Relocating to a new city can bring about exciting opportunities, but it may also introduce some challenges, especially when it comes to managing your credit agreements. It's essential to understand how a change in address could impact your financial commitments and credit score. From updating your lenders with your new information to being mindful of local regulations, knowing the ins and outs can make the transition smoother. Curious about how to navigate these changes effectively? Read on to learn more!

Address Change Notification

Relocating can significantly impact ongoing credit agreements, such as mortgages, auto loans, or credit cards. An address change can affect credit scores and reports, particularly if the new location involves differing financial regulations or tax implications, especially in states like California or Texas. Creditors may require updated information to assess risk effectively. Outdated addresses can lead to missed payments or delayed correspondence, which may negatively affect credit history. Furthermore, monitoring services should be informed about changes to prevent identity theft. Keeping financial institutions well-informed ensures continuity and minimizes potential disruptions in creditworthiness during relocation.

Updated Contact Information

Relocating to a new address can significantly influence existing credit agreements and communication with financial institutions. Updating contact information, such as a new physical address or phone number, is crucial for maintaining effective correspondence with credit issuers, which include banks and credit card companies. Failure to notify creditors of changes may lead to missed payments or miscommunication regarding account statuses, even resulting in negative impacts on credit scores, typically calculated through factors like payment history and credit utilization ratio. Keeping updated information ensures timely delivery of important documents such as statements, notices, or payment reminders, which are essential for managing debts and maintaining financial health.

Agreement Number Reference

Relocating impacts credit agreements significantly, especially those tied to specific geographic locations. For example, a lease agreement (Agreement Number Reference) may become void or require renegotiation due to differing local laws or rental market conditions. Credit score influences, stemming from payment history or debt-to-income ratios, may shift as a result of changes in income or living expenses following the move. Furthermore, lenders may assess borrower risk differently based on regional economic factors such as unemployment rates, cost of living adjustments, or housing market fluctuations. Maintaining open communication with creditors is essential to managing changes that will affect financial stability during relocation.

Request for Confirmation

Relocation can significantly impact existing credit agreements held by individuals, such as mortgages and personal loans. A change of address may require an update to the lender or financial institution, ensuring that account information reflects the new residential location. It's essential to monitor the potential effects on credit scores, especially if bills or payments are missed during the moving process. Additionally, lenders often assess creditworthiness based on local economic factors, which may vary by region. Therefore, obtaining confirmation on how relocation will influence credit agreements is crucial for maintaining financial stability and ensuring continued access to favorable lending terms.

Impact on Payment Method or Schedule

Relocating to a new address can significantly impact credit agreements and related payment schedules. For instance, changing residency from New York to Texas (which has different state regulations) may require updating billing addresses with credit card companies, affecting statement delivery and payment deadlines. Additionally, lenders such as banks may adjust payment methods, necessitating reassessment for direct debit arrangements if the new address impacts local banking services. Timely communication with creditors is vital to prevent missed payments, potentially influencing credit scores (ranging from 300 to 850). Frequent relocations also pose risks to loan agreements, which often require consistent residency for approval.

