Are you looking to improve your credit score and lay the groundwork for a healthier financial future? Establishing a solid credit plan can be a game changer, opening doors to better interest rates and financial opportunities. In this article, we'll break down the essential steps to create a successful credit establishment plan tailored to your needs. Join us as we explore actionable tips and insights to help you take control of your credit journey!

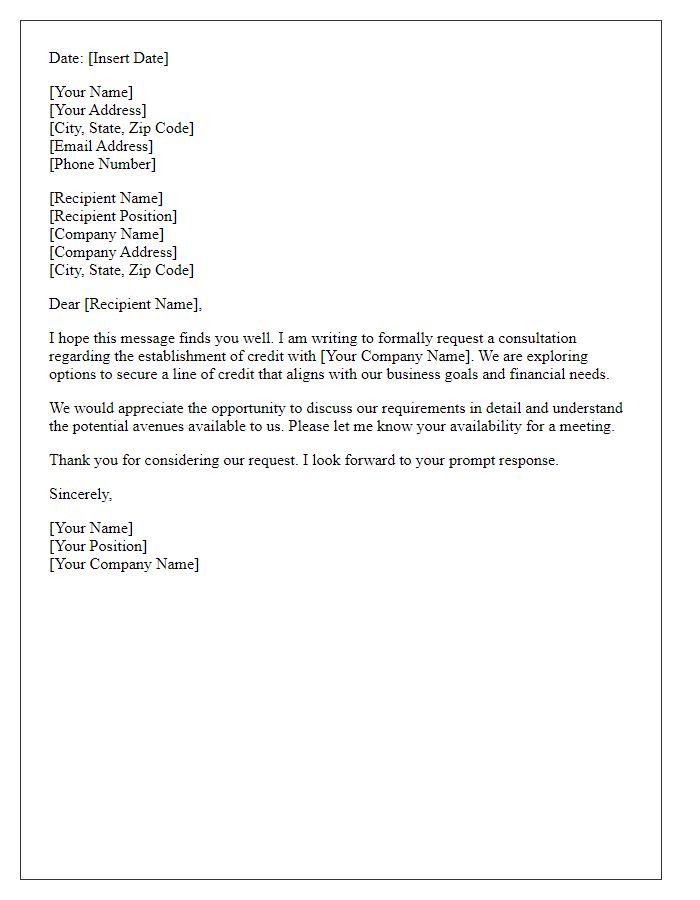

Clear Purpose and Objectives

Establishing a credit plan ensures financial stability and economic growth for individuals and businesses. A clear purpose involves identifying specific financial goals, such as improving credit scores to qualify for loans or securing better interest rates on mortgages. Objectives may include making timely payments, reducing existing debt by at least 20% over six months, and increasing available credit by applying for new lines of credit responsibly. Achieving these objectives requires disciplined budgeting, consistent monitoring of credit reports from agencies like Equifax and Experian, and engaging in educational resources about credit management. A well-structured plan enhances overall financial health and empowers individuals to make informed economic decisions.

Comprehensive Financial Overview

A comprehensive financial overview is essential for establishing a successful credit plan. This overview includes key financial metrics such as income, expenses, assets, and liabilities, with accurate monthly income figures reflecting all sources, including salary, investments, and any side businesses. A detailed expense breakdown, categorized by fixed (like rent or mortgage payments) and variable expenses (such as groceries and entertainment), provides insight into monthly spending habits. Assets encompassing cash savings, property values, and investments contribute to net worth calculations, while liabilities including outstanding loans, credit card debts, and mortgages are critical to assess financial health. Furthermore, historical payment behavior, reflected in credit scores from agencies like FICO or VantageScore, can demonstrate reliability in repaying debts, making a case for favorable terms in credit establishments. A well-prepared financial overview illustrates a clear picture of financial capability, which is vital for successfully negotiating credit arrangements with lenders or financial institutions.

Risk Assessment and Mitigation Strategies

A credit establishment plan, essential for financial institutions, involves a comprehensive risk assessment that identifies potential pitfalls in lending processes. Key risks include credit risk, which pertains to the likelihood of borrower default, and operational risk, arising from internal system failures. Mitigation strategies involve implementing robust credit scoring models, such as FICO or VantageScore, to evaluate borrower creditworthiness based on their credit history, income level, and debt-to-income ratio. Regular monitoring of macroeconomic indicators like unemployment rates and interest rates is crucial for anticipating market fluctuations impacting creditworthiness. Additionally, fostering transparent communication with borrowers regarding loan terms and conditions enhances trust and decreases default rates. Effective training programs for staff on recognizing early signs of credit risk can further empower institutions to take proactive measures in financial stability.

Strong Business Plan and Market Analysis

A compelling business plan, coupled with an in-depth market analysis, serves as the foundation for establishing a successful credit plan. The business plan outlines the company's core objectives, including projected revenue streams, target demographics, and operational strategies tailored to specific industries, such as technology or retail. A thorough market analysis delineates current market trends, consumer behavior insights, and competitor landscapes, showcasing opportunities for customer acquisition in regions like the Midwest or the Northeast. This combination provides lenders with confidence, illustrating a strategic approach toward sustainable growth, risk management, and potential profitability, thus facilitating the credit establishment process. Key factors such as market size (estimated at $450 billion in North America), customer segmentation, and financial projections strengthen the proposal further.

Legal and Regulatory Compliance

Establishing a comprehensive credit establishment plan requires a robust framework for legal and regulatory compliance. Financial institutions are obligated to adhere to standards set by governing bodies such as the Consumer Financial Protection Bureau (CFPB) and the Federal Reserve. Key regulations like the Truth in Lending Act (TILA) and the Fair Credit Reporting Act (FCRA) guide transparency and protect consumers against deceptive practices. Implementing due diligence procedures ensures adherence to anti-money laundering (AML) laws and the Bank Secrecy Act (BSA). Regular audits and staff training on compliance protocols are critical for identifying potential violations and minimizing legal risks. Through meticulous documentation and proactive engagement with regulatory changes, organizations enhance their credibility and foster trust within the marketplace.

Comments