Are you considering refinancing your mortgage but not sure where to start? You're in the right place! In this article, we'll take you through a convenient letter template specifically designed for your refinancing application. Join us as we simplify the process and provide you with tips to make your letter stand out!

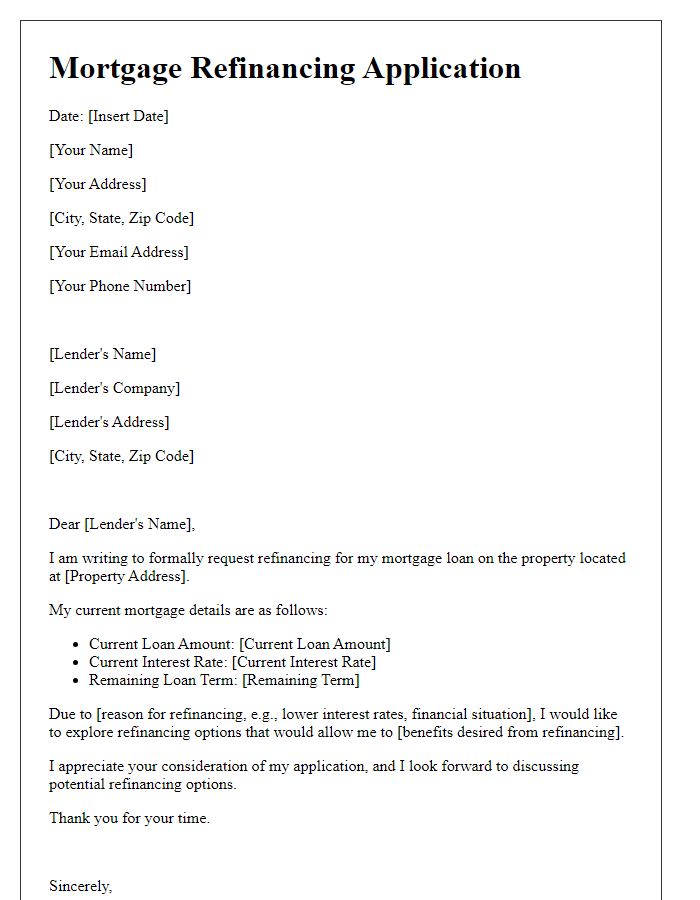

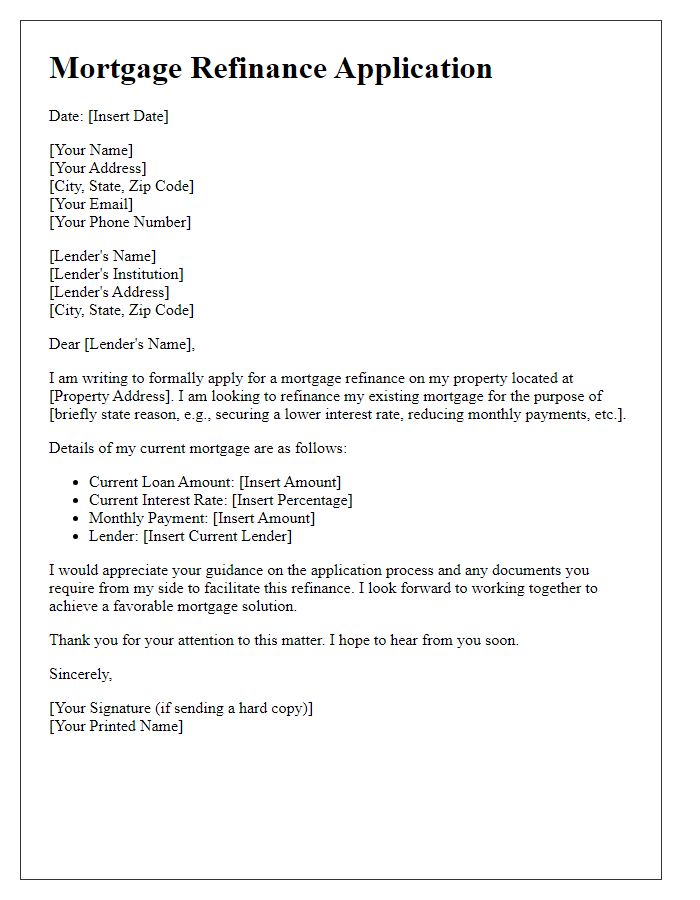

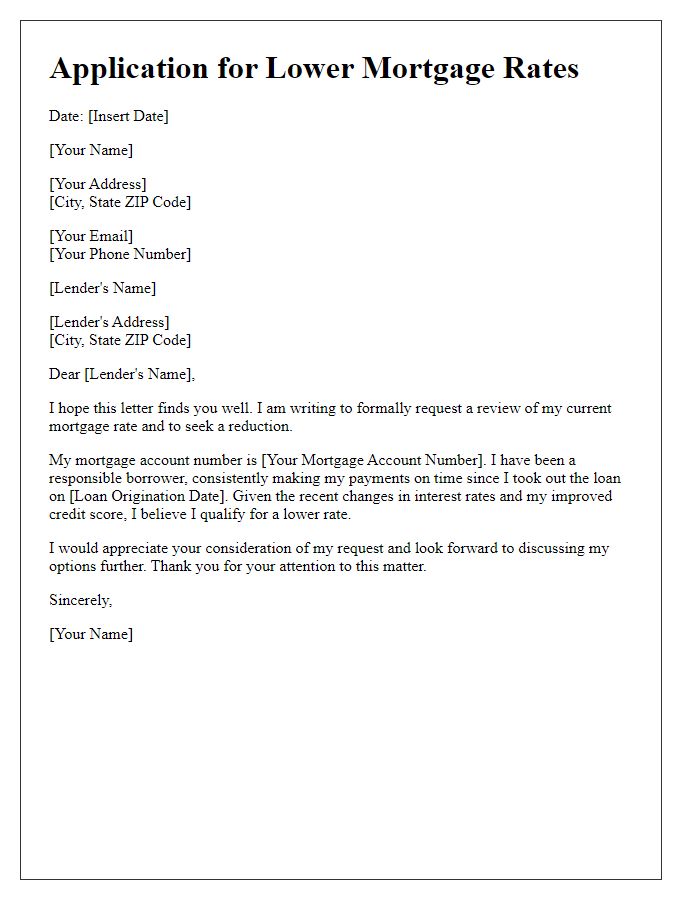

Borrower Information

Refinancing a mortgage can significantly impact financial planning and homeownership stability. The Borrower Information section typically includes the names of the applicants, Social Security numbers, current addresses, and information about employment history (including employer names and job titles). Financial details such as annual income, existing debts, and credit scores play vital roles in determining mortgage eligibility. Additionally, the property details like the address, purchase price, and current estimated value are crucial for lenders in assessing the overall risk associated with the refinancing process. Understanding these details helps streamline the application for favorable loan terms.

