Have you ever found yourself in a situation where your bank account just isn't fitting your needs? It can be frustrating to realize that you've accidentally selected the wrong account type, leading to complications that could have been easily avoided. In this article, we'll guide you through the process of correcting this mistake and ensure you're set up for success moving forward. So grab a cup of coffee and read on to learn how to smooth out your banking experience!

Clear Subject Line

Incorrect Account Type Resolution Process for Bank Customers In banking institutions, an incorrect account type can lead to complications in customer transactions and service availability. For instance, a checking account (often used for daily transactions) may inadvertently be set as a savings account (typically for holding funds with interest). This mismatch can restrict access to features such as ATM withdrawals or checks, particularly if account limits are exceeded. Customers encountering this issue should visit their local bank branch or contact customer service for resolution. Proof of identity, along with account details, may be required for adjustments. Banks typically process these corrections within a few business days, ensuring a reversion to the appropriate account type, thus improving customer experience and transaction efficiency.

Accurate Recipient Information

Accurate recipient information is crucial for effective correspondence within businesses such as finance or healthcare. Customer accounts often require specific details like account type (e.g., checking, savings) to avoid mismanagement. Incorrect account types can lead to issues like erroneous billing and service access restrictions, affecting client satisfaction. Institutions such as banks or credit unions must routinely verify recipient account details to ensure seamless transactions and maintain regulatory compliance. Failing to address these discrepancies promptly can damage trust and lead to potential complaints or audits. Regular account reviews and data verification processes are essential to mitigate these risks.

Detailed Account Information

Incorrect account types can lead to complications in financial transactions, such as debit or credit discrepancies. When an account type, such as a checking account versus a savings account, is not aligned with the intended use, it can hinder accessibility to funds and impact interest rate benefits. For instance, a checking account typically allows for frequent withdrawals and deposits, while a savings account offers higher interest accrual. Updating account information with financial institutions, including banks like Bank of America or Wells Fargo, is crucial to ensure compliance with federal regulations and to maintain accurate financial records. Ensuring correct categorization aids in enhancing user experience and optimizing account management.

Specific Correction Request

Many businesses face challenges with incorrect account types, leading to issues in billing and reporting. For instance, a company may mistakenly register as a sole proprietorship instead of an LLC (Limited Liability Company), impacting taxation statuses and liability protections. Addressing this issue promptly is crucial. Firms should provide documentation, such as the Articles of Organization, that verifies the correct account type. This ensures compliance with state regulations, such as those enforced by the Secretary of State's office. Additionally, accurate account types facilitate smoother financial transactions, enhance credibility with vendors, and prevent potential legal complications. Timely correction of account types can significantly improve overall operational efficiency and maintain the integrity of business records.

Contact Information for Follow-up

To address the issue of incorrect account type, users should ensure accurate contact information is provided for follow-up. Updating phone numbers (preferably mobile for direct communication), email addresses (with valid domains such as Gmail or corporate identifiers), and physical addresses (enabling accurate correspondence to registered offices) is crucial. Having multiple reliable contact methods increases the likelihood of timely updates and clarifications from service providers. Providing a succinct summary of the account type discrepancy alongside this contact information enhances the chances of a swift resolution.

