Are you feeling overwhelmed by your financial situation and looking for some guidance? We understand that navigating credit assistance programs can be daunting, but it's a vital step toward regaining control of your finances. In this article, we'll provide you with a comprehensive letter template specifically designed for credit assistance program applications, ensuring you present your case effectively. So, let's dive in and empower you to take the first step toward financial freedom!

Applicant's Personal Information

A credit assistance program application requires specific personal information to evaluate eligibility. Essential data includes full name (first, middle, last) to accurately identify the applicant, address (street, city, state, zip code) for verification and correspondence, date of birth (MM/DD/YYYY) to confirm age eligibility, and Social Security Number (SSN) for credit history assessment. Contact information should include phone number (cell and home) and email address for communication purposes. Employment details, such as employer name, job title, and monthly income, are necessary to determine financial stability, while previous addresses may be required if the applicant has moved within the past five years. Lastly, additional documentation may be requested to provide comprehensive insight into the applicant's financial history and current situation.

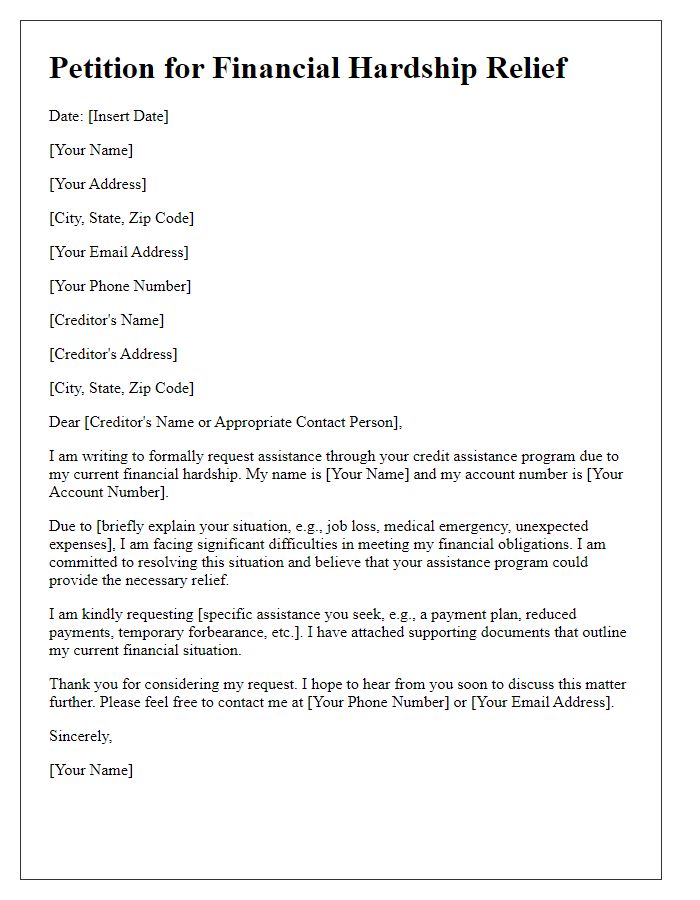

Financial Situation and Hardship Explanation

The financial situation of many individuals in today's economy often leads to hardships requiring assistance programs. Economic downturns, like the one caused by the COVID-19 pandemic, have resulted in increased unemployment rates, reaching as high as 14.8% in April 2020 across the United States. Families faced with unexpected medical emergencies, such as hospitalizations due to chronic illnesses or accidents, can quickly find themselves in financial distress. Monthly expenses, including housing payments averaging $1,500 in metropolitan areas, food costs, and childcare expenses, can become unmanageable. Additionally, individuals may struggle with rising debt levels, as the average American household owes approximately $6,000 in credit card debt. A credit assistance program can provide crucial support, helping alleviate financial burdens and facilitate a path towards financial stability, especially in the wake of loss of income or mounting expenses.

