Are you considering requesting a waiver for your annual fee? If so, crafting a well-structured letter can significantly increase your chances of approval. In this article, we'll explore essential tips and an easy-to-follow template that will guide you through the process seamlessly. Ready to take the next step? Let's dive in!

Personal account details

Individuals often seek annual fee waivers for credit cards or bank accounts under specific circumstances. Many financial institutions offer this courtesy to maintain customer satisfaction. Detailed account information such as account number (typically 10 to 16 digits), type of account (credit card, savings, etc.), and the name of the financial institution (such as Chase Bank, Bank of America) is crucial for processing the request. Additional considerations may include a history of timely payments, length of account ownership (often measured in months or years), and any qualifying hardships such as job loss or medical emergencies. A well-stated rationale can significantly influence the decision-making process on waiving fees.

Reason for waiver request

Annual fee waivers are commonly requested by customers due to various reasons, including financial hardship, loyalty to a service provider, or special circumstances like job loss or medical emergencies. Customers often cite a long-standing relationship with the company, loyalty benefits, and previous positive experiences as factors influencing their request. Specific situations, such as changes in income due to layoffs or unexpected medical expenses, can significantly impact a customer's ability to pay. Supporting documents, such as income statements or medical bills, may be attached to strengthen requests. Companies may have policies regarding waivers, often considering factors like account history, payment behavior, and service usage. Ultimately, the goal is to maintain customer satisfaction while also ensuring company policies remain equitable.

Demonstration of good history

A request for an annual fee waiver can be grounded in a strong history of consistent and responsible account management. Individuals with exemplary payment reliability often present their argument effectively, showcasing a record of on-time transactions over several years. Providing specific figures can enhance the appeal; for instance, noting a consistent zero-balance due over the last twelve months can illustrate financial prudence. Citing loyalty statistics, such as a 5+ year relationship with the financial institution and showing participation in loyalty programs may strengthen the case further. Additionally, mentioning financial hardships, like job loss or unexpected medical expenses, can provide a compelling context for the request, making it relatable and humane. This combination of responsible financial behavior and personal circumstances can make a persuasive case for waiving the annual fee.

Expression of loyalty

Long-term customers often seek fee waivers from service providers due to their consistent loyalty. An annual fee waiver request can highlight a client's commitment over several years. This may include specific details such as the number of years as a customer, the frequency of transactions, and any referrals made to friends or family. It can mention the impact of economic changes, such as inflation, on personal finances. Expressing appreciation for the service received, along with gratitude for any assistance provided in the past, adds a personal touch. A polite and respectful tone increases the chances of receiving a favorable response.

Contact information for response

Annual fee waiver requests often stem from financial hardship or changes in circumstances. Applicants typically provide personal information, outlining their current financial status and justifications for the waiver. Essential details include the applicant's full name, contact phone number, email address for responses, and any relevant account numbers or identification associated with the service. Providing a brief summary of the reasons behind the waiver request, supported by any necessary documentation, can strengthen the appeal. To facilitate communication, a direct contact person within the issuing organization may also be referenced to streamline the response process.

