Are you feeling the financial pinch and wondering if there's a way to ease your burden? Writing a letter for an emergency payment reduction can be your first step toward relief. It's a straightforward process that allows you to communicate your situation effectively and request a more manageable payment plan. Join us as we explore the essential elements of crafting a persuasive letter that can help you get back on track.

Urgency and reason for reduction

A sudden financial crisis can arise from unforeseen events, such as job loss affecting monthly income. In this volatile economic climate, timely communication becomes crucial to maintain financial stability. A request for an emergency payment reduction may involve outlining specific circumstances, such as a medical emergency resulting in unexpected expenses or a significant decrease in working hours leading to diminished earnings. Providing detailed context establishes urgency. Institutions may require supporting documentation, like evidence of income change or hospital bills, to assess the request effectively. A clear and concise narrative can expedite the review process and facilitate a favorable response.

Current payment details

Emergency payment reduction can alleviate financial stress for individuals in dire situations. Current payment details include outstanding balances, such as monthly installments due on loans or credit cards at interest rates ranging from 5% to 29%. During economic downturns, financial institutions may offer temporary relief programs, allowing reductions in monthly payment amounts by 20% to 50%, depending on circumstances. Clients must provide documentation, such as proof of income loss or unexpected medical expenses, to qualify for assistance. This process can provide immediate relief and help prevent defaults or missed payments, fostering better financial stability.

Proposed adjusted payment amount

Emergency financial situations often necessitate discussions regarding adjusted payment amounts to alleviate economic pressure. A proposed adjusted payment amount, reflecting an individual's current financial capability, can ensure timely repayments while accommodating unexpected expenses, such as medical bills or job loss. Details may include a specific percentage decrease from the original payment, a new schedule for reduced payments, and a clear duration for this temporary adjustment, such as six months or until financial stability is regained. Important documentation, like income statements or medical invoices, can support the request for a revised payment plan, ensuring a transparent process with creditors or financial institutions.

Duration of payment reduction

Emergency financial circumstances can necessitate temporary payment reductions for individuals facing challenges. For instance, a payment reduction period may extend for twelve months, allowing individuals to alleviate immediate financial burdens. This adjustment provides essential relief, particularly during economic hardships such as unforeseen medical expenses or job losses in sectors like hospitality or retail. Supporting documentation, including income statements or medical bills, may be required to justify the need for a reduced payment arrangement during this crucial period. Ensuring access to financial stability can significantly enhance individuals' quality of life and allow them to focus on recovery and stability.

Contact information for discussion and agreement

In situations requiring emergency payment reduction, the process often involves contacting financial institutions or creditors directly. Essential contact details include the customer service phone number, typically found on account statements or official websites, and the dedicated email address for financial hardship requests. Clear documentation (such as pay stubs or bank statements) must be prepared to support the request for reduced payments. Agreements can vary in terms of duration--often ranging from three to six months--and may involve a temporary reduction in monthly payment amounts (e.g., 50% for a specified period). Key metrics to track also include total outstanding balance and interest rates, ensuring that any agreements do not adversely affect credit scores or lead to additional fees.

