Are you an unmarried couple looking to close a joint credit account? Navigating the ins and outs of financial responsibilities can be tricky, especially when life takes you in different directions. In this article, we'll walk you through the essential steps and considerations for closing that account seamlessly. So, stick around to discover valuable tips and guidance on how to ensure a smooth transition!

Account Details

Unmarried couples may face unique challenges when it comes to sharing financial responsibilities. Closing a joint credit account, such as a credit card or line of credit, can be a necessary step to separate finances, particularly after a relationship change. Important account details, like the account number (such as 1234-5678-9012), total balance (perhaps $2,500), and payment history (noting the last payment date, e.g., September 1, 2023), must be documented carefully. Additionally, understanding the impact of account closure on credit scores, as it may affect utilization ratios, is essential. Proper coordination with the issuing bank, which could be an institution like Chase or Wells Fargo, is crucial since they may have specific requirements for account closure requests from multiple parties.

Reason for Closure

When an unmarried couple decides to close a joint credit account, reasons can include financial independence, differing spending habits, changes in personal circumstances, or the desire to separate joint financial responsibilities. This decision often arises when one partner feels a need to establish individual credit scores or when changing life events such as a breakup or moving to separate residences occur. Closing such accounts can help both individuals regain control over their financial situations and clarify their credit histories, which is essential for future financial endeavors like securing a mortgage or applying for personal loans.

