Are you struggling with an inaccurate credit inquiry on your report? You're not alone, as many people face challenges with their credit history that can impact their financial health. In this article, we'll guide you through crafting a compelling letter template for disputing a credit inquiry, ensuring you have the tools to take control of your financial narrative. Let's dive in and explore how you can effectively address this issue!

Clear and Concise Subject Line

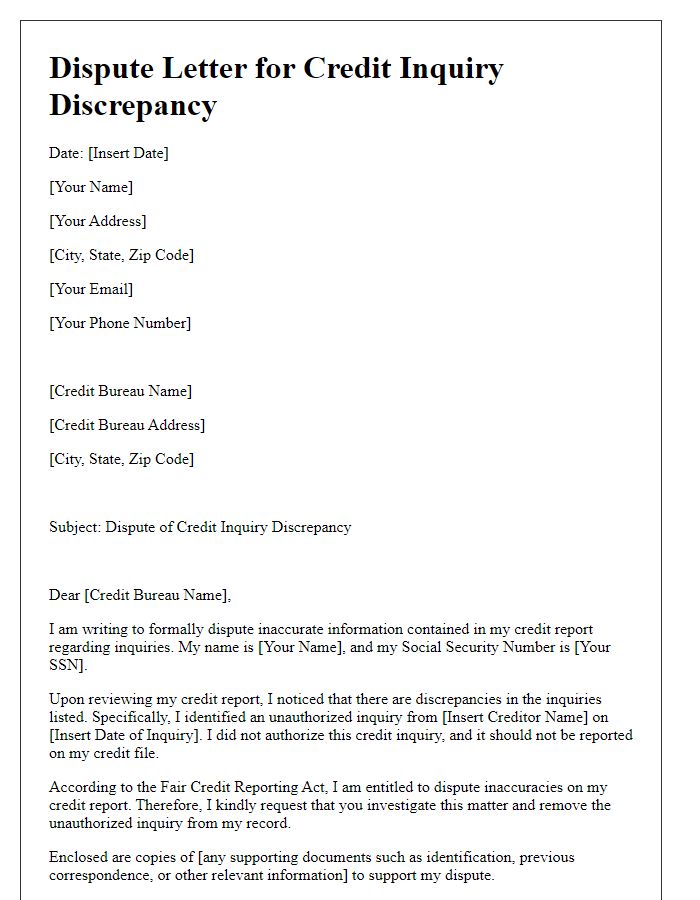

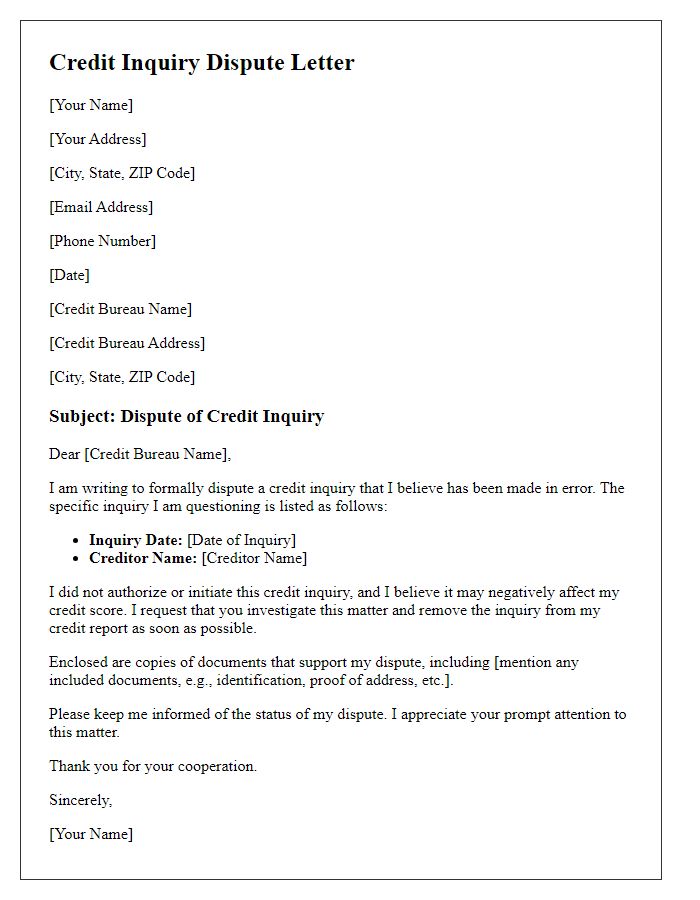

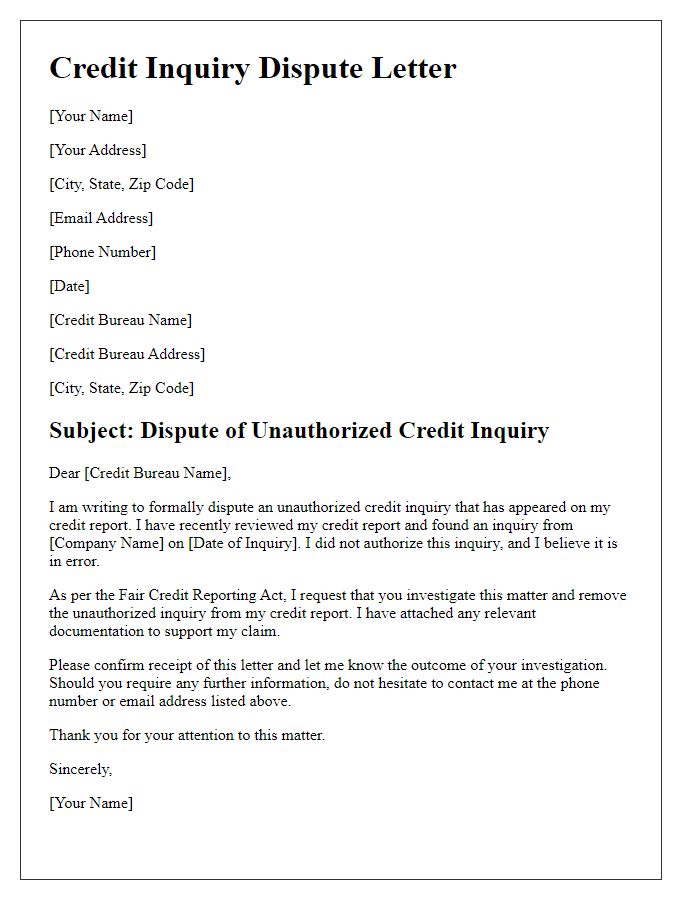

Credit inquiry disputes can arise when individuals find unauthorized or incorrect reports on their credit history. These inquiries can significantly impact credit scores, potentially affecting loan eligibility or interest rates. Thorough documentation (including personal identification numbers like Social Security Number) is essential to substantiate claims. The Fair Credit Reporting Act (FCRA) legislates the accuracy of credit information, ensuring that consumers have the right to dispute discrepancies. Financial institutions (like credit bureaus Experian, TransUnion, and Equifax) are required to investigate disputes within 30 days. Promptly addressing inquiries ensures protection of consumer rights and stability of creditworthiness.

Accurate Personal Information

Accurate personal information plays a crucial role in maintaining a positive credit score and ensuring fair access to financial services. Errors or discrepancies in personal details such as names, addresses, or Social Security Numbers can lead to erroneous credit inquiries from lending institutions. Inaccurate information can stem from various sources, including previous addresses or clerical errors during data entry by credit bureaus such as Experian, TransUnion, or Equifax. These inaccuracies can result in unfavorable loan terms or denials. Consumers are encouraged to regularly review their credit reports, ensuring that all personal information is precise and up-to-date to mitigate potential issues with credit approval or disputes.