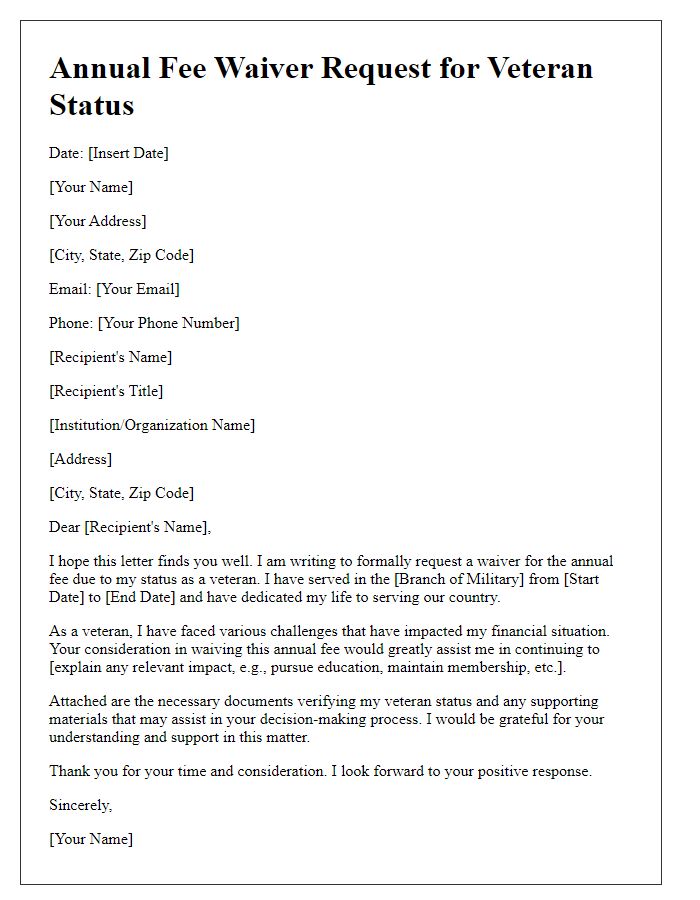

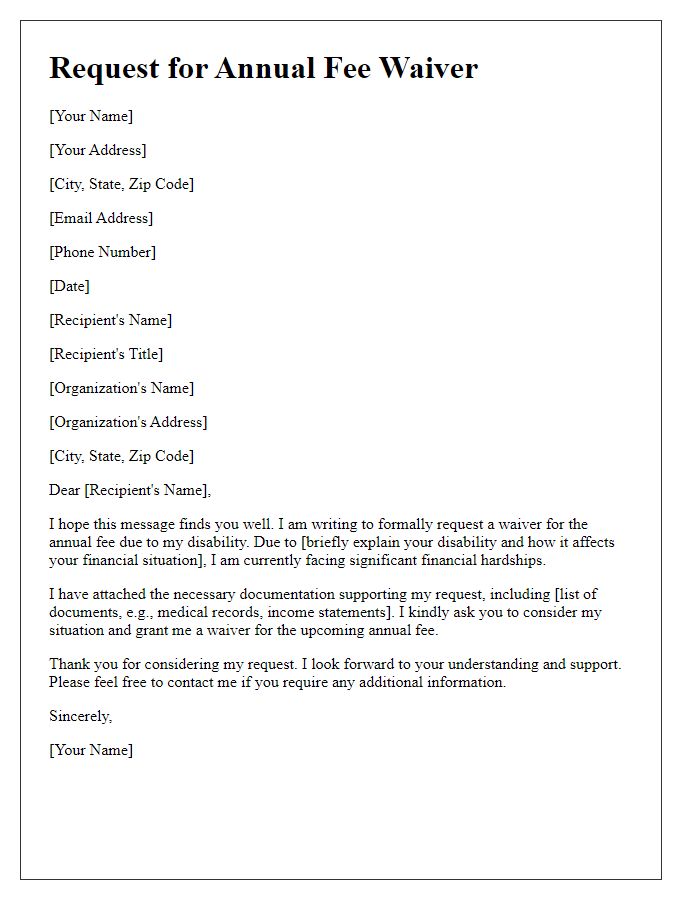

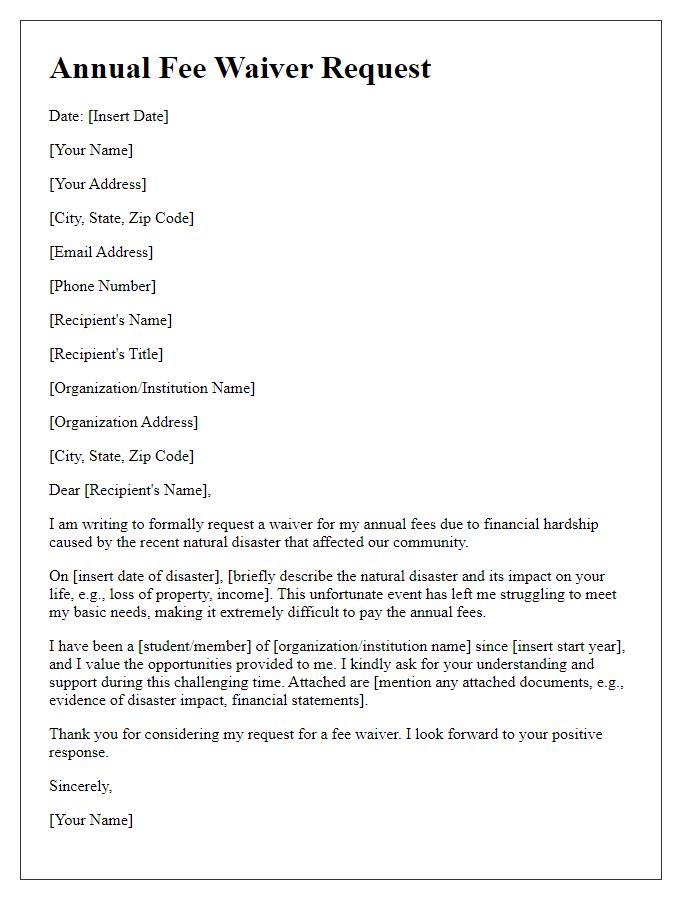

Letter Template For Annual Fee Waiver Request Samples

