Are you struggling to manage medical debt? You're not alone, as many people face financial challenges due to unexpected health expenses. Crafting a letter to negotiate a payment plan can be the first step towards regaining control of your finances and alleviating stress. Join us as we explore effective tips and a sample template that can help you tackle your medical debts head-on!

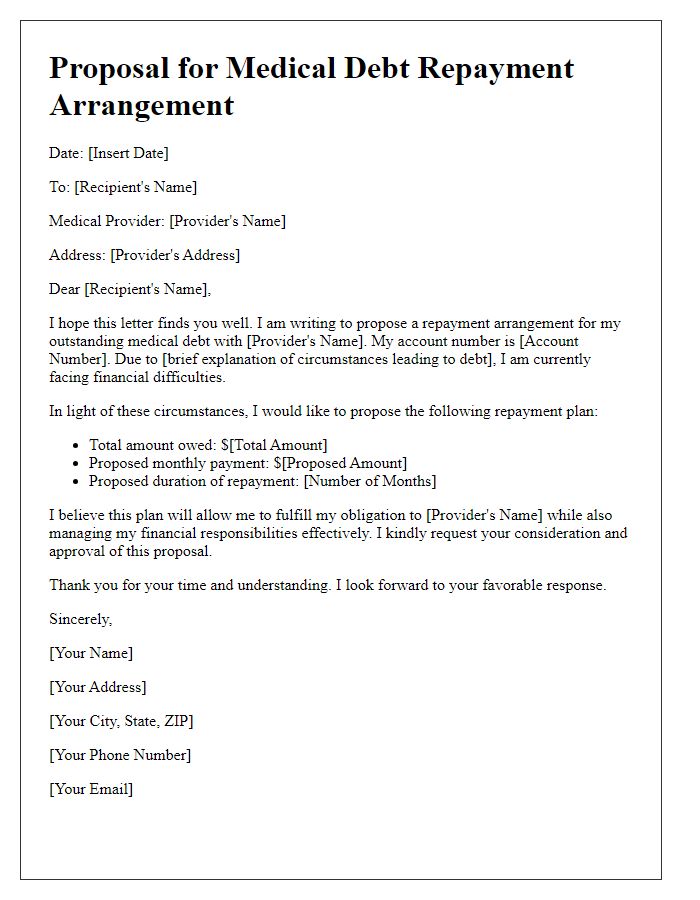

Account Information

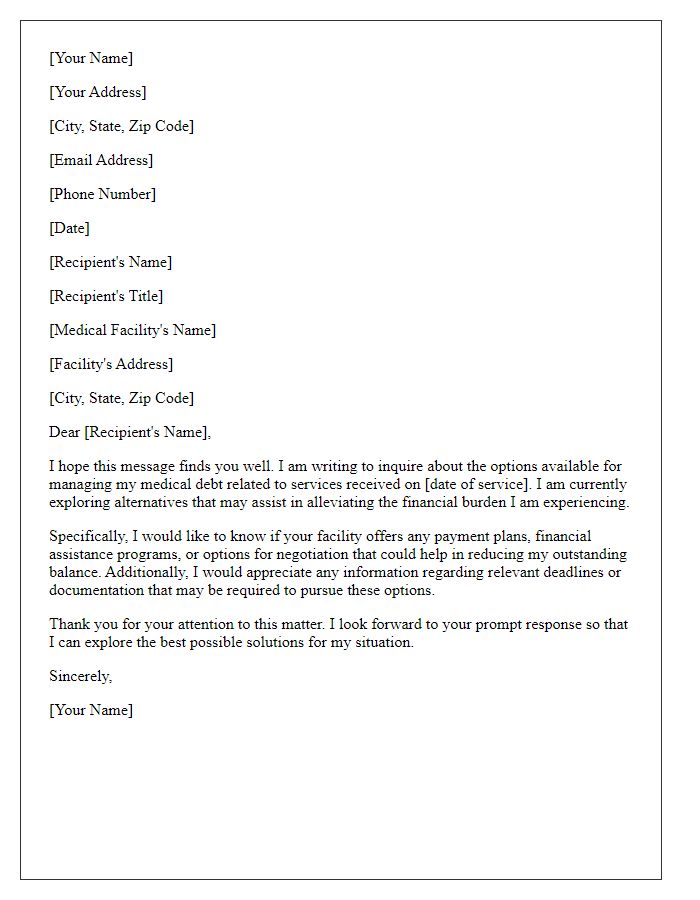

Medical debt management often involves discussing a payment plan with healthcare providers. With an account balance reaching thousands of dollars, patients may struggle to meet their financial obligations. Notably, healthcare institutions like hospitals and clinics usually have designated account numbers to track individual debts, making it essential to reference these in any correspondence. Additionally, the date of service can provide context for outstanding charges, while specific billing codes associated with treatments may clarify services provided. Addressing these factors in a structured communication can facilitate a smoother negotiation process and improve understanding between patients and providers.

