If you've recently received a credit denial and are feeling frustrated, you're not alone. Many individuals face this situation, and understanding how to navigate it can make all the difference. In this article, we'll explore effective strategies to appeal your credit denial, ensuring you have the best possible chance of success. So, let's dive in and discover how you can turn that denial into a stepping stone towards achieving your financial goals!

Name and Contact Information

In the realm of personal finance, an appeal for credit denial often emerges as a crucial step in navigating the complexities of credit management. Individuals facing denial may seek assistance by composing a formal letter, which typically includes their name, address, and telephone number, creating a direct line for communication. The letter serves as a platform to outline reasons for the appeal, which may include discrepancies in credit reports from major bureaus like Experian, TransUnion, or Equifax. It is imperative that individuals provide pertinent details such as the date of the credit application, the name of the financial institution involved (like Wells Fargo or Chase), and references to any supporting documentation, such as proof of income or credit score reports, which could substantiate their case. The aim of such correspondence is not only to contest the credit denial but also to present a clear, organized narrative that persuades the lender to reassess the application based on the newly provided information or clarification.

Reference to Credit Denial Notice

Receiving a credit denial notice can significantly impact financial opportunities, such as obtaining loans, credit cards, or mortgages. The credit denial notice, usually issued by major credit bureaus like Equifax, Experian, or TransUnion, outlines the reasons for denial, which may include low credit scores (often below 640 for conventional loans), high debt-to-income ratios (exceeding 43%), or recent late payments. Challenging this denial can involve providing additional documentation, such as proof of income, payment history from the past year, or corrections to inaccuracies on credit reports. It is essential to address these points clearly to improve chances of favorable reconsideration, demonstrating financial reliability and commitment to resolving any discrepancies.

Reason for Appeal

Credit denial can occur due to various reasons, including insufficient credit history, high debt-to-income ratio, or missed payments. Individuals often receive a credit denial notification from financial institutions, such as banks or credit unions, detailing specific denial reasons. The Fair Credit Reporting Act (FCRA) grants consumers the right to dispute inaccuracies in their credit reports, which can lead to a reconsideration of their application. A well-structured appeal, often including documentation like pay stubs, proof of timely payments, and explanations regarding employment status or recent financial hardships, can help address the concern noted by the creditor. Additionally, it is essential to submit the appeal within the stipulated timeframe mentioned in the denial letter to ensure consideration from the credit issuer.

Supporting Documentation or Evidence

A credit denial appeal requires clear and precise supporting documentation to strengthen the case. Key elements include a detailed letter outlining the reasons for the appeal and a list of documents such as credit reports (including FICO scores), income verification (such as pay stubs or tax returns), and any evidence of timely payments or debt-to-income ratio calculations. Specific incidents, such as medical emergencies or unexpected job losses, should be documented with dates, amounts, and conditions. Additional materials like letters from creditors acknowledging payment plans or proof of employment stability can bolster the appeal. Ensuring all documentation is accurate and well-organized will significantly increase the chances of a successful overturn of the credit denial.

Request for Reevaluation and Contact Information

A credit denial can significantly impact financial opportunities, such as loan applications or credit card approvals. Individuals often receive these denials from financial institutions like banks or credit unions, stating specific reasons related to credit history, payment tardiness, or outstanding debts. The Financial Institutions Reform, Recovery, and Enforcement Act outlines consumers' rights to request reevaluation of credit decisions. Including essential contact information, like a phone number and email address, ensures prompt and efficient communication with the institution for further discussions or to provide additional data that may positively influence their decision. Providing supporting documents such as income proof, payment records, or dispute resolutions can strengthen the appeal process, demonstrating improved creditworthiness.

