Navigating financial challenges can be tough, and sometimes we all need a little flexibility. If you find yourself in a situation where an extended payment period is necessary, crafting a well-structured request can make all the difference. It's important to express your circumstances clearly and convey a sincere desire to fulfill your obligations. Join us as we explore the essential components of a persuasive letter that can help you secure the payment terms you need.

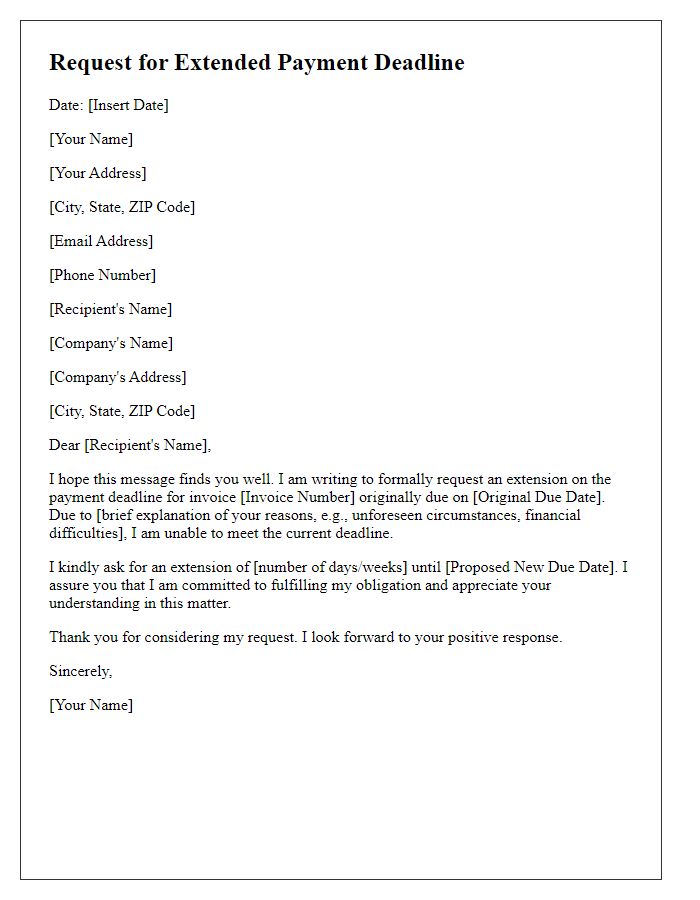

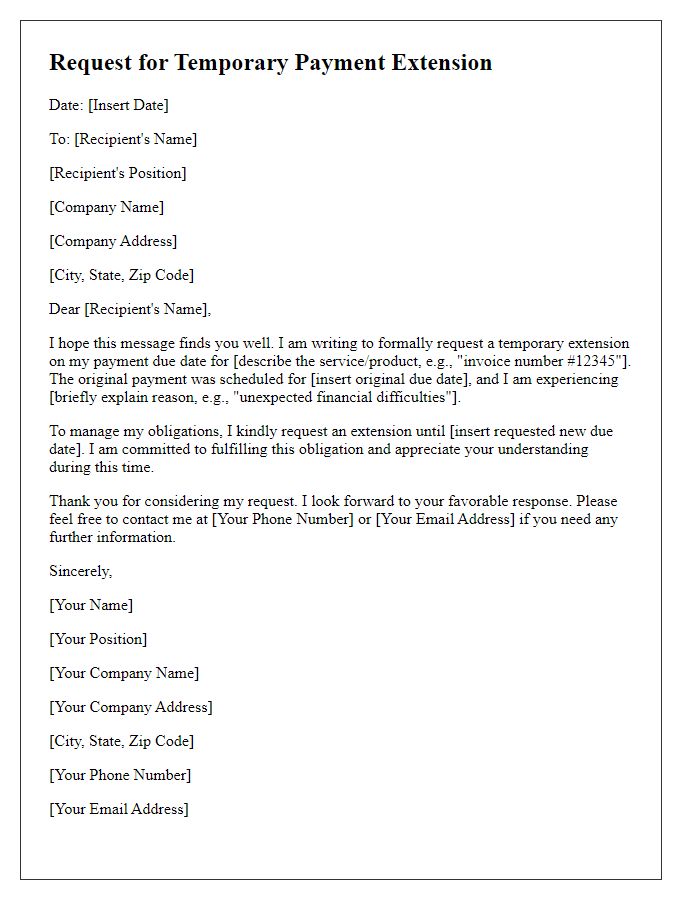

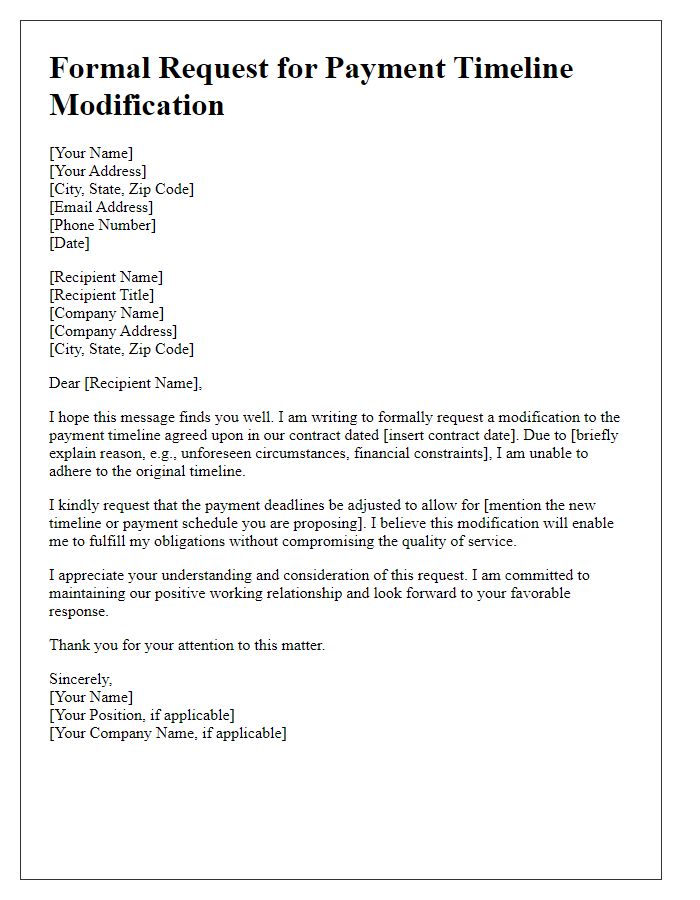

Polite and professional tone

Due to unforeseen financial circumstances, an extended payment period request is necessary. Current obligations include a secured loan from a local bank and multiple credit card debts, which have become challenging to manage. Requesting a three-month extension would provide sufficient time to regroup and rectify the financial situation without defaulting on any payments. An improved cash flow plan is being developed, aiming for a stable resolution by the end of this proposed extension. Your consideration of this situation is greatly appreciated, as maintaining open lines of communication remains a priority during this challenging phase.

