Are you curious about your credit score and how it can impact your financial future? Understanding your credit report is essential for making informed decisions about loans, credit cards, and even job applications. In this article, we'll explore the importance of requesting a credit score inquiry, the steps involved, and how to interpret the results. So, let's dive in and empower you to take control of your financial journey!

Personal Identification Information

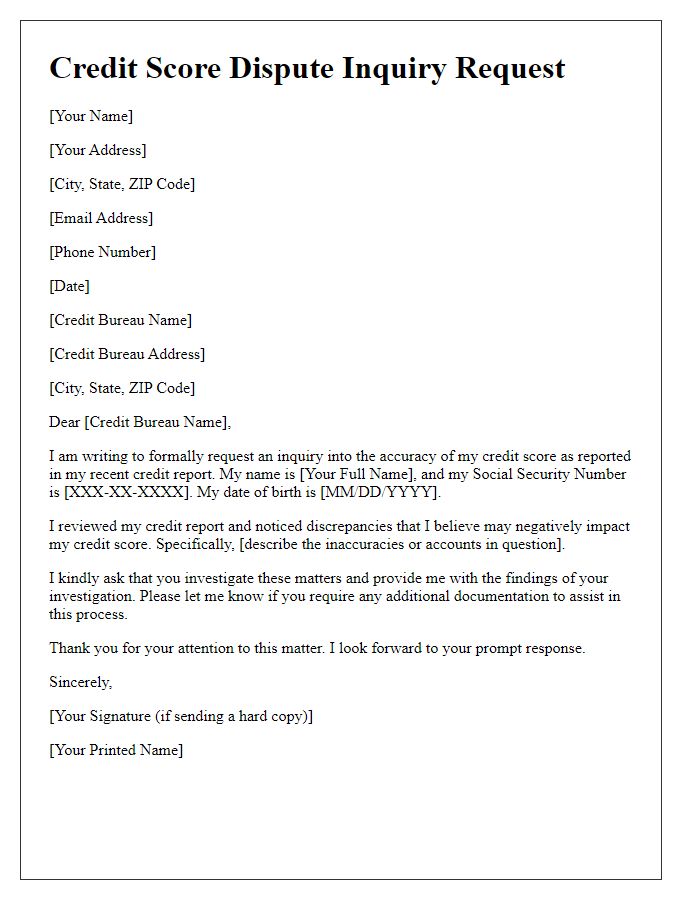

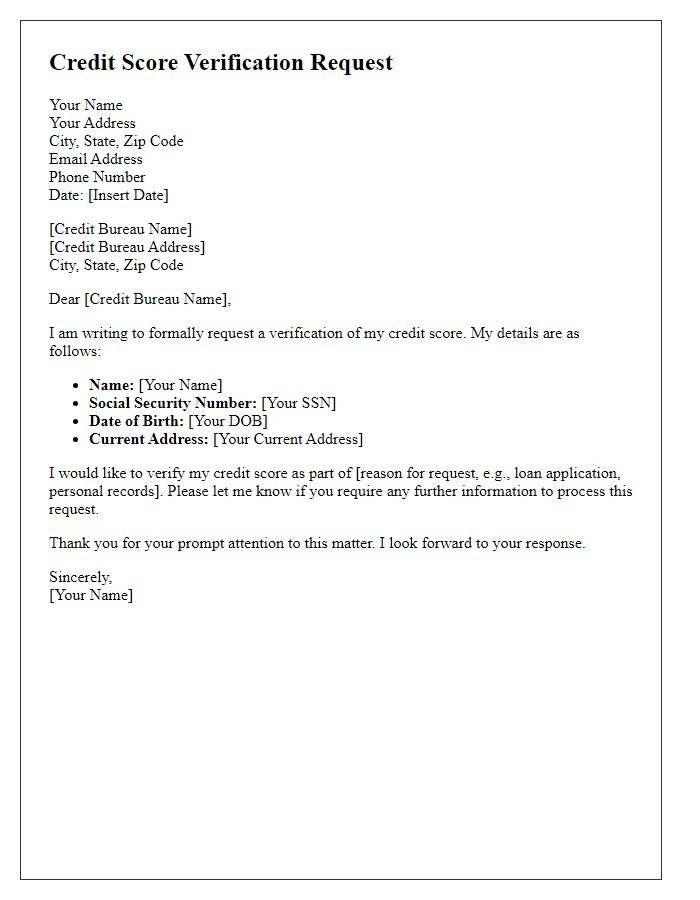

A credit score inquiry request typically requires detailed personal identification information, which includes full name, Social Security Number (SSN), date of birth, current address, and previous addresses (if applicable) for the last five years. This information is essential for credit bureaus like Experian, TransUnion, and Equifax to accurately locate your credit file. Providing a valid government-issued ID, such as a driver's license or passport, along with contact information including phone number and email