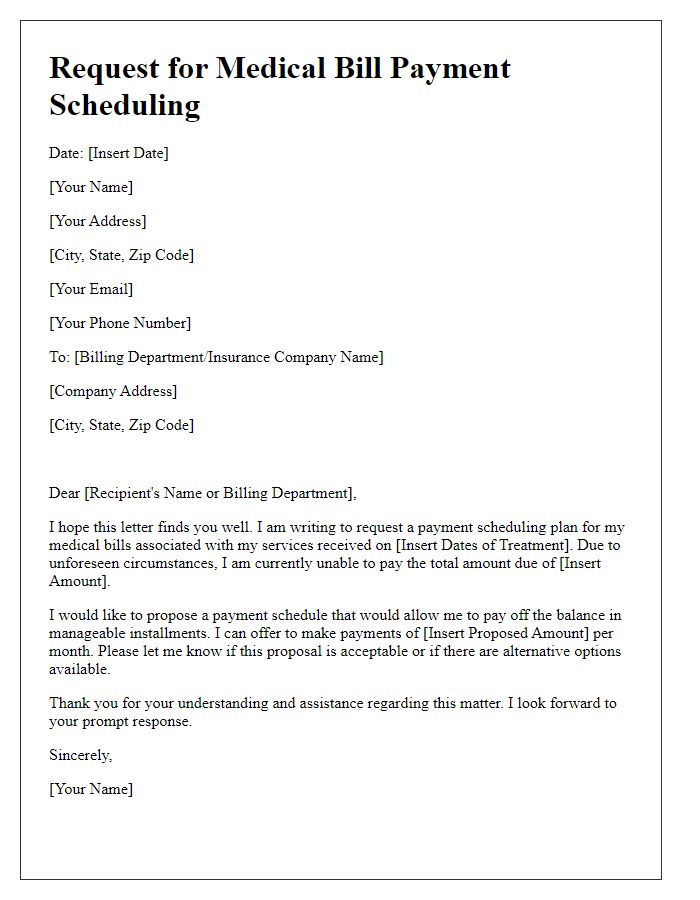

Current Financial Situation

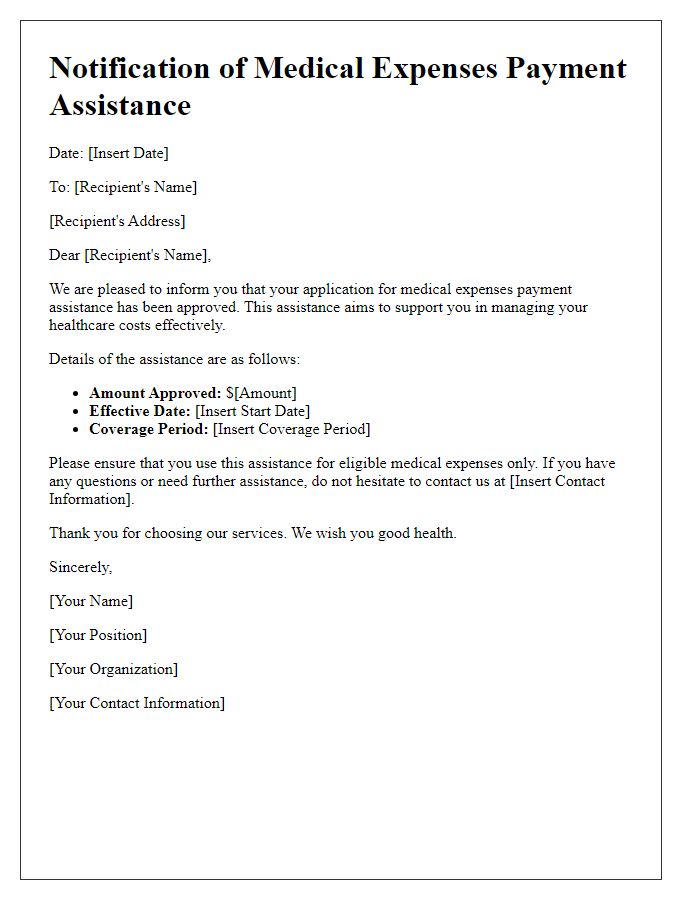

The current financial situation of individuals grappling with medical debt can be quite challenging, often marked by overwhelming bills and unexpected expenses. Medical debt, encompassing various healthcare services such as hospital stays, surgeries, or emergency room visits, can escalate quickly, sometimes reaching thousands of dollars. Factors contributing to this scenario include high deductibles, insufficient insurance coverage, and rising healthcare costs in countries like the United States, where healthcare spending topped $4 trillion in 2020. Many affected individuals may find it difficult to manage additional monthly obligations while coping with other living expenses such as housing and food, often leading to feelings of anxiety and stress. Compassionate options such as payment plans or financial assistance are crucial for alleviating the burden of medical debt and restoring financial stability.

