Are you looking to improve your credit score by adding utility payments to your credit report? You're not aloneâmany people are discovering the benefits of leveraging on-time utility payments as a way to enhance their creditworthiness. In today's financial landscape, understanding how to incorporate these payments can unlock new opportunities for credit access and improvements. So, if you're curious about how to seamlessly add utility payments to your credit profile, let's dive deeper into this topic!

Accurate account information

Accurate account information plays a crucial role in reporting utility payments to credit bureaus, helping consumers build a positive credit history. Utility providers like electric (e.g., Pacific Gas and Electric), water (e.g., American Water), and gas services often report monthly payment histories to major credit bureaus such as Experian, TransUnion, and Equifax. Ensuring accurate account details, including the account number and payment history, can directly influence your credit score, particularly for those lacking robust credit profiles. Small utility bills, when paid consistently, can contribute positively to a credit score, often seen in lending decisions, including home mortgages and auto loans.

Detailed payment history

Utility payment history plays a crucial role in building creditworthiness, especially when considering payments made for services like gas, electricity, and water. Regular on-time payments (typically monthly) can significantly impact credit scores, as companies such as Experian and Equifax offer credit reports that include alternative data. A well-documented payment history, often spanning several years, provides clear evidence of financial reliability. Establishing a pattern of consistently paying utility bills on or before their due dates can enhance a consumer's credit profile, allowing for better terms on loans and credit cards from entities such as banks and credit unions.

Identification of utility company

Identification of utility company impacts the credit score reporting process. Utility companies, such as electric, water, and gas providers, often report payment histories to credit bureaus. Regular on-time payments contribute positively to credit profiles, while late payments can lead to lower scores. For example, leading utility firms like Pacific Gas and Electric (PG&E) or Con Edison report consumer payment activities to major bureaus (Experian, TransUnion, Equifax). Ensuring accurate identification of utility providers enables consumers to leverage their payment records effectively. Consumers should confirm correct account information, including account numbers and service addresses, before initiating reporting requests. This diligence ensures credit agencies receive the right data while potentially enhancing overall creditworthiness.

Consent for data sharing

Utility payment history can significantly enhance credit scores for consumers. Consent for data sharing allows utility companies, like electric, water, and gas providers, to report payment histories to credit bureaus such as Experian, TransUnion, and Equifax. Consistent on-time payments (made monthly, typically between the 1st and 15th) can reflect positively, contributing to improved creditworthiness. Over 60% of consumers have utility bills that could be included in their credit reports, potentially increasing their chances of securing loans or mortgages. Opting into this program may assist in building a more comprehensive credit profile, especially for those with limited credit histories or low credit scores.

Request for credit report update

Utility payments, such as electricity or water bill payments, can significantly impact an individual's credit score when reported to credit bureaus. Timely payments contribute positively, showcasing good payment history. Requesting an update to a credit report may involve formal submissions to major credit bureaus like Experian, TransUnion, and Equifax. Including relevant account details such as service provider names, account numbers, and payment history can enhance the credibility of the request. Additionally, referencing consumer protection laws like the Fair Credit Reporting Act may support arguments for accurate and updated reporting. The outcome can influence creditworthiness, potentially lowering interest rates on loans and improving chances for approval.

