Are you considering canceling your credit monitoring service? It can feel overwhelming, but taking this step might be just what you need for your financial peace of mind. In this article, we'll guide you through the necessary steps to cancel your service effectively and ensure all your information is handled properly. So grab a cup of coffee and keep reading to discover how to navigate this process seamlessly!

Account Information

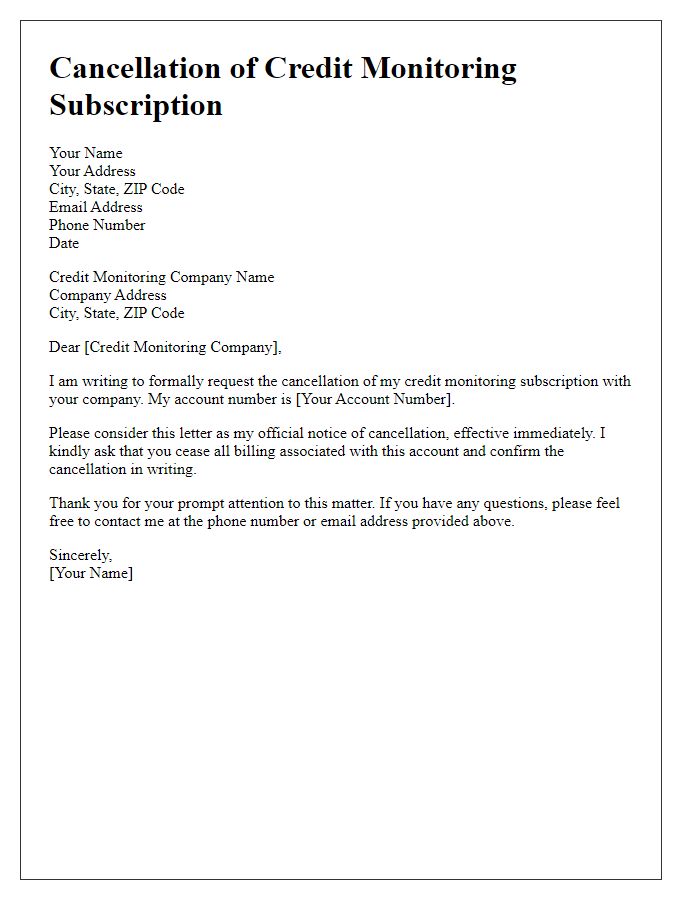

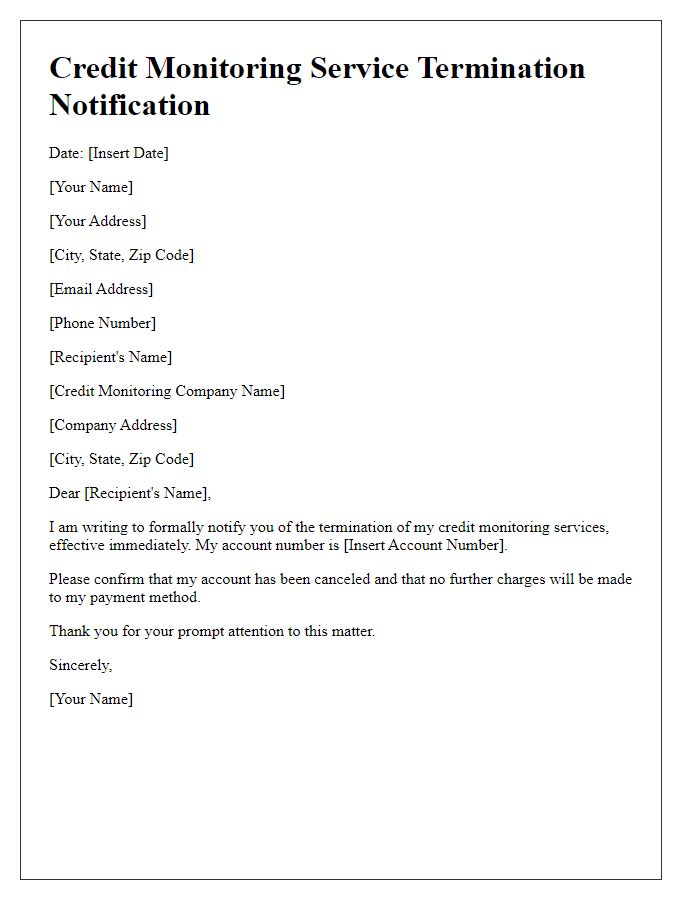

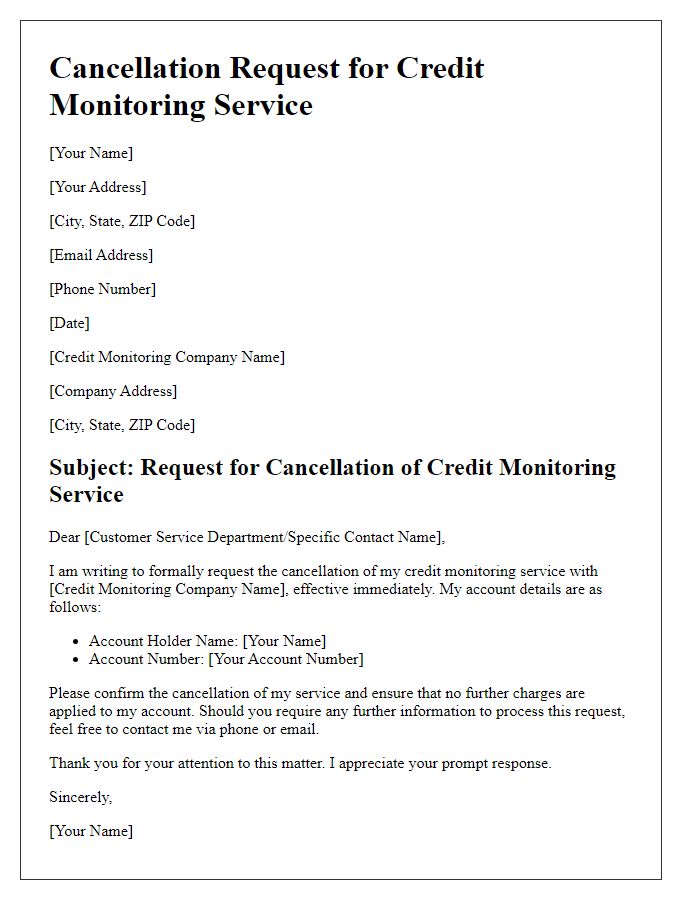

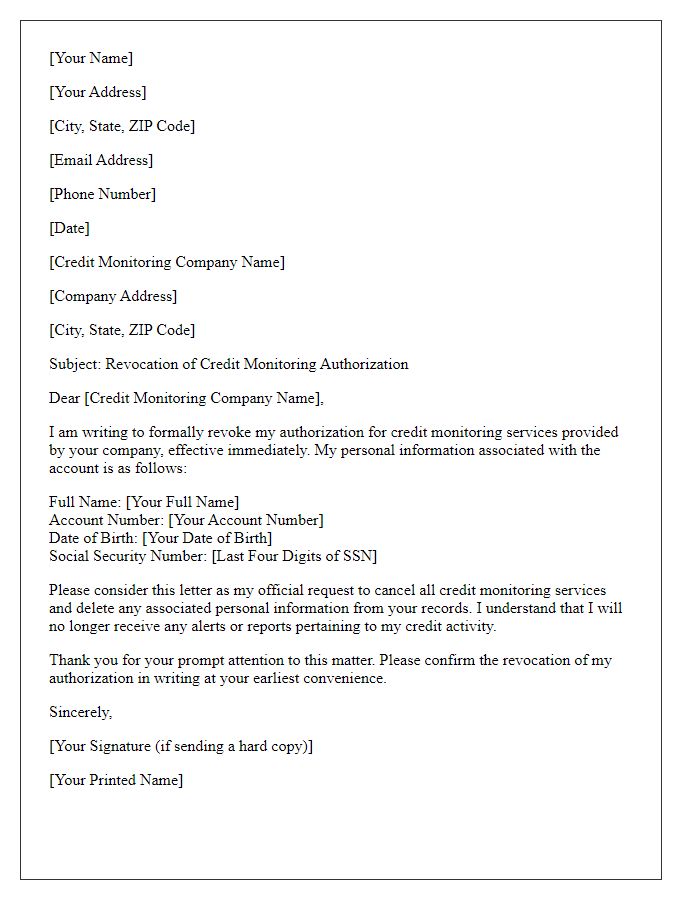

To cancel a credit monitoring service, users need to provide specific account information that usually includes their name, account number, and the