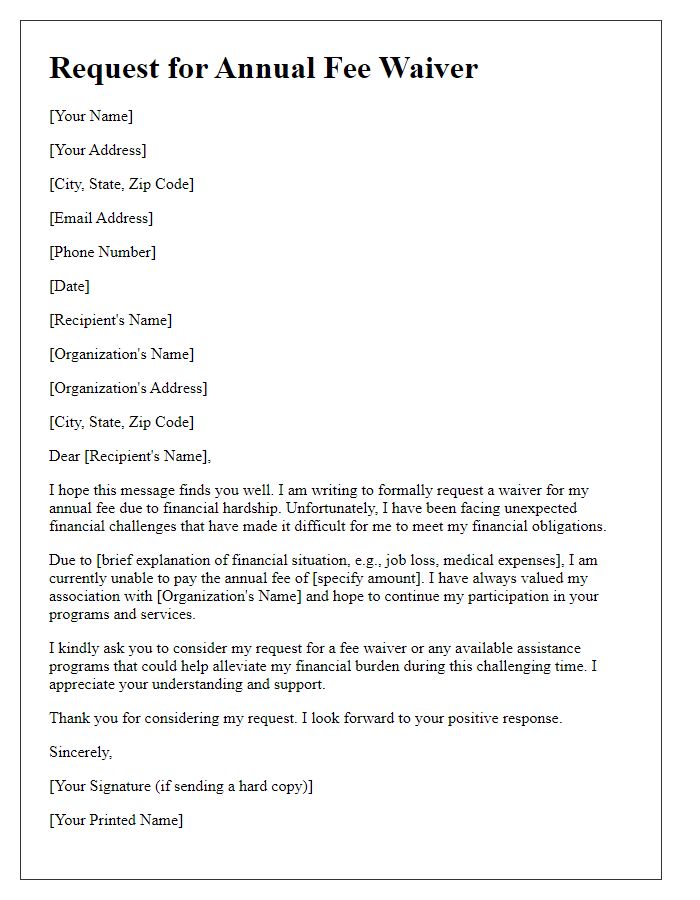

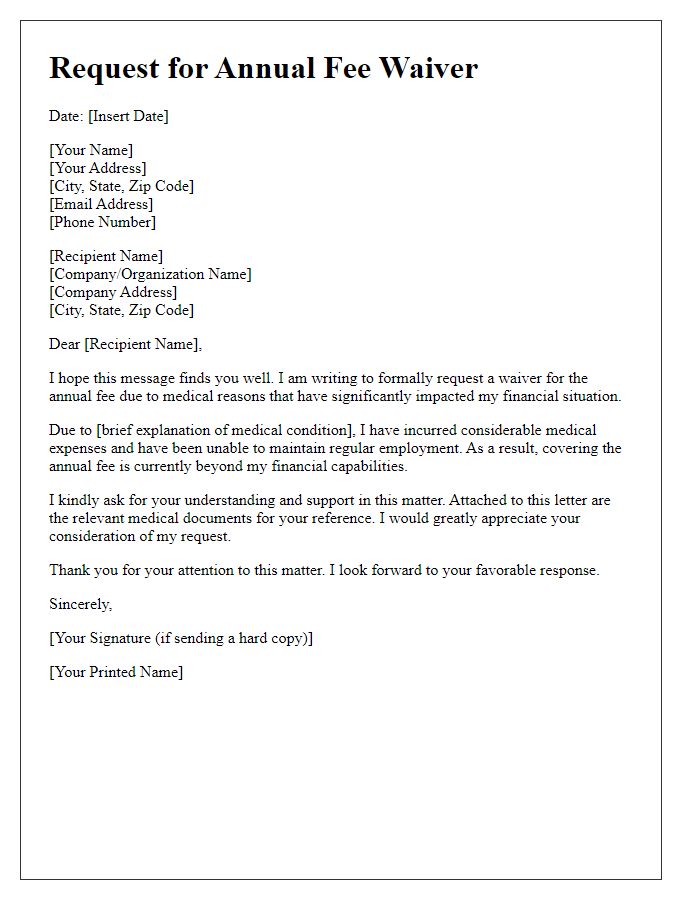

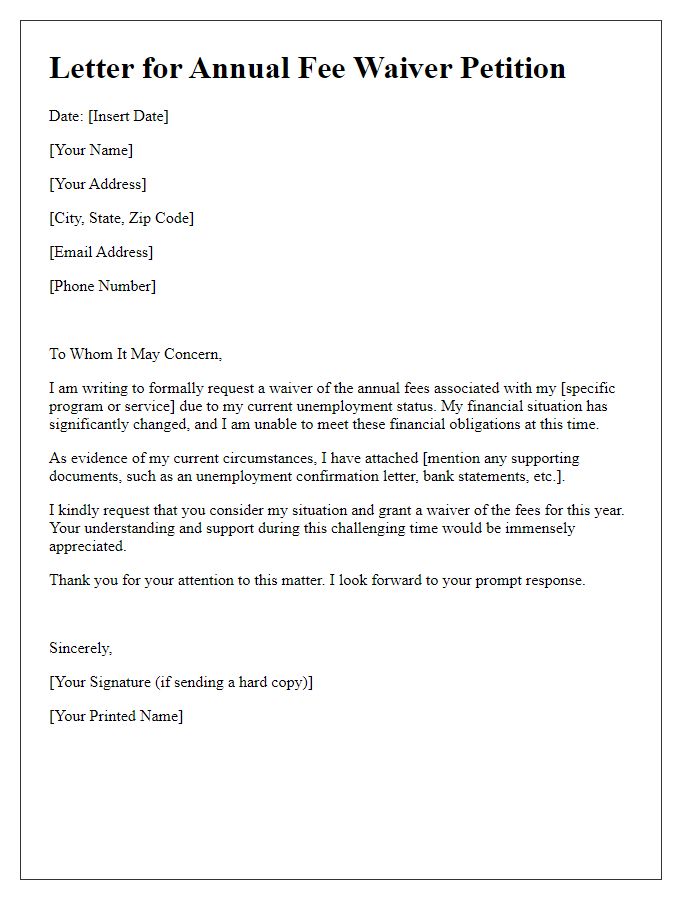

