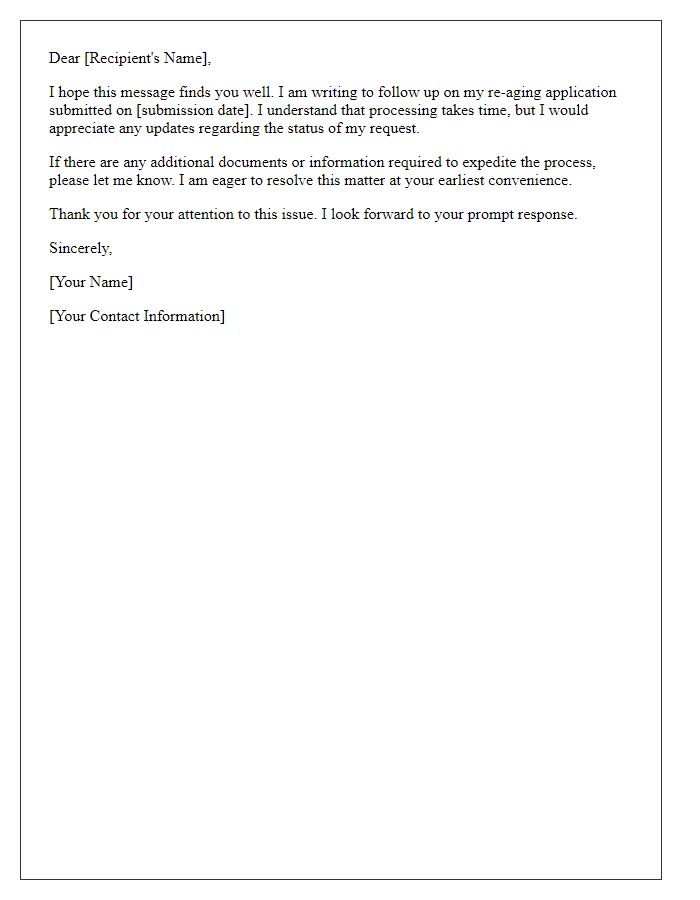

When it comes to managing delinquent accounts, the process can often feel overwhelming and stressful. However, there's a way to navigate this situation through a well-structured letter for re-aging your account. This simple yet effective tool can help you communicate your circumstances effectively and potentially secure a more manageable repayment plan. Ready to learn how to craft the perfect letter? Let's dive in!

Account information and identification

Delinquent accounts often require careful attention to re-aging strategies to manage outstanding balances effectively. An account placeholder, such as Account Number 12345678, represents individuals or businesses who have fallen behind on payments, often due to financial hardship or unforeseen circumstances. Identification, including social security numbers or tax identification numbers, is crucial for verifying the account holder's identity during the re-aging process. Proper documentation of payment history, combined with an understanding of the account's status (like 30, 60, or 90 days delinquent), facilitates communication strategies between creditors and debtors. Legal compliance under the Fair Debt Collection Practices Act ensures the process remains ethical while offering solutions like modified payment plans for improved cash flow management.

