Have you ever found yourself wondering how to address an overpayment on your account? It's a common situation, and knowing the right way to request a refund can save you time and stress. In this article, we'll provide you with a handy letter template that simplifies the process of getting your money back. So, if you're ready to navigate the world of refunds with ease, keep reading!

Recipient's Information

The process of receiving a refund for an overpayment on an account typically requires submitting a formal request, which includes essential details like the recipient's information. This includes the full name of the individual receiving the refund, often associated with financial transactions or services rendered; the mailing address, which consists of the street address, city, state, and ZIP code, ensuring that the refund reaches the correct location; and the account number, a unique identifier linked to the specific overpayment situation, allowing the organization to verify the claim efficiently. All this information provides a clear and concise identification of the recipient, streamlining communication with the billing department or financial institution handling the refund request.

Subject Line

Filing for a refund due to overpayment on account balances can be essential for maintaining accurate financial records. An overpayment may occur when payments exceed the amount owed for services rendered, such as utility bills or subscription services. It is crucial to note specific details in the refund request, including the account number, the date of overpayment, and the total amount overpaid. Additional reference could involve previous payment methods or transaction IDs to expedite processing. The recipient should be the customer service department or the financial accounting office, typically at the company location, ensuring that communication reaches the appropriate personnel for prompt resolution. Documentation associated with the account, such as invoices or payment confirmations, should also accompany the refund request to support the claim.

Reference Details

Submitting a refund request for overpayment on an account requires attention to specific details such as account numbers, referenced transaction dates, and the total amount overpaid. For instance, the account number (e.g., 123456789) should be clearly stated alongside the specific transaction date (e.g., July 15, 2023) that resulted in the overpayment. It is also essential to specify the overpayment amount (such as $150.00) and attach any relevant documents like receipts or billing statements for clarity and to support the request. Clear identification of the service provider or company name (e.g., XYZ Utilities) in the communication will ensure that the request is directed to the appropriate department for processing. Promptness in submission is crucial, particularly if there are company policies regarding time limits for refund requests.

Explanation of Overpayment

Overpayment on accounts can lead to significant financial discrepancies and require rectification. An overpayment occurs when payments exceed the invoiced amounts, often due to clerical errors, miscalculations, or misunderstandings of billing terms. Common scenarios include overpayments resulting from double transactions or payments sent before the final amount due was accurately determined. For example, if an individual was billed $150 for services rendered but paid $200, an overpayment of $50 has occurred. Addressing such issues is crucial to maintaining financial accuracy and rectifying customer account balances. The process typically involves providing supporting documentation, such as receipts and statements, to validate the claims and expedite the refund process.

Request for Refund

A refund of overpayment on accounts can occur when businesses, such as retailers or service providers, charge customers more than the agreed amount. These discrepancies may arise from billing errors, incorrect rates, or returned merchandise. For instance, a customer purchases electronics from a store like Best Buy, resulting in a $200 charge but later discovers a $50 markdown for a special sale. If the customer has already paid the $200, they would seek a refund of the $50 overpayment. Documentation, such as receipts and billing statements, is essential in streamlining the refund process. Timely submissions are crucial, with many companies processing refunds within 30 days. Potential delays may arise from high volumes, particularly during holiday seasons or events like Black Friday.