name of the credit monitoring service provider. It is crucial to include a detailed request stating the intention to cancel the service. Time-sensitive considerations, such as the service provider's cancellation policy, must be noted to avoid any delays or unintended charges. Users should also check the required method of cancellation, whether it's through online requests, phone calls, or written notice, to ensure compliance with the provider's procedure. Any additional identification information may be required to confirm the account holder's identity, helping to secure a smooth cancellation process.

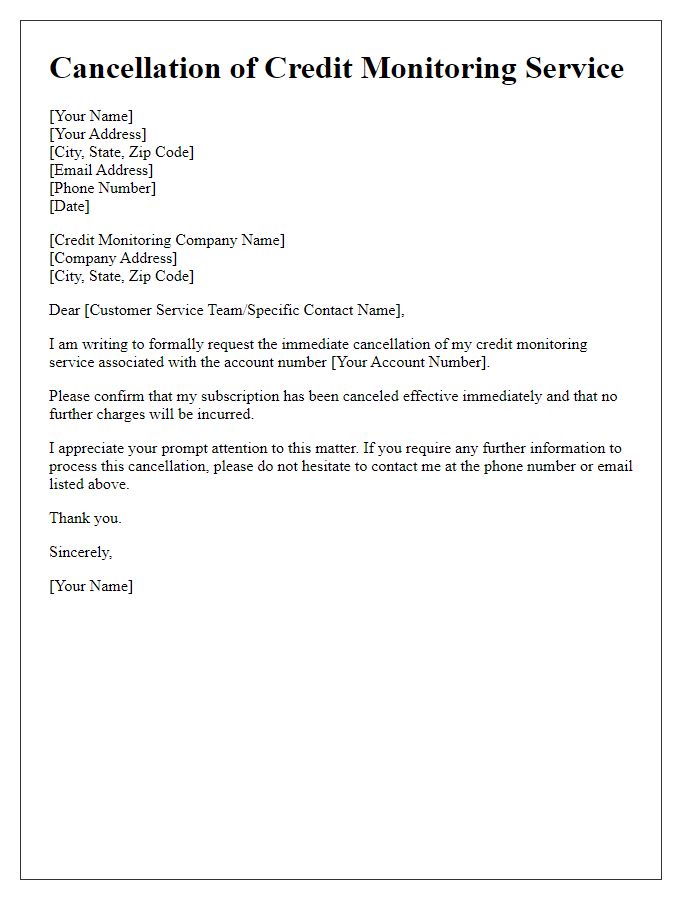

Cancellation Request Statement

Credit monitoring services, such as those provided by Experian and Equifax, require careful attention when considering cancellation. To ensure a smooth process, users typically send a cancellation request statement. This statement should include the account number associated with the subscription, the full name of the individual, and the date of the request. Services often have policies detailing necessary notice periods, often ranging from 30 to 60 days. Additionally, customers should reference the specific monitoring plan (e.g., basic or premium) and any promotional offers utilized during sign-up. Users may also wish to confirm if there are any cancellation fees, as some services impose a penalty for early termination. Providing a clear request can facilitate a prompt and accurate cancellation process.