Letter Template For Emergency Payment Reduction Samples

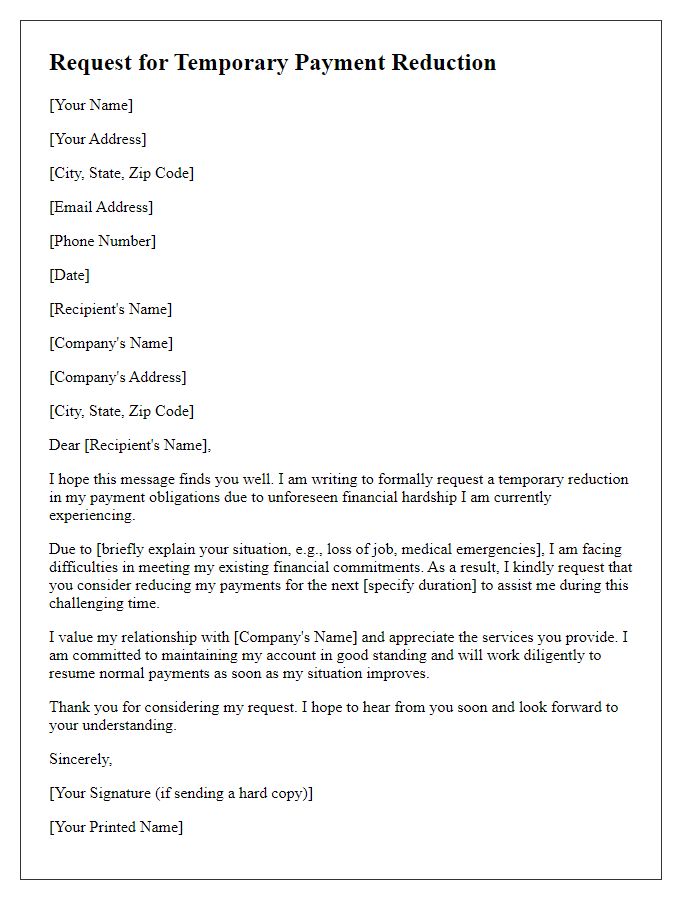

Letter template of request for temporary payment reduction due to financial hardship.

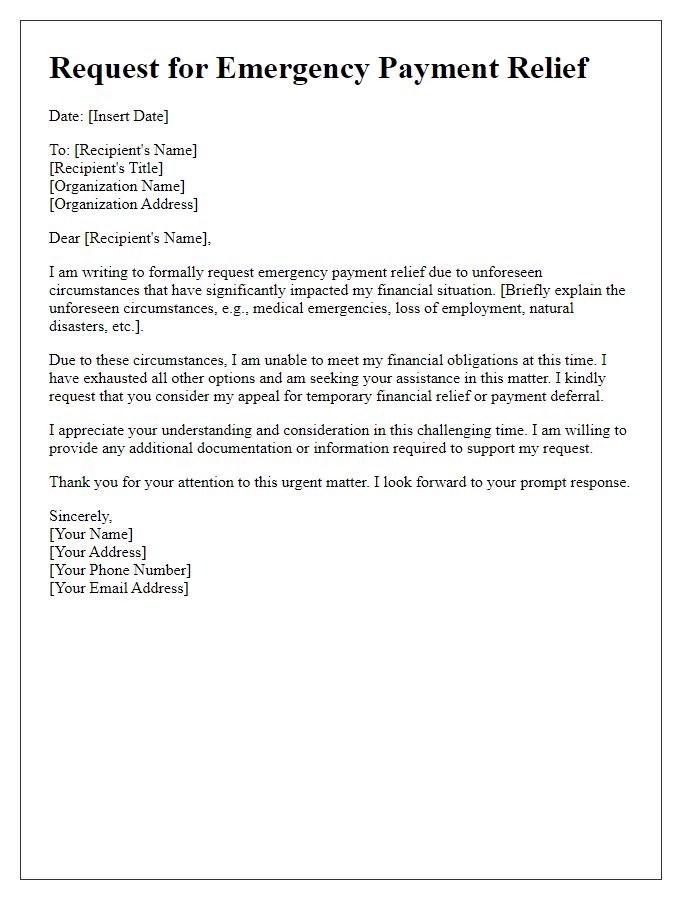

Letter template of appeal for emergency payment relief in light of unforeseen circumstances.

Letter template of notification for temporary adjustment in payment plan because of urgent needs.

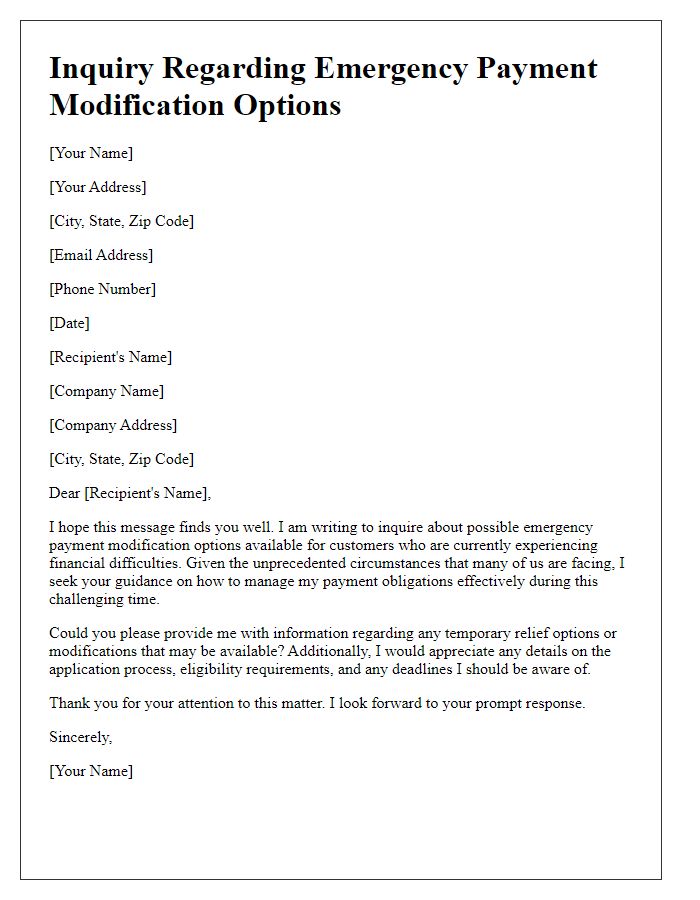

Letter template of inquiry regarding emergency payment modification options for struggling customers.

