Are you facing the stress of a repossession and unsure how to dispute the information affecting your credit report? You're not alone; many individuals find themselves in similar situations, grappling with the complexities of the repossession process. In this article, we'll walk you through a clear and effective letter template that empowers you to communicate your concerns and dispute inaccuracies. So, if you're ready to take control of your financial narrative, let's dive in and explore the steps you can take!

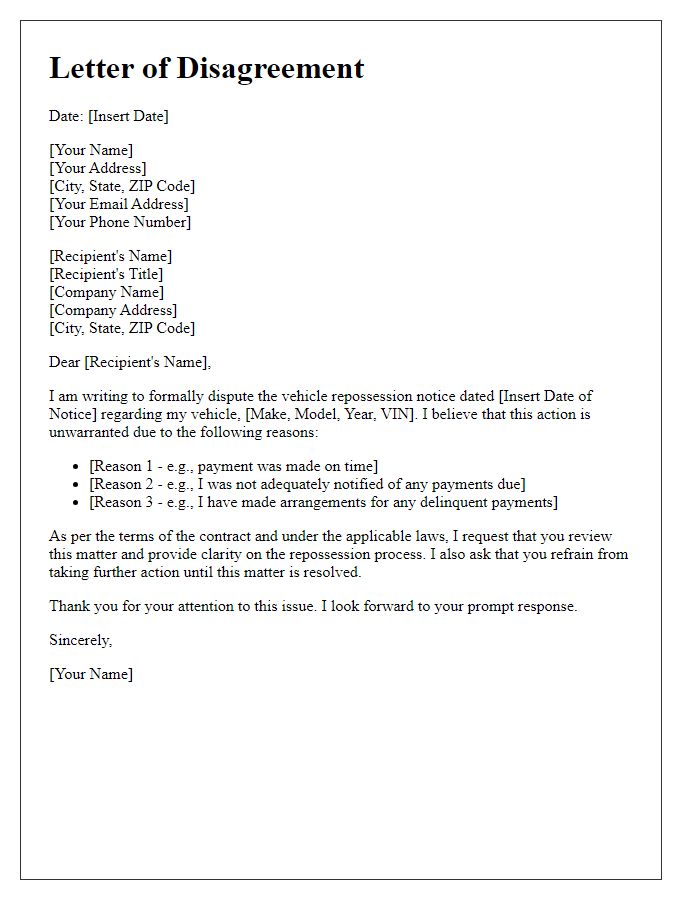

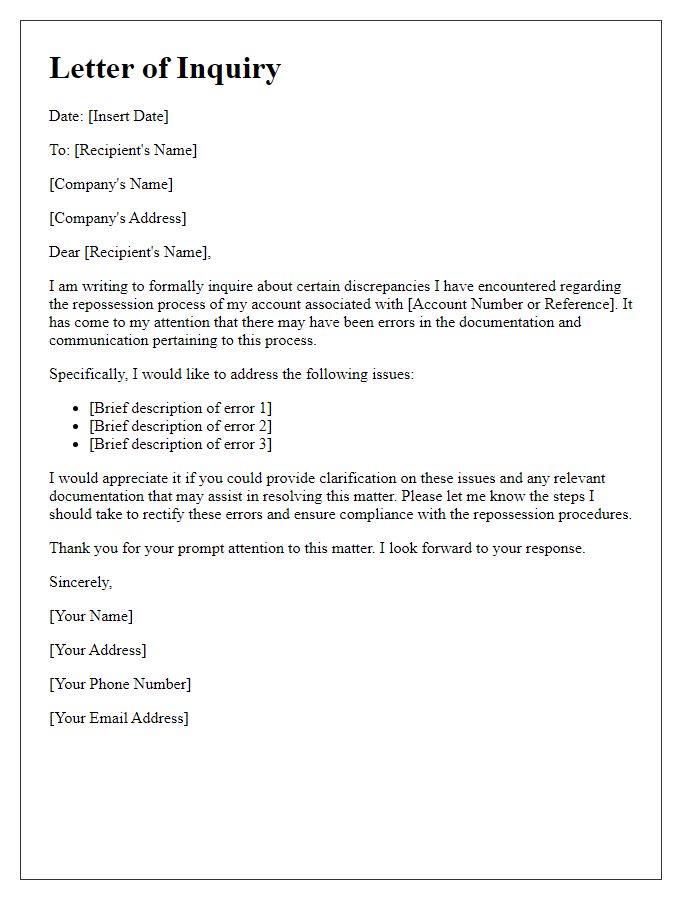

Contact Information

Disputing repossession information requires a clear presentation of facts and evidence. Relevant details include the individual's name, account number, and the name of the lending institution (e.g., Bank of America or Credit Acceptance Corporation). This should be followed by a concise statement outlining the reasons for the dispute, which may include inaccuracies in the reported amount owed, the validity of the repossession, or errors in the dates of missed payments. Pertinent dates such as the repossession date and the last known