Are you looking to establish a solid payment history? Building a reliable payment record is essential for improving your credit score and unlocking better financial opportunities. In this article, we'll share valuable insights on how to create a clear and structured payment history that works in your favor. So, grab a cup of coffee and let's dive in to learn more!

Creditor's Full Name and Contact Information

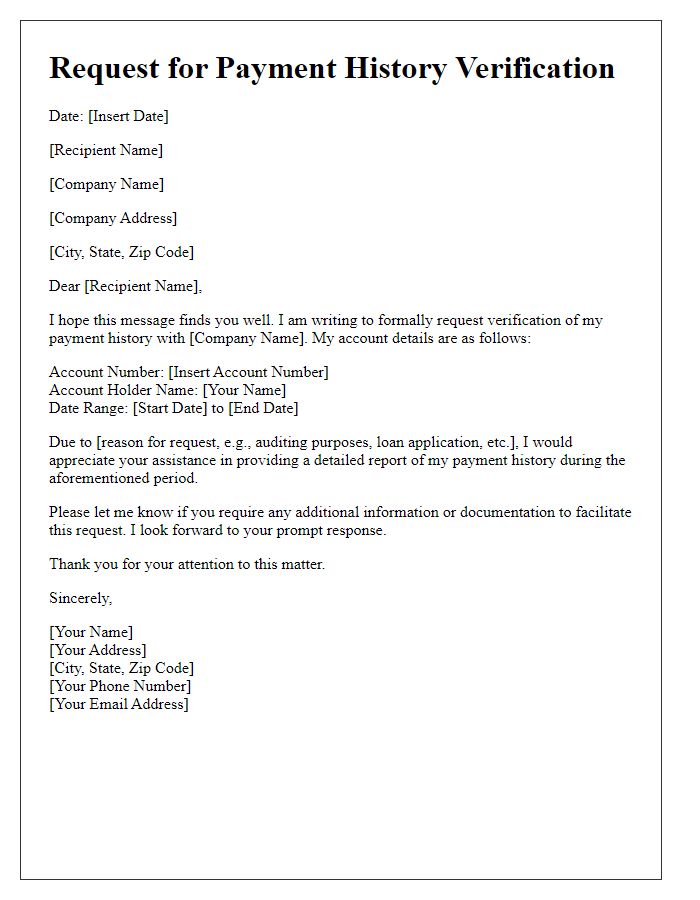

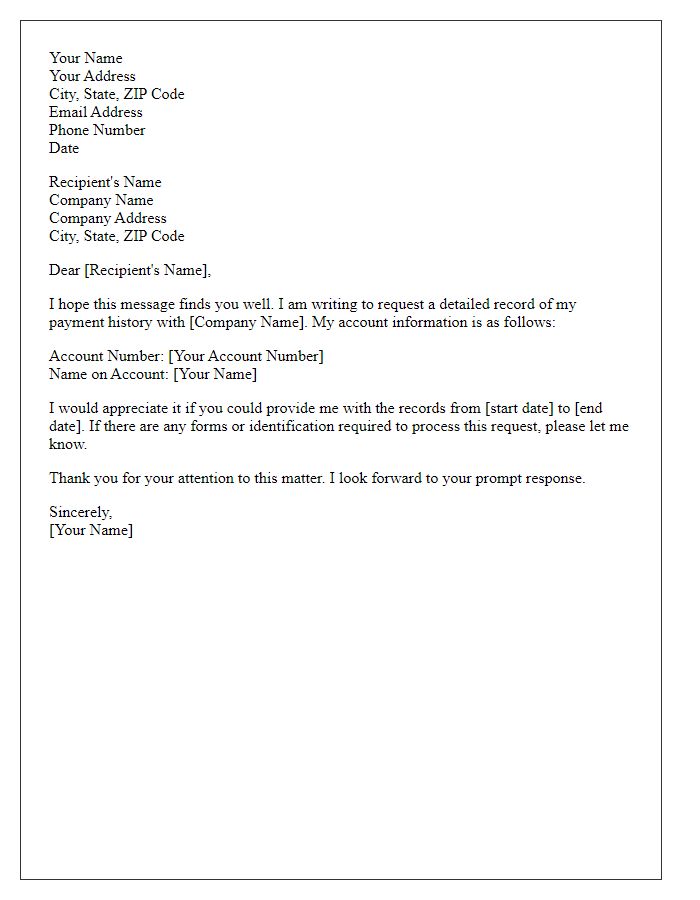

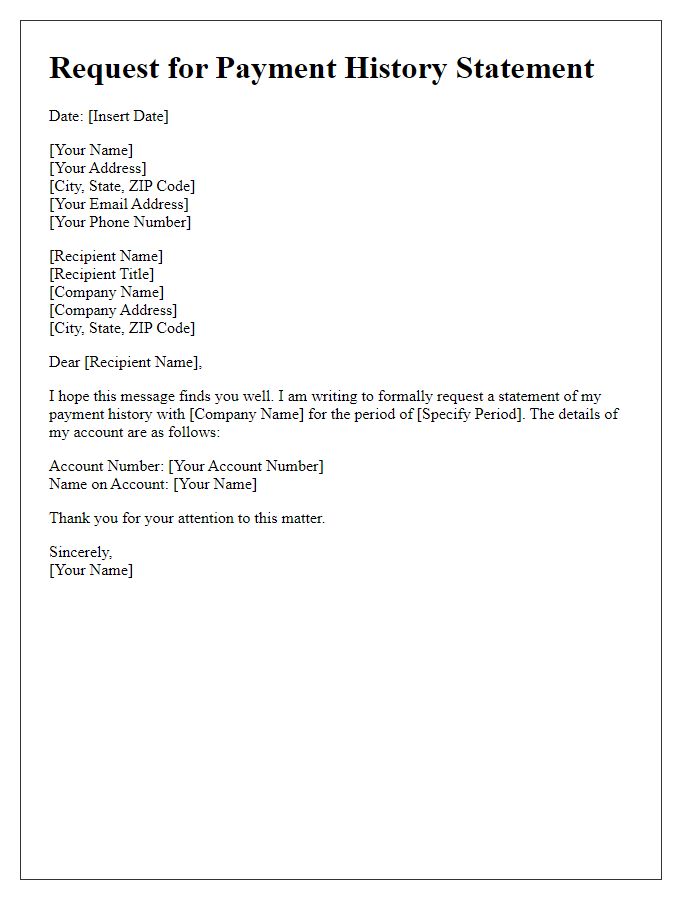

Creditor's full name and contact information play a crucial role in establishing a reliable payment history. This information typically includes the creditor's official name, such as "XYZ Financial Services," followed by a physical mailing address, for example, "123 Main Street, Suite 400, Anytown, USA." Additionally, the contact information should encompass a phone number, which could be a toll-free number, such as "1-800-555-0199," and an email address like "support@xyzfinancial.com." Accurate identification of the creditor assists in documenting payment records, ensuring prompt communication for inquiries or disputes, and maintaining a professional rapport in financial transactions.

Debtor's Account Details

Establishing a detailed payment history for a debtor's account involves reviewing records such as invoices, payment dates, and amounts. Account details must include debtor's name, unique identification number, and contact information. The documentation should highlight payment milestones like initial invoice issuance (date and amount), subsequent payments (broken down by date and amount), and any missed payments. Including balance summaries after each transaction can provide a clear financial snapshot. Past due amounts and late fees should also be noted, along with any arrangements made for deferred payments. This meticulous financial overview facilitates understanding of the debtor's payment behavior and assists in future credit assessments.

Specific Payment Dates and Amounts

