Are you noticing some puzzling discrepancies in your credit utilization report? It's a common issue that can lead to confusion and potentially impact your credit score. Understanding how credit utilization works and the importance of accurate reporting is key to maintaining a healthy financial profile. Join us as we delve into this topic and explore the steps you can take to address these discrepancies effectively!

Accurate Account Information

Discrepancies in credit utilization reporting can significantly impact credit scores, particularly for individuals seeking loans or credit cards. Credit utilization, defined as the ratio of current credit card balances to credit limits, should ideally remain below 30% for optimal credit health. Errors in reporting can arise from various sources, such as outdated account balances or incorrect credit limits, leading to skewed credit utilization percentages. Inaccurate data may originate from credit reporting agencies like Experian, Equifax, or TransUnion and can affect consumer trust in financial institutions. Resolving discrepancies promptly is essential for maintaining accurate credit profiles and ensuring fair access to credit opportunities.

Specific Discrepancy Details

Frequent discrepancies in credit utilization reporting can significantly impact credit scores, making it crucial to address these issues promptly. For instance, an individual may find that their utilization appears as 85% instead of the correct 30%, based on the credit limit of $10,000 on a Visa card. This overstatement can result from reporting errors by credit bureaus like Experian or TransUnion, which handle millions of accounts. A review of monthly statements and balances may uncover timing issues, where the balance reported does not reflect recent payments made before the reporting date, such as a $2,500 payment received on the 10th, while the report was generated on the 15th. Rectifying these discrepancies requires contacting creditors, providing evidence of accurate balances, and requesting updates to the reporting agencies to ensure the credit profile accurately reflects the individual's financial responsibility.

Supporting Documentation

Credit utilization reporting discrepancies can significantly impact credit scores and financial health. Credit bureaus, such as Experian, Equifax, and TransUnion, may report inaccurate utilization percentages if credit limits or card balances are incorrectly recorded. Supporting documentation, including recent billing statements and account summaries, is crucial for correcting these inaccuracies. A detailed breakdown of discrepancies, such as a reported credit limit of $5,000 versus an actual limit of $7,500, aids in clarifying misunderstandings. Timely submission of this documentation is essential, especially if seeking correction within a 30-day dispute period, to uphold the rights guaranteed under the Fair Credit Reporting Act.

Request for Correction

Discrepancy in credit utilization reporting can significantly impact credit scores and financial decisions. Credit bureaus, including Experian, Equifax, and TransUnion, rely on accurate data from creditors to report individual credit utilization ratios, usually expressed as a percentage of used credit against total credit limits. Common errors may stem from delayed updates or incorrect data submissions, leading to inflated utilization ratios as high as 90% rather than the actual 30%. This can affect loan applications, interest rates, and overall creditworthiness. Promptly addressing discrepancies with supporting documentation, such as credit card statements and prior reports, is essential to ensure corrections are made, thereby restoring an accurate representation of the individual's credit profile.

Contact Information for Follow-up

Credit utilization discrepancies may arise from incorrect reporting by credit bureaus, significantly impacting credit scores. Credit utilization, the ratio of current credit card balances to total credit limits, should ideally remain below 30% for optimal credit health. Consumers should regularly monitor their credit reports from major bureaus such as Equifax, Experian, and TransUnion to identify any errors. A common discrepancy could involve a reported balance that does not reflect timely payments or accounts that were closed but still show available credit. Reporting a discrepancy can involve submitting documentation such as bank statements or screenshots of account information, ensuring swift correction. For follow-up, consumers should retain contact information for relevant credit bureaus, noting their customer service numbers and website links for efficient resolution of issues.