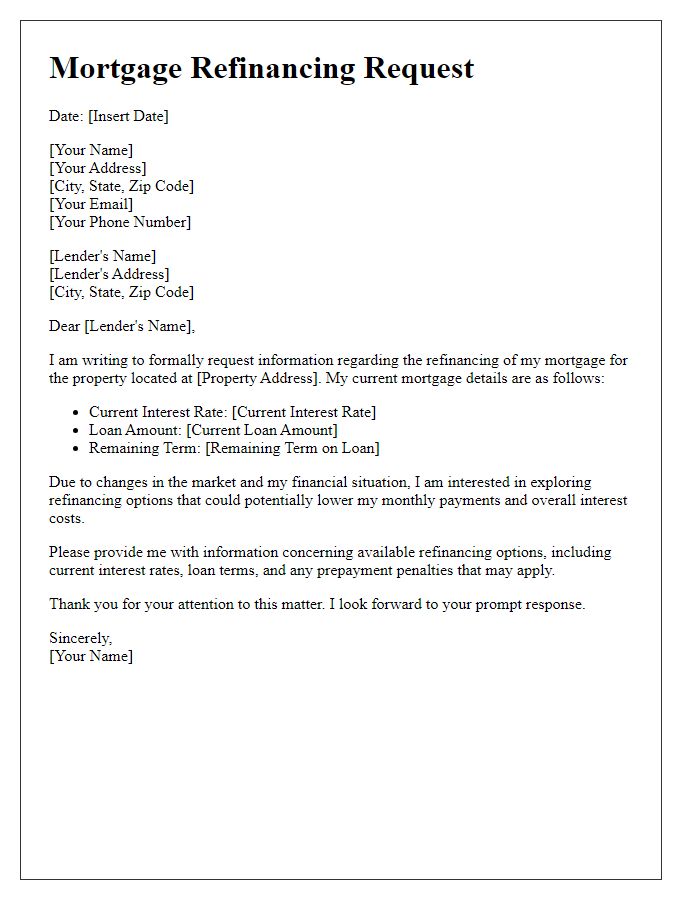

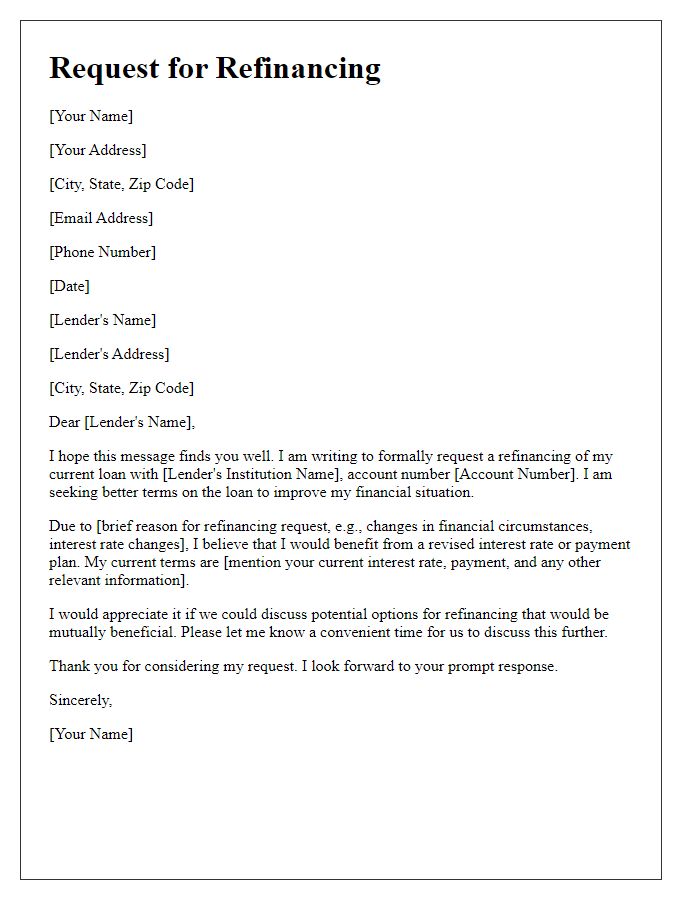

Loan Details

When considering a refinancing mortgage application, it is essential to provide key loan details that will facilitate the process. Include the current mortgage amount, typically in the range of hundreds of thousands, which reflects the principal owed on the original loan. The interest rate, whether fixed or adjustable, plays a significant role; for example, a fixed rate of 3.5% could be compared to current market rates. Specify the loan term, commonly set at 15 or 30 years, which impacts monthly payments and total interest paid. Include property details such as the address located in a specific city, allowing lenders to verify property values in the local real estate market. Additionally, provide information on current equity, defined as the difference between the home's market value and remaining mortgage balance, which can influence refinancing eligibility and terms. Note any recent significant financial events, such as changes in income or credit score, that could impact the refinancing process.