Establishing a payment history is essential for maintaining financial credibility and accountability. Specific payment dates, such as June 1, 2023, and July 1, 2023, can mark timely payments, while amounts like $500 and $750 illustrate consistent contributions. Documenting these transactions provides a clear financial record, supporting creditworthiness. Additionally, noting patterns, such as monthly payment cycles or variations in amount due to additional services, enhances understanding of financial behavior. Addressing past due payments or fluctuations helps build transparency in business relationships, facilitating future negotiations or loan applications.

Payment Method and Reference Numbers

Establishing a comprehensive payment history is crucial for maintaining financial transparency and accountability in transactions. Payment methods, such as credit cards and bank transfers, often assign unique reference numbers which facilitate tracking and management of financial records. For example, a Visa credit card transaction might generate a reference number containing a combination of 16 digits, providing a specific identifier for each purchase. Additionally, bank transfers typically include reference numbers that vary in length depending on the financial institution, allowing for precise identification of funds exchanged on particular dates. Maintaining accurate records of these reference numbers is vital for efficient reconciliation of accounts, ensuring prompt resolution of discrepancies, and fostering trust between involved parties.

Acknowledgment of Outstanding Balance

Establishing a payment history is crucial for both businesses and individuals to maintain financial clarity. An acknowledgment of outstanding balance typically refers to a formal recognition of the unpaid amounts owed, which can include invoices from a specific date, such as April 2023, for services rendered or products delivered. This document usually details critical information like the total outstanding amount, payment due dates, and any applicable late fees, which can be around 1.5% per month, emphasizing the importance of timely payments. Including historical payment data helps illustrate payment patterns, allowing both parties to assess creditworthiness and establish a reliable financial relationship moving forward.

Comments