Authorization and Consent

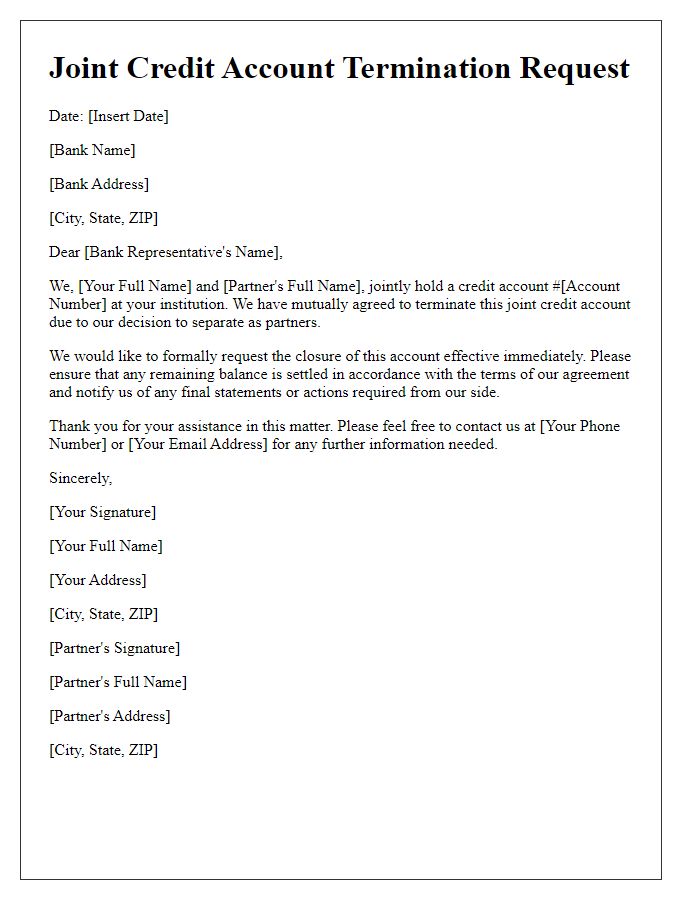

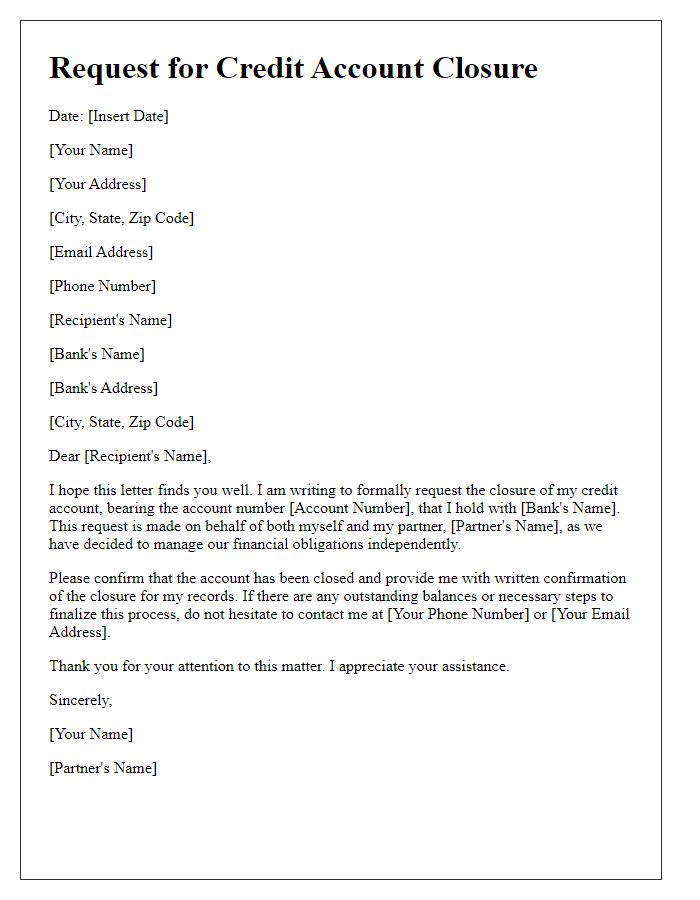

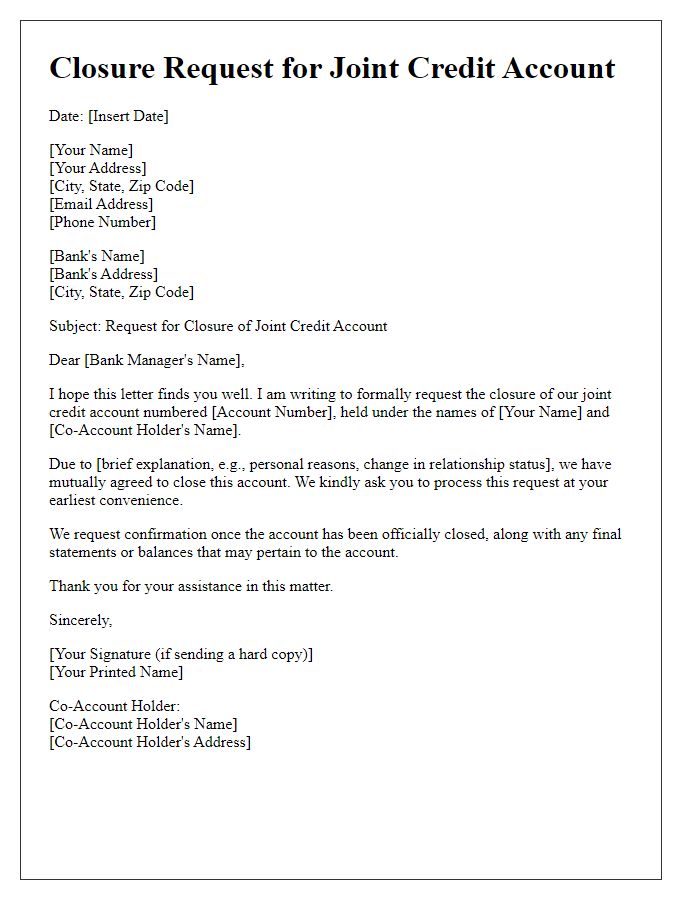

Unmarried couples seeking to close a joint credit account can process the closure by providing a signed authorization and consent letter to the financial institution. The letter should include essential information such as the account holder names, account number, and a clear statement expressing the desire to close the account. Important details, including the reason for closure and instructions for the disbursement of any remaining balance, should also be indicated. Signatures from both parties affirm consent and authorization for the bank to proceed with the closure. The letter must ensure compliance with the bank's policies regarding joint account closures and should be sent through certified mail to ensure delivery confirmation.