Letter Template For Adding Utility Payments To Credit Samples

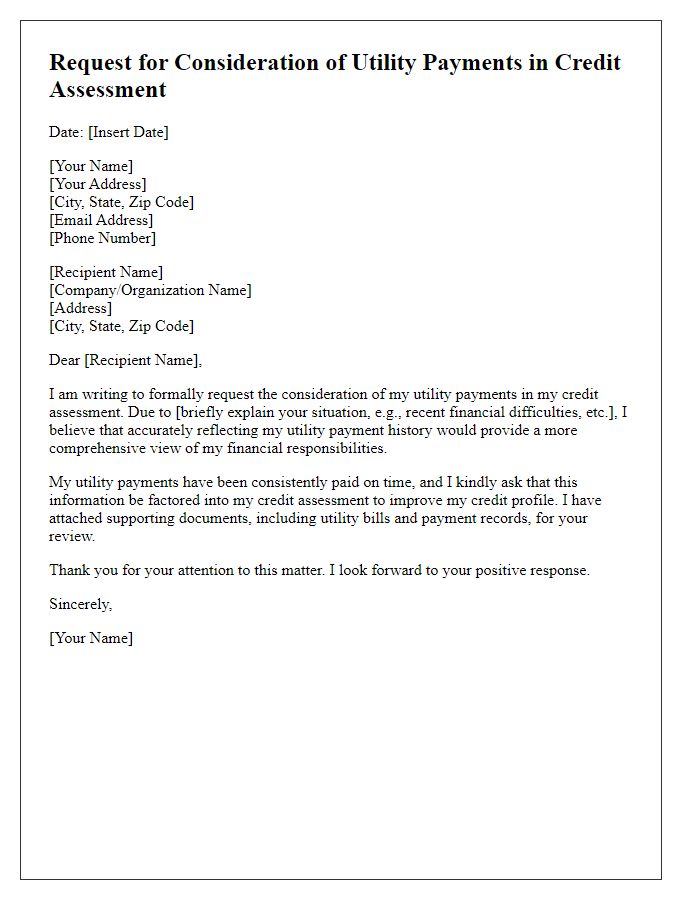

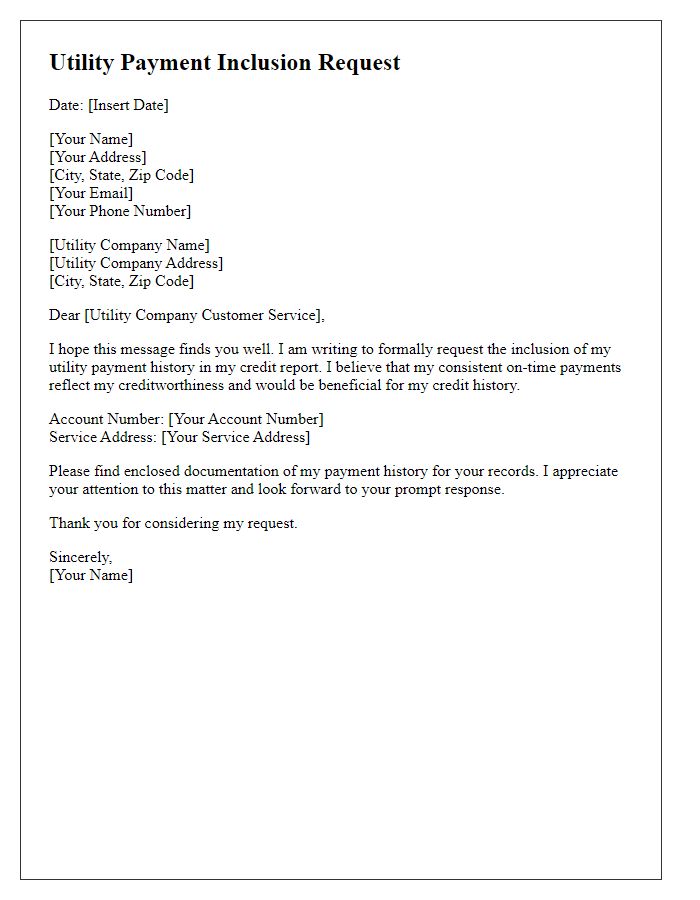

Letter template of Request for Consideration of Utility Payments in Credit Assessment