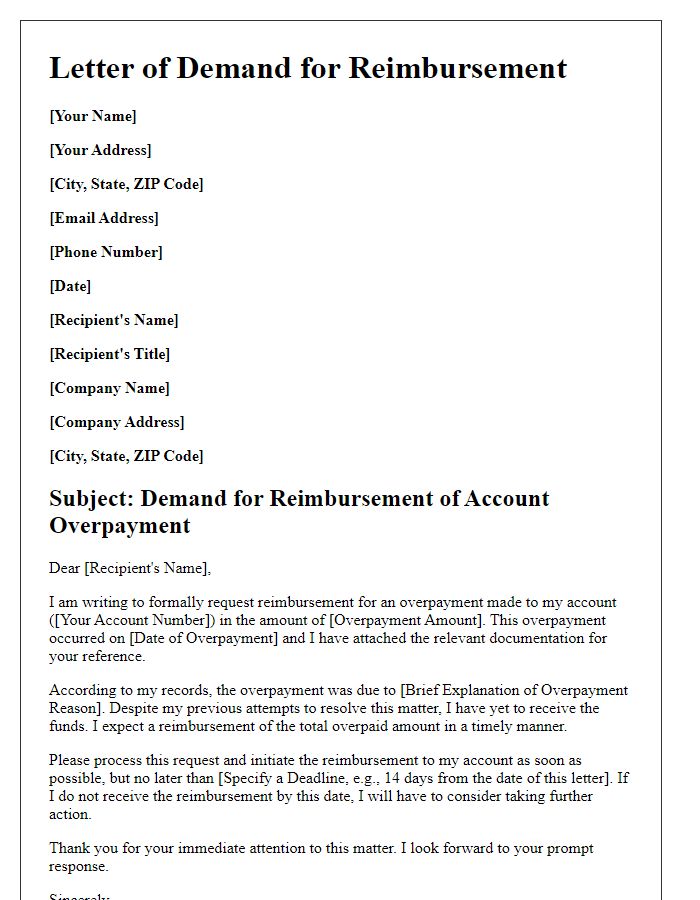

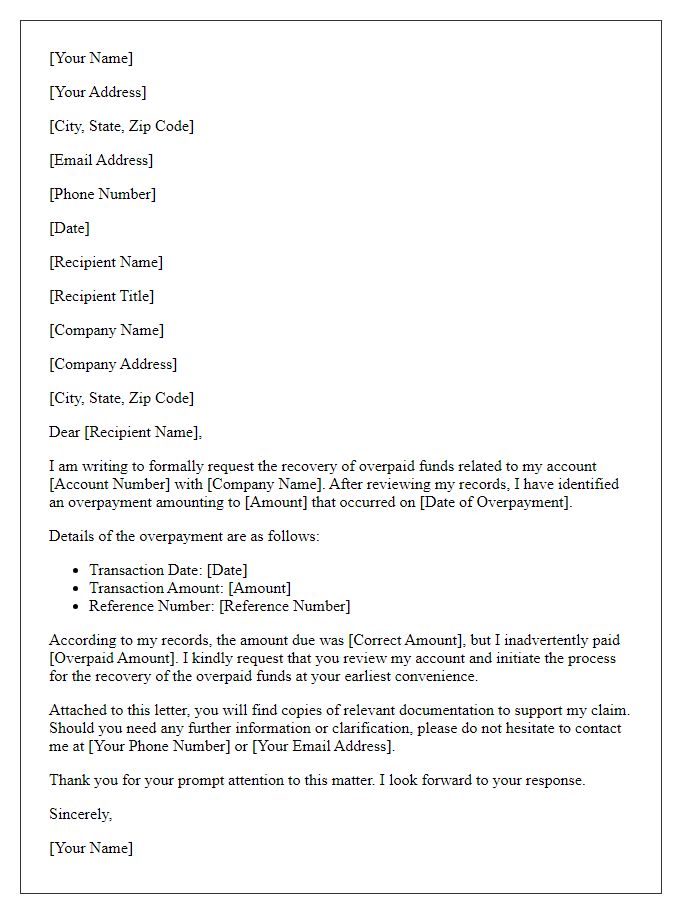

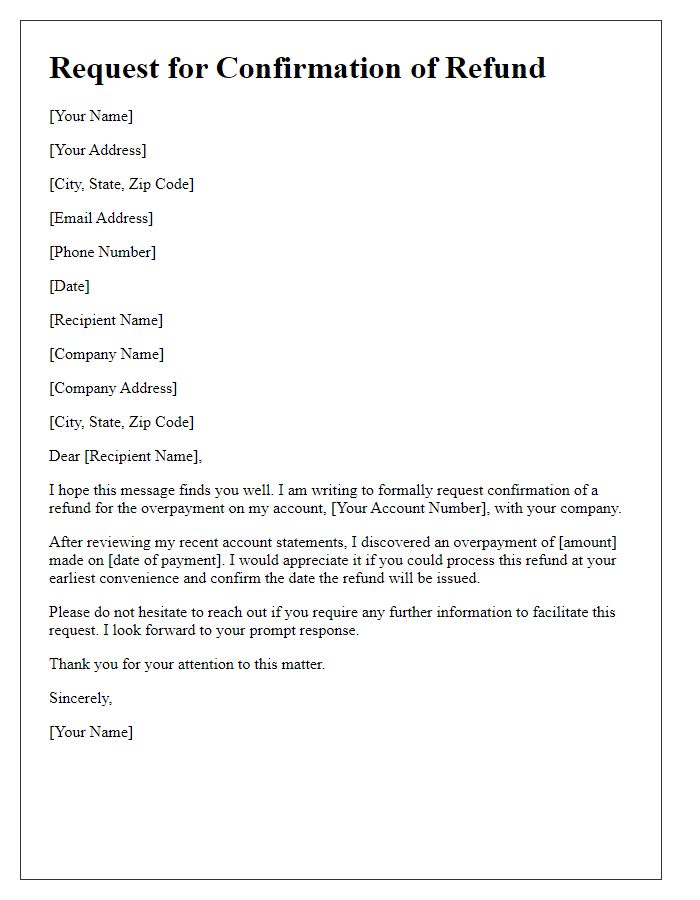

Letter Template For Refund Of