address, is also crucial to authenticate your identity and help expedite the inquiry process. Additionally, including your reason for the inquiry, whether for checking credit limits, potential loan applications, or general credit monitoring, can assist in providing targeted insights regarding your credit status.

Credit Bureau Contact Details

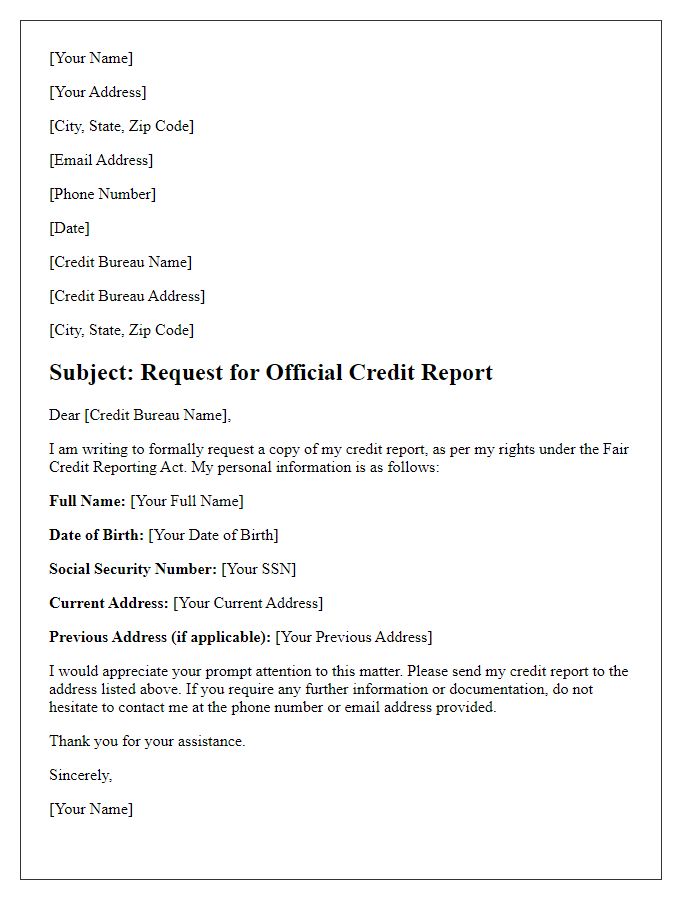

Credit score inquiries are crucial for understanding personal financial health and future borrowing potential. Consumers can request their credit reports from credit bureaus, such as Equifax, Experian, or TransUnion, to monitor for inaccuracies or fraudulent activity. Each bureau typically allows one free report annually under the Fair Credit Reporting Act (FCRA) in the United States. The request process often requires personal identification details, such as Social Security numbers, and verification of address history. Additionally, consumers can check online through the bureaus' official websites or request reports via mail, ensuring they stay informed about their creditworthiness.

