Are you feeling overwhelmed by the burden of medical debt? You're not alone, as many individuals find themselves in a similar situation that can affect their financial stability. Thankfully, there are options to help exclude medical debt from your credit report, allowing you to regain control of your financial future. If you're curious about how to navigate this process and alleviate some of your stress, I invite you to read more!

Personal Identification Details

Exclusion of medical debt from a credit report can significantly improve an individual's financial standing. Medical debt, often incurred through health services such as emergency room visits or surgery, can adversely impact credit scores (typically measured on a scale from 300 to 850). Identifying personal details, such as full name, Social Security number, and date of birth, plays a crucial role in the request process. Proper documentation from healthcare providers and creditors, including invoices and payment records, can substantiate the claim that such debts should not be included in the credit report. Timely resolution, usually within 30 days, is essential to ensure that credit reporting agencies accurately reflect an individual's financial situation.

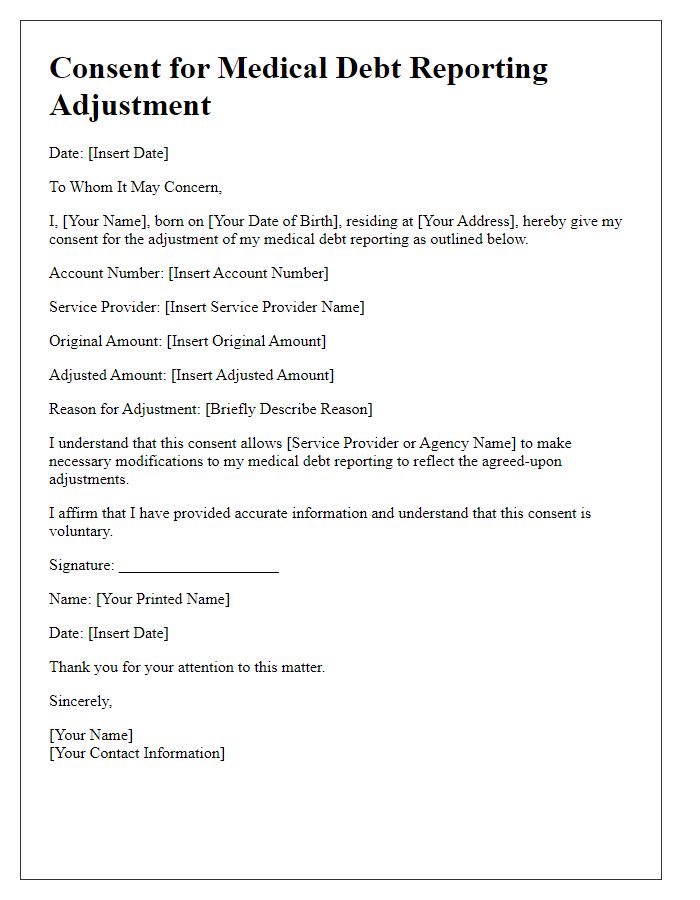

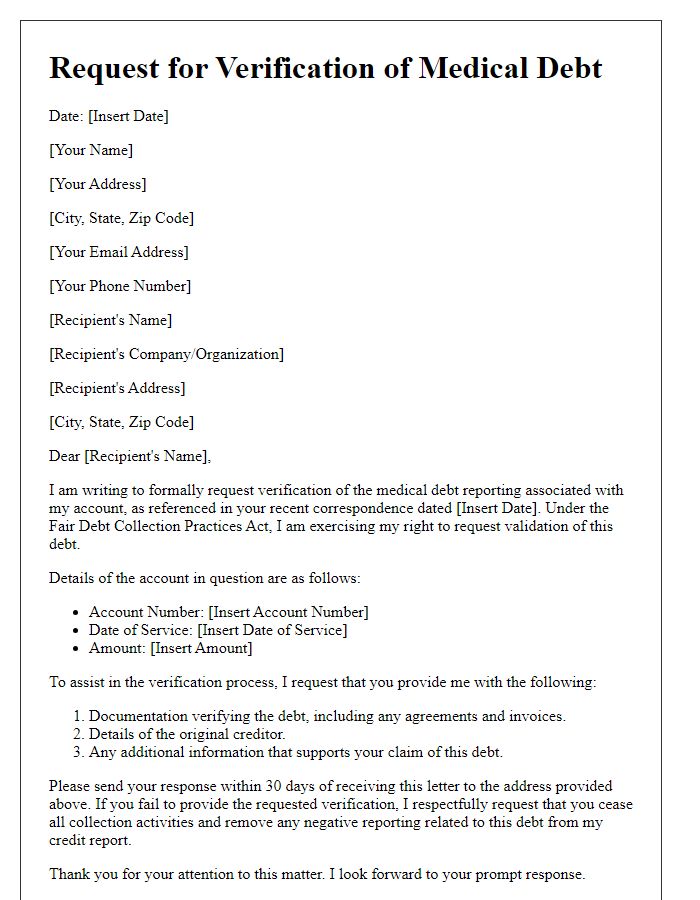

Debt Verification Information