Detailed Account Information

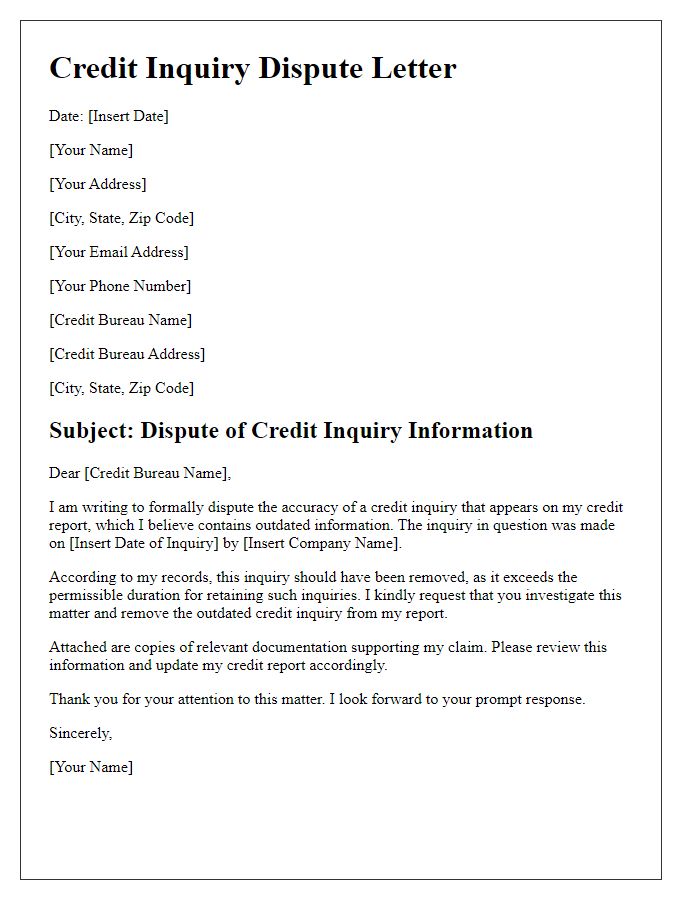

Disputing a credit inquiry requires comprehensive information for clarity and accuracy. The credit report, typically generated by agencies like Experian, Equifax, or TransUnion, includes account details that may warrant a dispute. Key information such as inquiry date (e.g., January 15, 2023), inquiry type (hard or soft), and the creditor's name (for instance, ABC Bank), is essential. The dispute letter should clearly indicate the specific account number (123456789), type of inquiry (e.g., unauthorized, inaccurate), and relevant personal information, including full name, address, and social security number (with parts redacted for privacy). Failing to validate accurate inquiries can negatively impact one's credit score, as inquiries may remain on a report for up to two years. Promptly addressing these discrepancies is crucial for maintaining financial health and credibility.