Contact Information

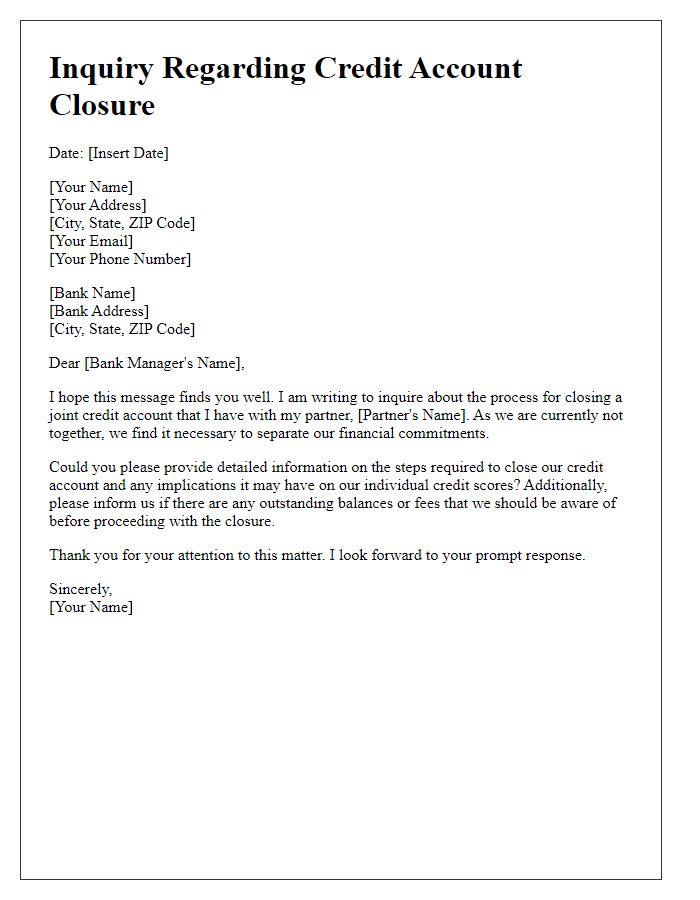

Unmarried couples closing a joint credit account must provide accurate contact information to facilitate the process. This includes full names of both parties, their individual addresses--such as a residential address and a billing address--and phone numbers for direct communication. Additionally, including email addresses ensures swift correspondence during the account closure verification. It's essential to include the account number associated with the credit account, which may be issued by banks or financial institutions, as well as any relevant customer identification numbers. Proper documentation, such as identification forms like driver's licenses or social security cards, may also be necessary to authenticate the identities of both account holders when submitting the closure request.

Request for Confirmation

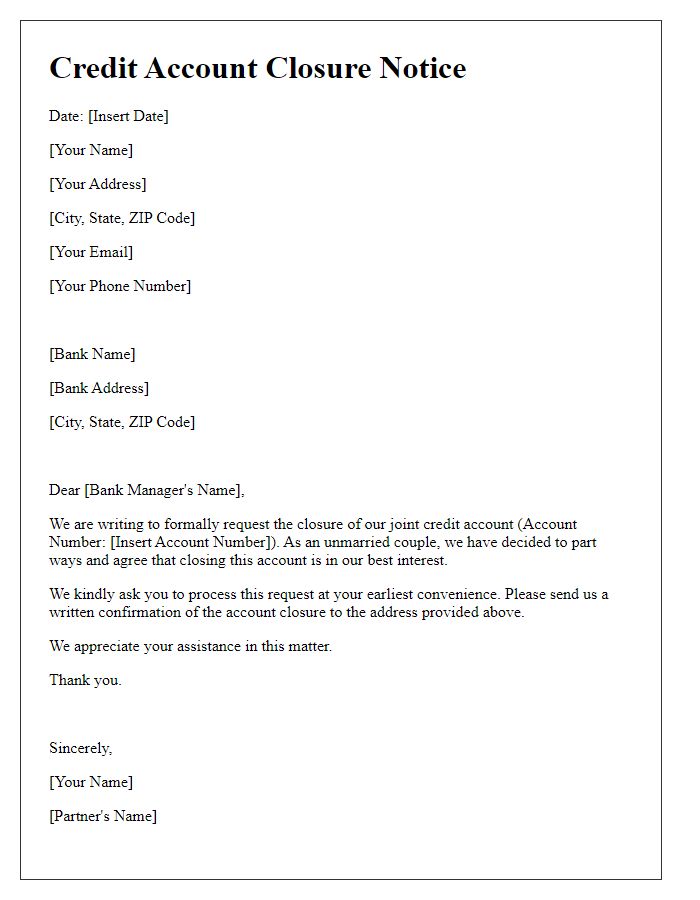

Unmarried couples may need to address joint credit accounts for various reasons such as relationship changes or financial planning. The closure of a shared credit account often requires formal communication with the financial institution to ensure all parties agree and the account can be removed without penalties. Proper confirmation of account closure is crucial for credit score management and future financial stability. In this context, providing personal identifiers, account numbers, and a clear request for written confirmation from the creditor is essential. As of October 2023, guidelines from credit agencies recommend formally documenting such requests for transparency and accountability.