Overpayment On Account Samples

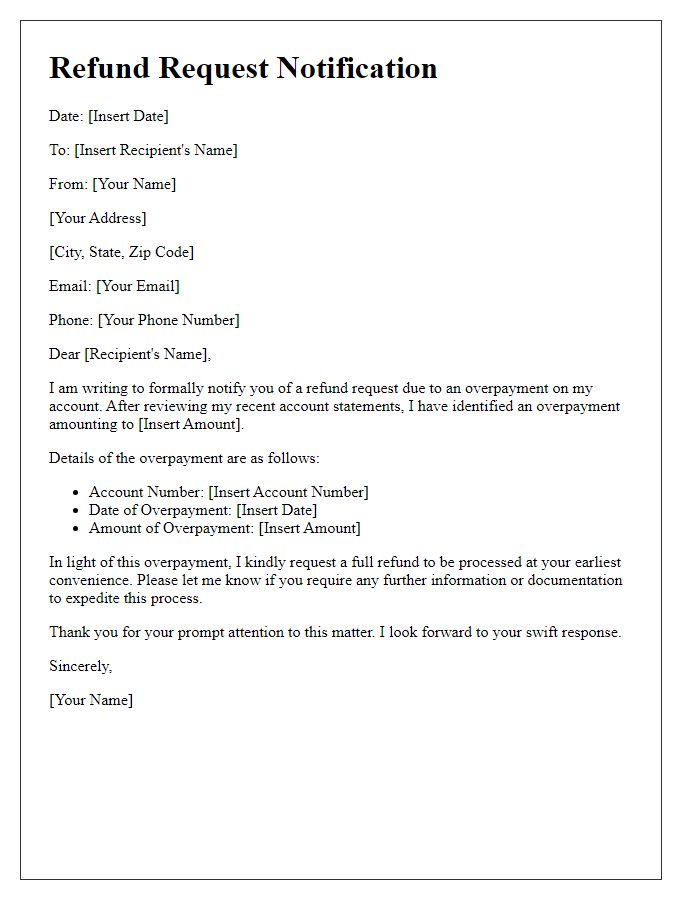

Letter template of notification for refund request due to account overpayment.