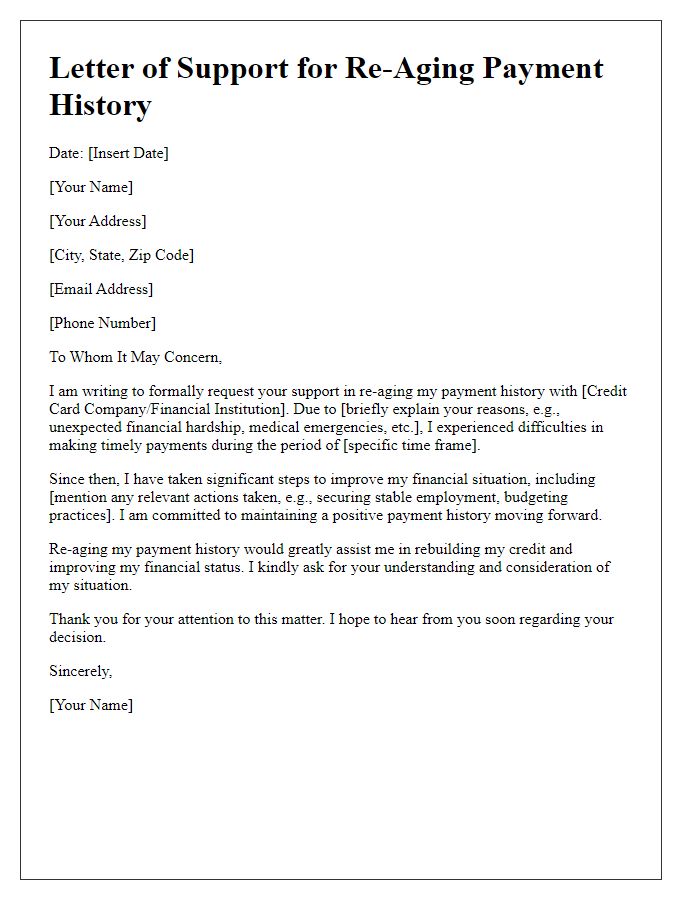

Current outstanding balance

A re-aging request for a delinquent account aims to modify the repayment terms of an account that has fallen behind on payments. The current outstanding balance represents the total amount owed, including any accrued interest and late fees. For example, an account with an outstanding balance of $2,500 can impact a customer's credit score significantly, particularly when it has been overdue for over 90 days. Such accounts often require careful consideration of financial hardship circumstances, such as job loss or medical emergencies, before credit issuers decide to re-age the account. This process can potentially reinstate the account's status to current, allowing for a fresh start on repayment and positively influencing the credit score recovery process.