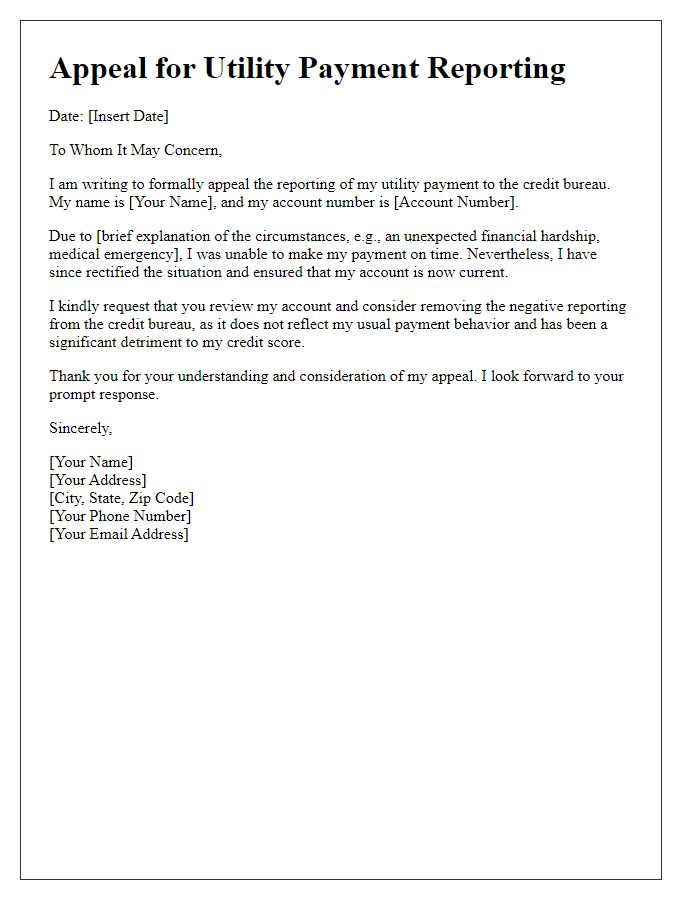

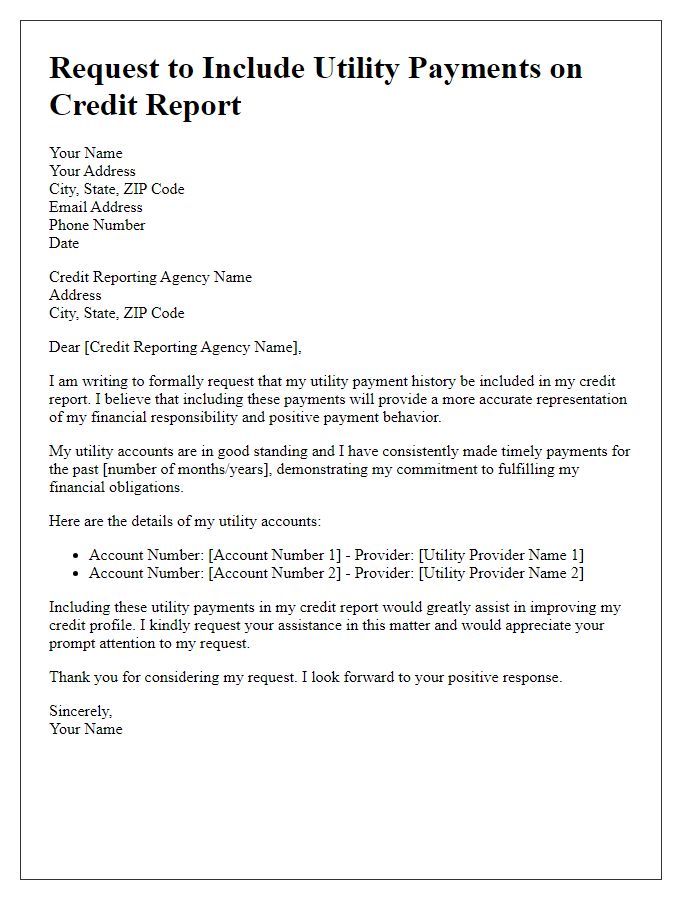

Letter template of Appeal for Utility Payment Reporting to Credit Bureau

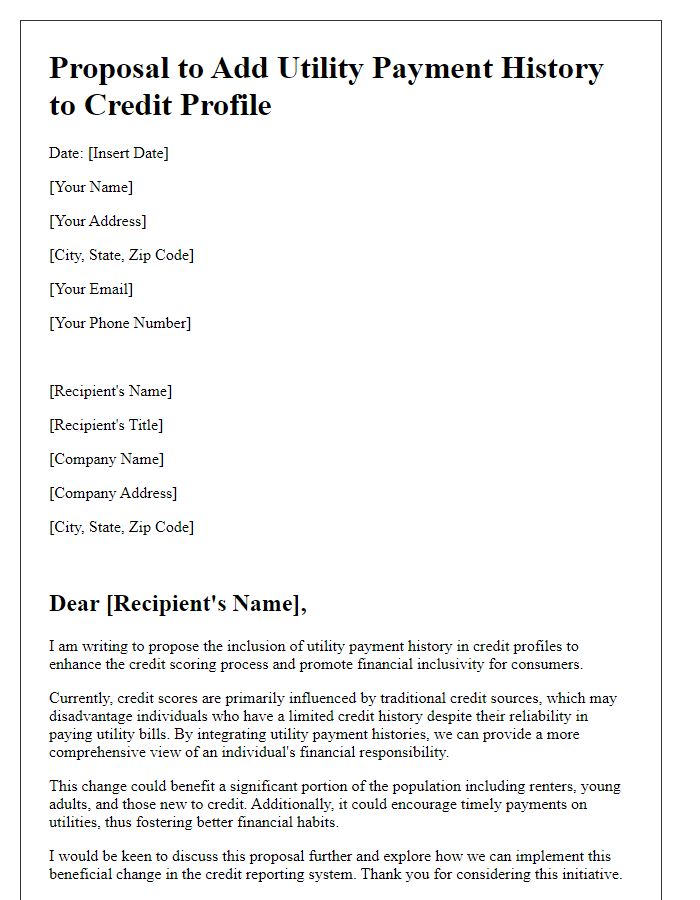

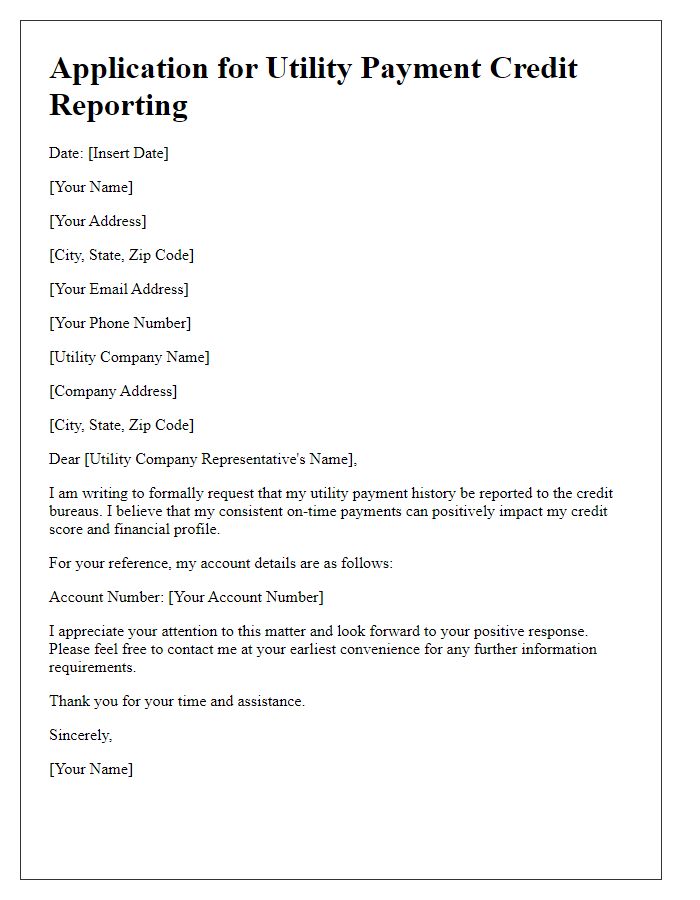