Letter Template For Appealing Credit Denial Samples

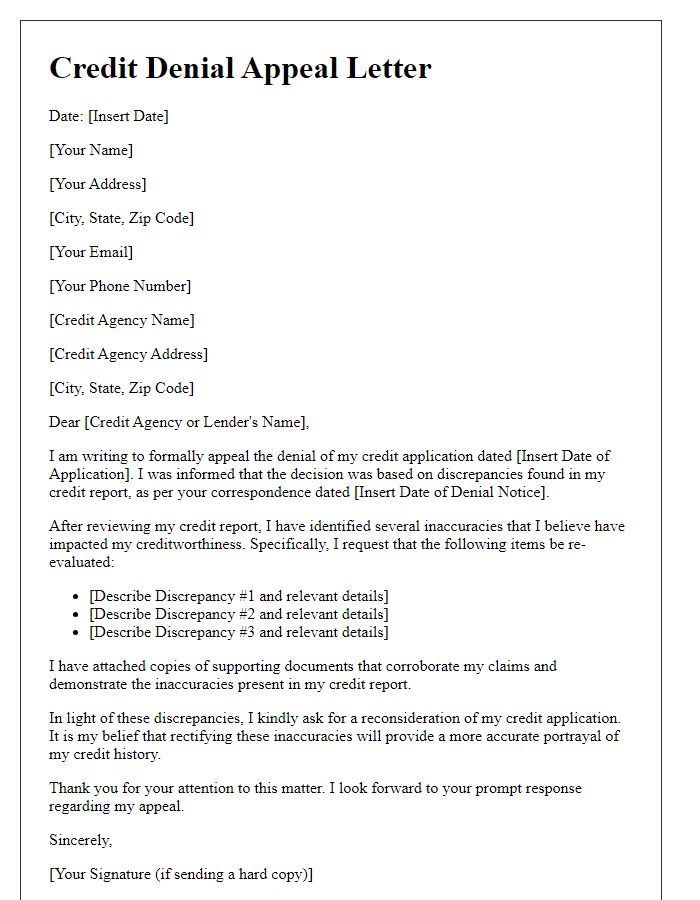

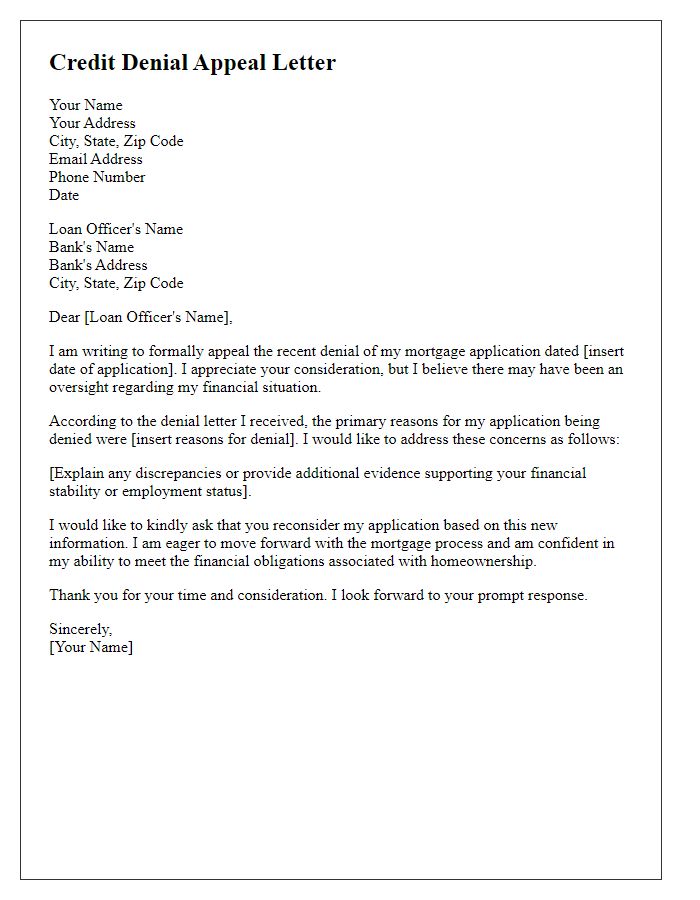