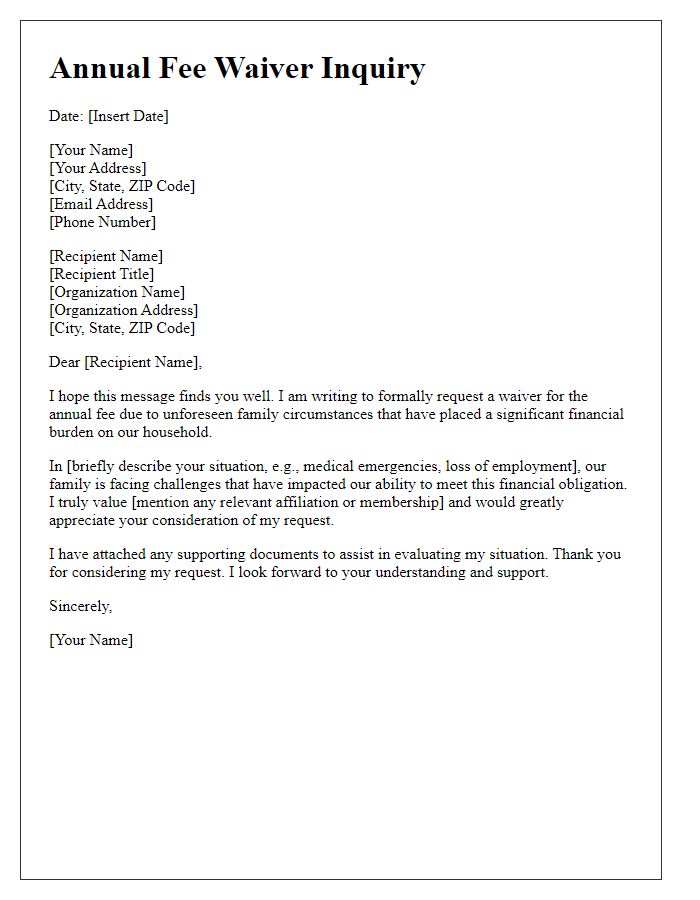

Letter template of request for annual fee waiver due to financial hardship

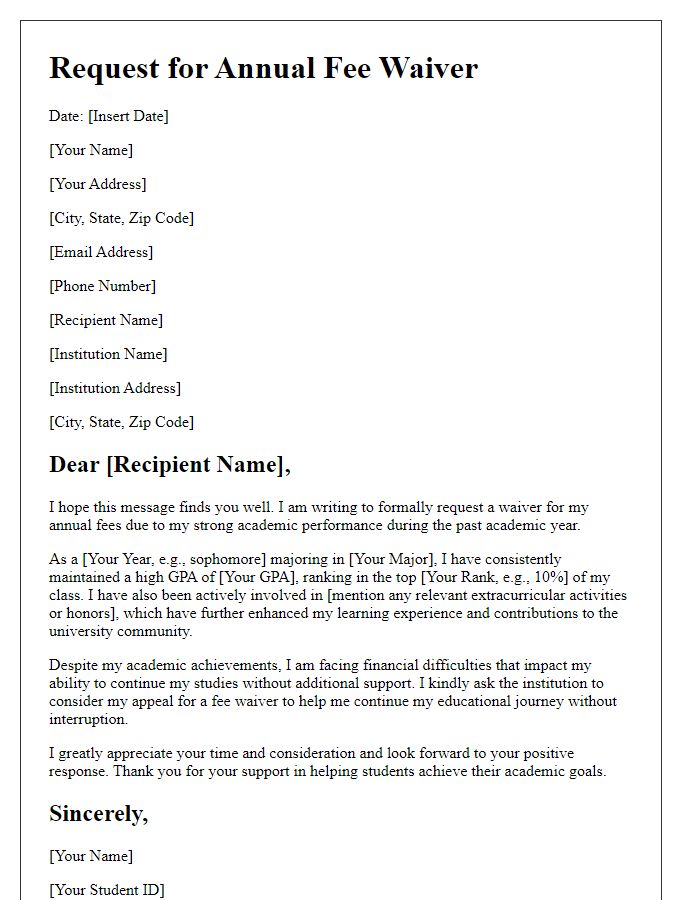