Letter Template For Unmarried Couple Credit Account Closure Samples

Letter template of joint credit account termination by unmarried partners.

Letter template of notice for closing credit account as an unmarried couple.

Letter template of cancellation of credit account for non-married partners.

Letter template of inquiry regarding credit account closure for unmarried couples.

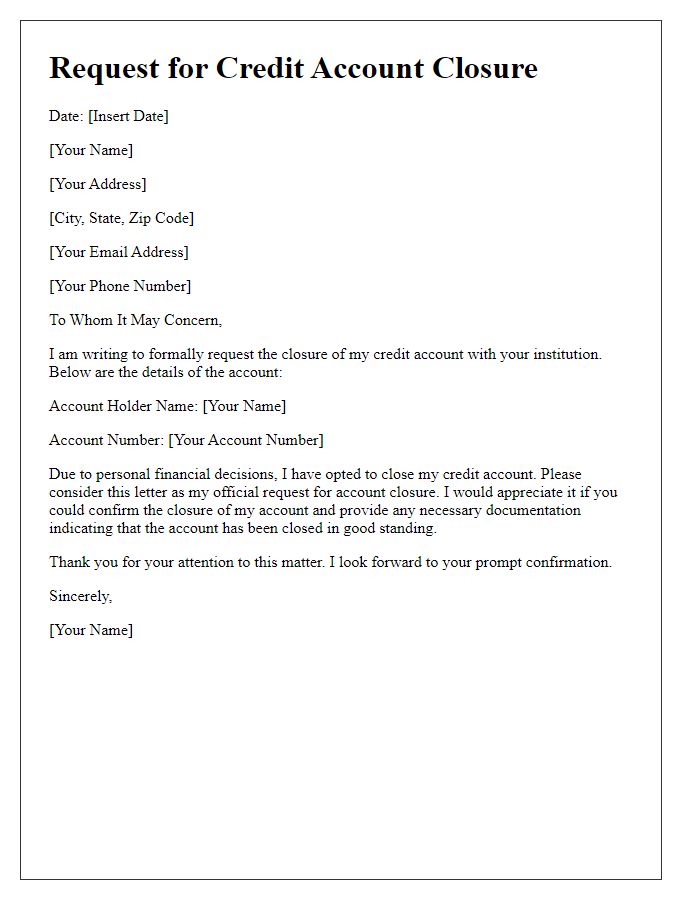

Letter template of formal request for credit account closure by non-married individuals.

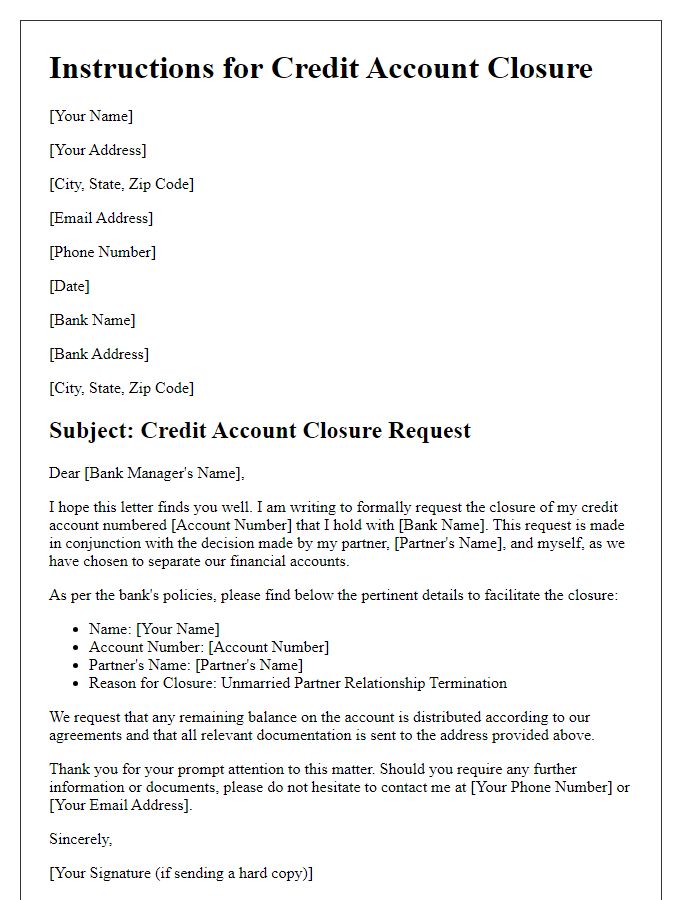

Letter template of instructions for credit account closure from unmarried partners.