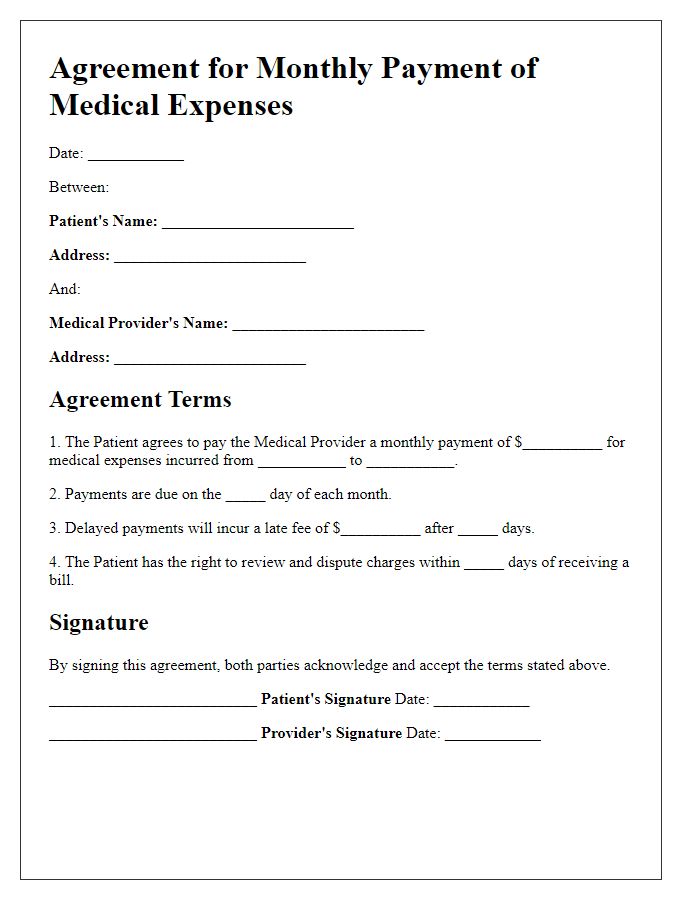

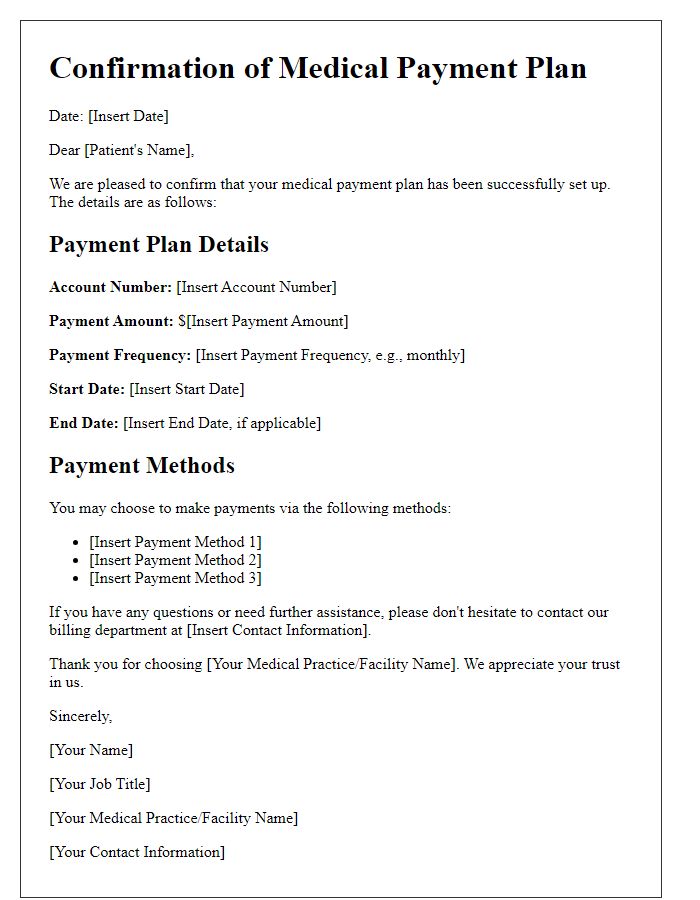

Proposed Payment Plan

Medical debt can often lead to financial stress for individuals and families, especially following significant illnesses or treatments. A proposed payment plan may require detailed breakdowns of outstanding balances, medical provider names like hospitals (e.g., Mount Sinai Hospital) or specialists (e.g., Dr. John Smith Orthopedic Surgeon) along with specific amounts owed. It's essential to adhere to guidelines that may specify a fixed installment amount, often as low as $50 monthly for smaller debts or potentially higher for larger sums. Timely payments can build trust with medical creditors and may enable future negotiations for reduced interest rates or settlement options. Incorporating due dates and payment methods, such as bank transfers or credit card automation, can enhance organizational efficiency in managing these repayments while ensuring compliance with state laws regulating medical debt collection.

Contact Information

Creating a medical debt payment plan involves clear and structured communication. Include complete contact information for both the debtor and the medical institution. Debtor details should encompass full name, address, phone number, and email. Medical institution information should feature the name of the hospital or clinic, billing department address, phone number, and email. A specific account number related to the debt must also be included for reference. Using organized formatting enhances clarity and ensures that all necessary information is easily accessible, facilitating smoother communication regarding payment arrangements.