payment date must be included for context. Additionally, any applicable laws (such as the Fair Debt Collection Practices Act) may strengthen the argument, along with copies of supporting documentation like payment receipts or correspondence with the lender. All information should be organized and presented professionally to ensure clarity and effectiveness in communication.

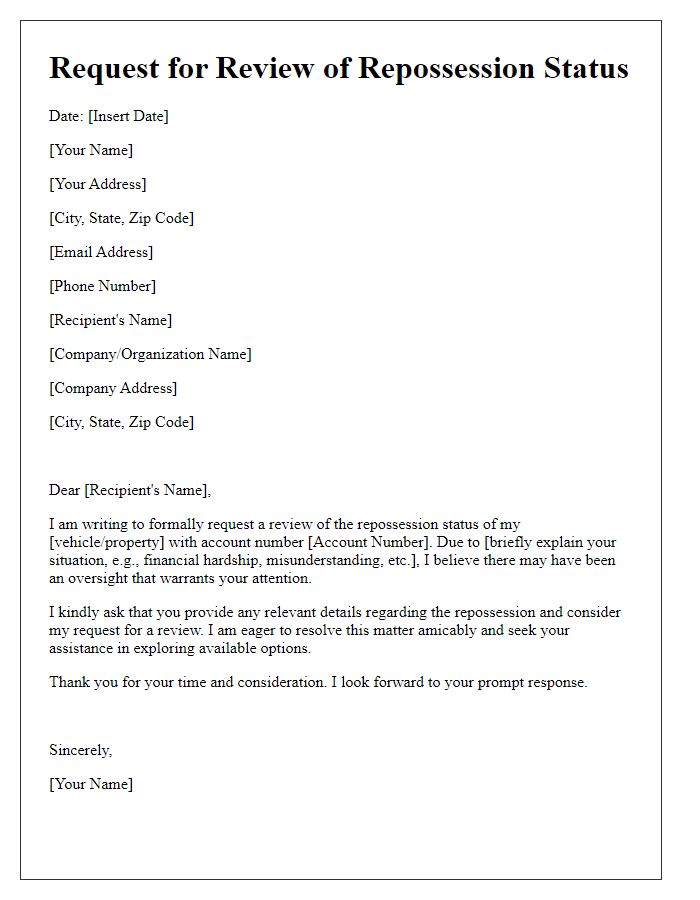

Account and Loan Details

Disputing repossession information can be critical for maintaining a positive credit history. Accurate account details are essential during this process, including specific loan information (like the loan number and outstanding balance) and records of payment history, which can show timely payments as evidence against wrongful repossession claims. It is important to reference relevant dates, such as the date of the alleged repossession, as well as any communication records with the lending institution regarding payment plans or financial hardships. Providing supporting documents, such as receipts or bank statements, can strengthen the dispute by backing up claims against inaccuracies in the repossession records.