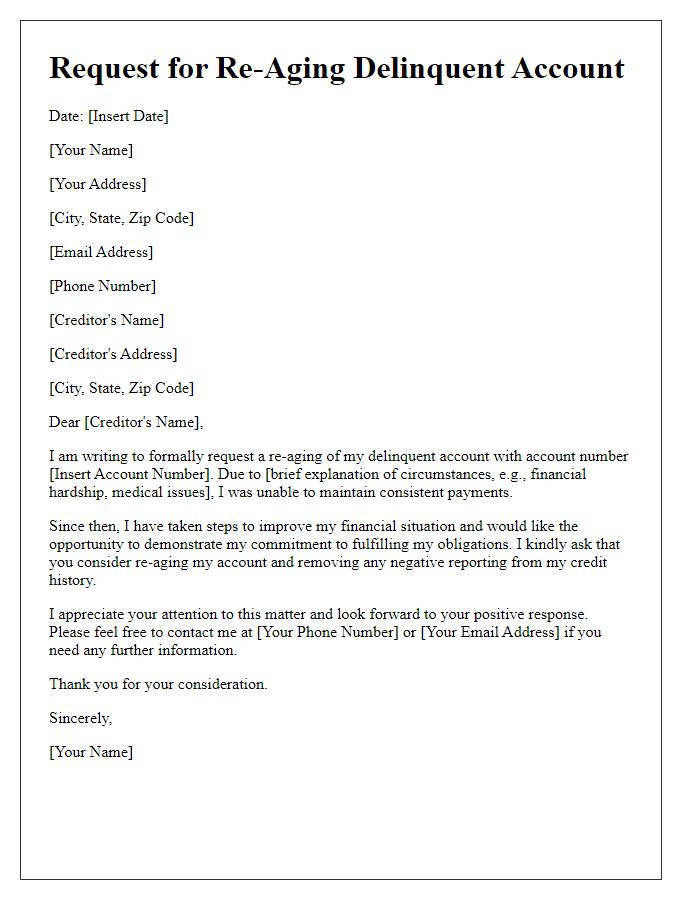

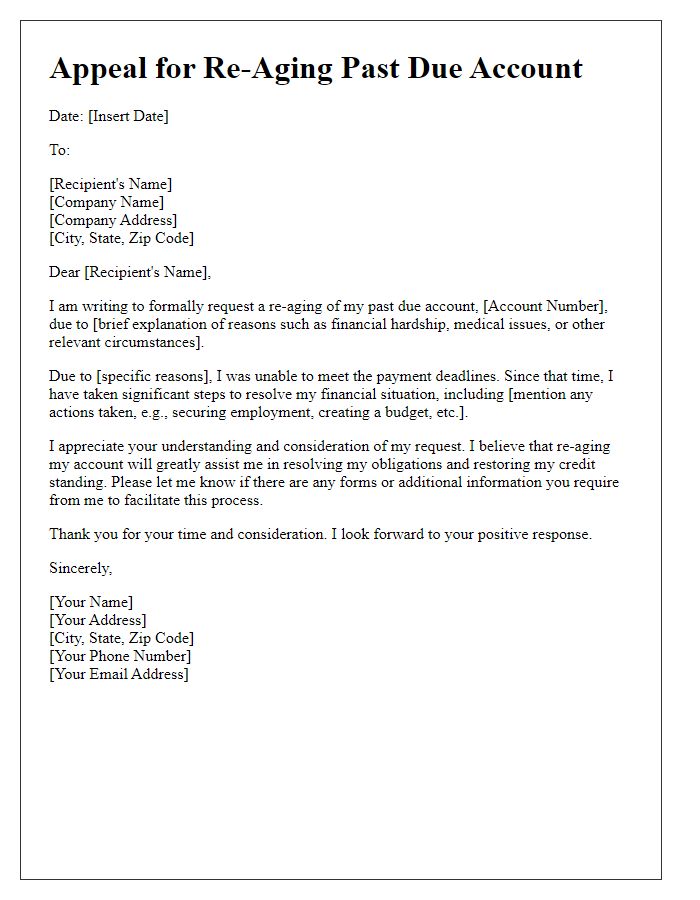

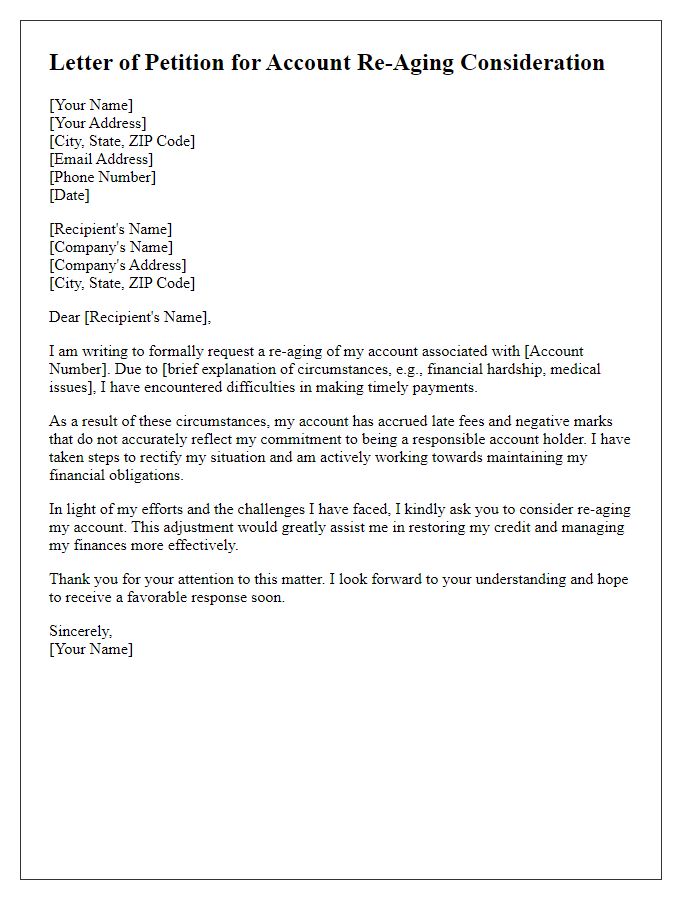

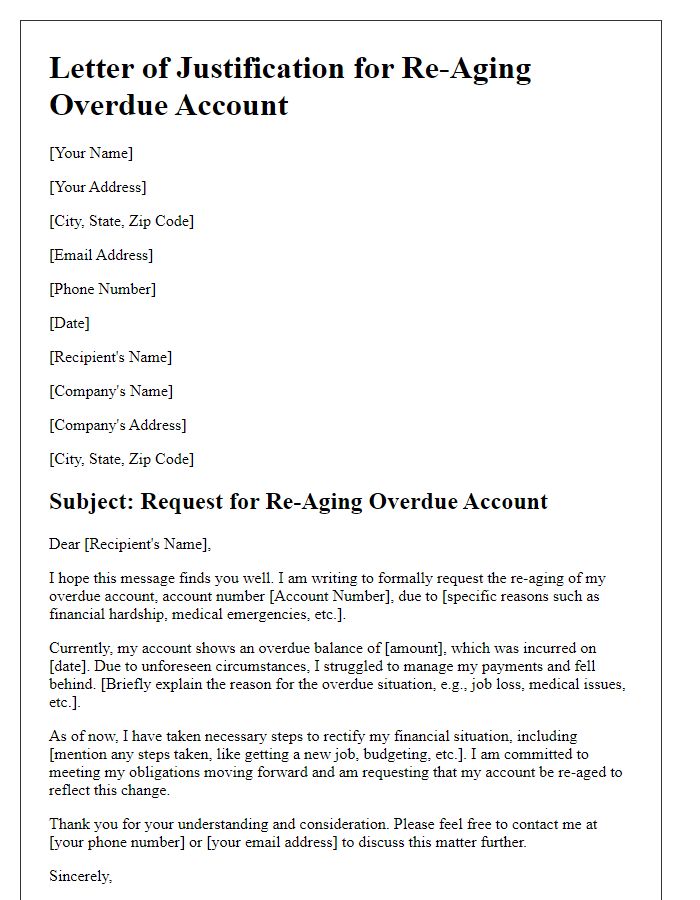

Request for re-aging justification

A delinquent account represents a significant financial challenge, often marked by missed payments that negatively impact credit ratings. Requesting re-aging involves asking creditors, like banks or credit card companies, to change the account status from delinquent to current after meeting specific criteria, such as demonstration of timely payments over a set period. Re-aging an account can improve a credit score, allowing greater access to loans, which is crucial for achieving financial goals, such as home ownership or car purchases. The justification process entails proving commitment to repayment through consistent payment history, financial hardship documentation, or agreement to a new repayment plan.