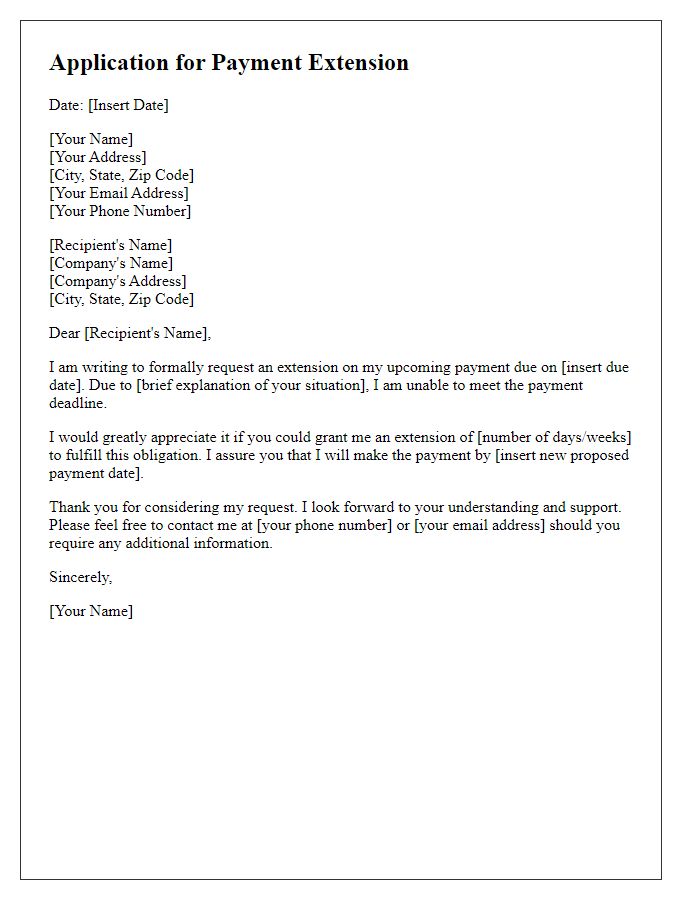

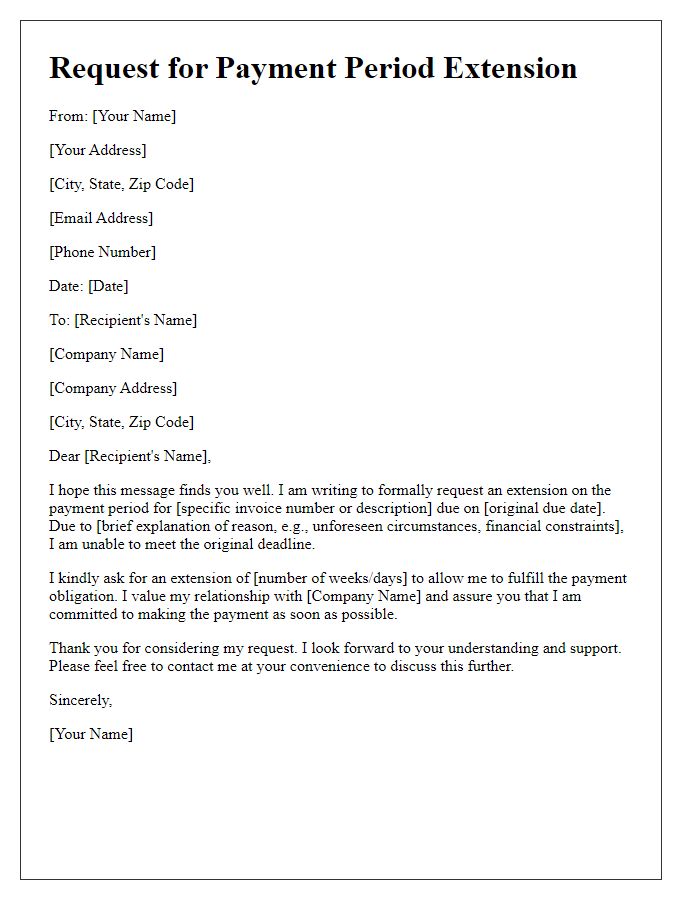

Clear and concise reason for request

Requesting an extended payment period can be essential for managing cash flow difficulties in a variety of situations, such as unexpected business expenses or temporary loss of income. Small business owners, like those operating in retail sectors or service industries, often face fluctuating revenue streams that can impact their ability to meet financial obligations on time. Clear communication with creditors is necessary, detailing the specific circumstances causing the delay. Highlighting intentions to maintain a good relationship and honoring debts eventually can foster understanding and cooperation. It's important to specify the amount of time needed for the extension, as well as a proposed payment plan to illustrate commitment.