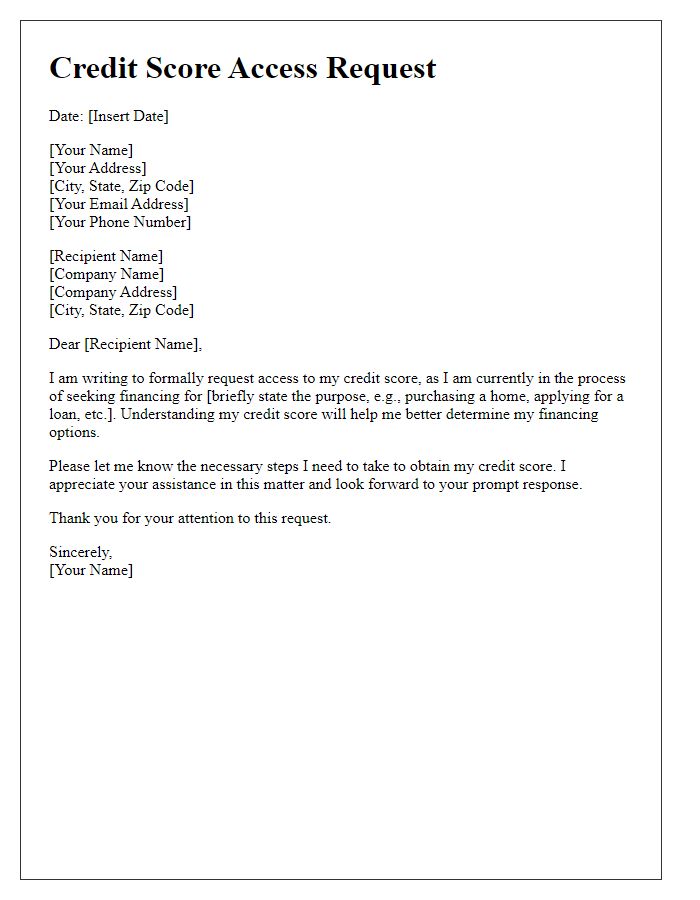

Inquiry Purpose and Context

Credit score inquiries are crucial for understanding one's financial health and making informed decisions regarding loans or credit applications. A credit score, typically ranging from 300 to 850, provides insight into an individual's creditworthiness. Requests for credit score inquiries often arise when individuals seek to secure mortgages, auto loans, or credit cards. Financial institutions like banks or credit unions utilize these scores to assess risk before approving applications. A soft inquiry, such as checking one's own score, does not affect the score, while a hard inquiry, often initiated by lenders, can temporarily lower the score by a few points. Understanding the context of these inquiries permits individuals to better manage their financial profiles and improve their chances of obtaining favorable credit terms.