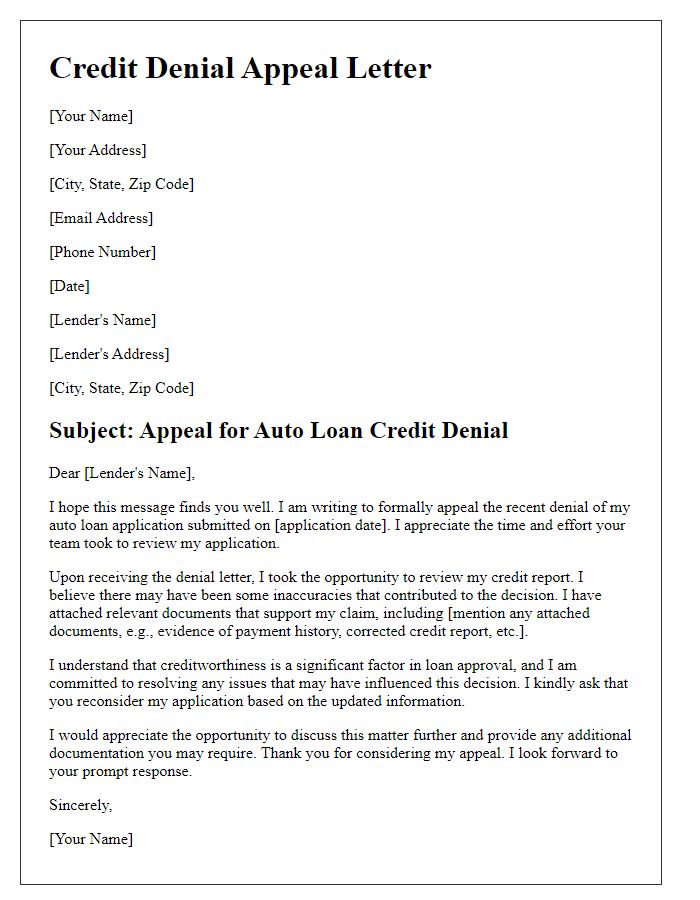

Letter template of credit denial appeal addressing discrepancies in credit report.

