If you've ever experienced the unsettling feeling of identity theft, you know just how important it is to act quickly and assertively. In this article, we'll guide you through the essential steps to reporting identity theft effectively, ensuring that your personal information is well-protected and the culprits are held accountable. We'll also provide a sample letter template that you can use to communicate with authorities and financial institutions. So let's dive in and empower you to take control of your identityâread on for more!

Personal Information Details

Identity theft occurs when an individual's personal information, such as Social Security number, bank account details, or credit card information, is used fraudulently by another person. Victims may experience significant financial loss, damage to credit scores, and emotional distress. It's crucial to collect all relevant documentation, including police reports, credit reports from major agencies like Experian and Equifax, and any communication with financial institutions about unauthorized transactions. Additionally, contacting organizations such as the Federal Trade Commission (FTC) and placing a fraud alert on credit reports helps to prevent further misuse of personal data. Taking swift action can mitigate the impact of identity theft and protect individuals from more extensive fallout.

Incident Description

Identity theft incidents have become increasingly pervasive, with over 1.4 million victims reported in the United States alone in 2020. This form of fraud involves unauthorized use of an individual's personal information, such as Social Security numbers (SSNs), bank account details, and credit card information, to commit financial crimes. Victims often discover the unauthorized activities through monitoring their credit reports from agencies like Experian and Equifax, or through alerts from their banking institutions. Additionally, incidents frequently include fraudulent applications for loans or credit cards, which can severely impact victims' credit scores and financial standing. Law enforcement agencies, including the Federal Trade Commission (FTC), advise victims to report the theft promptly to mitigate further damage and begin the recovery process. Essential documentation, including police reports and identity theft affidavits, plays a critical role in substantiating claims and securing rightful compensation or assistance.

Relevant Dates and Locations

Identity theft incidents can disrupt lives, particularly when personal information is unlawfully accessed, leading to fraudulent activities across various platforms. Notable incidents often arise around key dates, such as when data breaches occur or significant purchases are made, allowing thieves to exploit vulnerable times. Major locations, like New York City or Los Angeles, frequently feature in reports due to higher population density and financial activities, increasing the likelihood of identity theft cases. Establishing a timeline, encompassing when the theft was discovered and any fraudulent transactions was made, assists law enforcement agencies in their investigation, offering crucial evidence against perpetrators who may utilize stolen identities for financial gains.

Attached Supporting Documentation

Identity theft presents significant challenges and legal repercussions for victims. Victims often experience financial loss exceeding $1,700, according to the Federal Trade Commission (FTC). Affected individuals frequently report discrepancies in their credit reports, with an average of 15 fraudulent accounts opened in their names. Key documents to support identity theft claims include police reports (necessary for legal action), bank statements (showing unauthorized transactions), and credit reports (highlighting inaccurate information). Reporting incidents to the credit bureaus (Experian, Equifax, and TransUnion) is crucial, as it helps mitigate further damage to credit scores and prevents future fraud. Legal assistance may also be sought to navigate the complexities arising from identity theft cases.

Request for Specific Actions or Resolution

Identity theft incidents can lead to significant personal and financial distress, affecting victims' credit scores and financial well-being. Individuals may discover unauthorized transactions on bank statements or new accounts opened in their name without consent, typically through credit reports from agencies such as Experian, Equifax, or TransUnion. Reporting the crime promptly to local authorities and relevant institutions (including banks and credit card companies) is crucial to mitigate further damage. Victims often initiate a credit freeze or fraud alert with major credit bureaus to protect against fraudulent activity. Additionally, filing a report with the Federal Trade Commission (FTC) can provide a structured recovery plan, helping victims regain control of their personal information.

