Are you considering switching your account to a fixed rate? Making this change can offer peace of mind and stability in your financial planning. By locking in a fixed rate, you may benefit from predictable payments, allowing you to better manage your budget without the unpredictability of fluctuating rates. Curious about the process and how to get started? Read on to discover the steps involved!

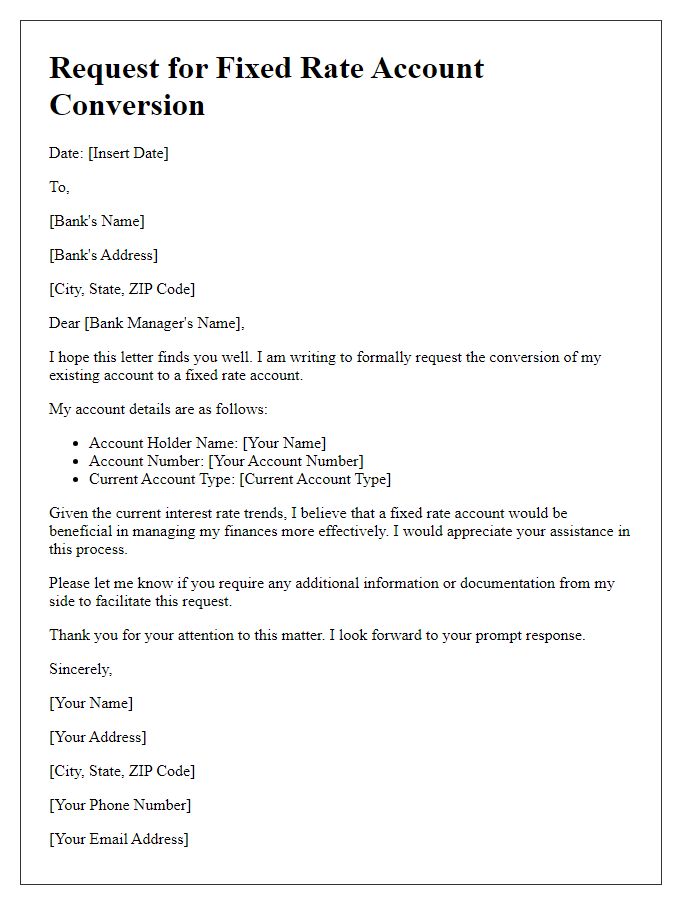

Account Holder's Information

Changing an account to a fixed rate can provide stability in financial planning. Fixed-rate accounts typically offer consistent interest percentages, which can help account holders manage their budget effectively. For instance, a fixed-rate savings account may offer an annual percentage yield (APY) of 2.5% compared to a variable account that fluctuates based on market conditions. Account holder information, such as full name, contact number, and account number, ensures proper identification and processing of the request. Financial institutions, like banks and credit unions, often require verification of this information to proceed with the conversion efficiently and securely. This change can impact future earnings, especially in a low-interest-rate environment, prompting account holders to consider their long-term financial goals.

Current Account Details

Converting a current account to a fixed-rate account can provide several advantages, including consistent interest rates. A fixed-rate account, often referred to as a fixed deposit, locks in the interest rate for a specified term, typically ranging from one month to five years. Account holders, such as individual investors or businesses, choose this option to secure predictable earnings. Fees associated with such conversions can vary by financial institution. Choice of financial institutions is crucial; reputable banks, credit unions, or online lenders each offer different rates and terms. Always review the penalties for early withdrawal, as well as the impact on liquidity, before proceeding with the account conversion.