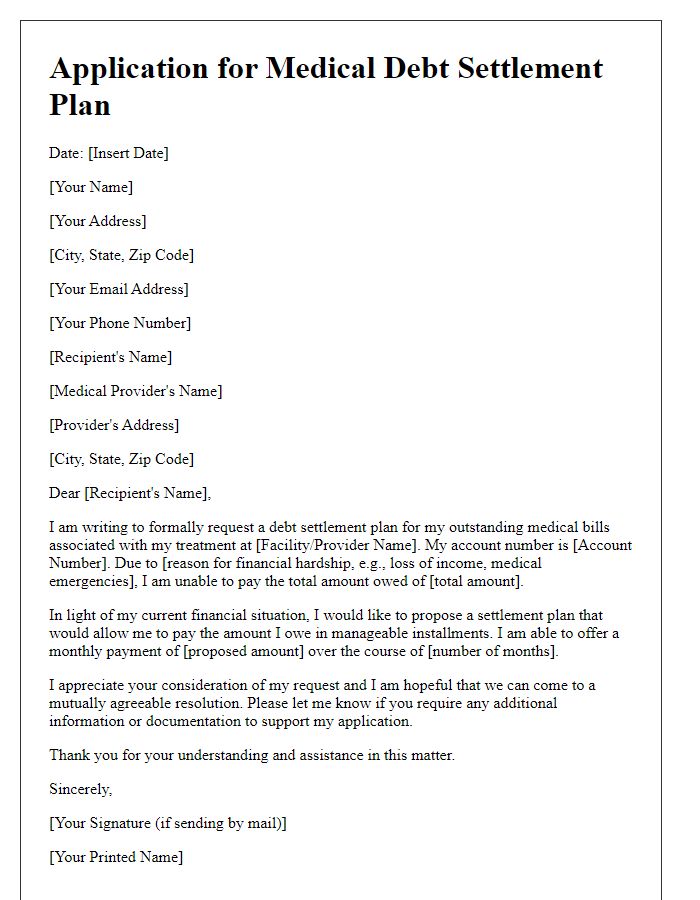

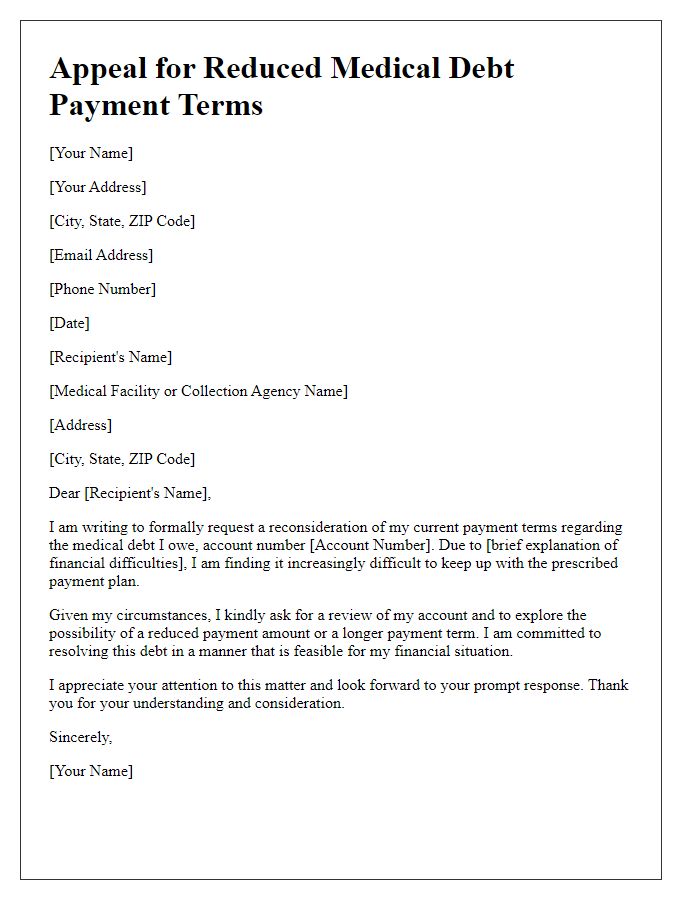

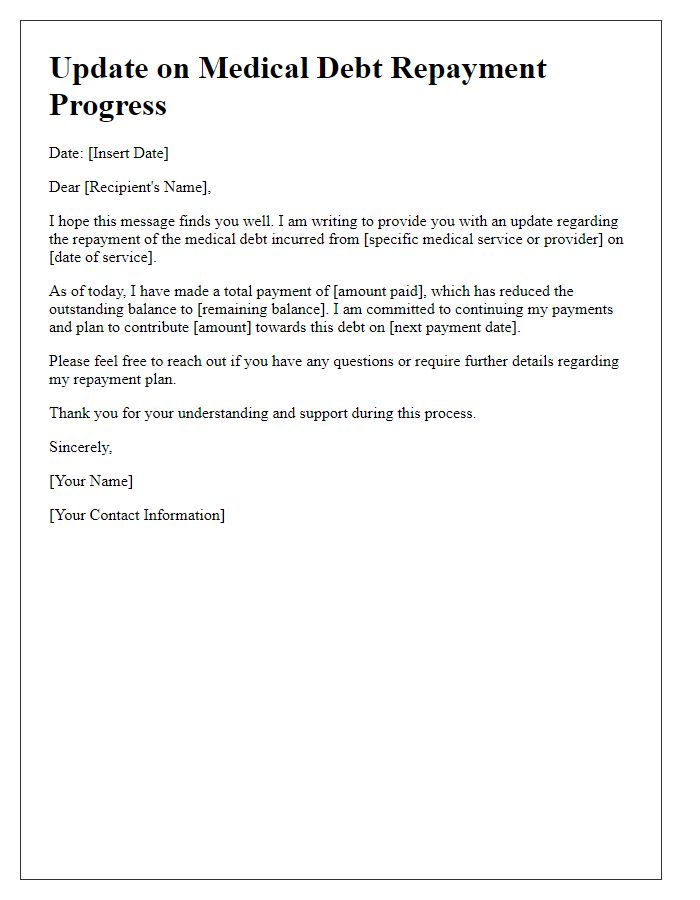

Request for Written Agreement

Medical debt, often arising from hospital visits or treatments (such as surgeries or emergency care), can be a significant financial burden for individuals. Many healthcare providers (including hospitals such as Mayo Clinic and Cleveland Clinic) offer payment plans to help patients manage their medical bills, which may total thousands of dollars. When negotiating