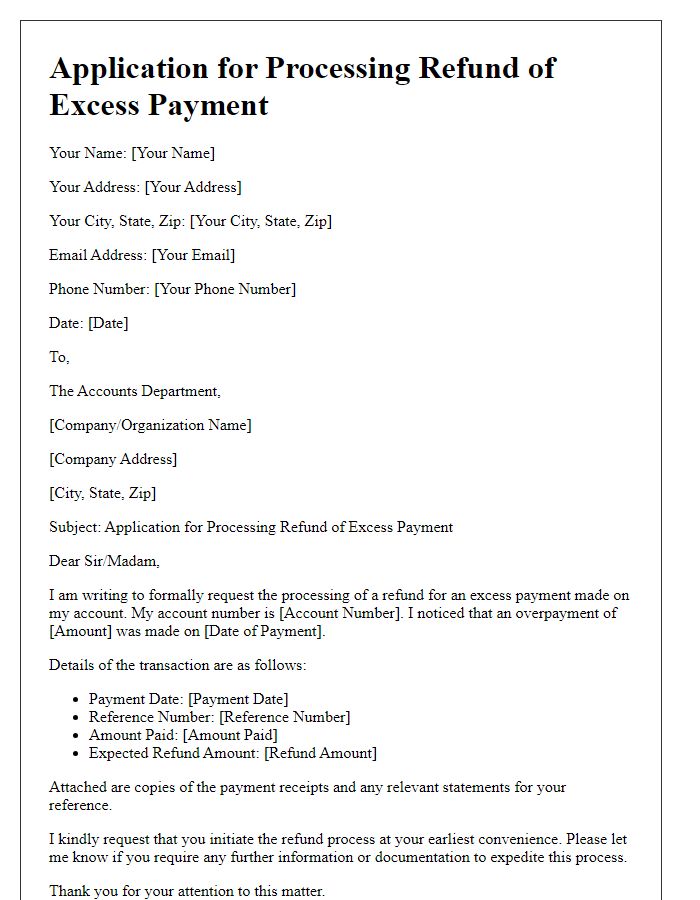

Letter template of application for processing refund of excess payment on account.

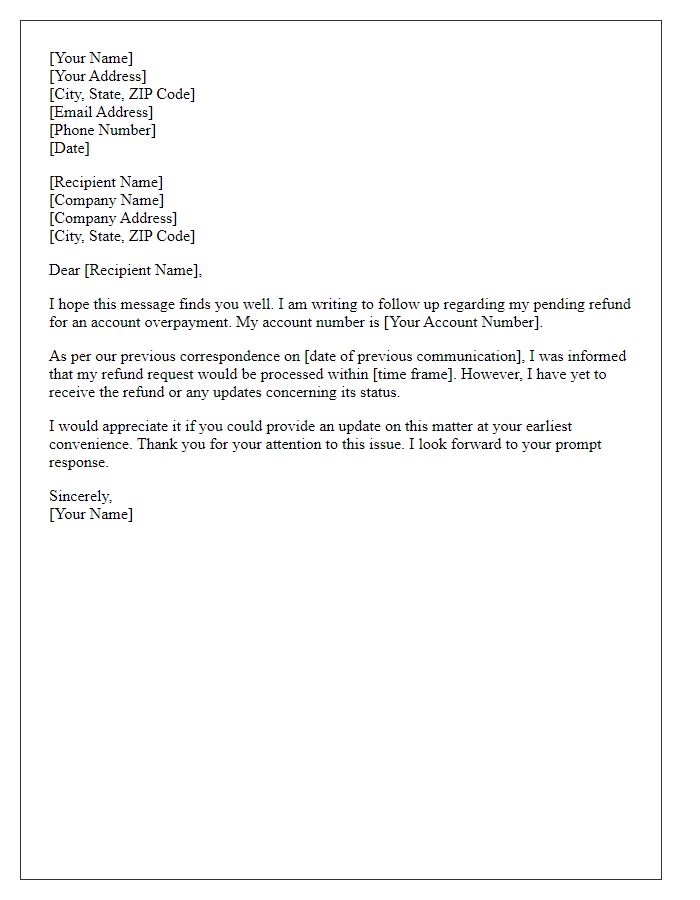

Letter template of follow-up regarding pending refund for account overpayment.

Letter template of courtesy reminder for refund of overpayment on account.

Comments