Requested Assistance Details

The requested assistance details for credit programs, including specifics on loan amounts, interest rates, and repayment terms, are crucial for potential applicants. Individuals seeking financial aid generally inquire about programs offering reduced interest rates, typically ranging between 2% and 5%, to alleviate the burden of monthly payments. Eligibility requirements, such as a minimum credit score of 620 or proof of income, can greatly influence the approval process. Geographic limitations, like residence in specific states such as California or New York, may also apply. In addition, understanding the duration of assistance, which can span from three months to several years, is essential for effective financial planning and ensuring sustainable repayment strategies.

Supporting Financial Documents

Supporting financial documents are essential for the successful application to credit assistance programs, encompassing various forms that substantiate an applicant's financial situation. Tax returns, usually for the past two years, reflect income stability and are crucial for lenders to assess repayment capability. Pay stubs from recent employment (typically last month) confirm the current earning potential of the applicant. Bank statements for the last three months offer insights into spending habits and available funds, indicating financial health. Additionally, any existing debts, represented by loan documents or statements, provide a comprehensive profile of the applicant's liabilities. Lastly, a list of assets, including property or investments, bolsters the application by showing overall net worth and financial resilience, enhancing the chances of receiving the desired support.

Contact Information and Acknowledgment

The credit assistance program application requires accurate contact information, such as the applicant's full name, address, phone number, and email, ensuring efficient communication. Acknowledgment of program terms should include understanding of eligibility criteria, documentation requirements, and potential impacts on credit scores. Personal identification, like Social Security numbers or tax identification numbers, is also crucial for validating identity and processing the application. Awareness of the expected timeframe for application processing, typically ranging from two to six weeks, can influence the applicant's financial planning.

