Are you feeling burdened by high finance charges on your credit accounts? You're not aloneâmany people are in the same boat, looking for ways to ease the financial strain. In this article, we'll explore how to effectively negotiate lower finance charges with your creditors, making your financial journey a bit easier. Read on to discover practical tips and strategies that can help you save money and reduce stress!

Account and Personal Details

Negotiating lower finance charges can significantly benefit consumers managing credit accounts. Credit card issuers, such as Visa and MasterCard, often have standard interest rates ranging from 15% to 30%. These rates apply to balances carried over month-to-month on accounts, affecting overall debt. Personal details, including a credit score (typically ranging from 300 to 850) and payment history, play vital roles in negotiation. Consumers with a solid payment track record may possess leverage in discussions. Timing is crucial; contacting the issuer during promotional periods, like holiday seasons or after account anniversaries, can yield positive responses. Implementing clear communication strategies and providing rationale, such as financial hardship or competitive offers from other institutions, can enhance negotiation outcomes.

Specific Charge Details

Finance charges associated with credit card accounts can significantly impact overall debt management. For instance, high annual percentage rates (APR) often hover around 20% across various credit card issuers such as Visa and MasterCard. Negotiating these charges may reduce total repayment amounts, particularly for outstanding balances exceeding $1,000. Key factors include payment history over the last six months, which can demonstrate reliability, and the consumer's credit score, often calculated by agencies like FICO, potentially affecting negotiation outcomes. External economic conditions, such as changes in the Federal Reserve's interest rates, can also influence lenders' willingness to lower finance charges.

Reason for Request

High finance charges on accounts can significantly impact monthly budgeting strategies for individuals and families. For instance, an annual percentage rate (APR) of 24% on a credit card balance of $5,000 can lead to over $1,000 in interest charges within a year. Rising inflation rates, currently at 3.7% in October 2023, exacerbate financial strain, making lower finance charges a critical request. Furthermore, maintaining a good payment history with timely payments can demonstrate reliability and prompt lenders to consider reducing rates. This proactive approach stands to benefit both the debtor and the financial institution, fostering a healthier long-term relationship.

Proposed Solutions or Alternatives

Negotiating lower finance charges, especially on significant debts or balances, can lead to substantial savings. When approaching financial institutions, individuals may propose alternatives such as restructuring payment plans, possibly considering a hardship plan or seeking promotional interest rates which can temporarily reduce charges. For instance, a borrower with a credit card balance of $5,000 might suggest a lower annual percentage rate (APR) of 10% instead of the existing 20%, translating into a savings of $500 annually. Additionally, an individual could inquire about loyalty programs or direct debits that could yield discounts on finance charges, thereby improving repayment terms while maintaining a positive relationship with the lender.

Appreciation and Follow-up Plan

High finance charges can significantly impact monthly budgets for credit card users. Negotiating lower charges, such as annual percentage rates (APR), provides relief for individuals managing balances. Recognizing outstanding payment history, such as consistently paying on time for the past two years, can strengthen requests for lower rates. A follow-up plan enables a structured approach; contacting customer service representatives from the financial institution (e.g., Bank of America, Chase) within a specific time frame, like two weeks, ensures timely communication. Documented conversations can bolster negotiation efforts and maintain accountability, fostering a solid relationship with the lender while aiming for more manageable financial terms.

Letter Template For Negotiating Lower Finance Charges Samples

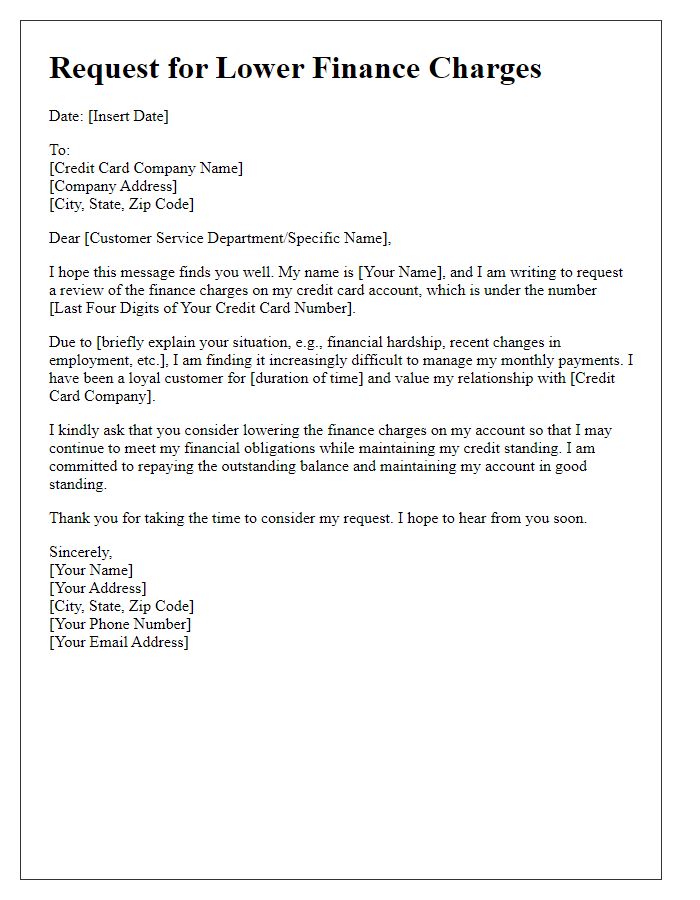

Letter template of request for lower finance charges on credit card account.