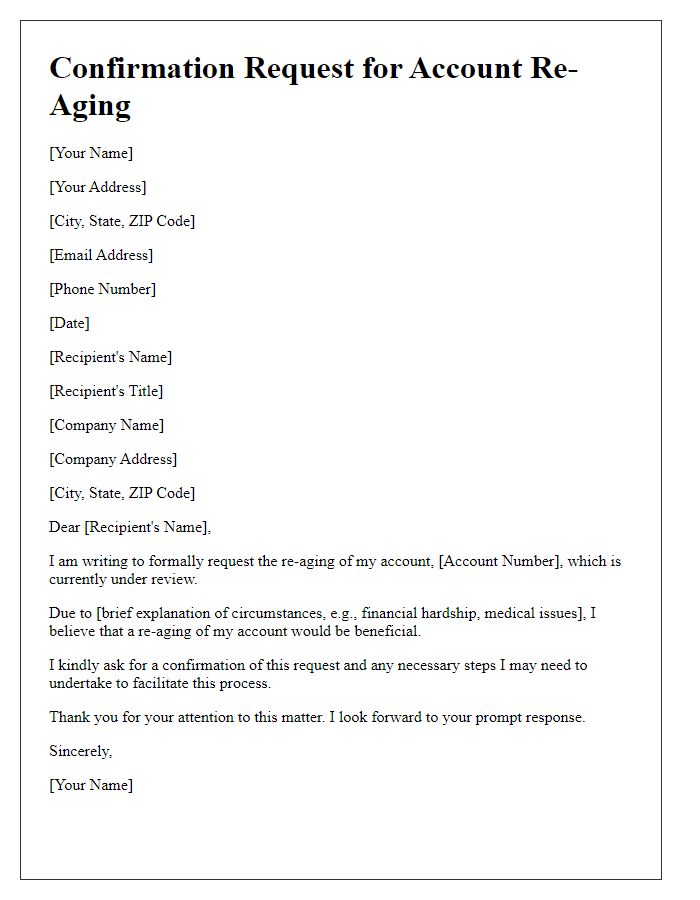

Proposed payment plan or terms

Creating a proposed payment plan for a re-aging delinquent account involves outlining the details of the agreement, including the payment amounts, frequency, and duration. For instance, if a customer has a delinquent account of $2,000, a proposed plan might suggest monthly installments of $200 over ten months. The account would be reviewed for re-aging after six consecutive on-time payments, allowing the customer a path back to good standing. Providing clear terms, such as the initial payment due date and any potential fees for late payments, can enhance transparency. Flexibility can be built into the plan to accommodate changes in financial circumstances, ensuring both parties remain aligned with expectations over the course of the arrangement.

