Hey there! If you're considering extending promotional credit terms for your customers, you're in good company. Many businesses find that offering flexible payment options not only boosts sales but also strengthens customer loyalty. Curious to learn how to craft the perfect letter to communicate this change? Let's dive in and explore some effective strategies!

Clear purpose and subject line

Promotional credit terms can attract more customers and boost sales potential for businesses. For example, retail companies may offer extended payment deadlines from 30 days to 90 days, giving consumers more time to manage their finances. These terms often apply to specific events like seasonal sales or new product launches, significantly enhancing customer purchase motivation. Retail outlets in urban centers, like New York City or San Francisco, are particularly adept at utilizing these strategies to create urgency and exclusivity. Offering promotional credit terms can ultimately result in increased customer loyalty and repeat business.

Specific credit terms details

Promotional credit terms often provide flexible financing options for consumers, particularly during sales events like Black Friday or Cyber Monday. Such terms may include no-interest financing for a predetermined period, typically 6 to 18 months, allowing customers to spread out payments without incurring additional costs. Minimum purchase requirements can apply, ranging from $200 to $500, depending on the retailer. Late payment penalties, often around $25, could be enforced if payments are not made on time. Additionally, promotional APR rates might revert to standard rates (usually between 15% and 30%) after the promotional period ends, significantly increasing the overall cost if not settled within the timeframe. Understanding these details is crucial for consumers to avoid unexpected fees and ensure responsible financial management.

Customer benefits and value proposition

Extending promotional credit terms can significantly enhance customer satisfaction and encourage repeat business. Customers can benefit from flexible payment options, allowing them to manage budgeting effectively while still enjoying products or services. For example, extending terms from 12 to 18 months can reduce monthly financial pressure, making larger purchases more accessible to customers. Enhanced credit terms can also promote loyalty, as customers feel valued and understood, leading to increased lifetime value and brand affinity. Moreover, promotional offers such as zero-interest periods can stimulate immediate sales, attracting new customers and retaining existing ones, ultimately driving revenue growth for businesses.

Conditions and eligibility criteria

Promotional credit terms can offer significant benefits for consumers, such as reduced interest rates or extended repayment periods. Eligibility criteria often include having a credit score above a specific threshold, typically 650 or higher, and a stable income source verified through recent pay stubs. Additionally, conditions may require the account to be in good standing, meaning no late payments in the last twelve months. Some promotional offers are limited to specific purchases, such as those made at a partnered retailer or within a designated timeframe, often lasting for six months to two years. Failure to meet these conditions can result in reverting to standard interest rates or fees, underscoring the importance of understanding each promotional offer's details.

Contact information for inquiries

Contacting customer service for inquiries regarding the extension of promotional credit terms can ensure clarity and support. Reach out through the dedicated phone line at (800) 555-0199, available from 8 AM to 8 PM EST, Monday to Friday. For online assistance, visit the official website's customer support section, where an online chat feature is available for immediate questions. Email inquiries can be sent to support@companyname.com, with a response time of 24 to 48 hours. Additionally, the company's physical address for written correspondence is 123 Business Lane, Suite 456, Cityville, State, ZIP Code.

Letter Template For Extending Promotional Credit Terms Samples

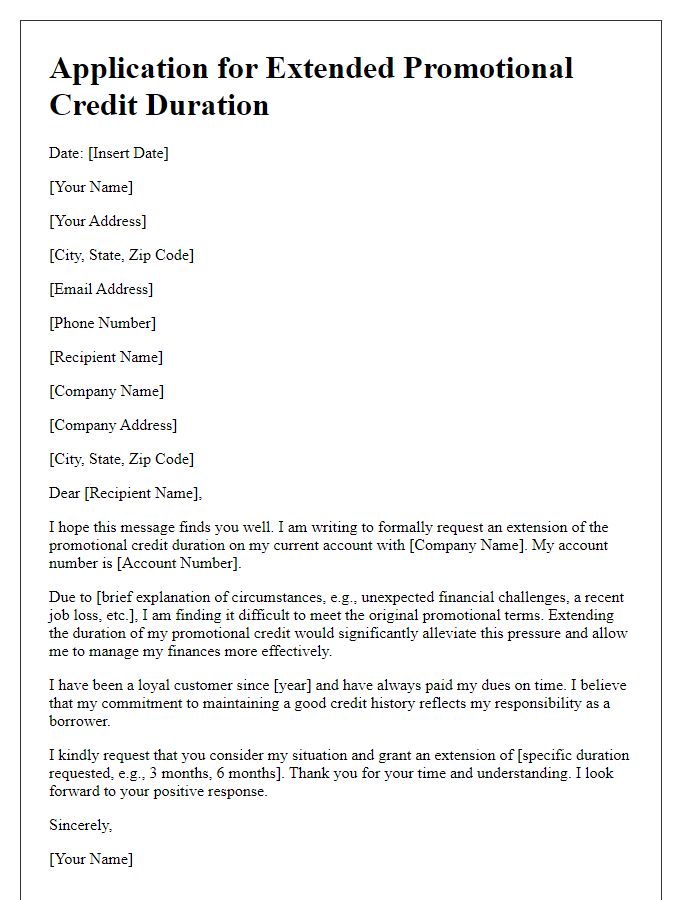

Letter template of application for extended promotional credit duration.