a payment plan, it is crucial to request a written agreement detailing the terms, such as monthly payment amounts (typically ranging from $50 to $200), interest rates (if applicable), and the duration of the repayment period (often spanning several months). This document serves as a legal assurance that both parties understand the financial obligations, providing clarity and peace of mind as patients navigate their financial recovery after medical emergencies.

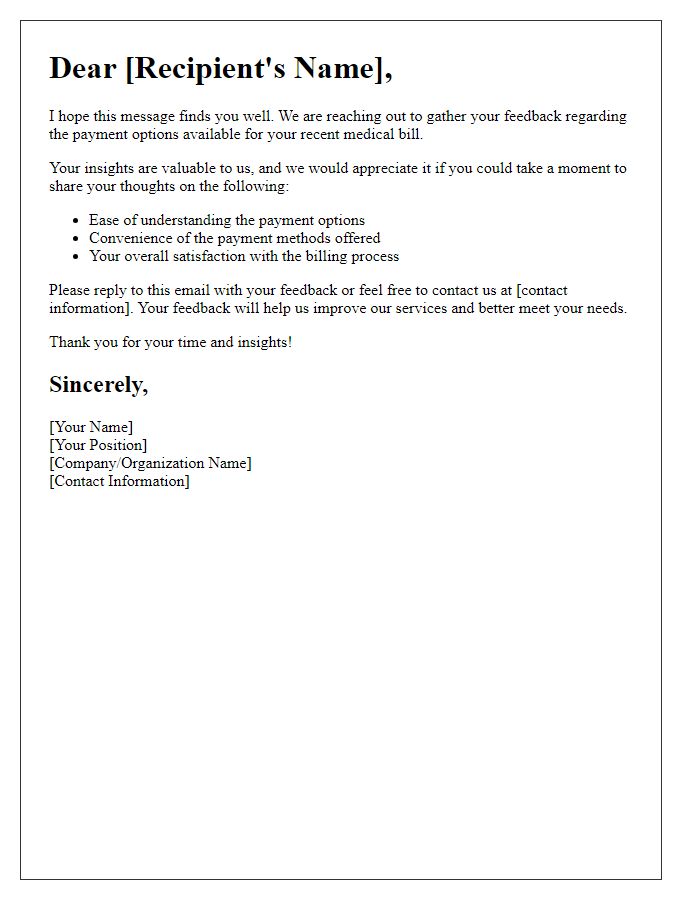

Comments