Are you looking to reclaim that extra credit balance sitting in your account? Navigating the refund process can be tricky, but we're here to simplify it for you. In this article, we'll explore the essential steps to craft a compelling letter that requests your credit balance refund quickly and efficiently. So, grab your pen, and let's dive into the details of how to get your money back!

Sender's contact information

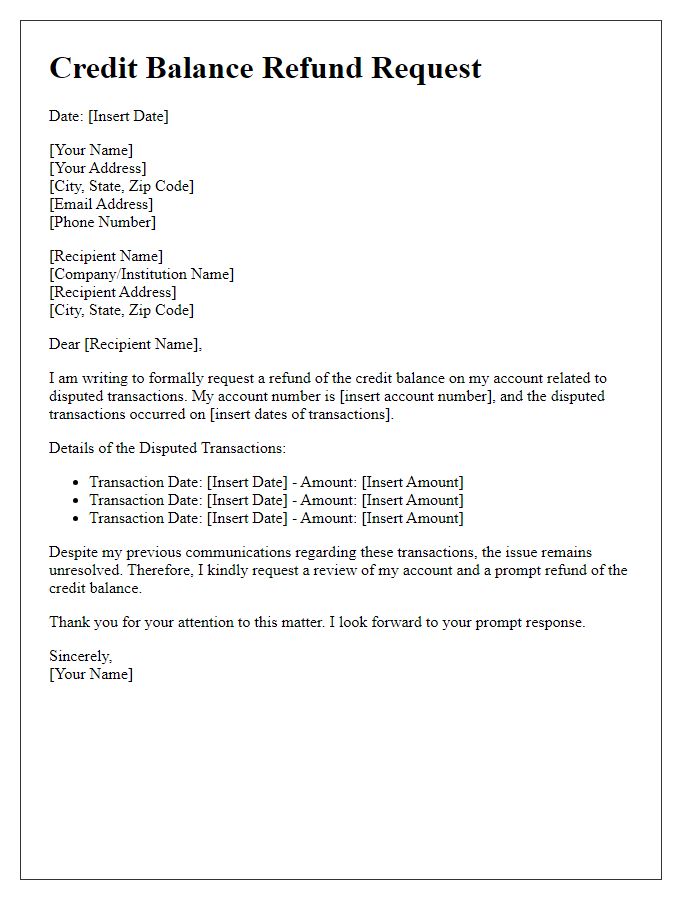

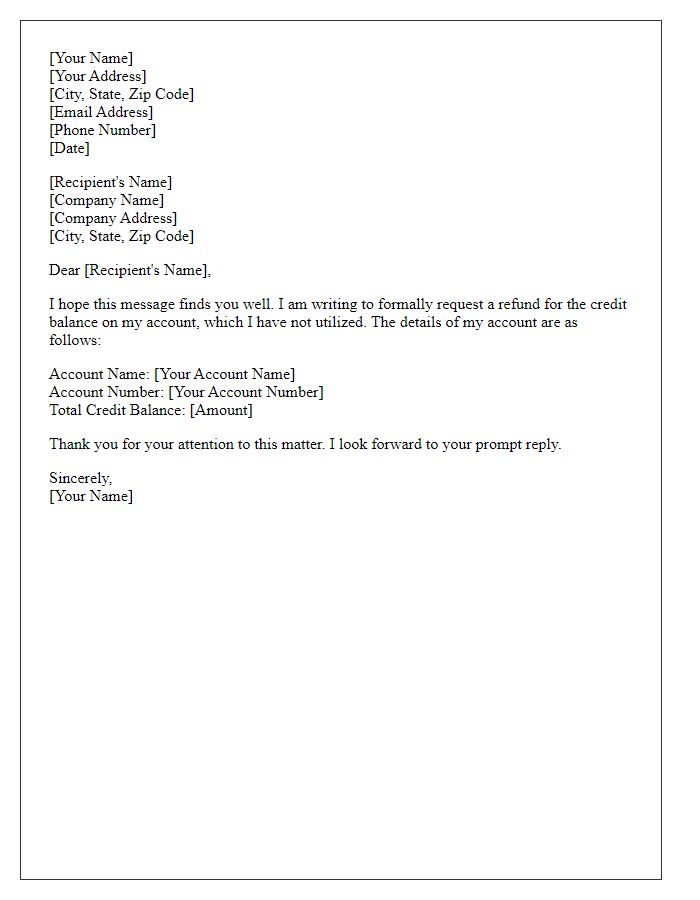

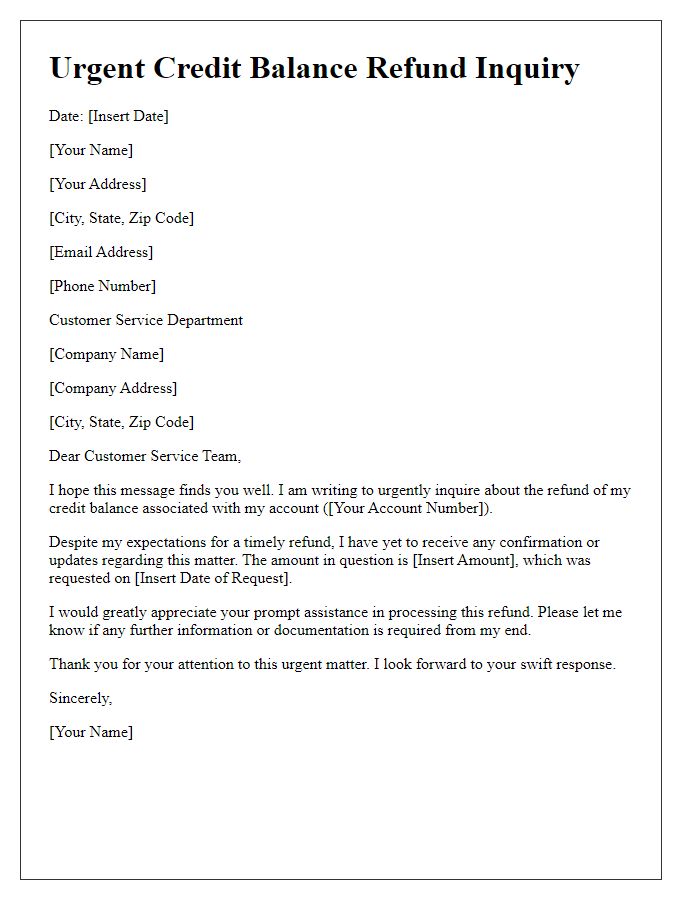

Sender's contact information includes essential details such as the name of the individual or organization, the mailing address including street, city, state, and Zip code, phone number for immediate communication, and an email address for digital correspondence. Accurate contact details ensure seamless interaction regarding the credit balance refund request submitted to the appropriate financial institution or service provider.

Recipient's details (financial institution)

Financial institutions often maintain credit balances for various reasons, including overpayments or account credits resulting from service adjustments. When an account holder identifies a credit balance that requires refunding, they typically need to approach the institution directly. This can include banks such as Wells Fargo or Chase, or credit unions like Navy Federal Credit Union. When crafting a request, key information must be included: the account number, transaction date, and the amount of the credit balance in question. Providing personal identification details, such as a driver's license number or Social Security number, might also be essential for verification purposes. Additionally, specifying the preferred refund method, whether direct deposit or a mailed check to the individual's address, enhances clarity and aids the institution in processing the request efficiently.

Clear subject line (Credit Balance Refund Request)

Credit balance refunds are essential for customers seeking to recover 'surplus funds' in their accounts. In June 2023, ABC Utilities Company received several requests from clients regarding unutilized credits after the closure of accounts. A formal request for a credit balance refund should include 'account number' for identification and state the total amount due, which can often be listed clearly. Customers typically prefer a response timeframe, giving a reasonable expectation of processing duration. Local regulations may require additional verification, influencing the process timeline. Having a verified mailing address ensures proper delivery of the refund check or an electronic transfer to designated accounts. Consumers should document their communications for future reference.