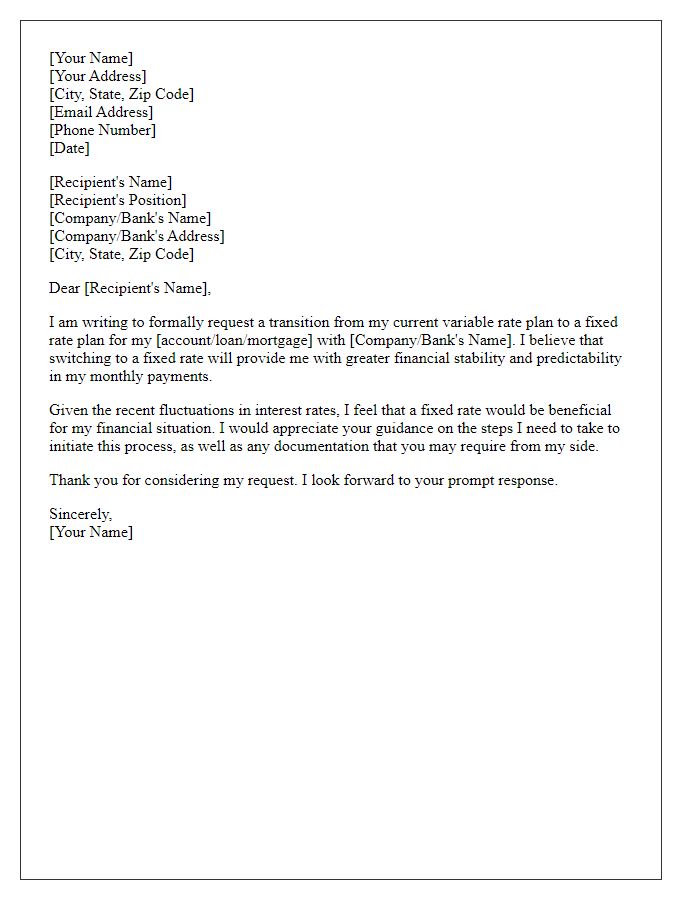

Fixed Rate Conversion Request

The Fixed Rate Conversion Request allows borrowers to transition from a variable interest rate to a fixed interest rate for their mortgage or loan. A fixed rate provides stability in monthly payments, typically advantageous during fluctuating market conditions or rising interest rates. Borrowers may seek this conversion through their financial institution, emphasizing the desire for predictability in budgeting. Institutions often have specific requirements, such as a minimum loan balance, application fees, or a pre-defined timeframe for the conversion. Timing of the request can also impact the efficiency of the process, especially given prevailing market rates and the borrower's financial health. Engaging with a mortgage advisor could be beneficial for understanding long-term implications of the fixed rate versus variable rate comparison.

Terms and Conditions Agreement

A conversion of account to a fixed rate involves a structured agreement that outlines the terms and conditions governing the financial arrangement. The fixed interest rate, typically determined at the time of conversion, remains unchanged throughout the designated period, often ranging from one to five years. Key financial elements include the annual percentage rate (APR), which may vary based on the applicant's credit score (often benchmarked at 650 or higher) and the total loan amount (commonly between $5,000 and $100,000). Essential terms cover the repayment schedule, specifying monthly payment dates and amounts, as well as penalties for late payments (usually a percentage of the missed payment). In addition, the agreement should clarify potential fees, such as early repayment charges or account maintenance fees, which may arise if the customer decides to pay off the loan early or requests changes to the account. Understanding this structured agreement ensures borrowers are well-informed before committing to the fixed-rate option, thereby promoting financial stability and planning.

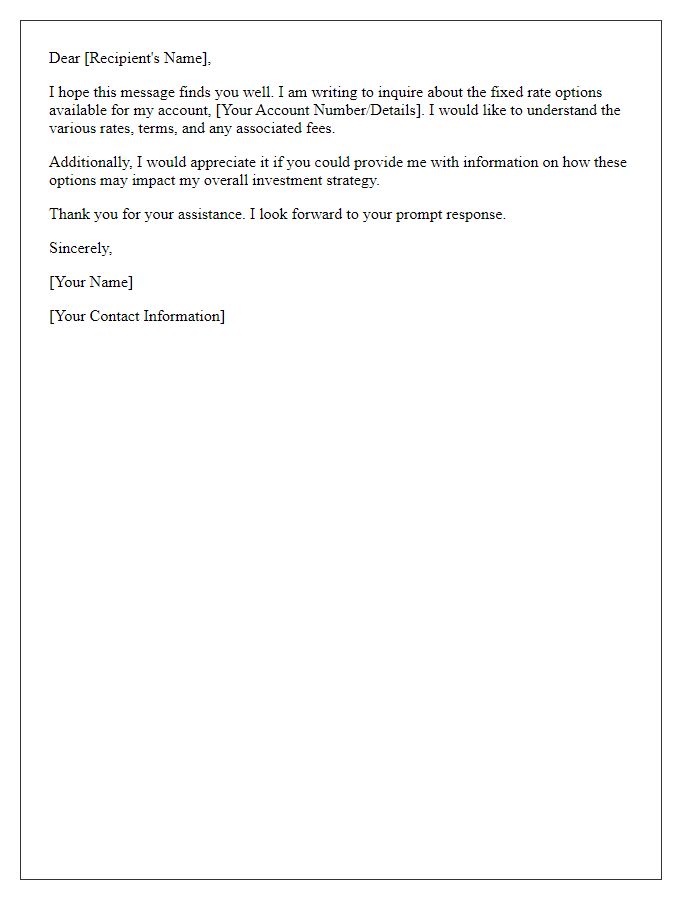

Contact and Follow-Up Information

The conversion of an account to a fixed-rate structure often presents a strategic financial decision for customers seeking stability. Fixed-rate accounts, such as fixed-rate mortgages or bonds, provide a consistent interest rate over a specified term, typically ranging from five to thirty years. Key benefits include predictable monthly payments and protection against interest rate fluctuations. Clients may contact financial institutions for specific terms and conditions, with Phone Numbers (example: 1-800-123-4567) provided for customer support inquiries. It's crucial for customers to follow up on their applications, ideally within a week of submission, to ensure timely processing and address any potential issues that may arise during the transition.

Comments