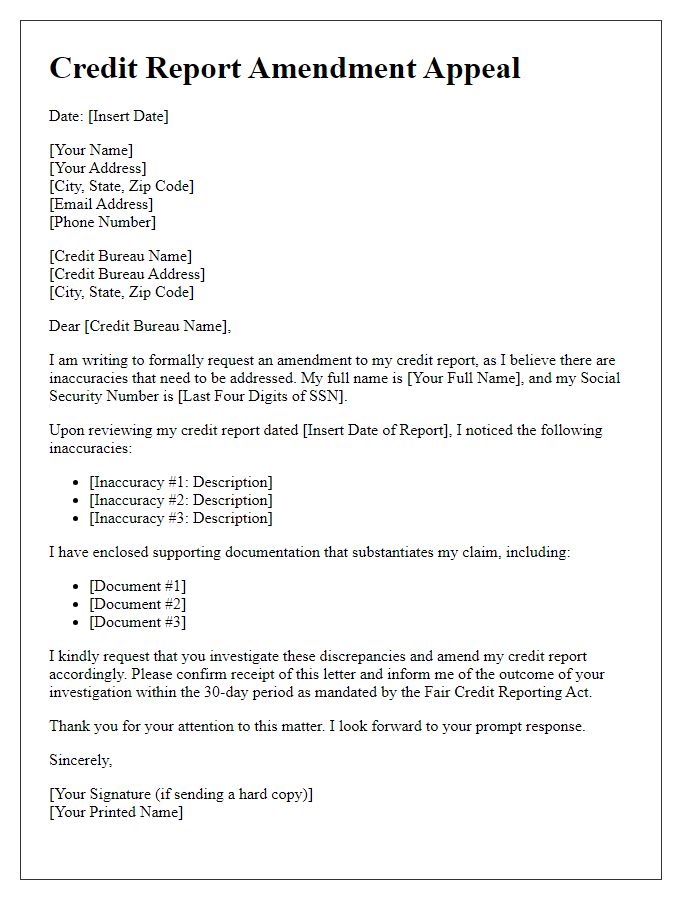

Credit utilization rate reflects the percentage of borrowed credit being used by consumers, crucial for determining credit scores. High utilization rates, above 30%, can negatively impact credit ratings. Inaccuracies in reporting can arise from reporting errors by creditors or identity theft. The Fair Credit Reporting Act governs consumer rights regarding errors, mandating actions to investigate disputes within 30 days. Consumers should request corrections from credit bureaus like Experian, Equifax, or TransUnion, providing documentation of inaccurate information, such as statements showing the owed amounts or explanations for discrepancies. A thorough investigation is vital to maintaining accurate credit histories, impacting loan approvals, interest rates, and overall financial health.

Contact Information and Response Time Limit

Credit utilization rate, a key factor in credit scoring, refers to the amount of credit used compared to the total credit available. Maintaining a low credit utilization rate, ideally below 30%, is crucial for a healthy credit score. High utilization can negatively impact scores, leading to higher interest rates on loans. The Fair Credit Reporting Act mandates timely responses (within 30 days) to disputes submitted by consumers to credit bureaus. Disputing inaccurate information is vital for financial well-being, as incorrect data can be detrimental to securing favorable credit terms.

Comments