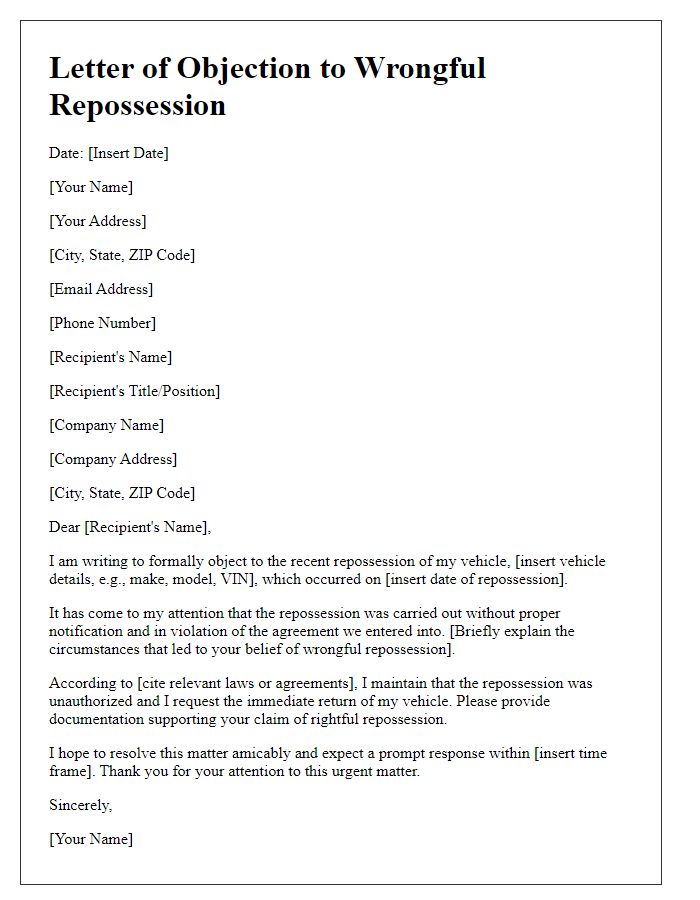

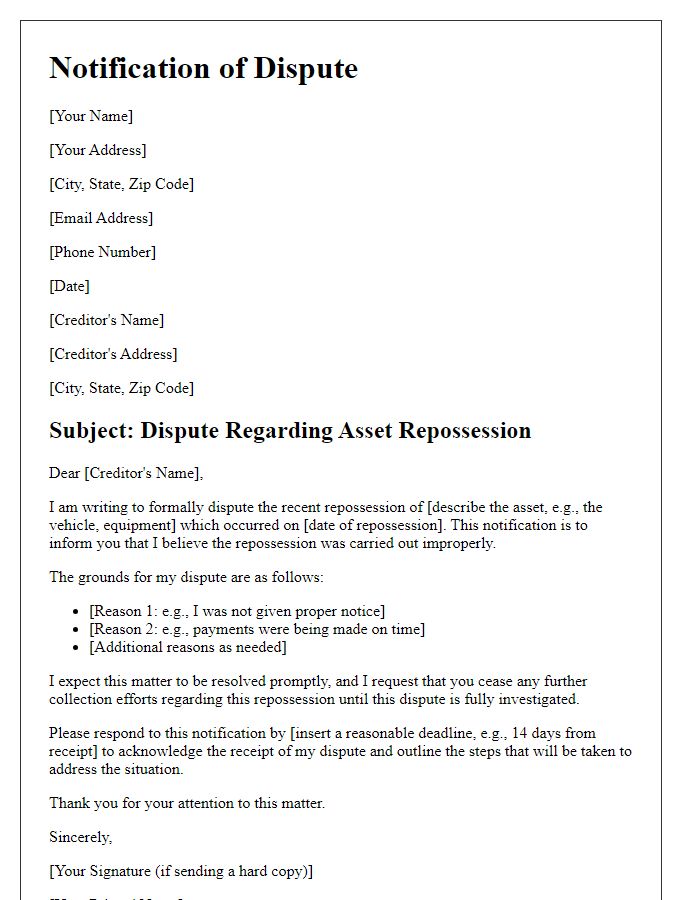

Explanation of Dispute

Disputing repossession information involves addressing inaccuracies that can negatively impact credit ratings and financial reputations. Repossession events, such as those conducted by financial institutions like banks or credit unions, can arise due to missed payments on loans or financing agreements, typically involving vehicles or real estate. Official documents, such as credit reports from agencies like Experian or TransUnion, may reflect these events inaccurately, including wrong dates or incorrect amounts owed. Disputes should clearly outline specific inaccuracies, referencing relevant account numbers (e.g., last four digits of the Social Security number or account identifier). Timely responses (usually within 30 days) are critical in maintaining valid records with lenders and agencies. Documentation such as payment receipts or correspondence may be included to substantiate claims and facilitate resolution.

Supporting Documentation

Disputing inaccurate repossession information requires clear and detailed documentation. Obtain credit reports from major agencies like Equifax, Experian, and TransUnion. Highlight discrepancies regarding repossession dates, amounts owed, and vehicle