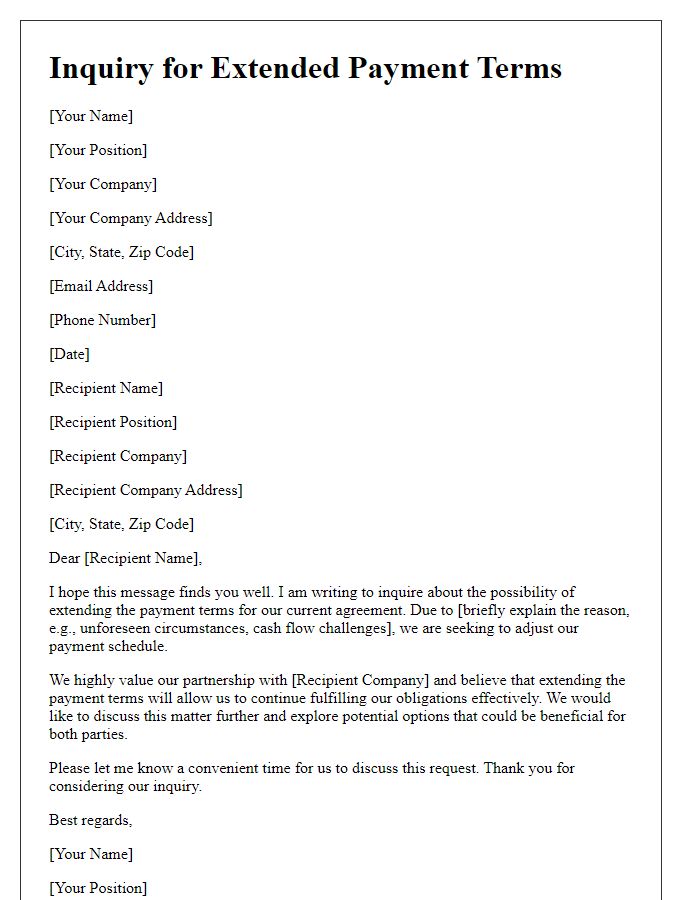

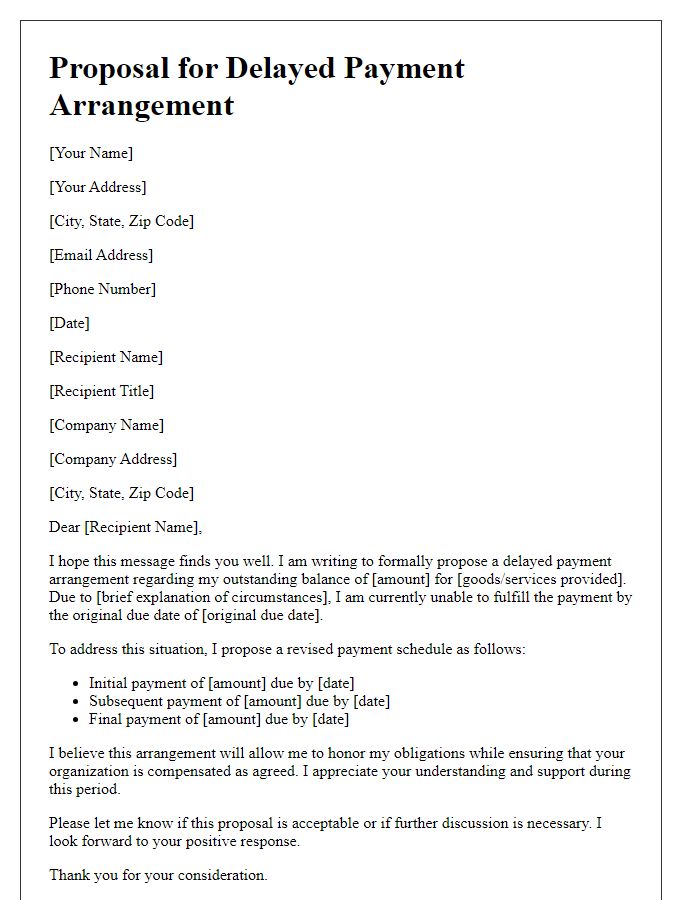

Specific details of the new payment terms

The request for an extended payment period can provide significant flexibility for both parties involved in a financial agreement. For example, a company could propose extending its payment terms from the standard 30 days to 60 days to better align with its cash flow cycles. This new arrangement would allow the company to manage its operational expenses while ensuring timely payment to suppliers. Key details might include a specific start date (e.g., January 1, 2024), outlining the new deadline for outstanding invoices, and any changes in interest or late fees associated with the extended period. Clear communication of these terms can foster collaboration and goodwill between the business and its creditors, ultimately enhancing long-term relationships.