Medical debt can significantly impact credit reports, affecting individuals' financial stability. Medical collections, typically reported under the Fair Debt Collection Practices Act, may not be accurately reflected in credit scores, especially if the debt is disputed or not verified. In some cases, amounts as low as $100 can lead to substantial drops in credit scores. Health care providers and collections agencies must follow stringent guidelines when reporting such debts. Moreover, data shows that about 60% of Americans have faced unexpected medical bills, leading to widespread credit report issues. Regular monitoring of credit reports from agencies like Experian, TransUnion, or Equifax is crucial for managing and correcting accurate representations of medical debts.

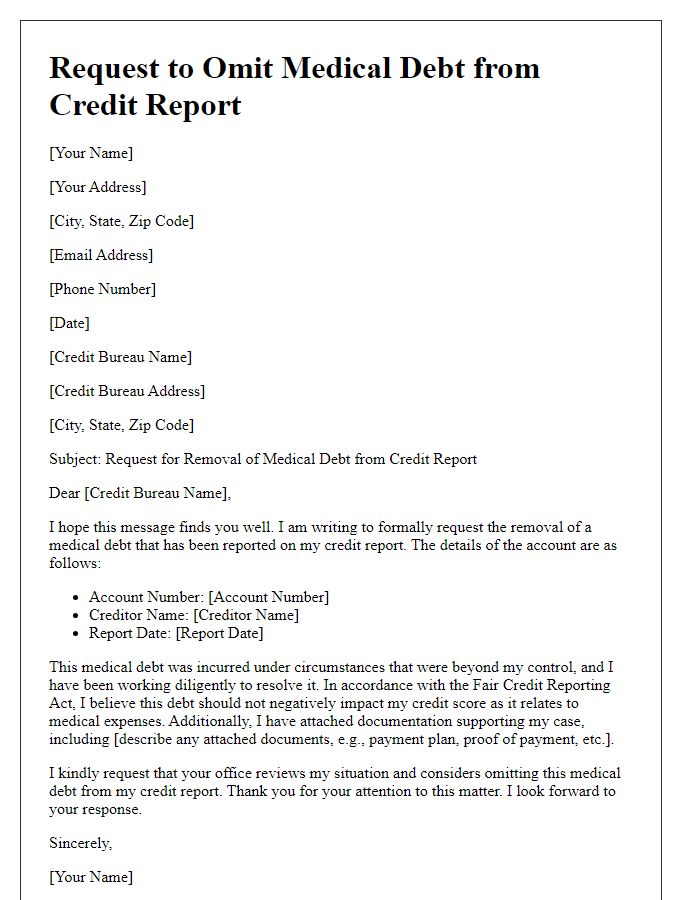

Request for Debt Removal

Medical debt, often resulting from unexpected health emergencies, can significantly impact credit reports and scores. Many individuals, especially those with chronic conditions or sudden medical events, may accrue substantial expenses in healthcare facilities, such as hospitals or outpatient clinics. The Fair Credit Reporting Act (FCRA) allows for the potential negotiation of inaccuracies in reporting, particularly regarding medical bills. In several states, laws protect consumers from immediate reporting of medical debt until 180 days post-billing, providing a window for addressing insurance claims or financial hardship. Furthermore, organizations like the Consumer Financial Protection Bureau (CFPB) advocate for the removal of medical debt when it does not reflect accurately on credit reports, offering resources and support for consumers seeking relief in this sensitive area.