identification numbers (VIN). Include supporting documents such as payment receipts, account statements, and correspondence with the lender, typically the bank or financing company. Ensure to attach a copy of your identification, such as a driver's license, to verify your identity. Document all communication with the repossession agency, including dates, times, and representatives' names. Retain these records for future reference to support your case effectively.

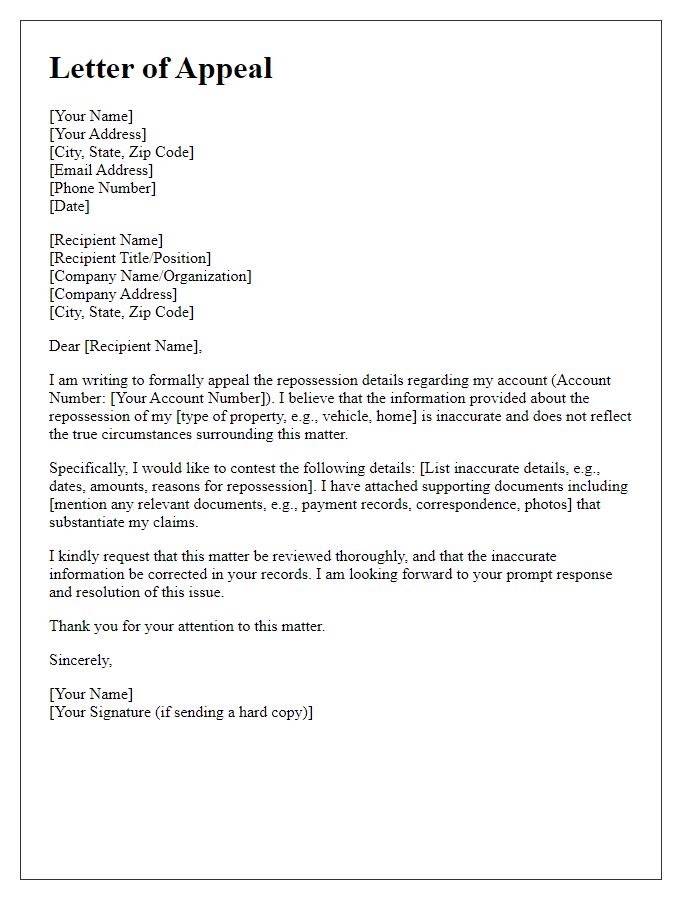

Resolution Request and Deadline

Disputing inaccurate repossession information can be a critical process for maintaining a clear credit history. Repossession records, frequently reported from credit reporting agencies like Experian, TransUnion, and Equifax, can significantly impact credit scores, often dropping them by 100 points or more. The resolution request should detail the specific inaccuracies and attach supporting documentation, such as payment records or communication with the creditor. It is important to set a clear deadline, typically 30 days, for the reporting agency or creditor to investigate and respond. If unresolved, federal law under the Fair Credit Reporting Act allows individuals to escalate the dispute to the Consumer Financial Protection Bureau for further action.

Comments