Specific Dispute Explanation

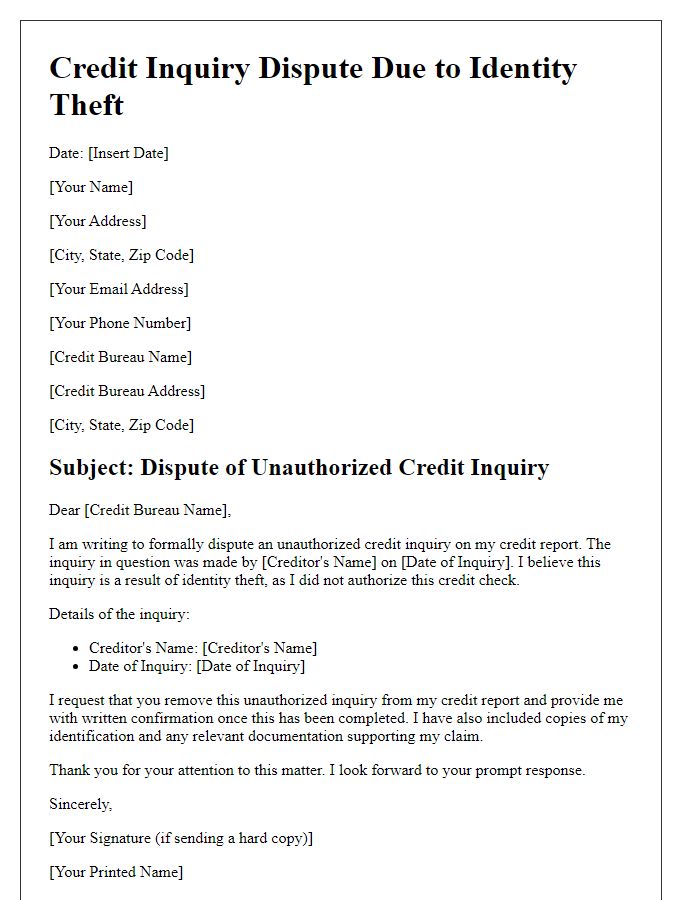

A credit inquiry dispute can arise from inaccuracies in the credit report. A hard inquiry, which occurs when a lender checks your credit for lending purposes, may be incorrect or unauthorized, potentially impacting credit scores. For instance, an inquiry conducted by a financial institution, such as Bank of America, without your consent can lead to a decrease in your credit score, possibly as much as 5 points. Resolving such disputes typically involves communication with credit bureaus like Experian or TransUnion, providing evidence of unauthorized inquiries. Maintaining accurate records of disputes, including dates and relevant correspondence, is crucial for ensuring fair credit evaluation during future lending processes.

Supporting Documentation Attached

A credit inquiry dispute involves a consumer challenging an inaccurate or unauthorized credit check reported by credit bureaus such as Experian, Equifax, or TransUnion. Disputes typically arise when individuals notice unfamiliar inquiries on their credit reports, potentially impacting their credit scores. Supporting documentation, such as a driver's license copy or bank statements, validates the individual's identity and supports their claims. The Fair Credit Reporting Act outlines the rights consumers hold during this process. Addressing the dispute may take 30 days, during which the credit reporting agency investigates the claimed inaccuracies.