Letter Template For Wrong Account Type Correction Samples

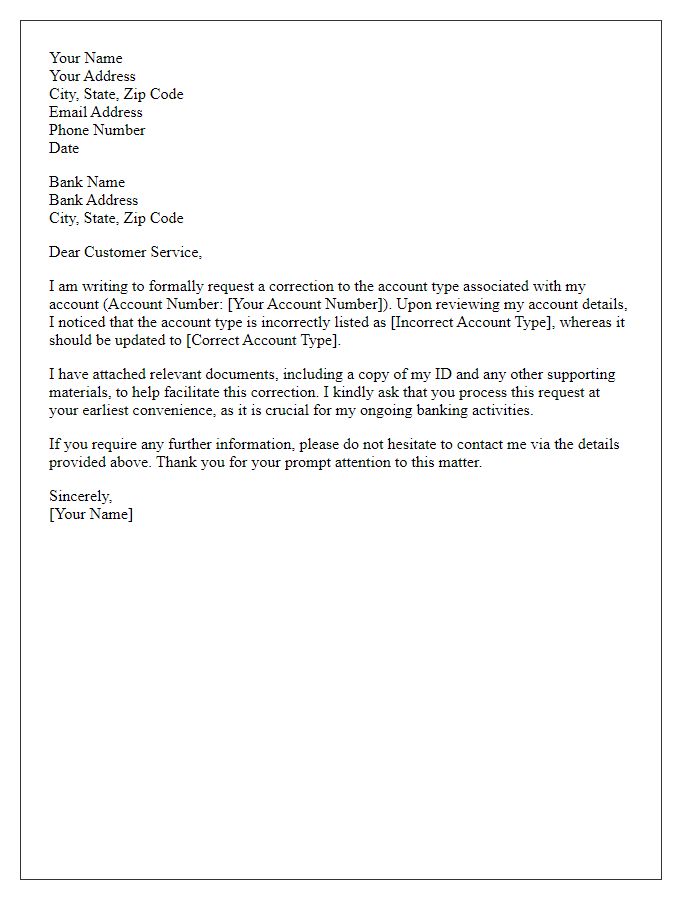

Letter template of account type correction request for banking institutions.

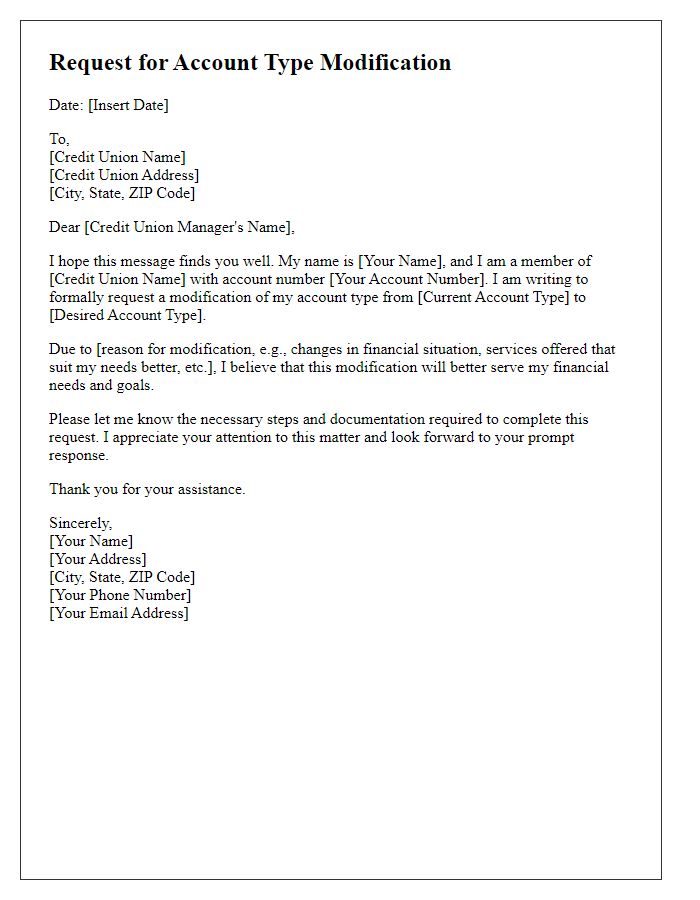

Letter template of request for account type modification for credit unions.

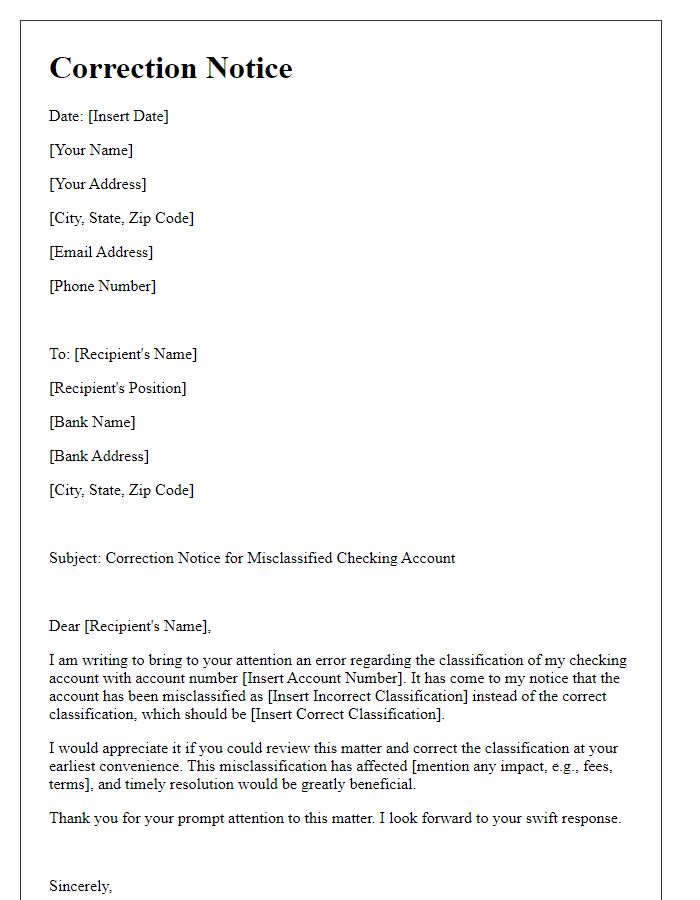

Letter template of correction notice for misclassified checking account.