Effective Cancellation Date

Credit monitoring services provide essential protection against identity theft and credit fraud, often involving monthly fees ranging from $10 to $40. Many popular services, including Experian, TransUnion, and Equifax, require a cancellation notice at least 30 days prior to the next billing cycle. To effectively cancel a subscription, users should provide specific details such as account number, their full name associated with the account, and the effective cancellation date, which is the day they wish the service to cease. Sending this information via certified mail ensures confirmation of the cancellation request, protecting users from unwanted charges.

Contact Information for Further Communication

Credit monitoring services provide users with real-time alerts about changes to their credit reports, helping them detect fraud or identity theft. Customers wishing to cancel these services must consider key factors such as account terms (including penalties for early termination), specific cancellation procedures outlined in user agreements, and contact information for customer service representatives who can assist with the process. Many companies, like Experian and TransUnion, require formal communication such as written letters or online submissions for cancellation. Cancellation confirmation might take a few business days, and it is advisable to monitor the credit report closely after cancellation for any unexpected activities or discrepancies.

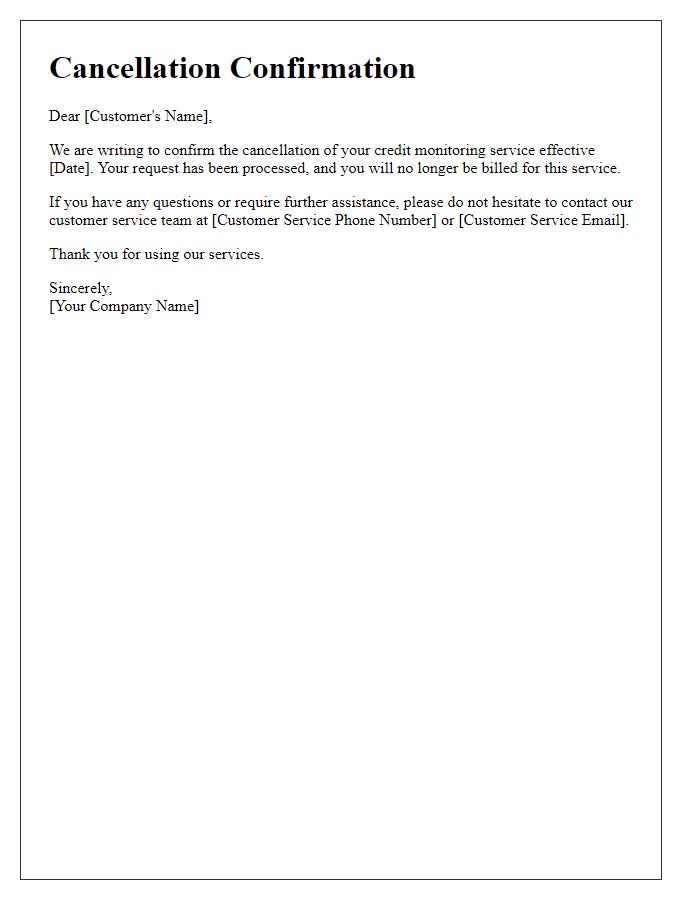

Request for Confirmation of Cancellation

Credit monitoring services provide individuals with regular updates about changes to their credit report and alert them to potential identity theft threats. Customers often subscribe to services such as Experian, TransUnion, or Equifax for enhanced financial security. However, many may choose to cancel these services due to changes in financial priorities or satisfaction levels. A formal confirmation of cancellation is important, particularly for reference during disputes about billing or future services. It is advisable for the customer to specify their account number and the date of cancellation request. Providing clear and concise information can facilitate a smooth cancellation process and ensure proper documentation of the cancellation for record-keeping purposes.