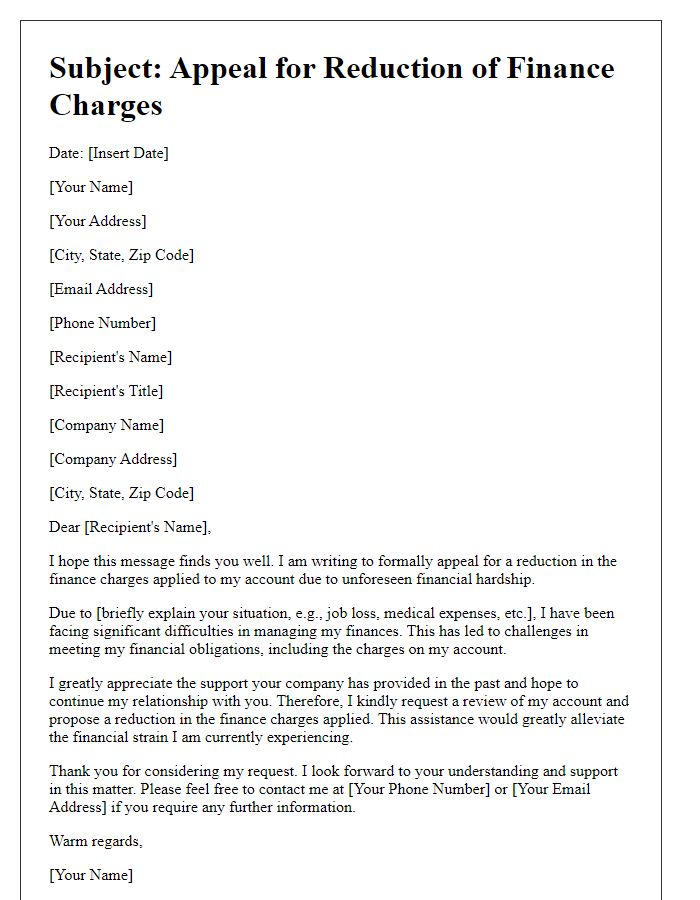

Letter template of appeal for reduced finance charges due to financial hardship.

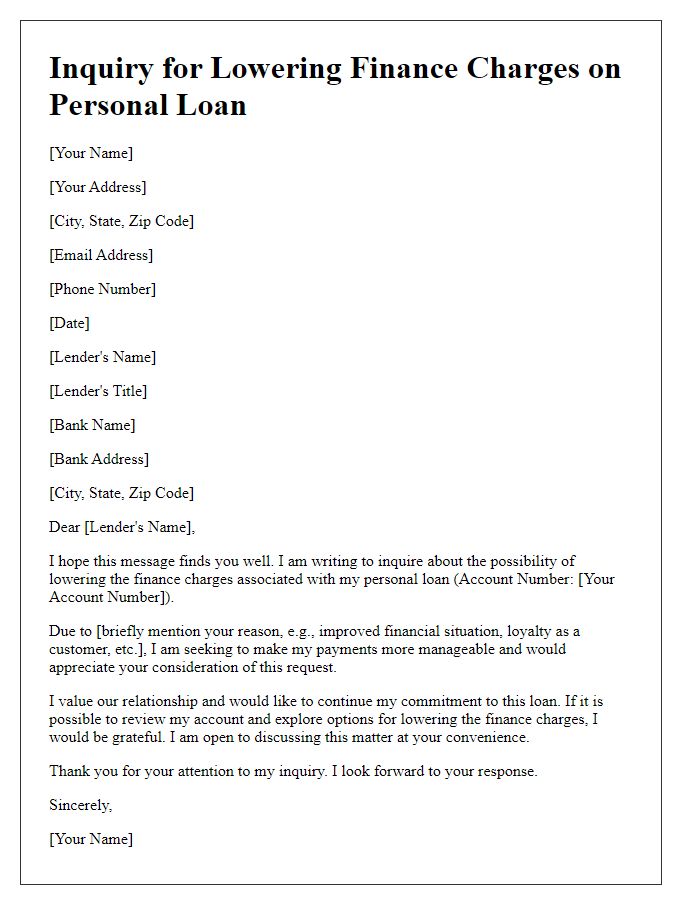

Letter template of inquiry for lowering finance charges on personal loan.

Letter template of negotiation for decreased finance charges for retail card.

Letter template of formal request for adjustment of finance charges on auto loan.

Letter template of demand for reconsideration of finance charges on mortgage.

Letter template of petition for lower finance charges based on loyalty to the company.

Letter template of follow-up for previously discussed reduction of finance charges.

Letter template of proposal for a more favorable finance charge structure.

Comments