Supporting Documentation

Medical debt exclusion from credit reports can significantly impact financial stability. The Fair Credit Reporting Act (FCRA) enables consumers to dispute inaccuracies. Supporting documentation can include medical bills, insurance statements, and payment records, essential for substantiating claims of medical debt. Agencies like the Consumer Financial Protection Bureau (CFPB) encourage consumers to gather detailed evidence, such as dates of service and treatment records from healthcare facilities. Correspondence with collection agencies may provide crucial insights into disputes. Various states, including California and New York, have specific laws protecting consumers regarding medical debt reporting, emphasizing the importance of understanding local regulations.

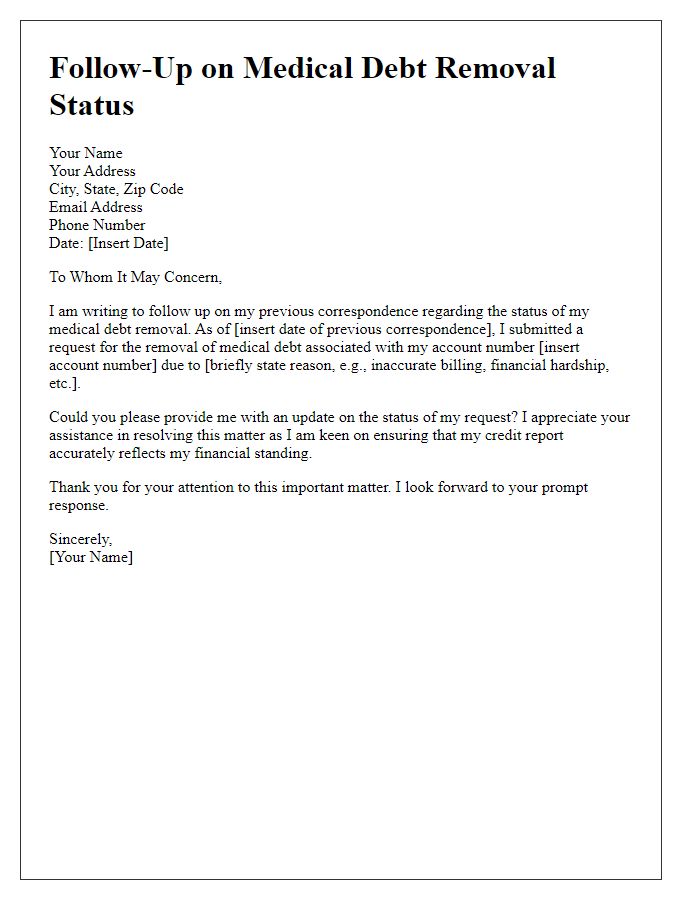

Contact Information and Follow-up Instructions

Medical debt exclusion from credit reports can significantly affect creditworthiness. Under the Fair Credit Reporting Act, individuals can request the removal of unpaid medical debt after a specific time frame, typically 180 days. Contact agencies like Experian, TransUnion, and Equifax through their customer service numbers or official websites for guidance on the dispute process. Individuals must provide personal information such as Social Security number and account details (like account number and healthcare provider name) to facilitate this exclusion. Follow-up instructions typically include waiting for a response within 30 days and reviewing updated credit reports for accuracy afterward.