Account details (account number, credit card details)

Submitting a credit balance refund request is essential for reclaiming funds held in accounts, such as those with financial institutions like Visa or Mastercard. Relevant account details, including account number (typically a series of 16 digits), must be clearly stated. Credit card details, including the cardholder's name, expiration date (usually a two-digit month and a two-digit year), and the CVV (three-digit code on the back), provide necessary identification to process the request. Accurate information ensures swift resolution and can expedite refund procedures through channels like online banking or customer service.

Specific refund amount and reasoning

A credit balance refund request may be necessary when a customer has an excessive balance on their account, such as a negative balance on their utility bill or unused points on a loyalty program. The requested refund amount can vary, depending on the individual's situation, such as a $150 overpayment on a utility bill for the month of July 2023. Reasons for the request can include a billing error, such as an incorrect charge or double payment, or a change in service that rendered the balance unnecessary. Customers should provide account details, including account number and relevant transaction dates, to ensure prompt processing and resolution of their refund inquiry.

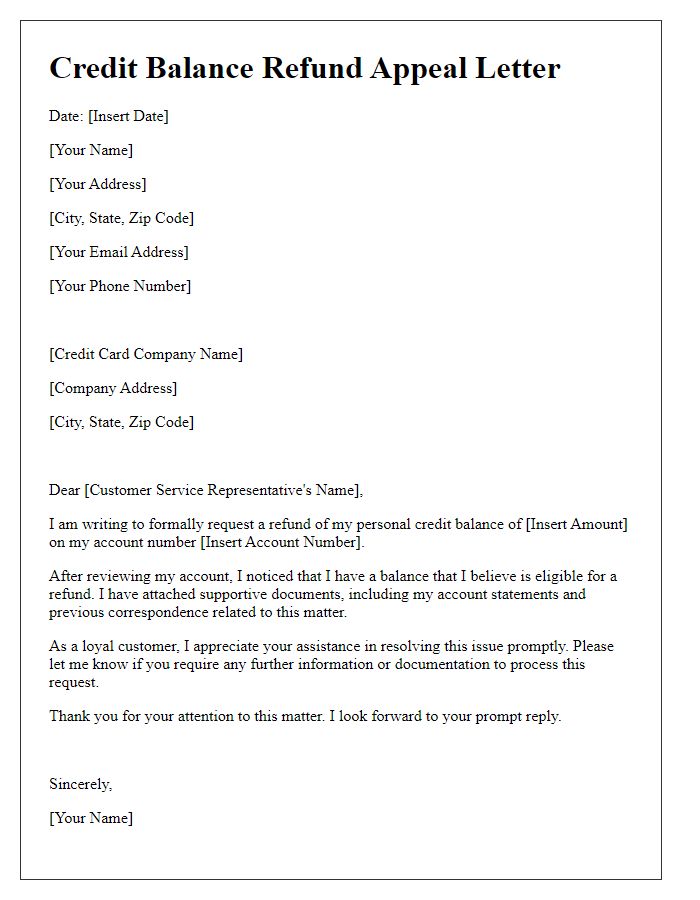

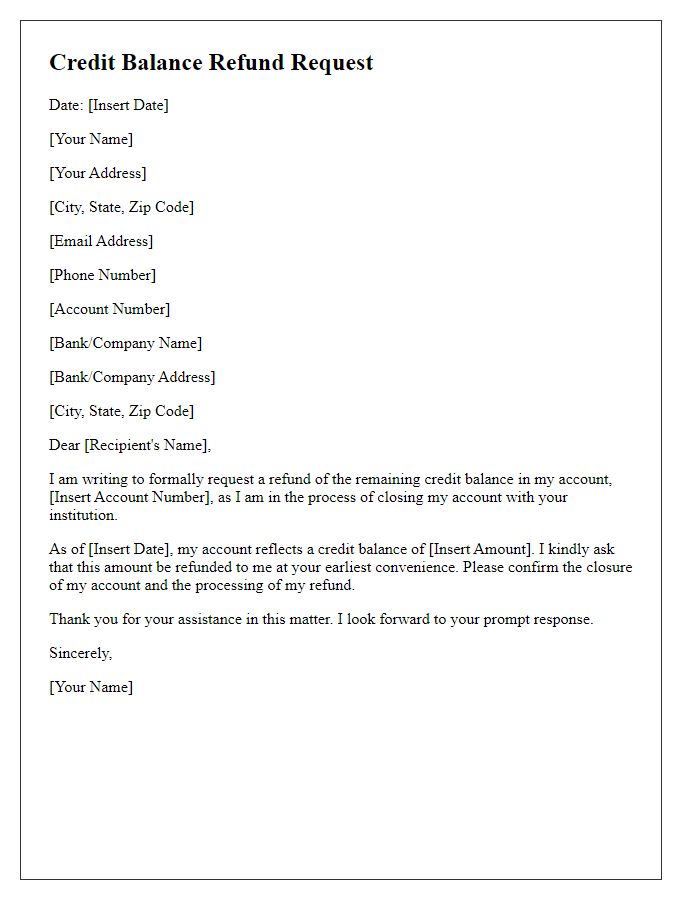

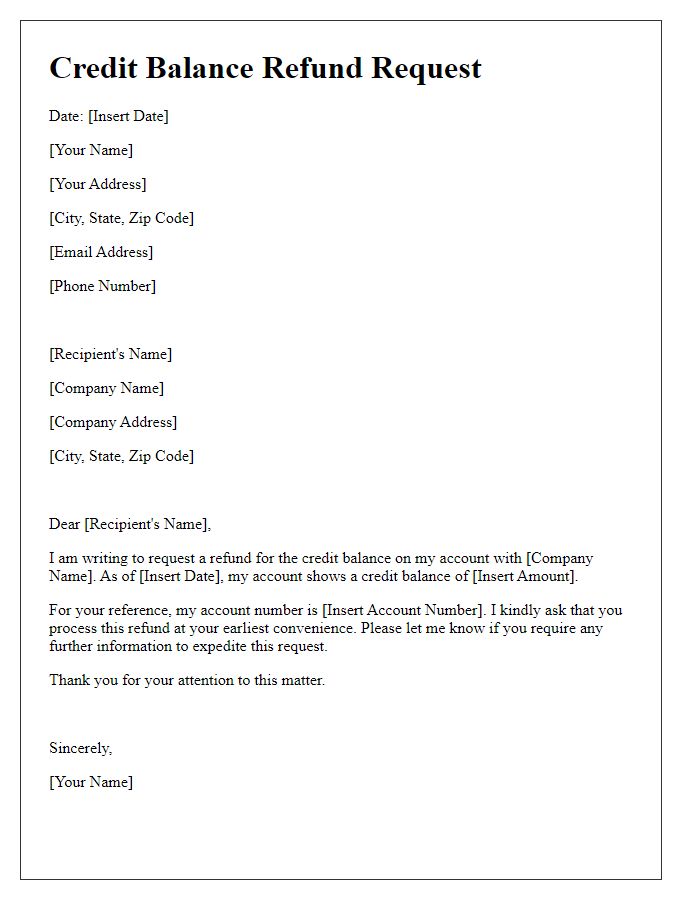

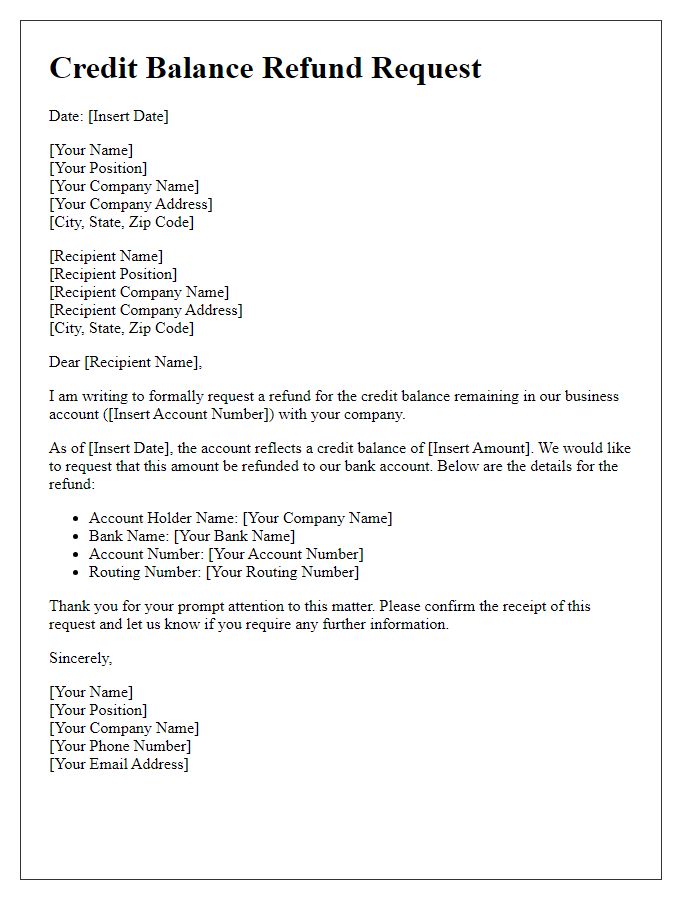

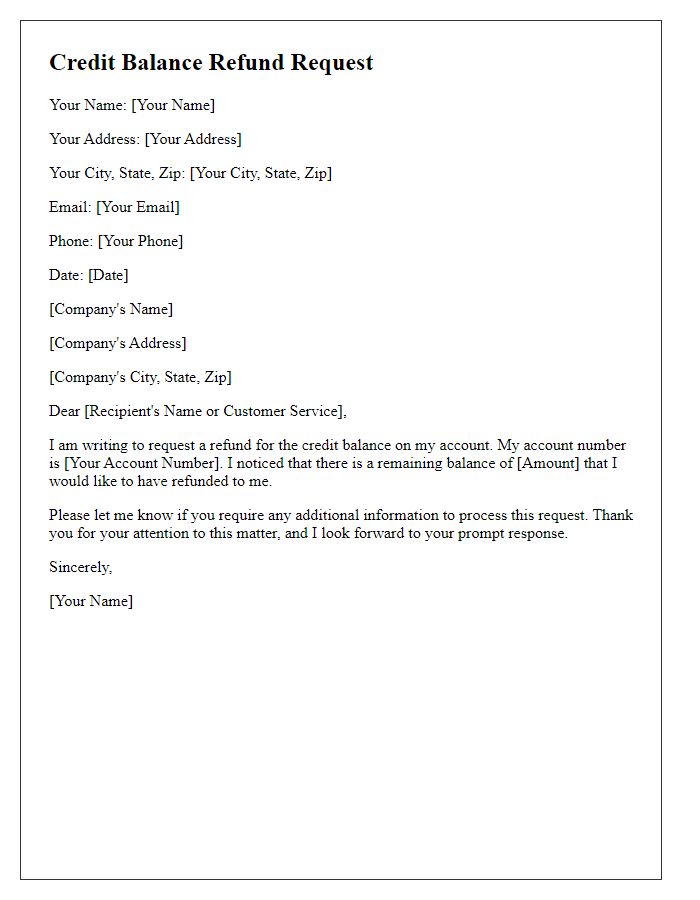

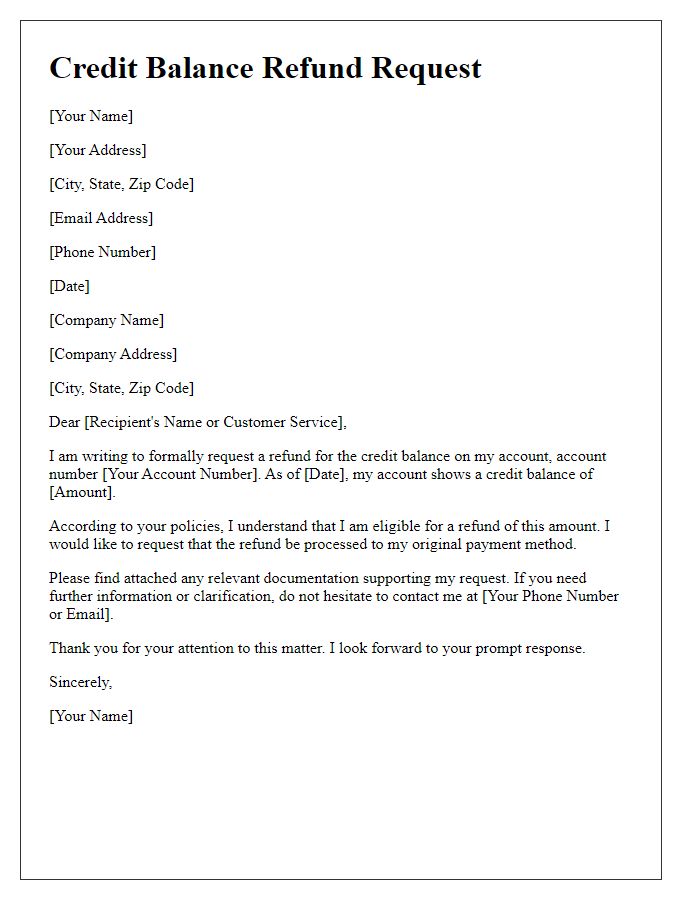

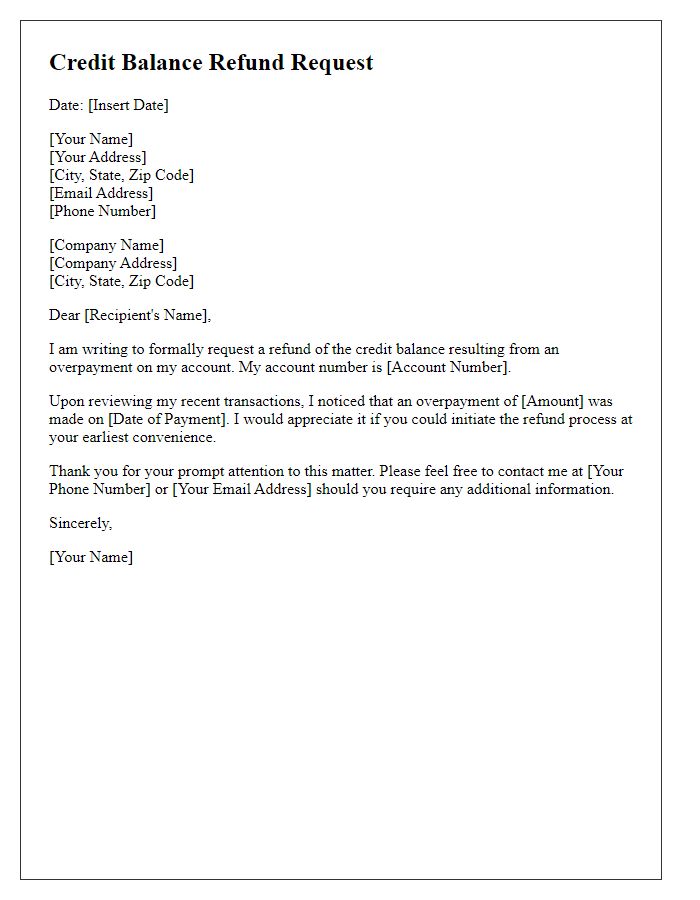

Letter Template For Credit Balance Refund Request Samples

Letter template of credit balance refund request for disputed transactions

Comments