Letter template of appeal for annual fee waiver based on academic performance

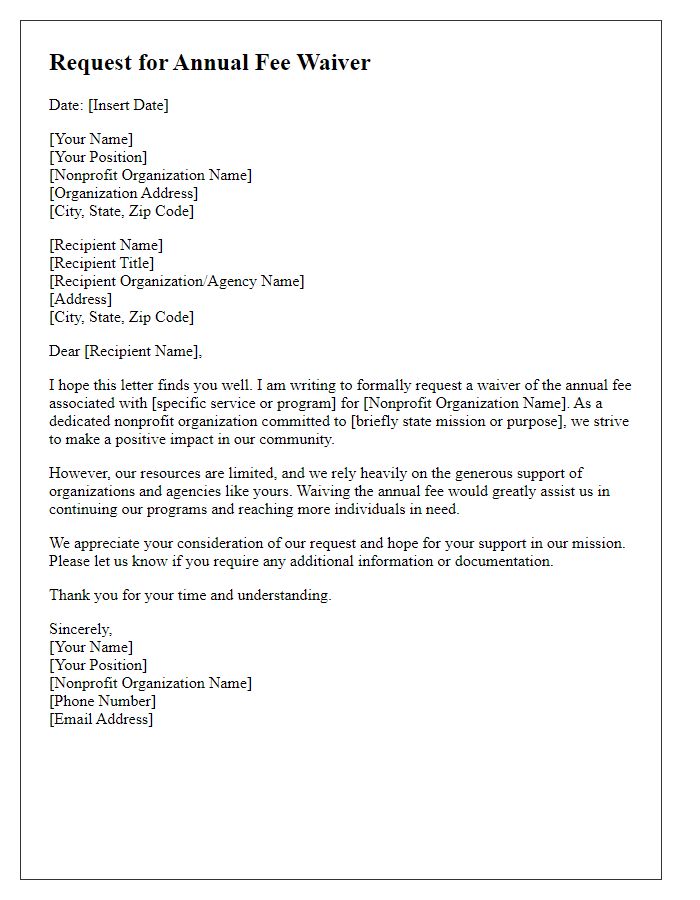

Letter template of annual fee waiver request for nonprofit