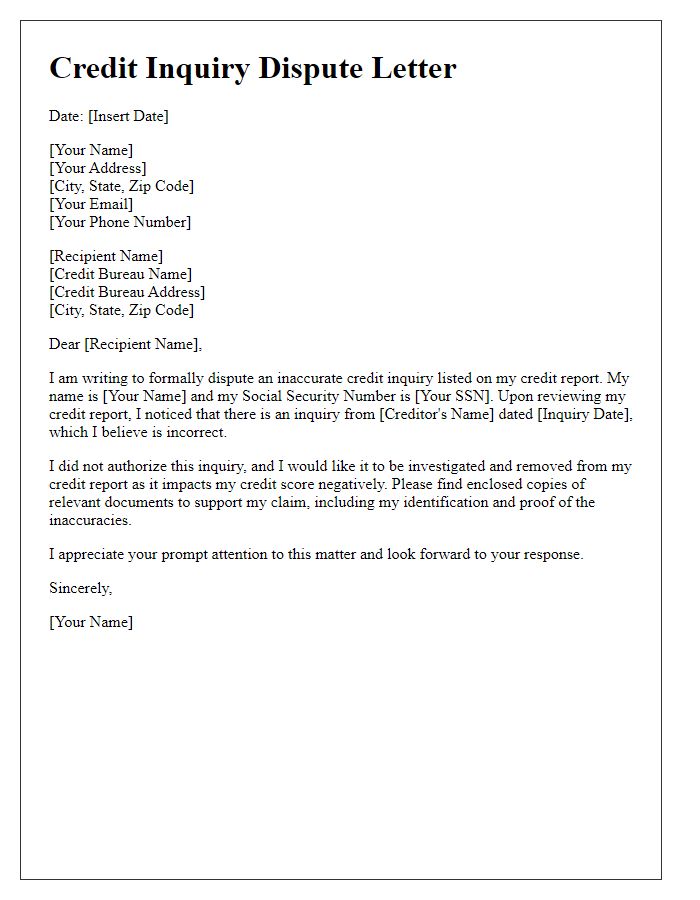

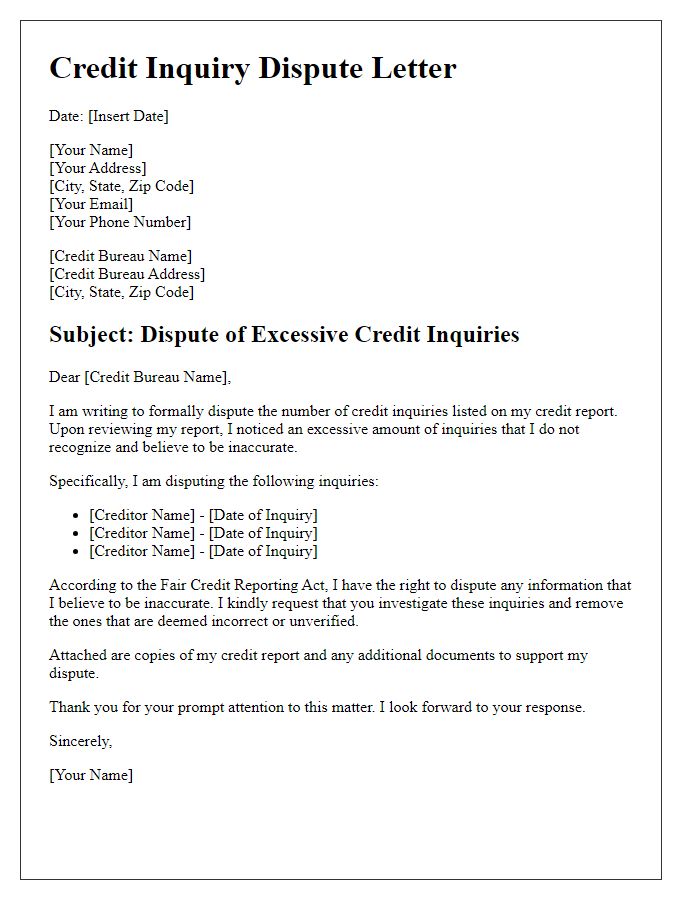

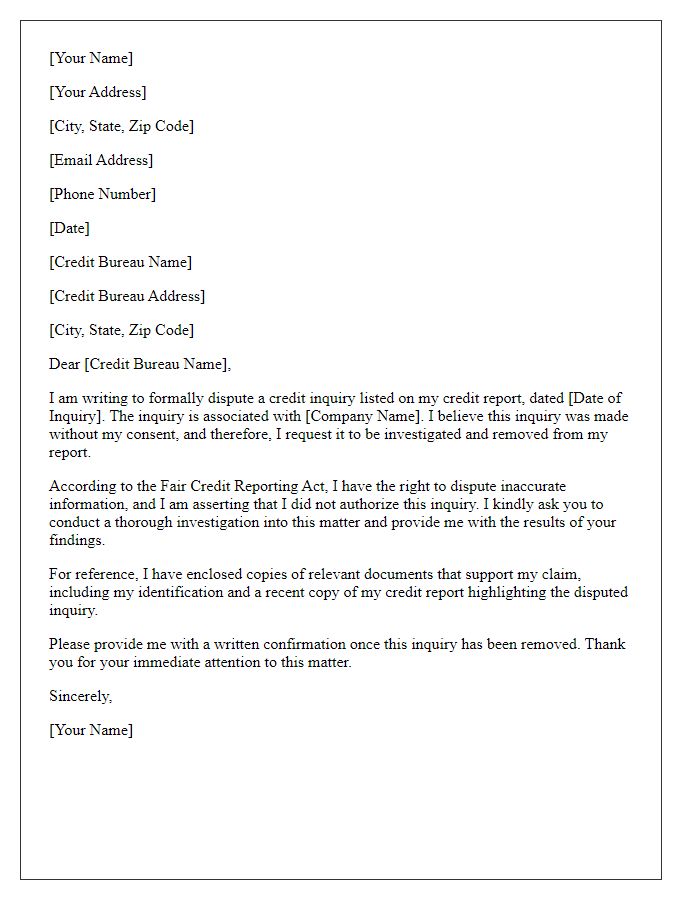

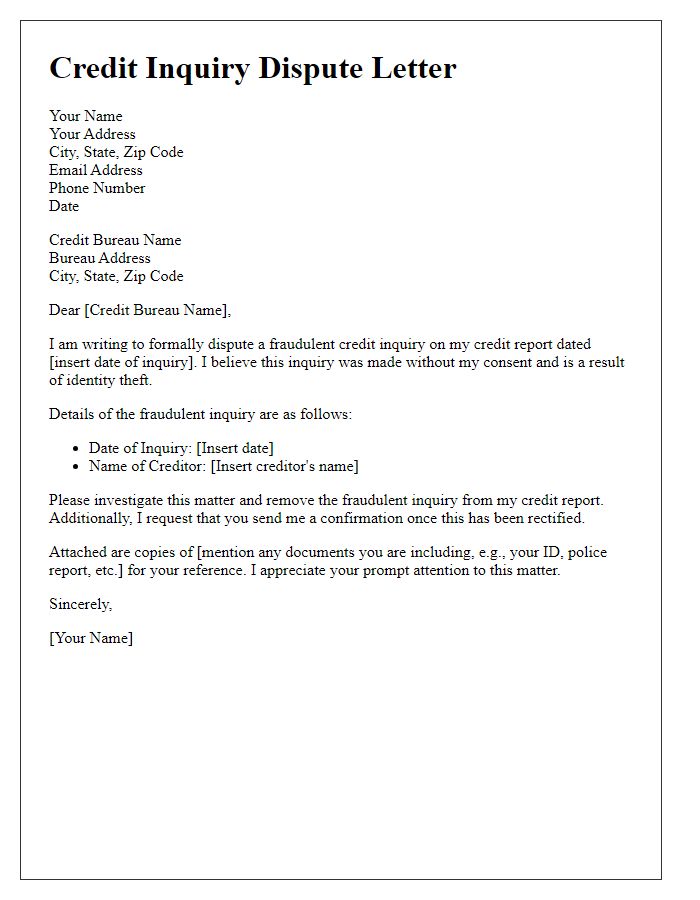

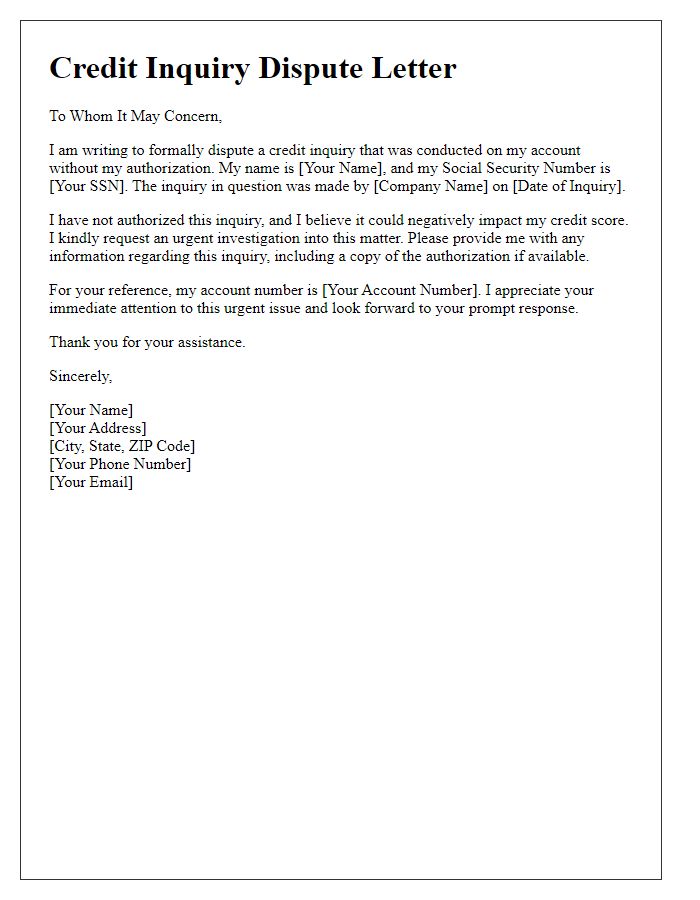

Letter Template For Credit Inquiry Dispute Samples

Letter template of credit inquiry dispute for discrepancies in reporting

Letter template of credit inquiry dispute for business account inquiries

Comments