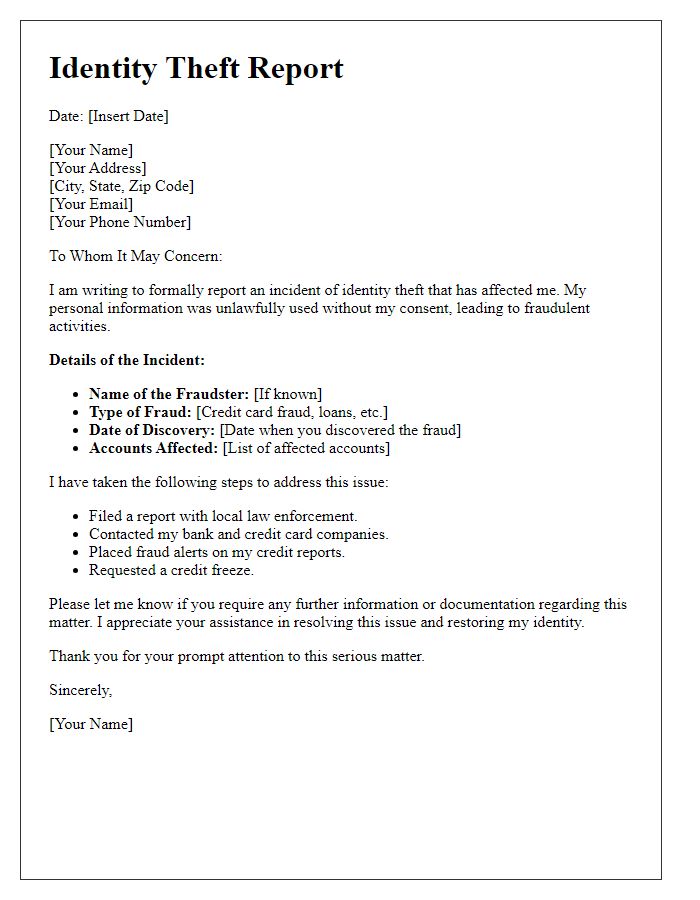

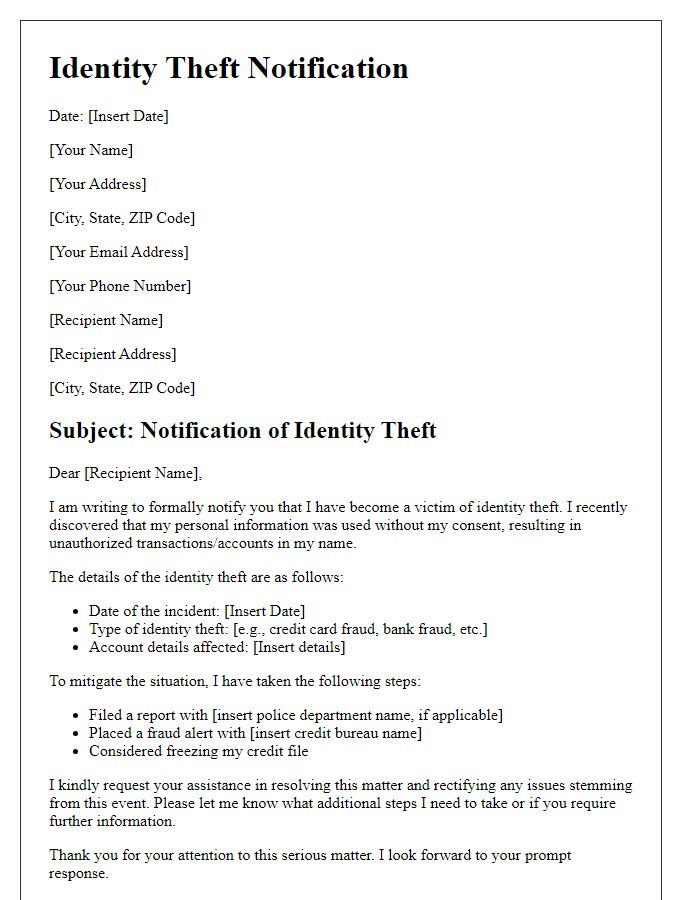

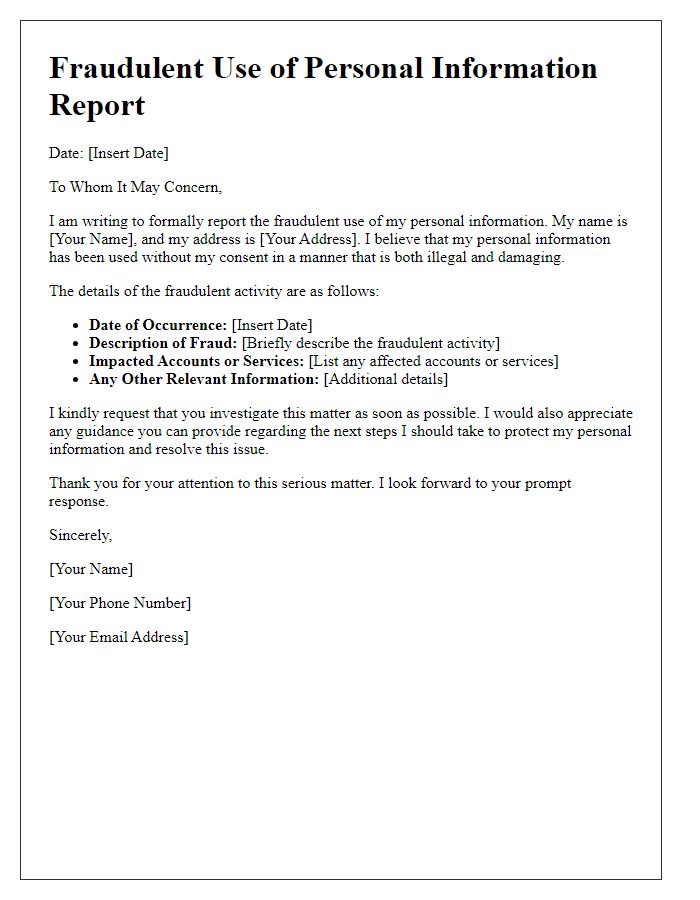