Letter template of Proposal to Add Utility Payment History to Credit Profile

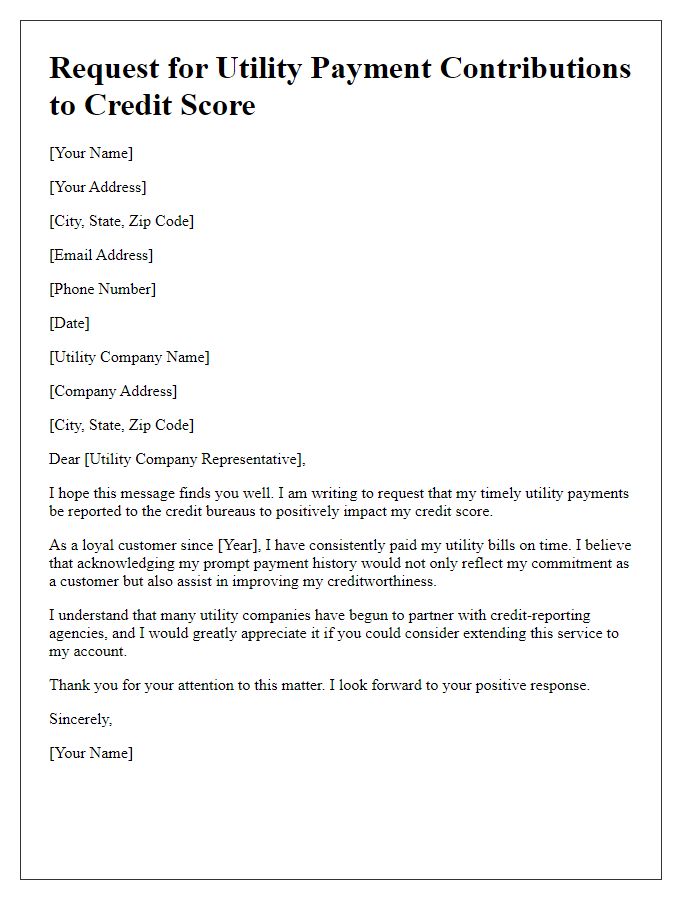

Letter template of Request for Utility Payment Contributions to Credit Score

Comments