Letter Template For Relocation Impact On Credit Agreements Samples

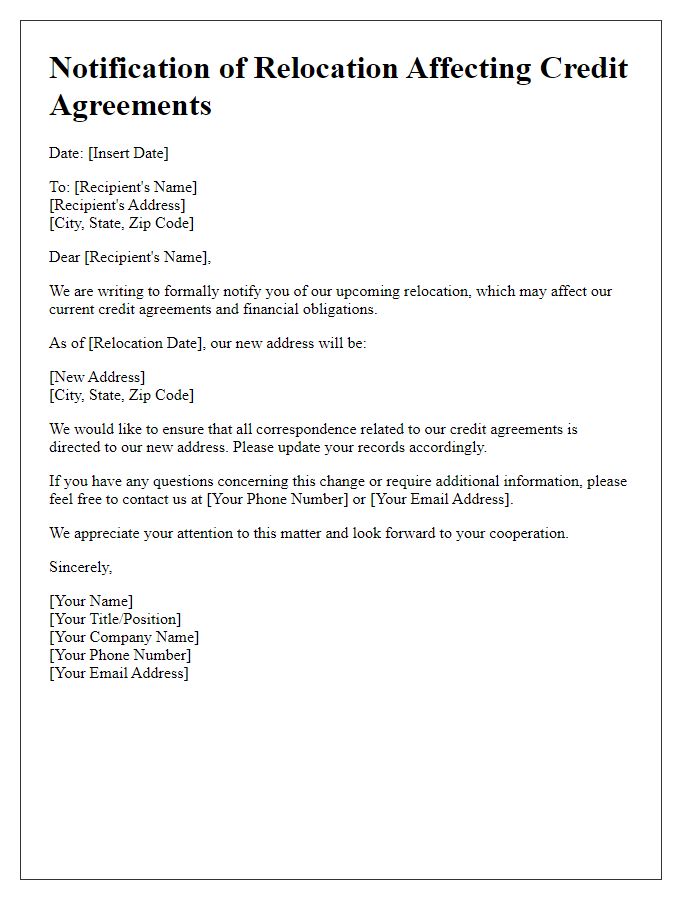

Letter template of notification for relocation affecting credit agreements

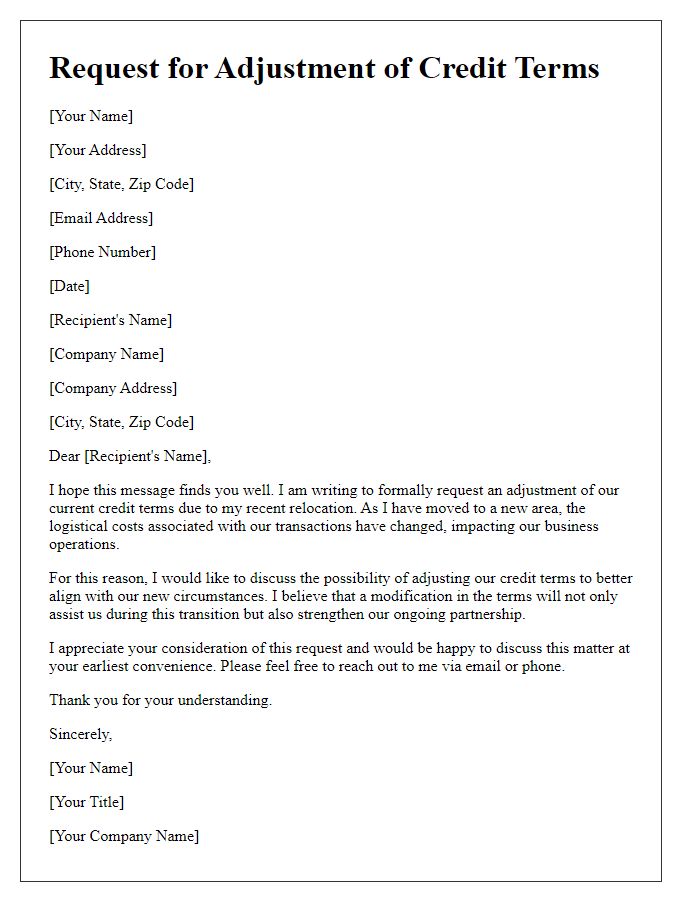

Letter template of request for adjustment of credit terms due to relocation

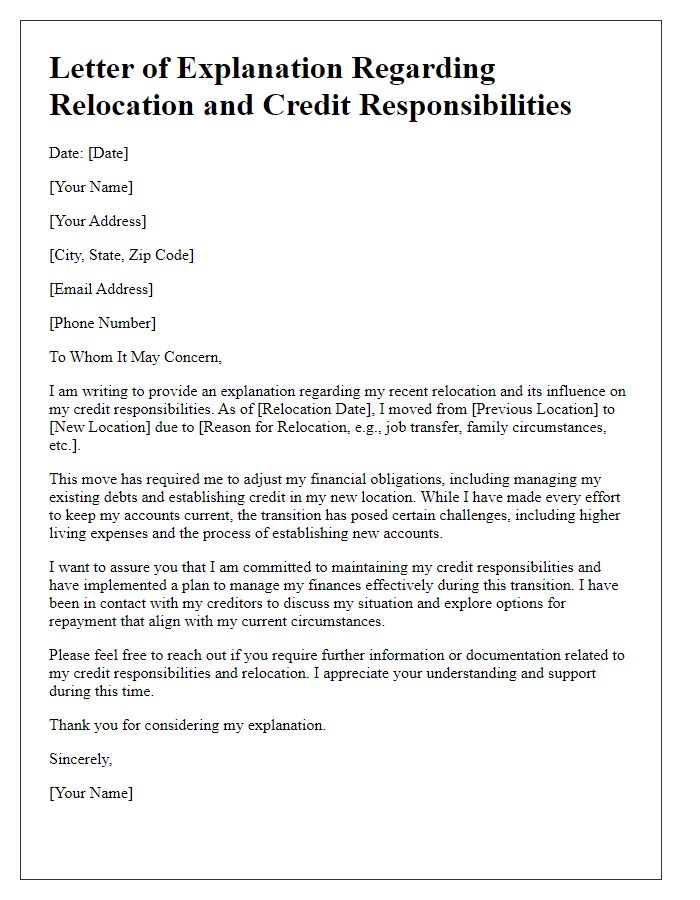

Letter template of explanation of relocation influence on credit responsibilities

Letter template of notice regarding relocation and its effects on loan agreements

Letter template of acknowledgment of credit implications from relocation

Letter template of communication regarding changes in credit obligations due to relocation

Letter template of appeal for reconsideration of credit conditions after moving

Comments