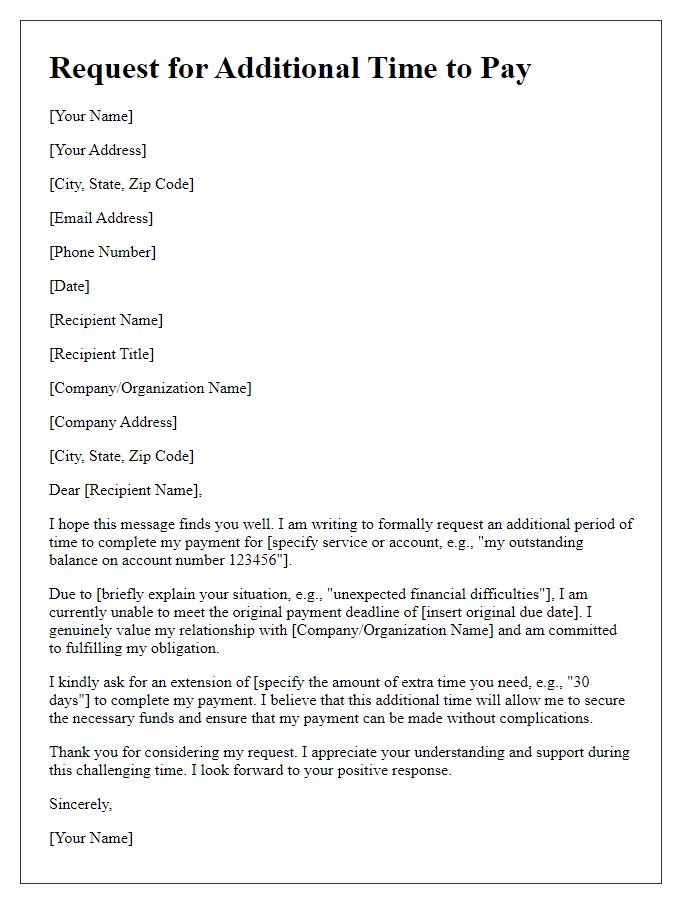

Assurance of commitment to fulfill obligations

Requesting an extended payment period can reflect a commitment to fulfill financial obligations responsibly. For instance, a small business, operating in a competitive environment, may seek an additional 30 days to pay outstanding invoices totaling $15,000 from suppliers due to temporary cash flow challenges. Demonstrating a history of timely payments and solid communication can emphasize reliability. Additionally, providing a clear repayment plan, highlighting anticipated cash flow improvements, and showcasing recent contract wins or increased sales projections can further assure creditors of the commitment to honor financial responsibilities. Properly addressing the request can foster trust and maintain positive relationships with stakeholders.

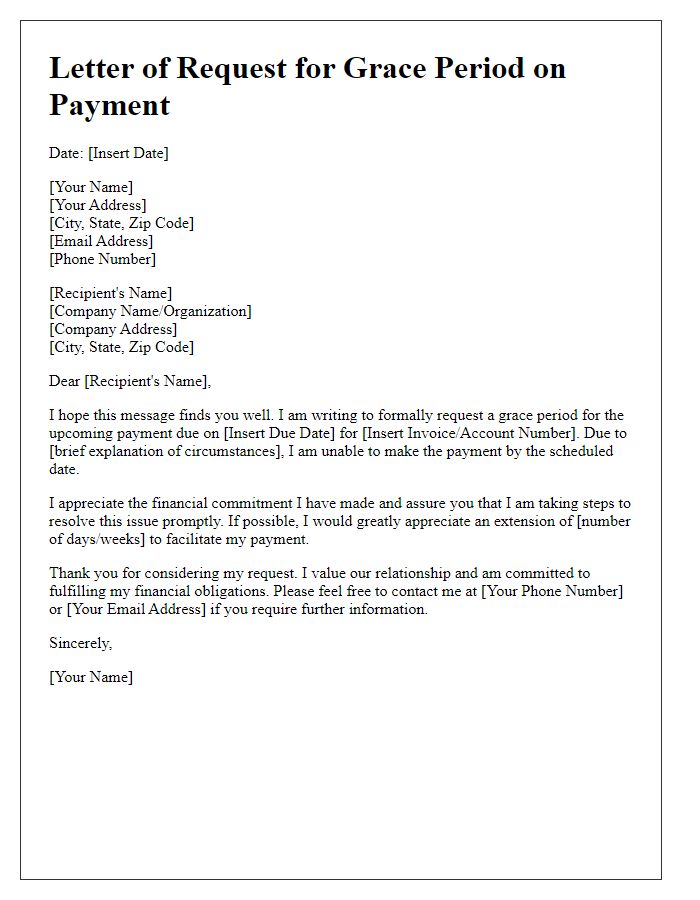

Contact information for further discussion

Extended payment period requests often arise from financial constraints or unexpected circumstances individuals or businesses may face. Providing accurate contact information facilitates effective communication, allowing for discussions regarding terms, repayment schedules, and potential agreements. Include vital details, such as full name, email address, and phone number, ensuring accessibility for any follow-up conversations or clarifications. Specifying a preferred time for contact can enhance the dialogue's efficiency, helping both parties reach a satisfactory resolution.

Comments