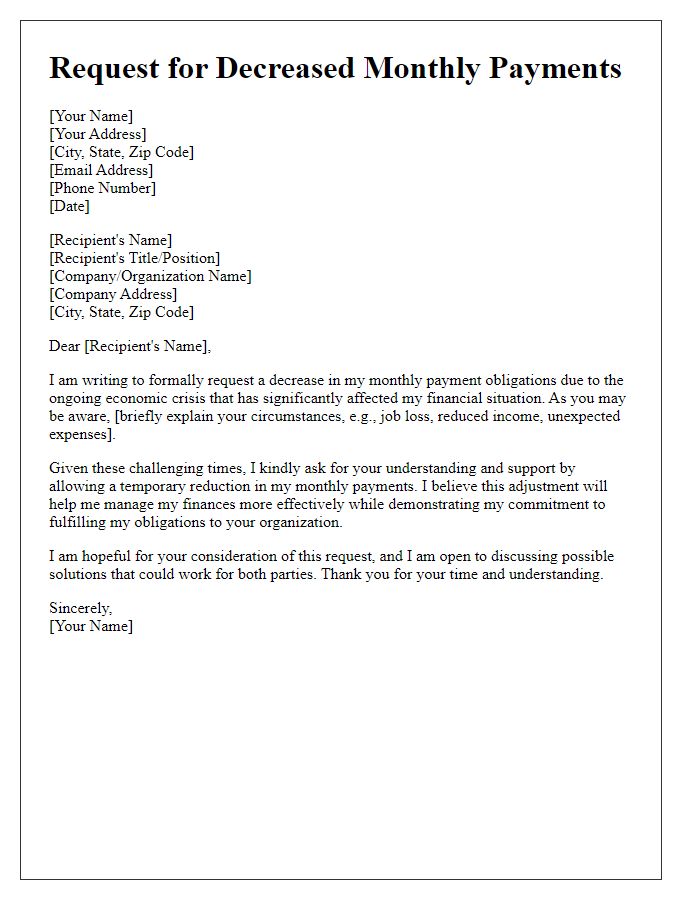

Letter template of formal request for decreased monthly payments during economic crisis.

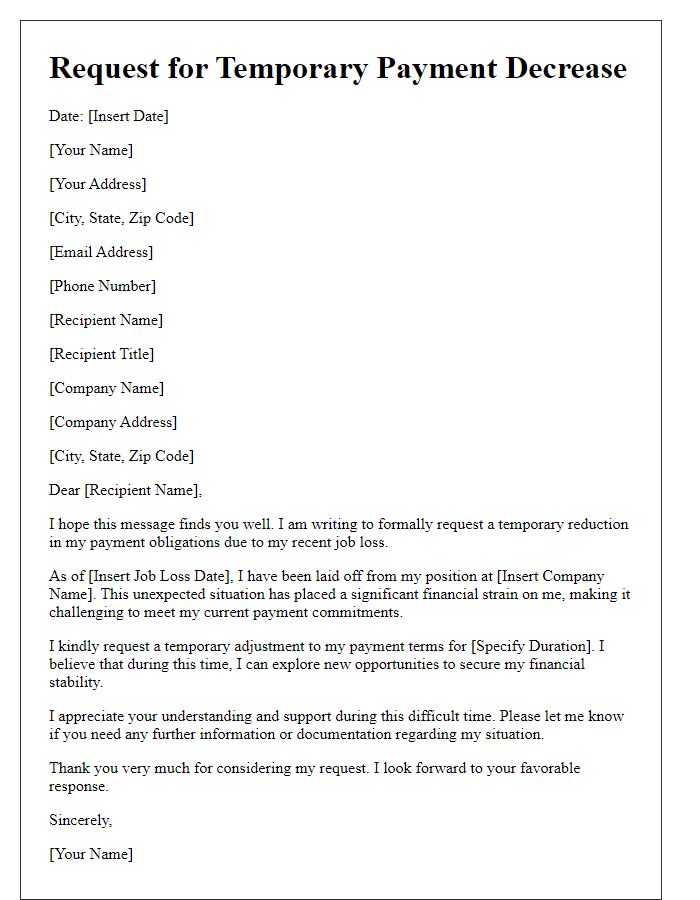

Letter template of explanation for needing a temporary payment decrease due to job loss.