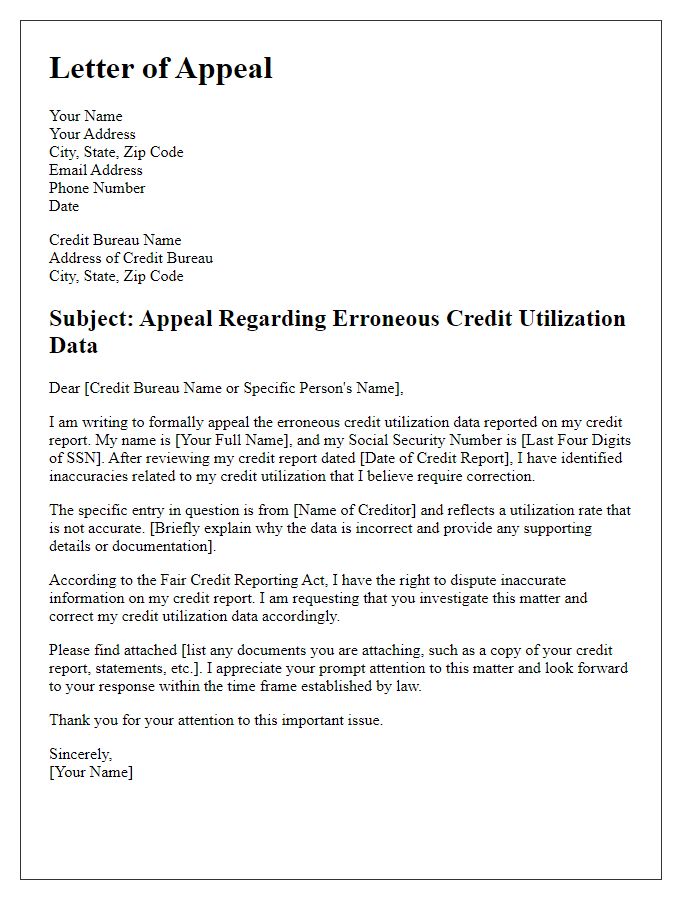

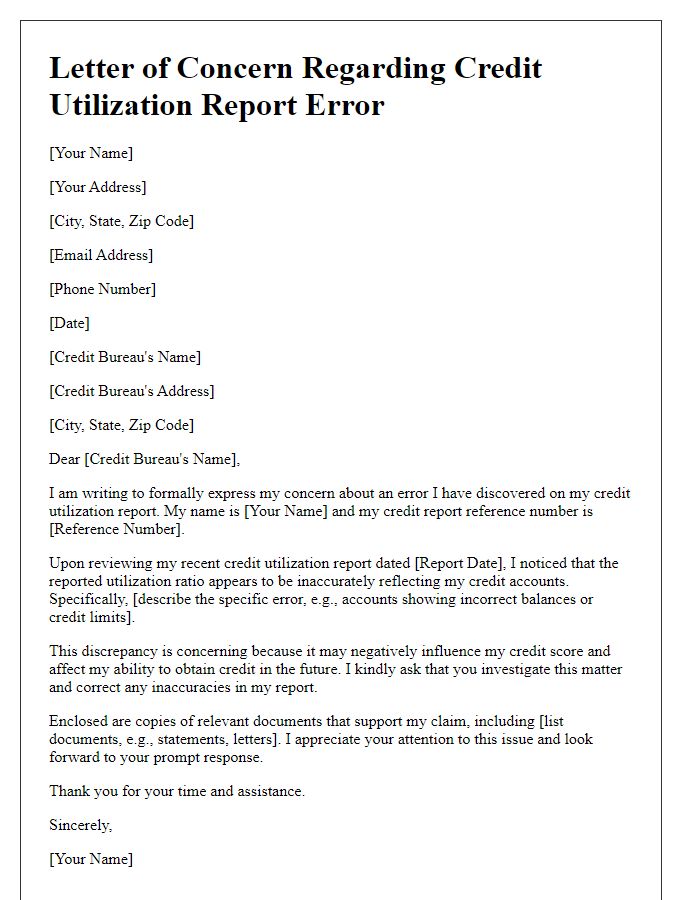

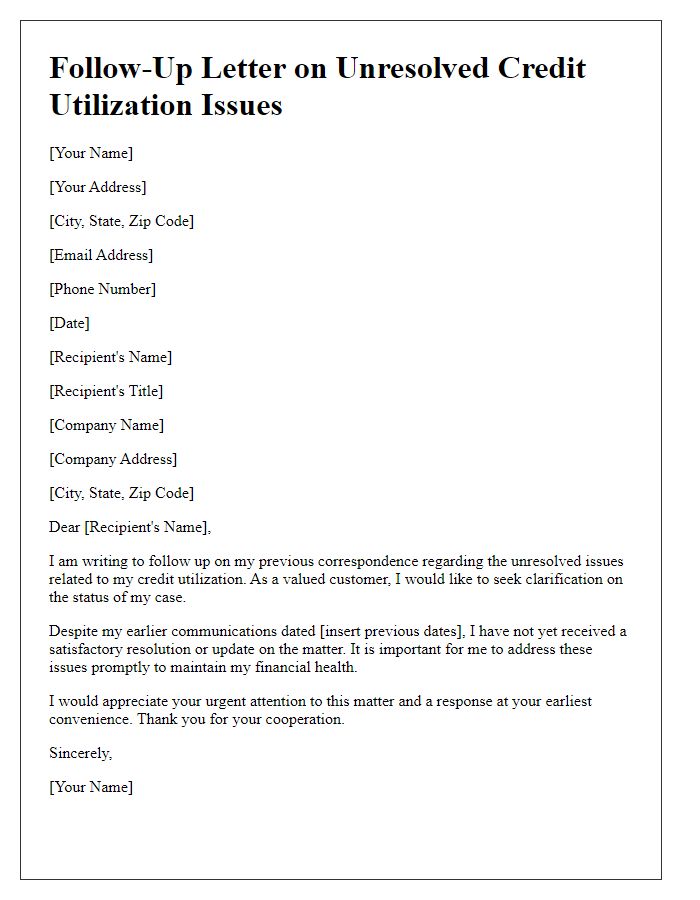

Letter Template For Discrepancy In Credit Utilization Reporting Samples