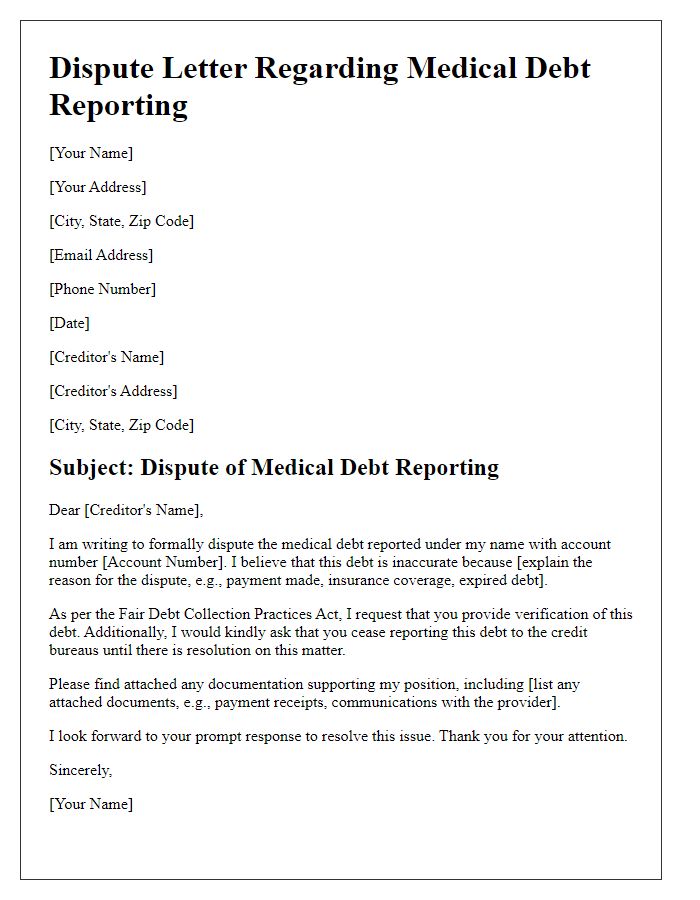

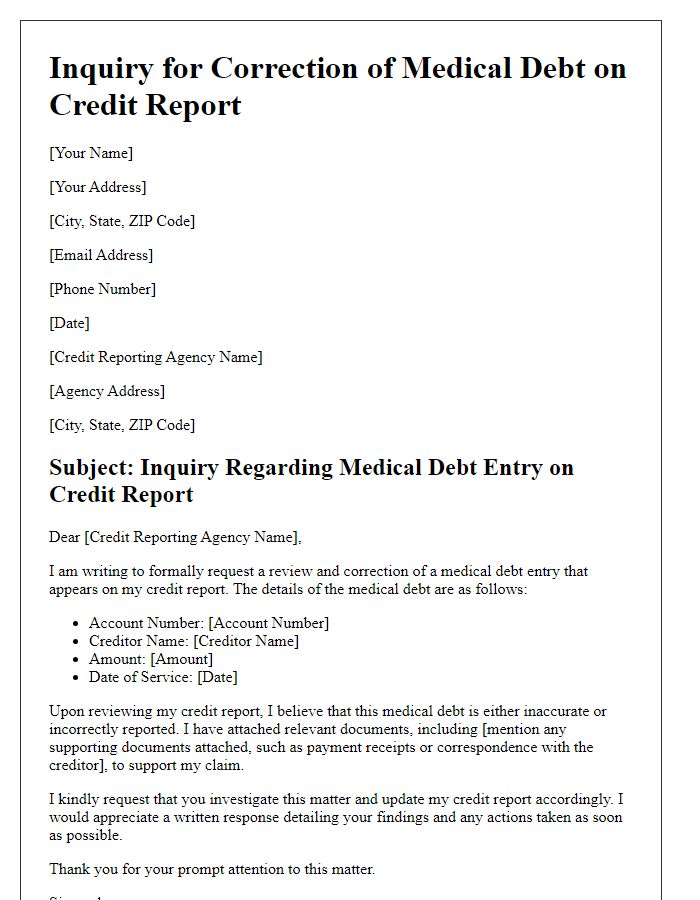

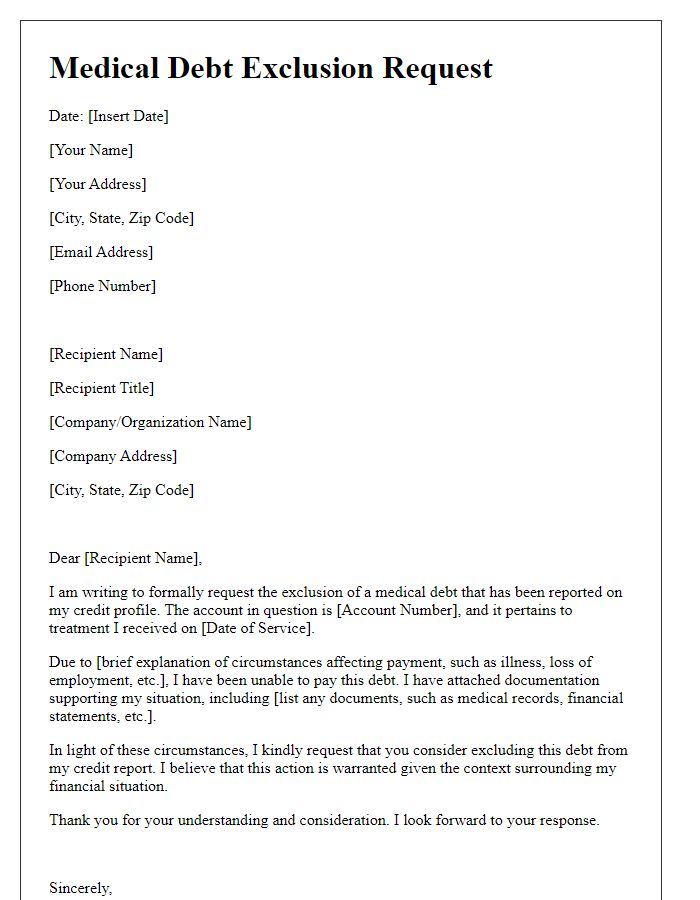

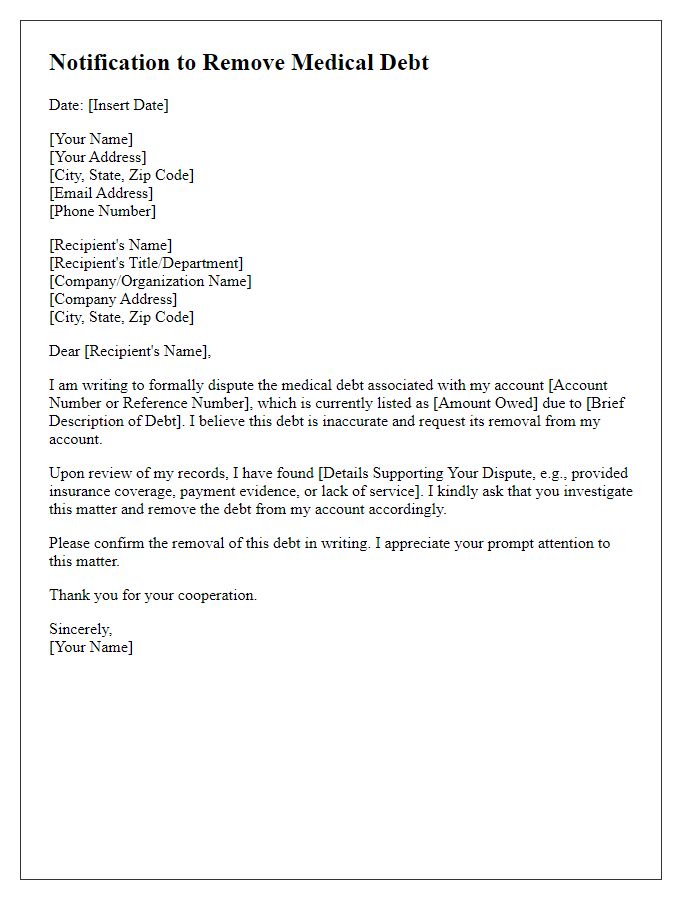