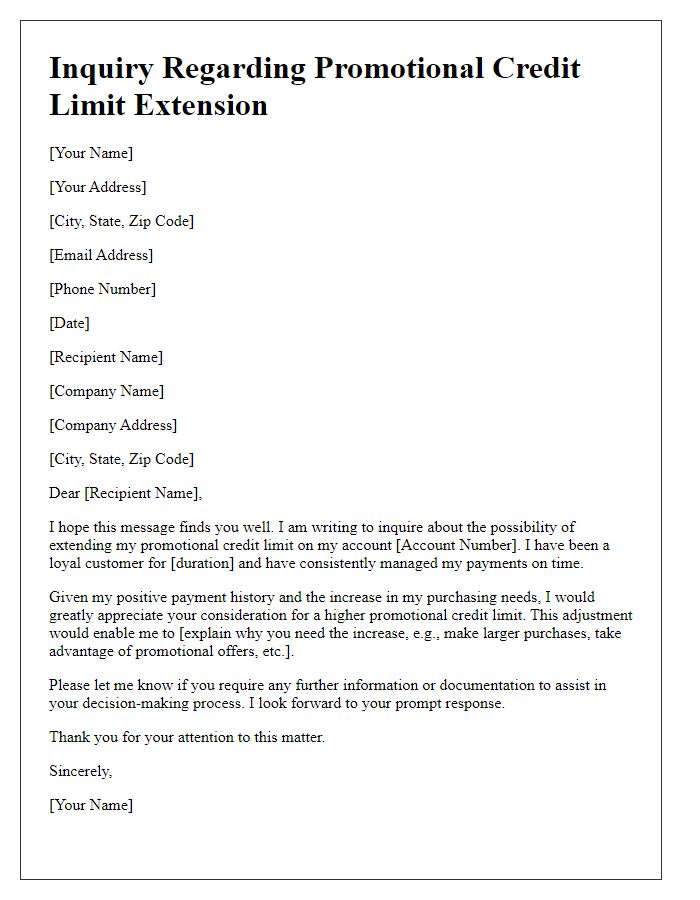

Letter template of inquiry regarding extending promotional credit limits.

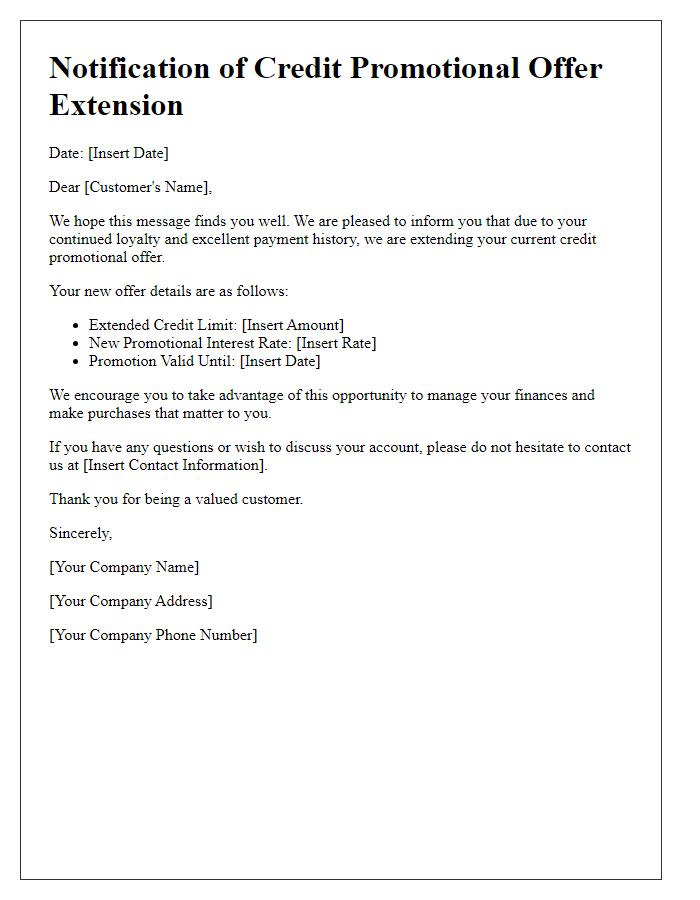

Letter template of notification for wishing to extend credit promotional offer.

Letter template of suggestion for modifying promotional credit conditions.

Letter template of formal request to extend promotional credit agreement.

Comments