Letter Template For Credit Assistance Program Application Samples

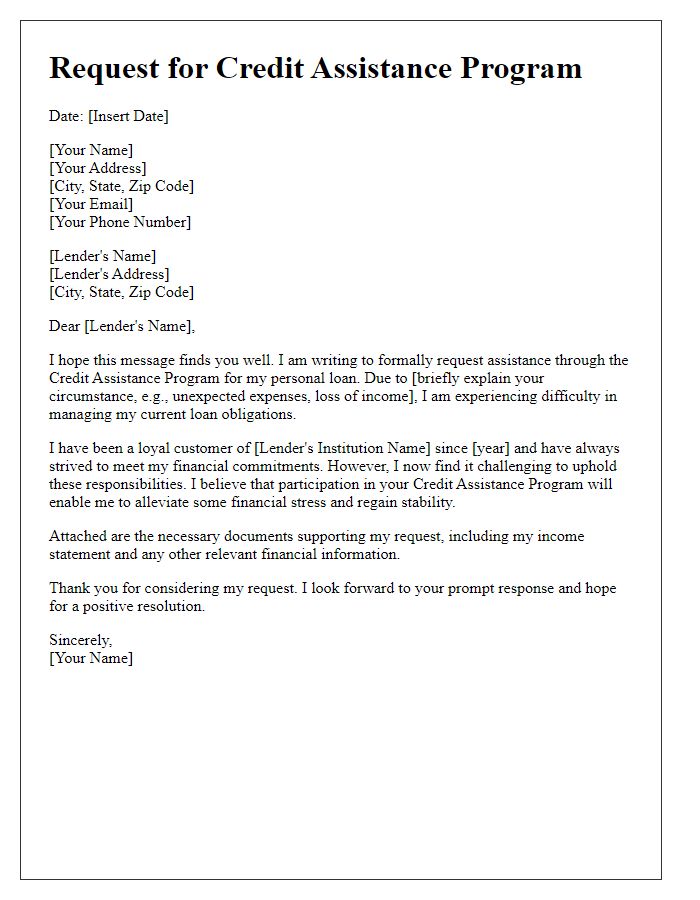

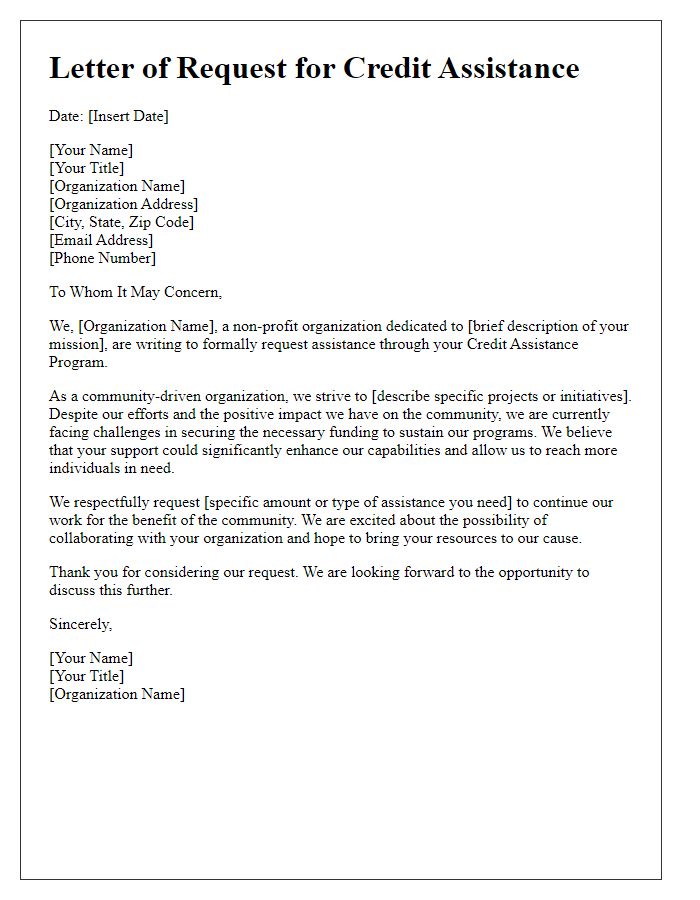

Letter template of credit assistance program request for personal loans.

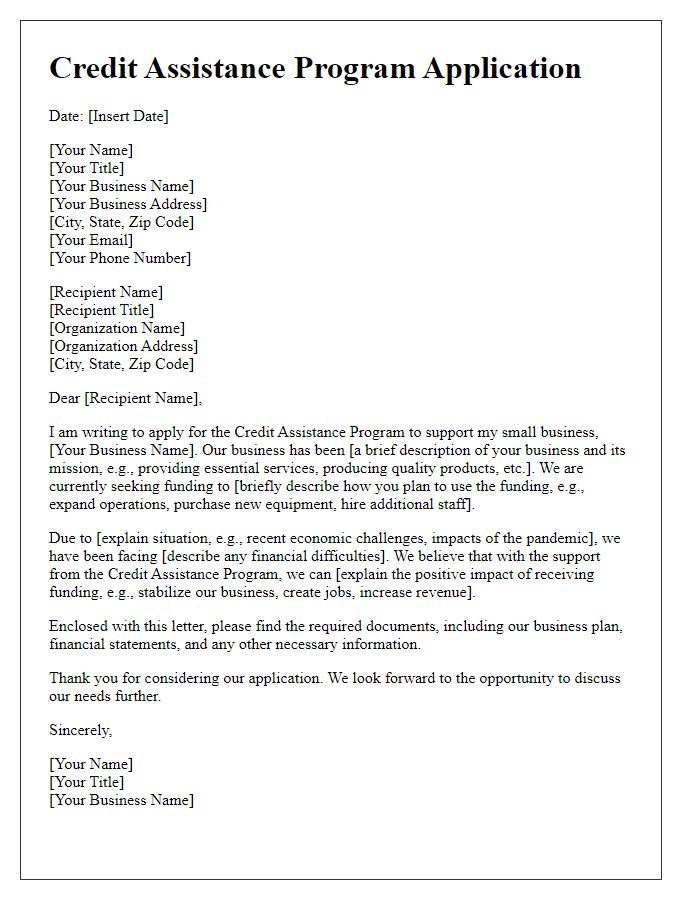

Letter template of credit assistance program application for small business funding.