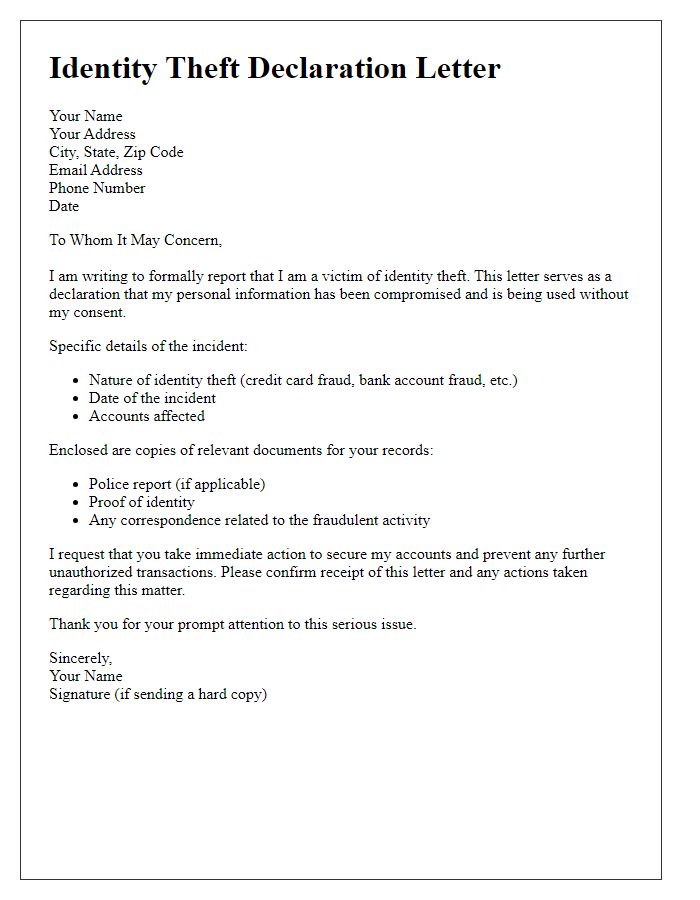

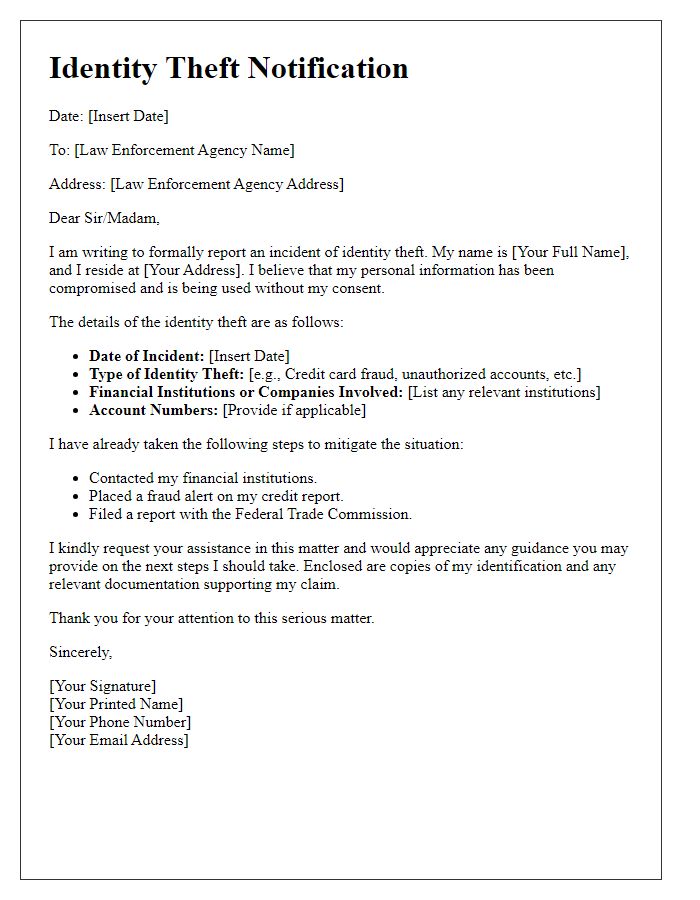

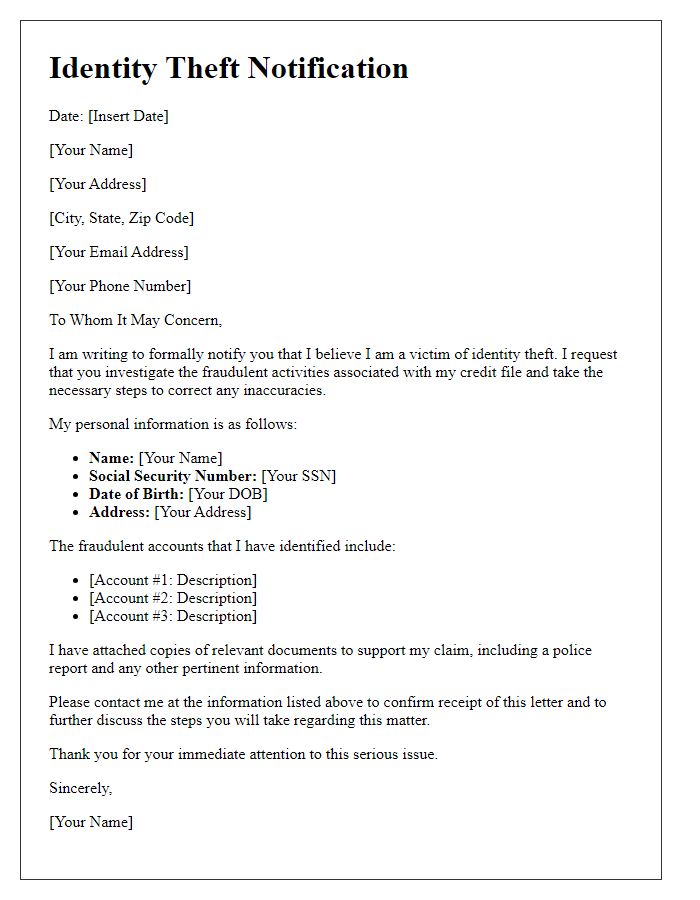