Letter Template For Excluding Medical Debt From Report Samples

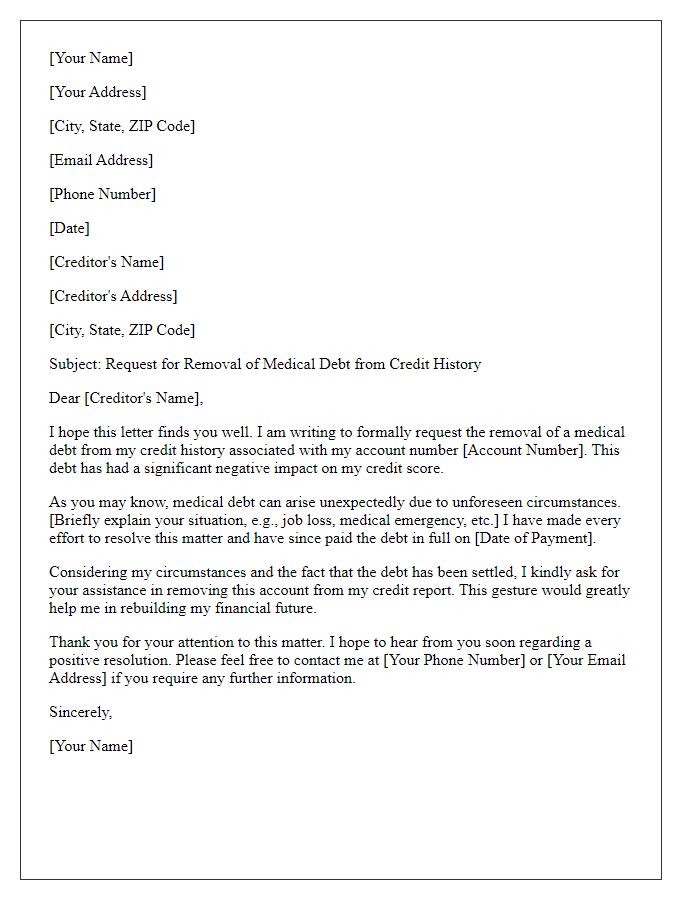

Letter template of appeal for removal of