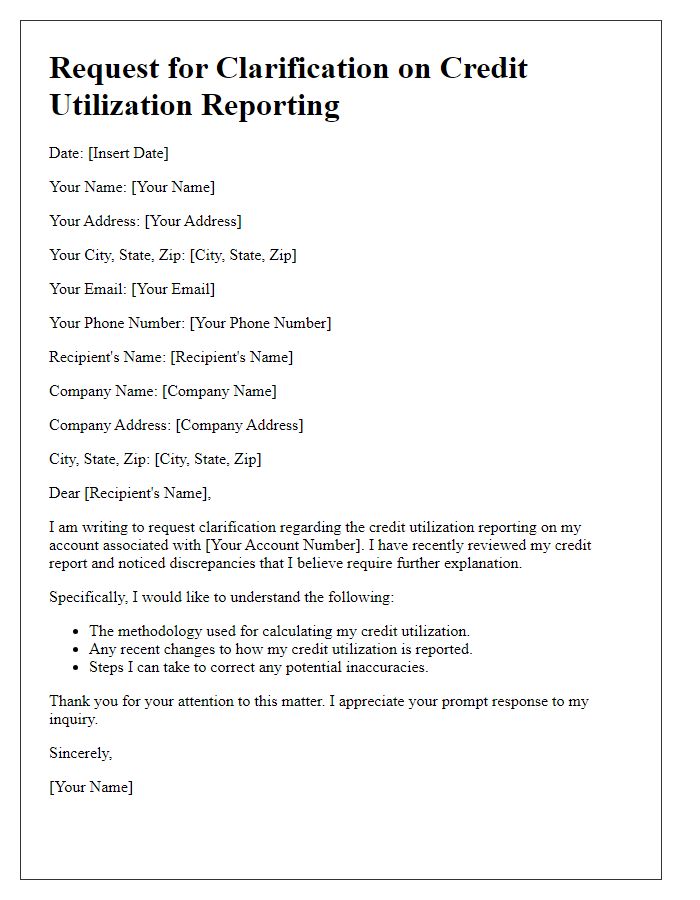

Letter template of clarification request on credit utilization reporting

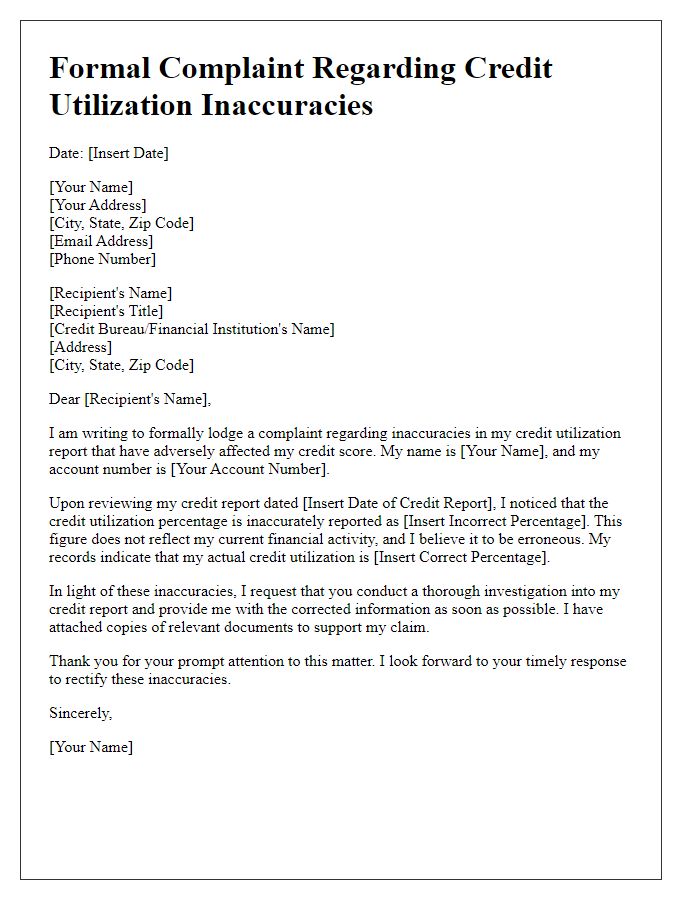