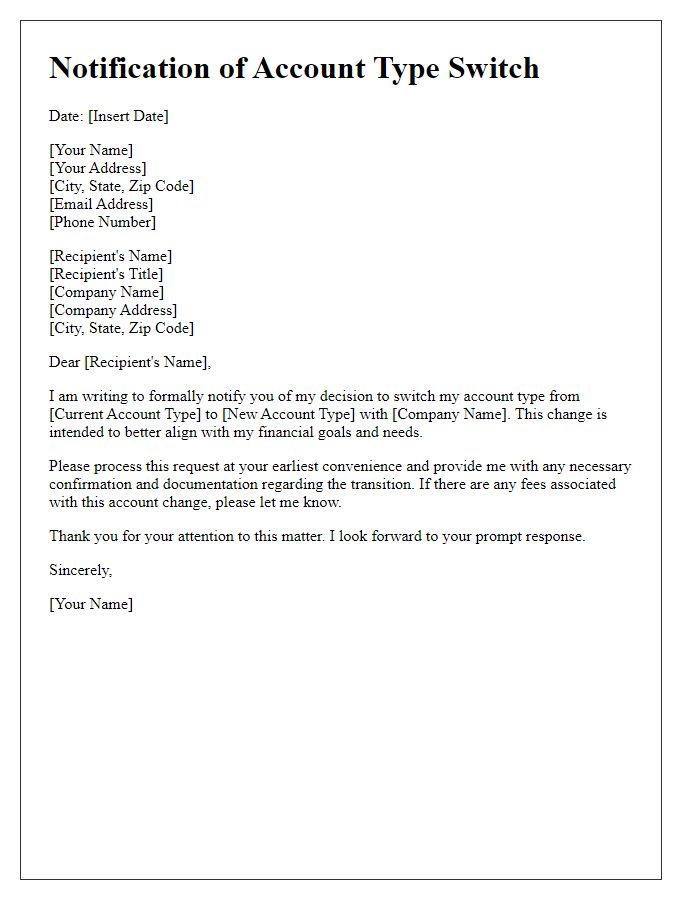

Letter template of notification for switching account types in financial services.

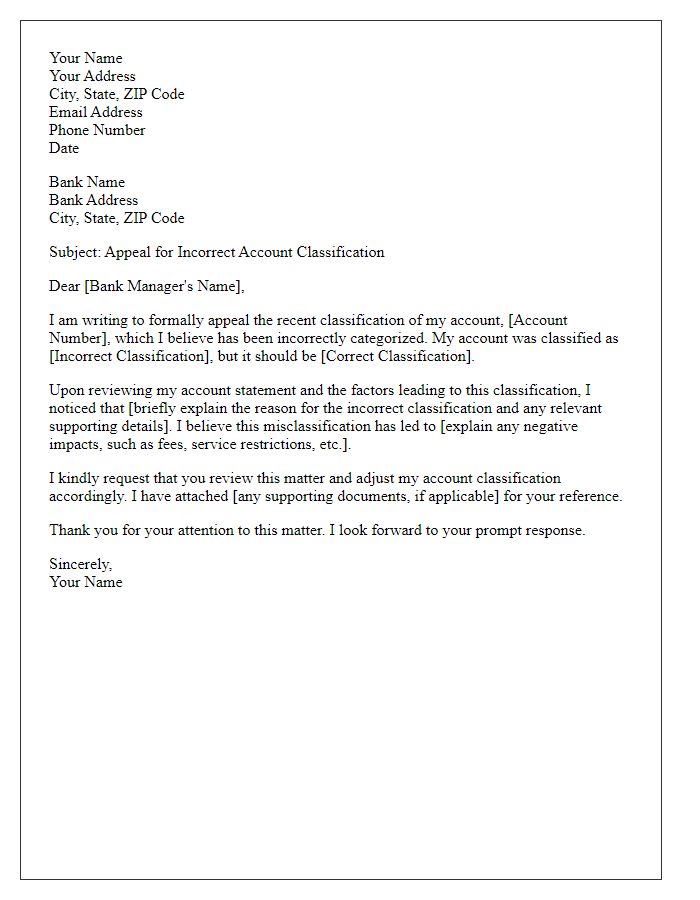

Letter template of appeal for incorrect account classification at a bank.