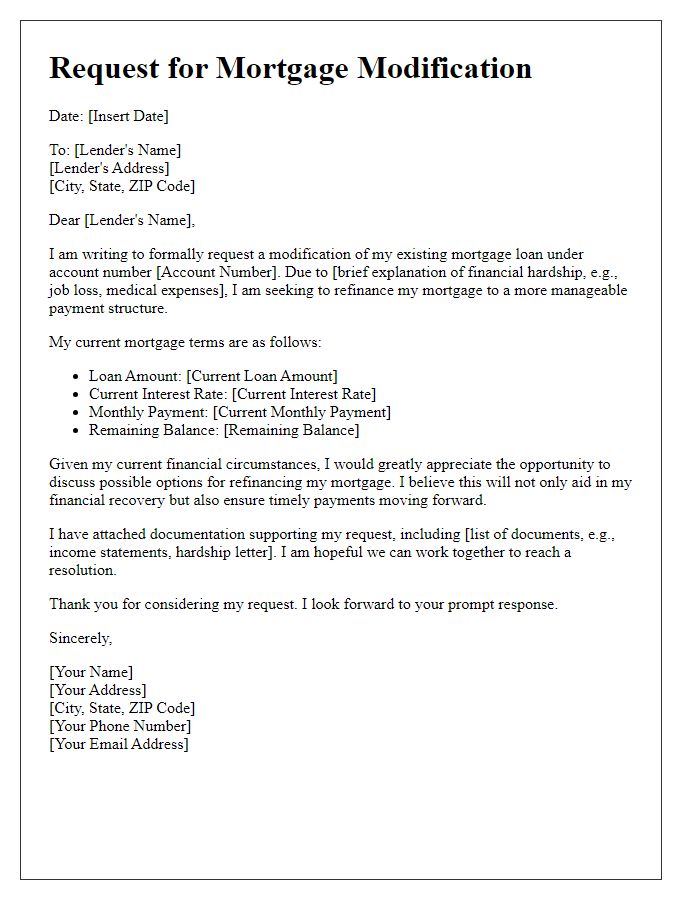

Financial Summary

A financial summary for a mortgage refinancing application requires detailed insights into a borrower's current financial standing. This includes current mortgage balance, typically sourced from monthly statements, detailing the owed principal amount, which could be roughly $200,000 for an average home in the United States. Documenting the interest rate on the existing mortgage, often around 4%, versus the market average of 3% can demonstrate potential savings. Monthly payment amounts need to be specified, for instance, $1,200, illustrating the typical financial commitment. Additionally, showcasing employment history, typically over the last two years, and annual income, which could average $75,000, establishes repayment capability. Including credit scores, with optimal ranges between 700-749, can enhance perceptions of creditworthiness. Lastly, highlighting any assets, such as savings accounts, valued at $15,000, and other properties can reinforce financial stability. Each of these elements creates a comprehensive financial overview necessary for a mortgage refinancing decision.