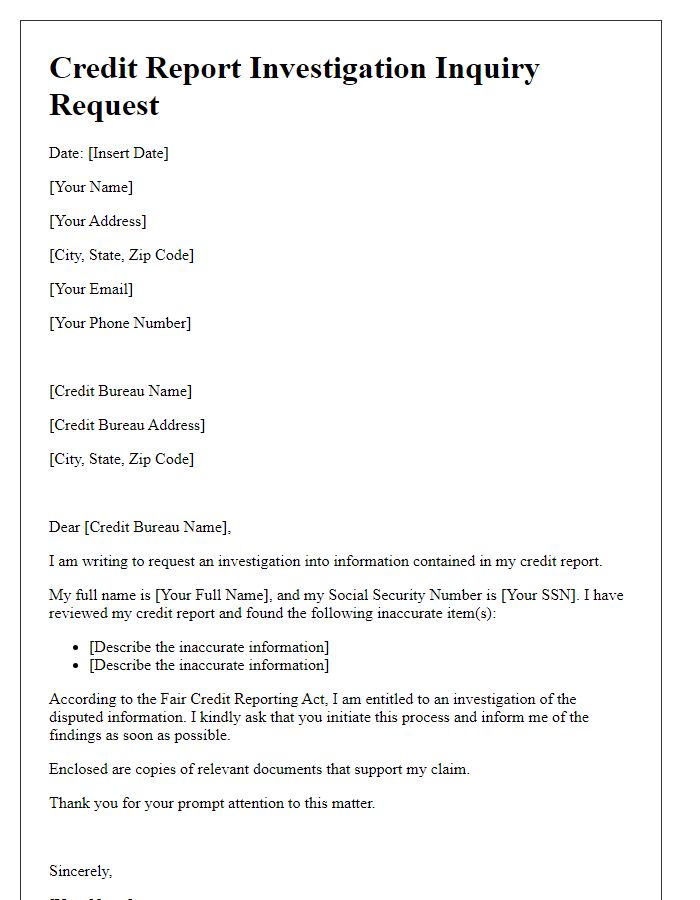

Specific Credit Report Details

A credit score inquiry request involves specific details regarding an individual's credit report, such as the name of the credit reporting agency (like Experian or TransUnion) and the requester's personal information (including Social Security number, full name, and address). The information needs to align with the Fair Credit Reporting Act guidelines, allowing consumers to receive their credit reports without charge under certain conditions like identity theft or recent credit applications. It is crucial to mention the exact time frame for which the report is requested, often the last 12 months, to ensure accuracy in assessing one's creditworthiness. Additional details about any disputes or incorrect information previously noted in the report can clarify the purpose of the inquiry.

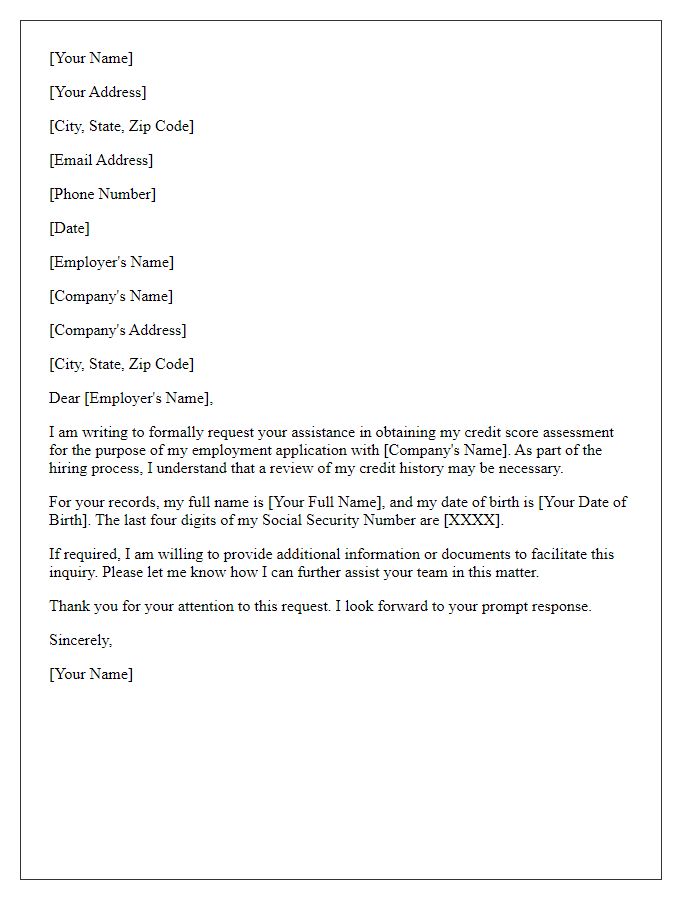

Request for Clarification or Correction

Credit score inaccuracies can lead to significant financial repercussions for individuals, impacting loan approvals and interest rates. When a consumer identifies discrepancies in their credit report from bureaus like Experian, Equifax, or TransUnion, it is critical to submit a clear inquiry. A formal request should include essential details such as the consumer's full name, social security number (last four digits), account numbers involved, and the specific items in question. Supporting documentation, such as copies of previous statements or transactions, may enhance clarity. Timely communication is vital, as the Fair Credit Reporting Act mandates a response from credit reporting agencies within 30 days. Prompt resolution ensures correct credit scores, facilitating better financial options and opportunities for the consumer.

Comments