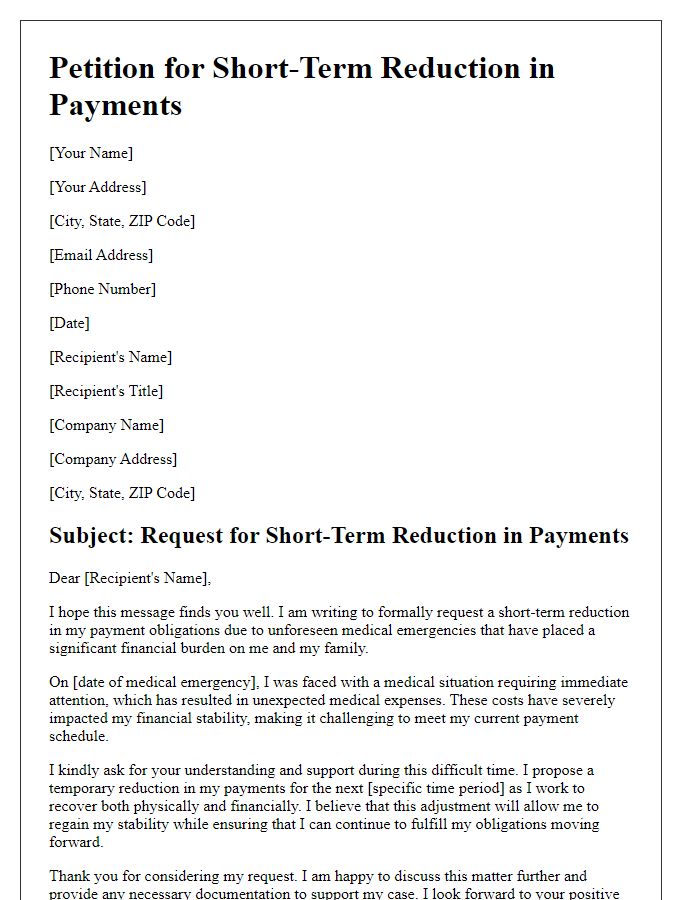

Letter template of petition for short-term reduction in payments due to medical emergencies.

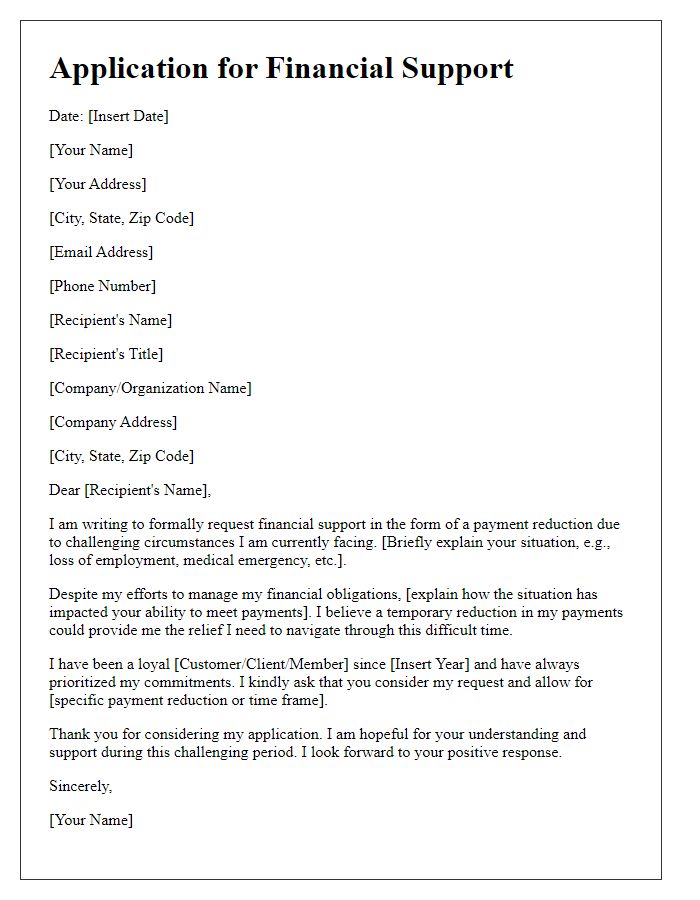

Letter template of application for financial support through payment reduction during challenging times.

Letter template of statement for requesting immediate help with payment adjustments.

Comments