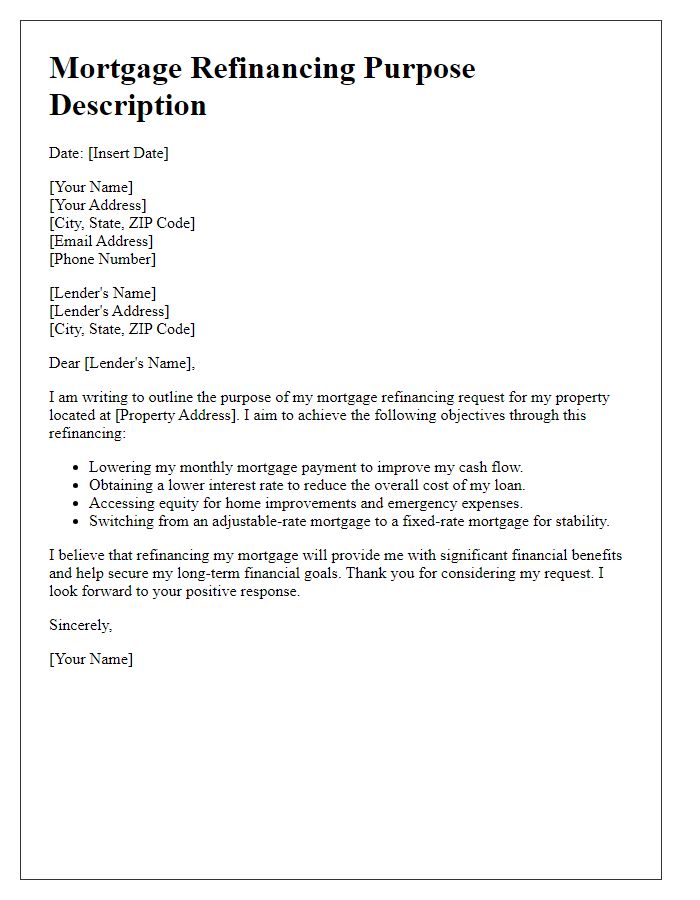

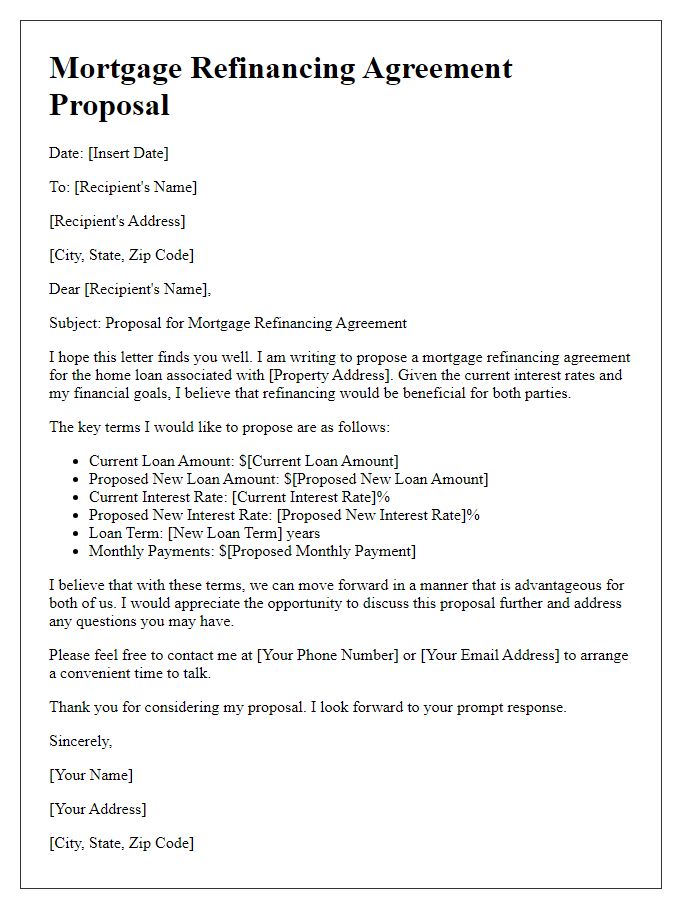

Property Description

The property, a single-family residence located at 123 Maple Street, Springfield, offers a total living space of 2,500 square feet. Constructed in 2015, this modern home features four bedrooms and three bathrooms, with an open floor plan that enhances natural light flow throughout the living areas. The property sits on a spacious lot measuring 7,500 square feet, complete with a landscaped backyard and a two-car garage. The neighborhood, known for its welcoming community, includes amenities such as parks, schools, and shopping centers within a five-mile radius. Recent market analysis indicates comparable properties in this area have appreciated by over 10% in the past year, reflecting a strong housing demand. The current market conditions present an excellent opportunity for refinancing to capitalize on this growing equity.