medical debt from credit history

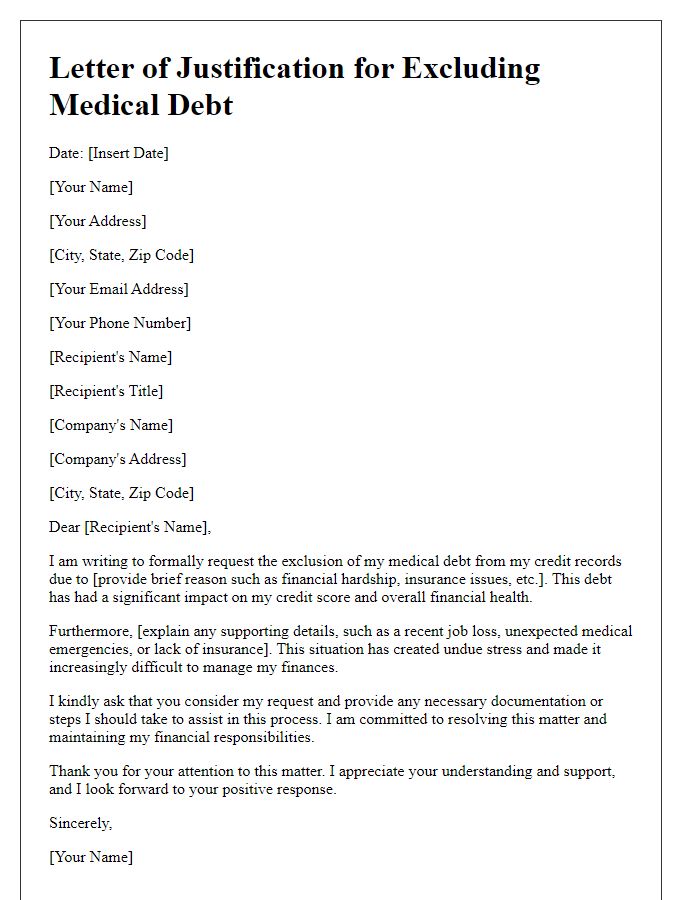

Letter template of justification for excluding medical debt from records

Comments