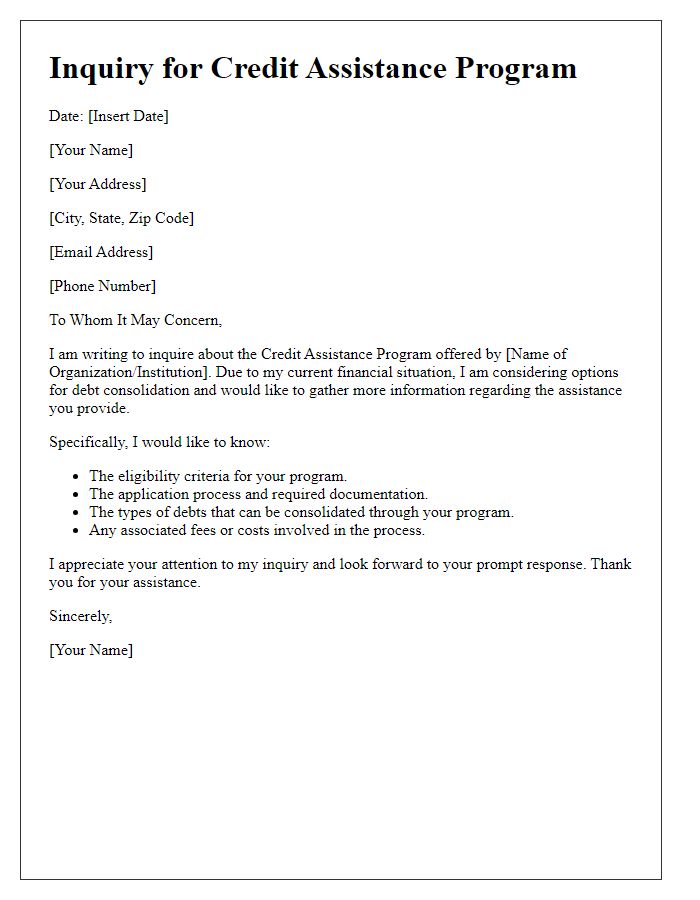

Letter template of credit assistance program inquiry for debt consolidation.

Letter template of credit assistance program petition for mortgage assistance.

Letter template of credit assistance program submission for educational loans.

Letter template of credit assistance program application for emergency funds.

Letter template of credit assistance program request for auto loan support.

Letter template of credit assistance program need for non-profit organization funding.

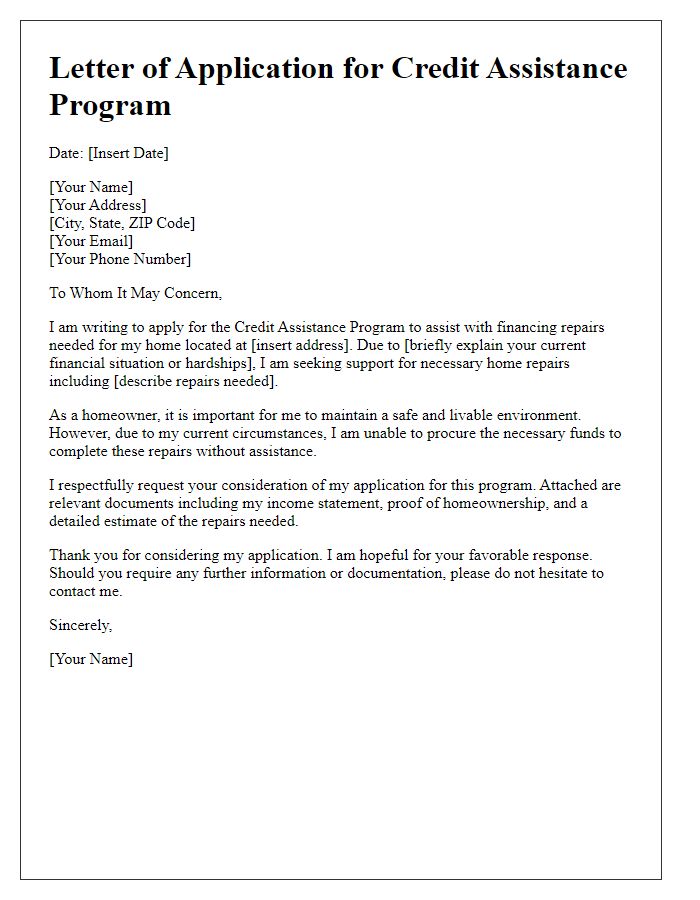

Letter template of credit assistance program application for home repair financing.

Comments