organization participation

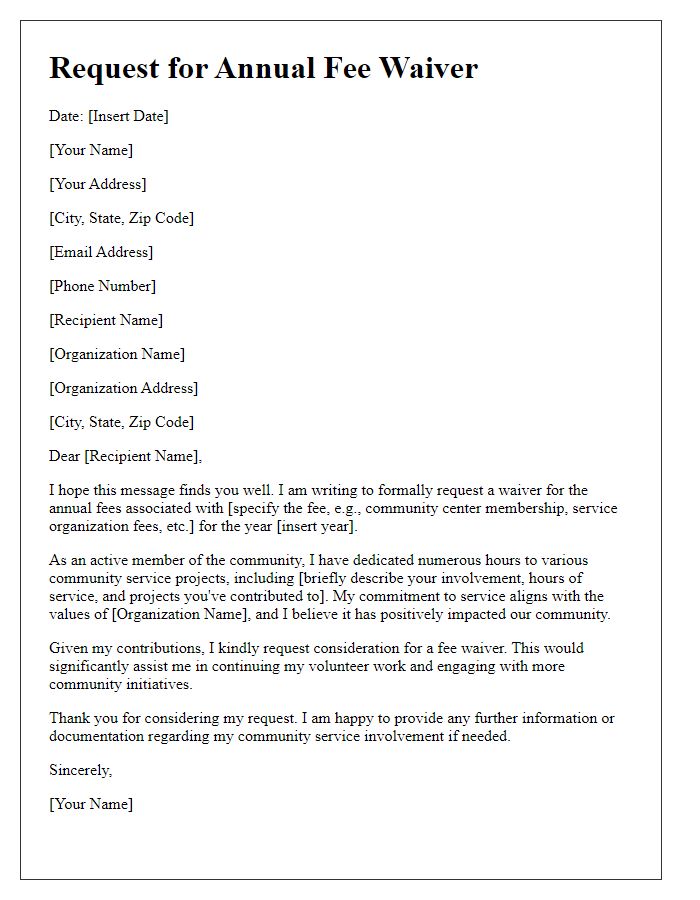

Letter template of annual fee waiver request for community service involvement

Comments