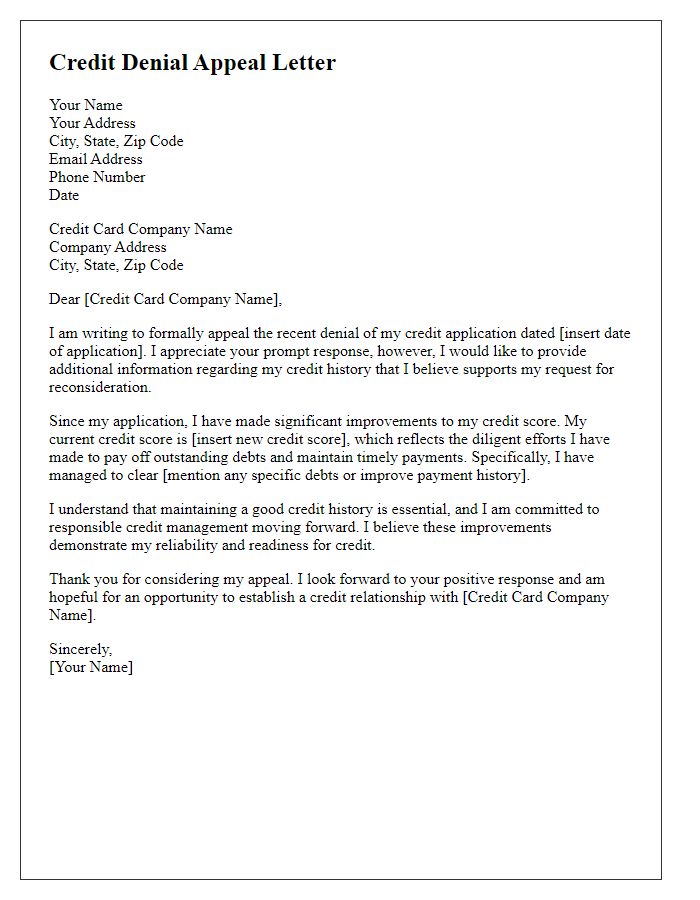

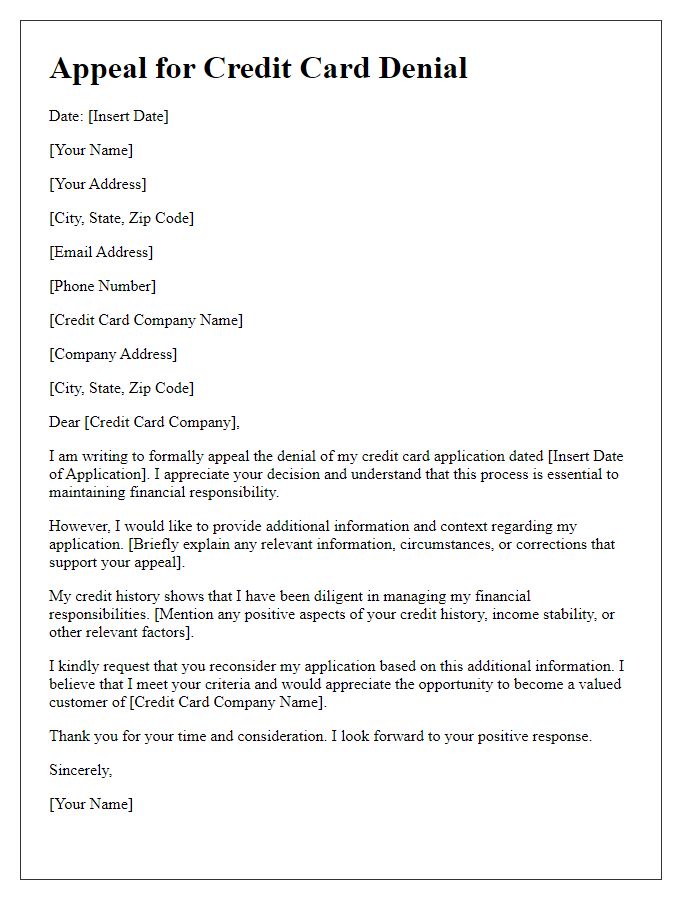

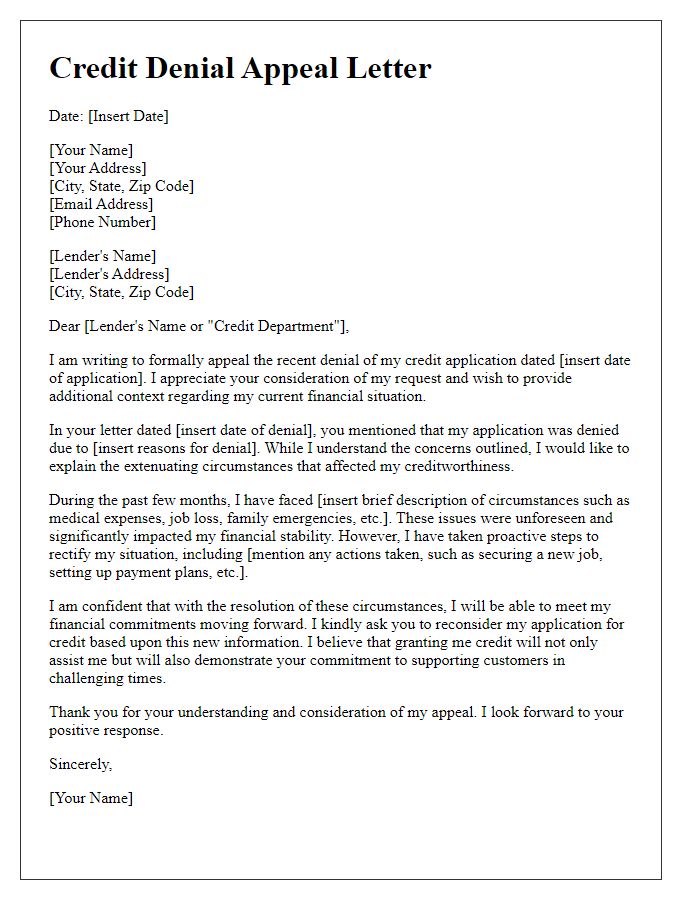

Letter template of credit denial appeal citing improvements in credit score.