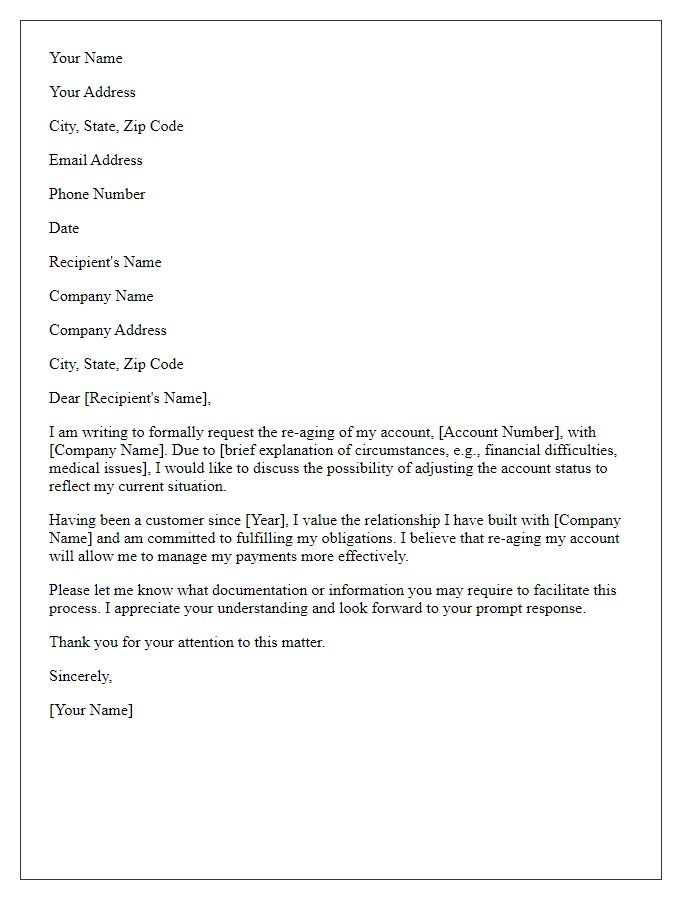

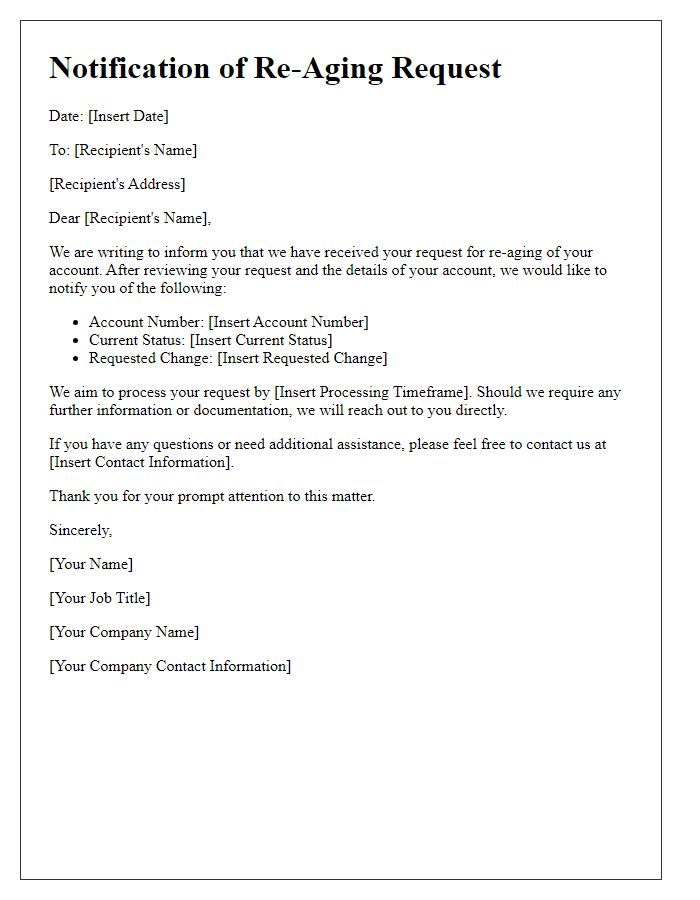

Contact information and follow-up details

Delinquent accounts can significantly impact credit scores and financial health. Regular monitoring of payment history is essential. Contact information for account inquiries typically includes a customer service phone number and email address associated with the lender or financial institution. Follow-up details should specify the next steps for reinstatement or revision of the account status. For example, lenders may offer options for payment plans or debt settlement negotiations. Maintaining open lines of communication can facilitate resolutions and may potentially lead to the re-aging of accounts, which allows for improved credit standings.

Comments