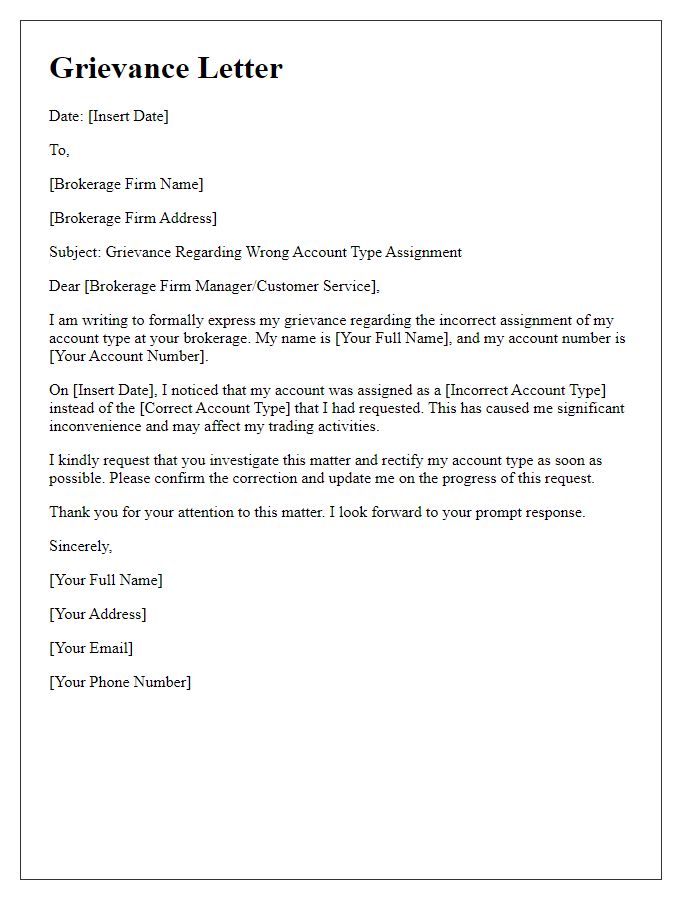

Letter template of grievance for wrong account type assignment in a brokerage.

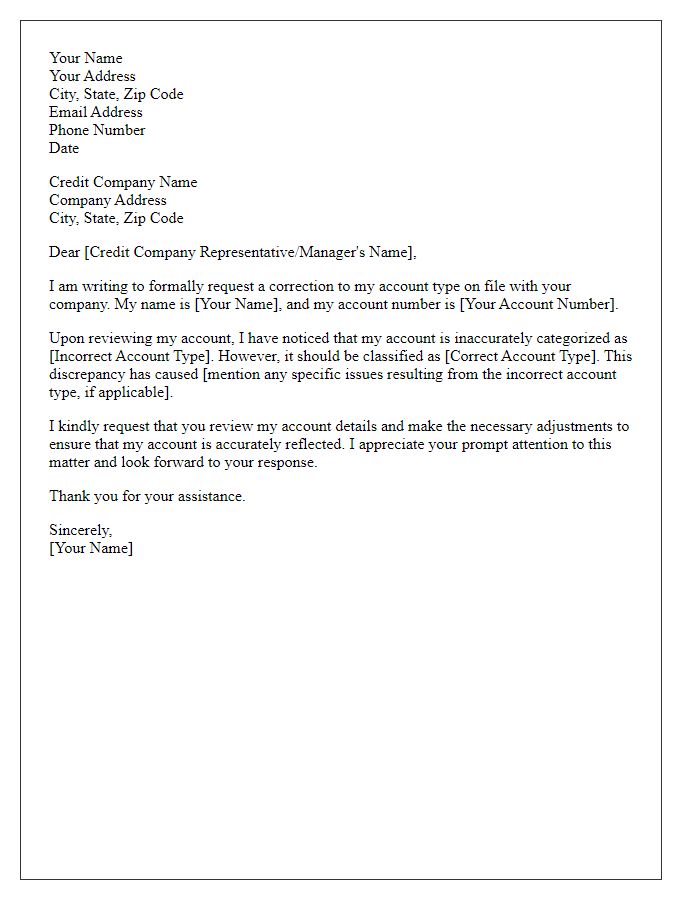

Letter template of formal request for correction of account type at a credit company.

Letter template of adjustment request for erroneous account type designation.

Letter template of inquiry for wrong account type resolution in a savings institution.

Comments