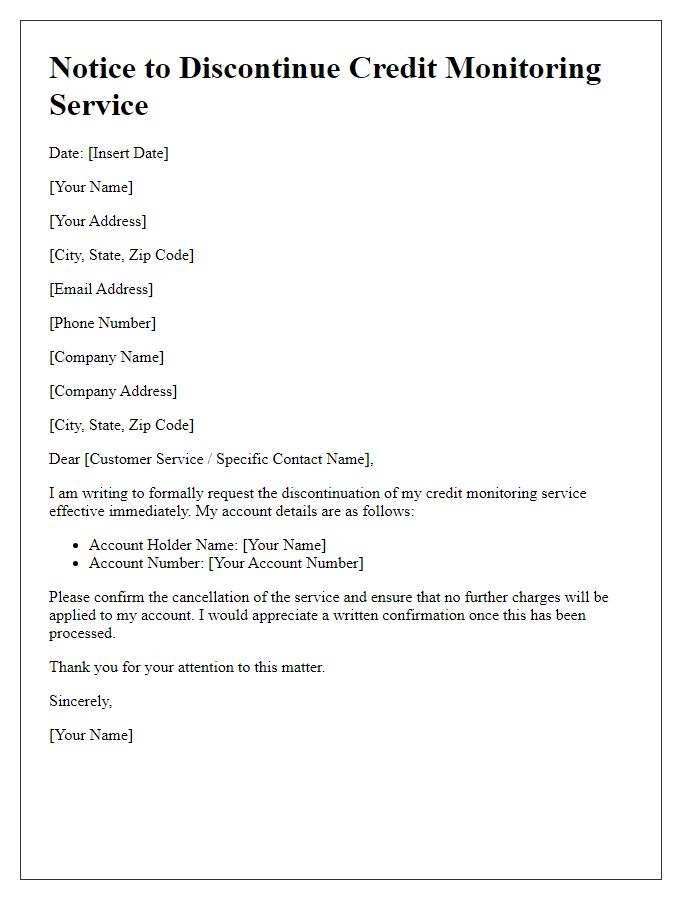

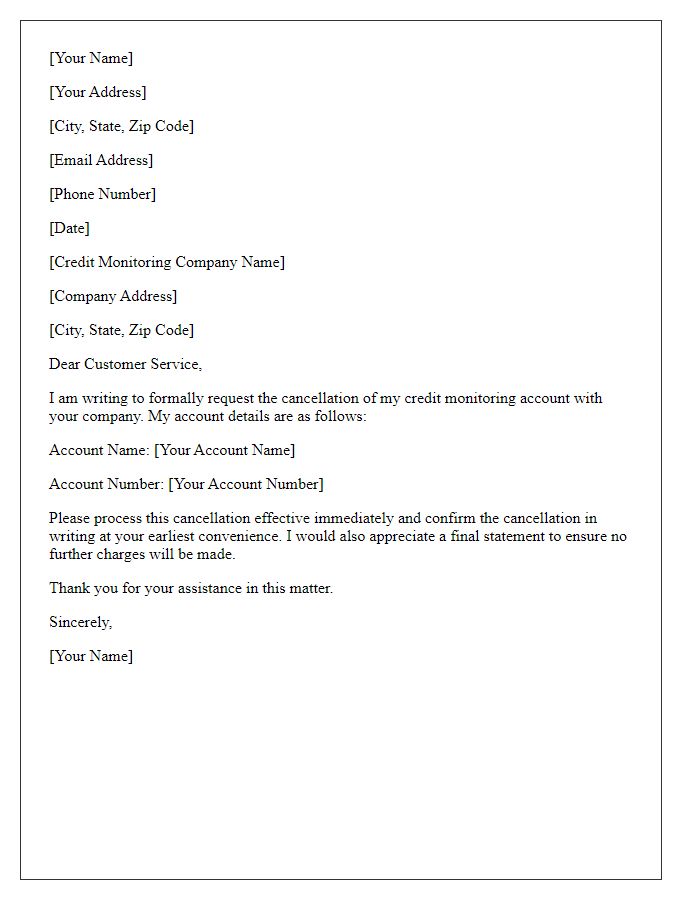

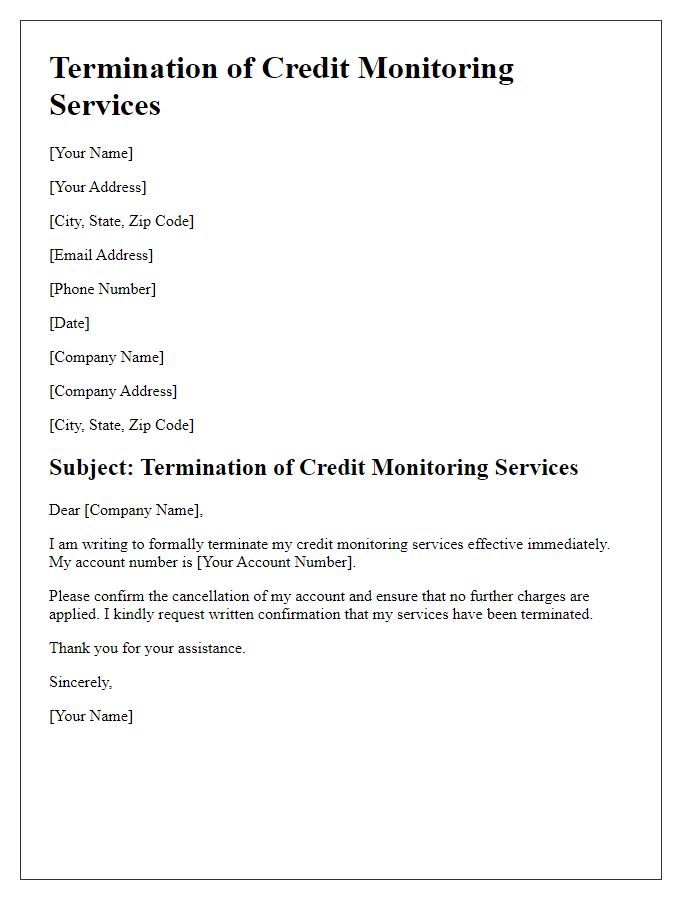

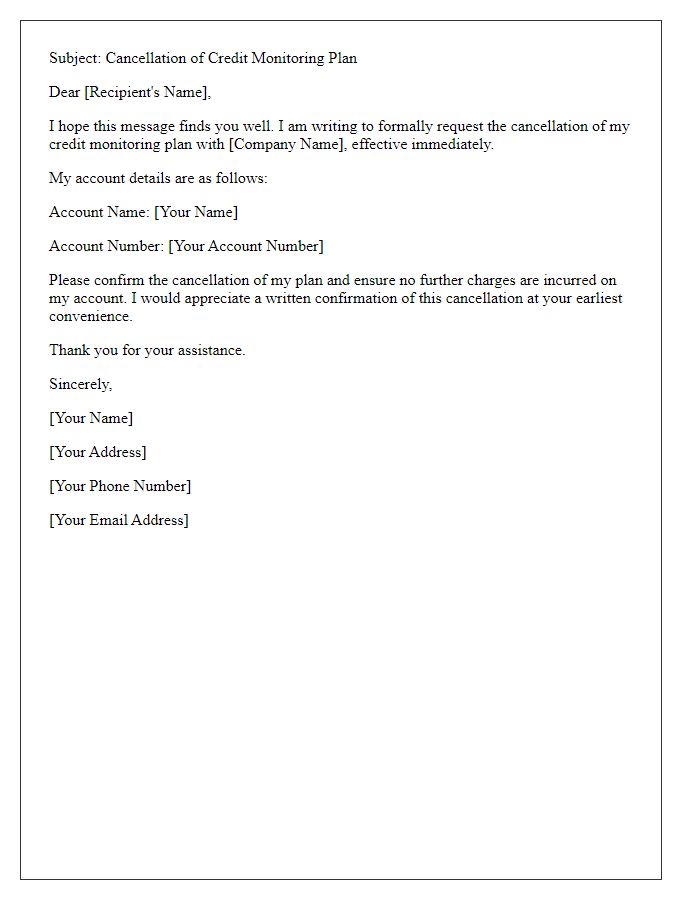

Letter Template For Credit Monitoring Cancellation Samples

Letter template of formal cancellation of credit monitoring subscription

Letter template of written notification for credit monitoring termination

Comments