Letter template of formal complaint about credit utilization inaccuracies

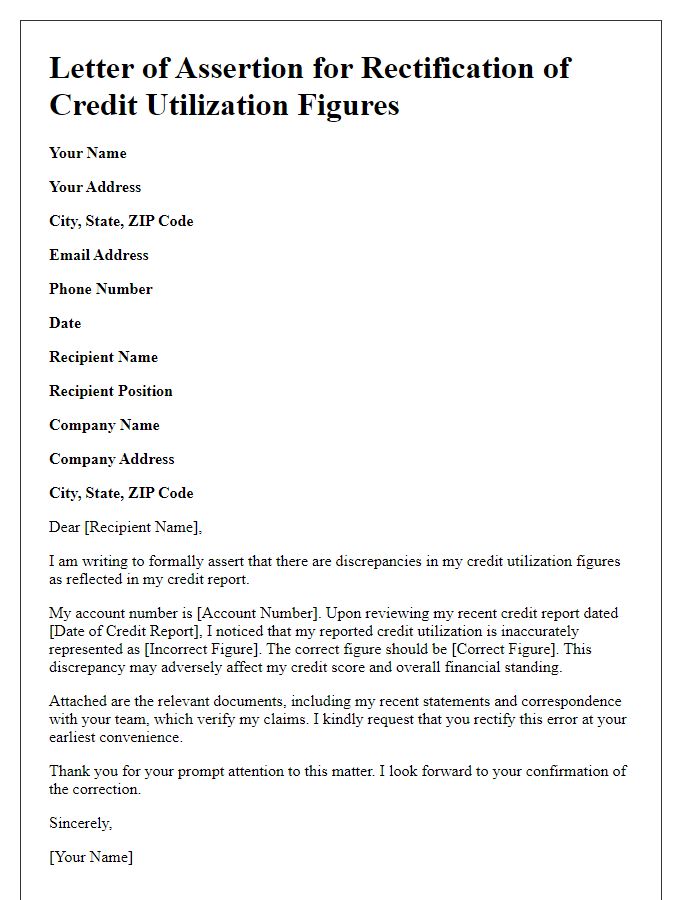

Letter template of assertion for rectification of credit utilization figures

Comments