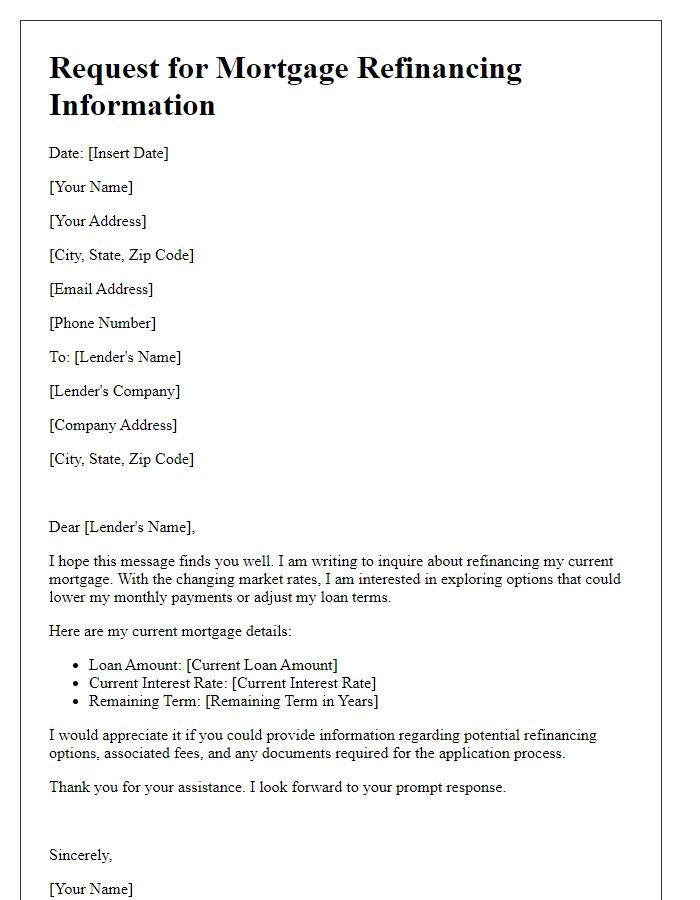

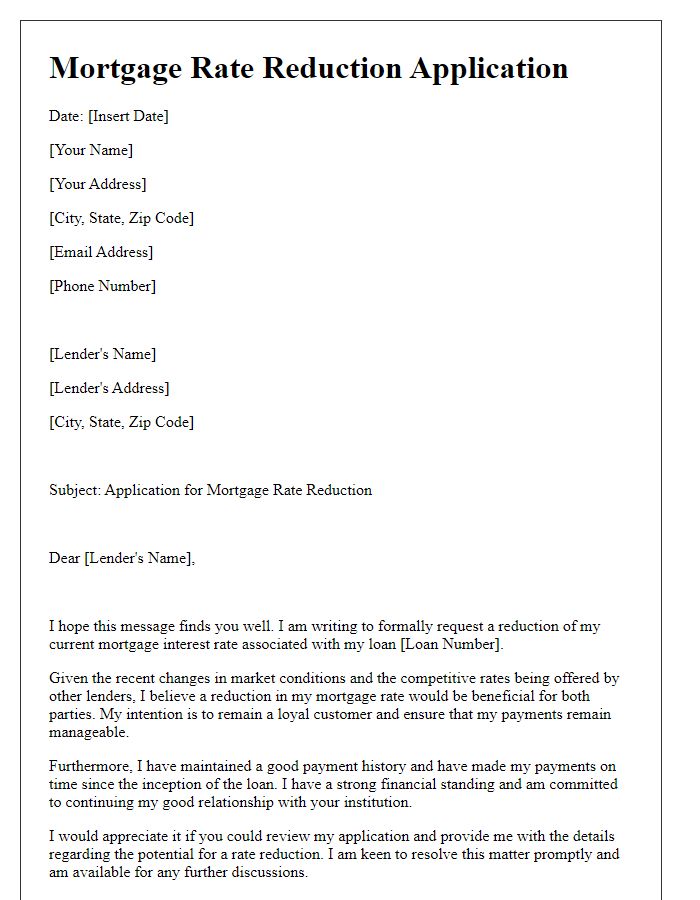

Contact Information

Refinancing a mortgage involves a significant financial transaction that can greatly impact a homeowner's investment. Potential applicants should ensure accurate contact information is included in the application process. Essential details include the homeowner's full name, current residence address (including city, state, and ZIP code), phone number, and email address. This information facilitates communication with the lender throughout the refinancing process, ensuring timely responses and updates regarding interest rates and loan terms. Homeowners may also want to include additional contact methods, such as secondary phone numbers or alternative emails, to ensure all communication channels remain open. Providing accurate and complete contact information enhances the efficiency of the refinancing application.

Comments