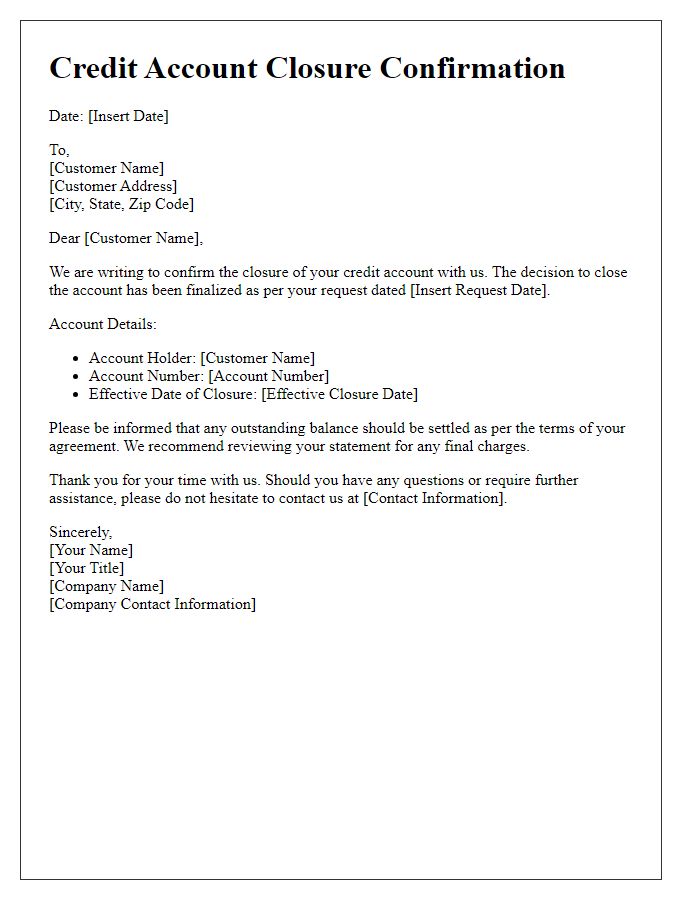

Letter template of confirmation for closing credit account of unmarried couple.

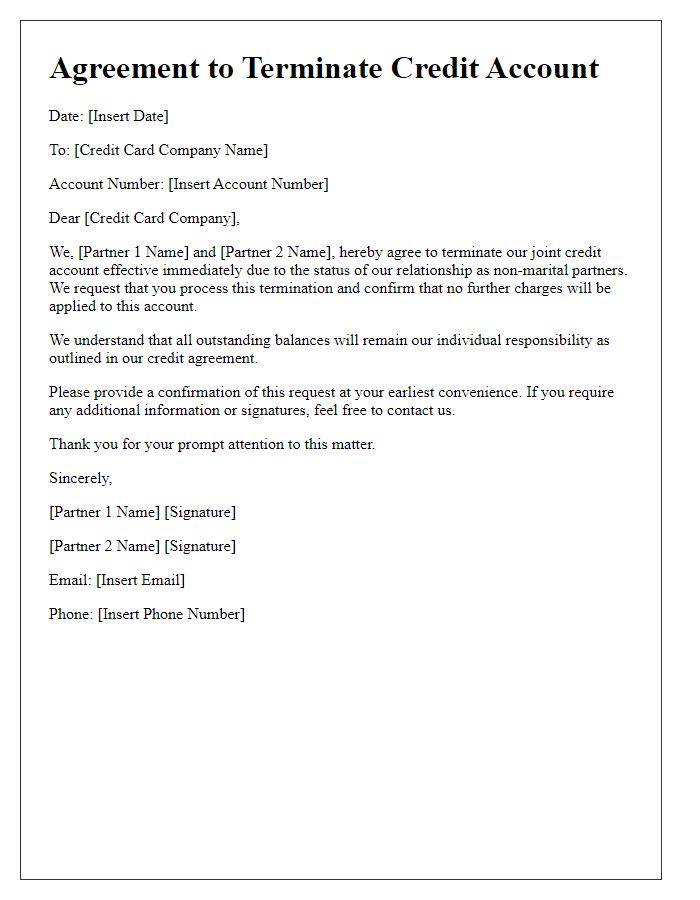

Letter template of agreement to terminate credit account for non-marital partners.

Comments