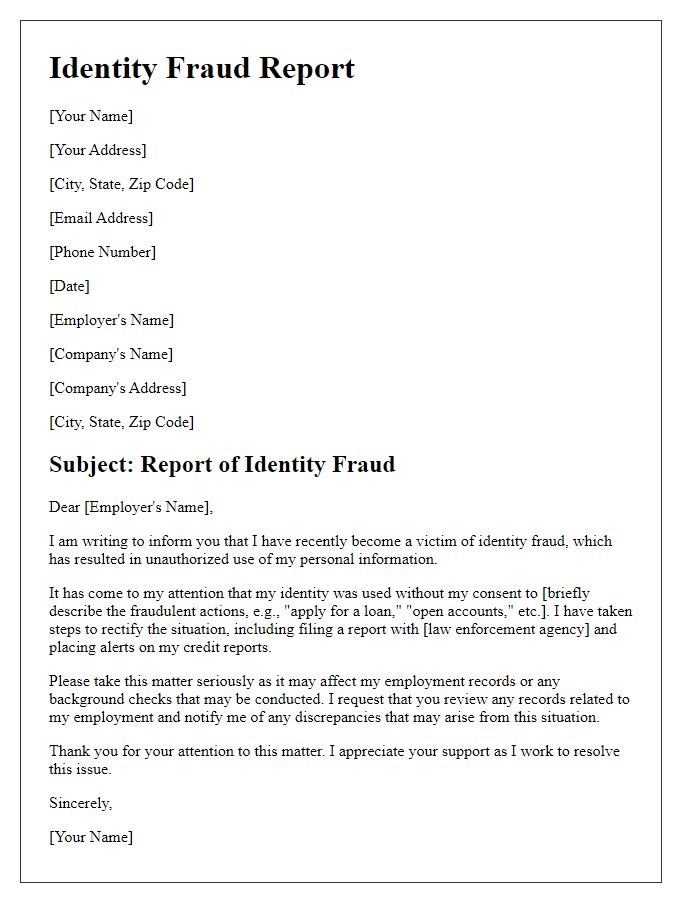

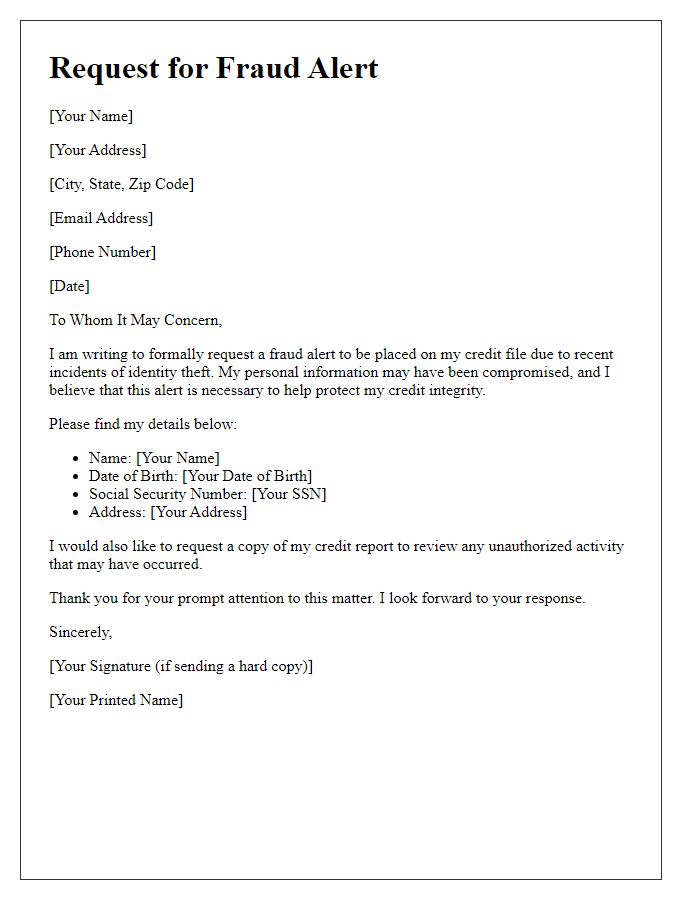

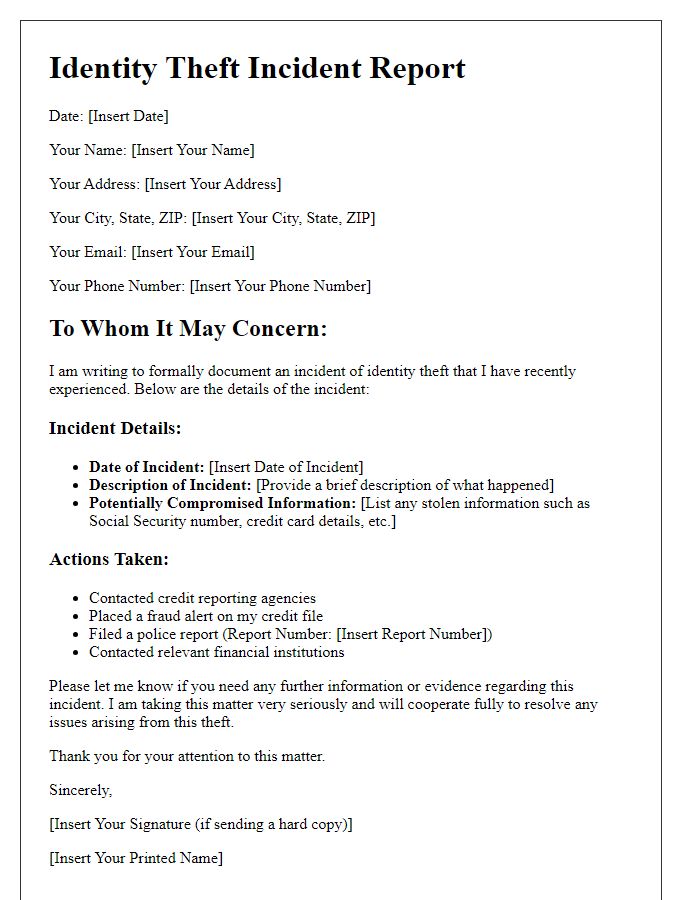

Letter Template For Reporting Identity Theft Samples

Letter template of reporting identity theft to consumer protection agencies

Comments