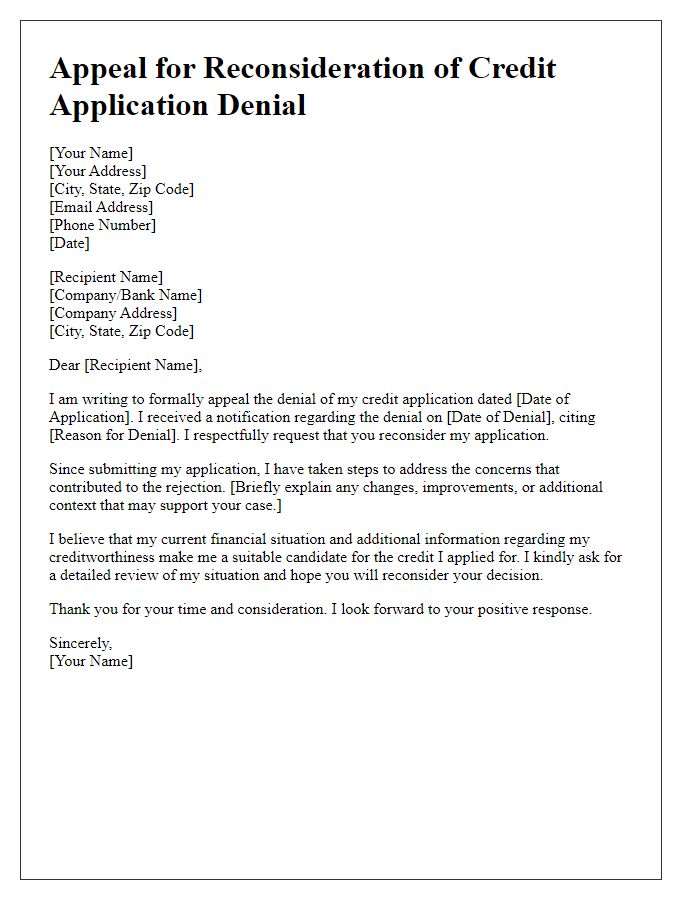

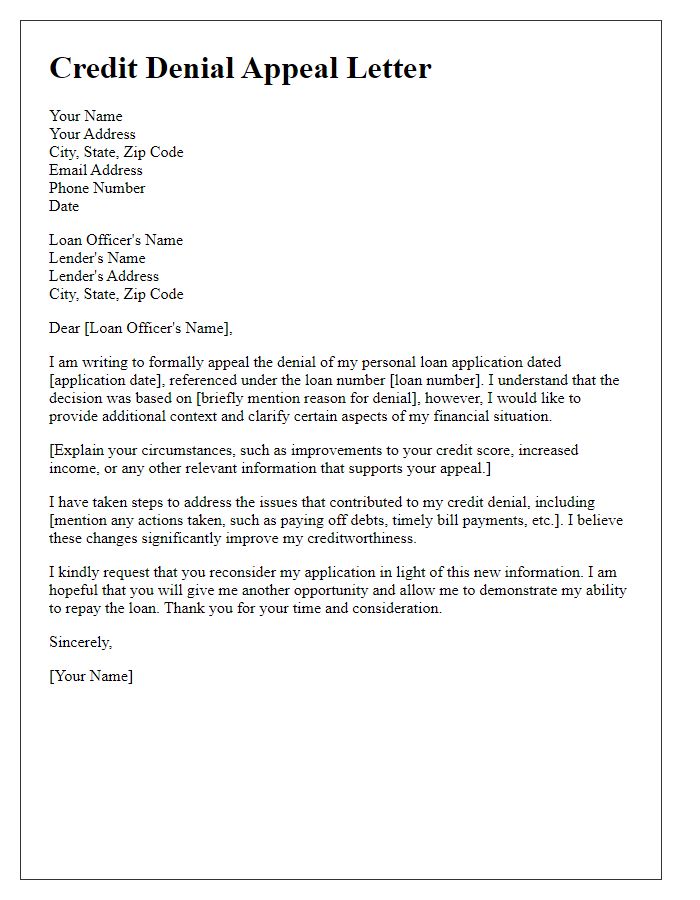

Letter template of credit denial appeal for reconsideration of application.

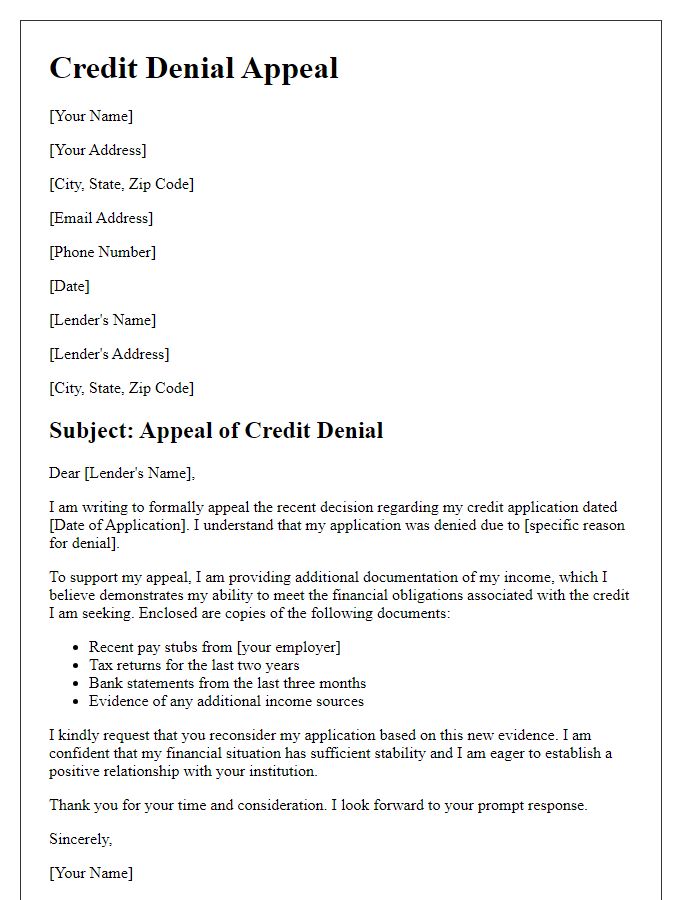

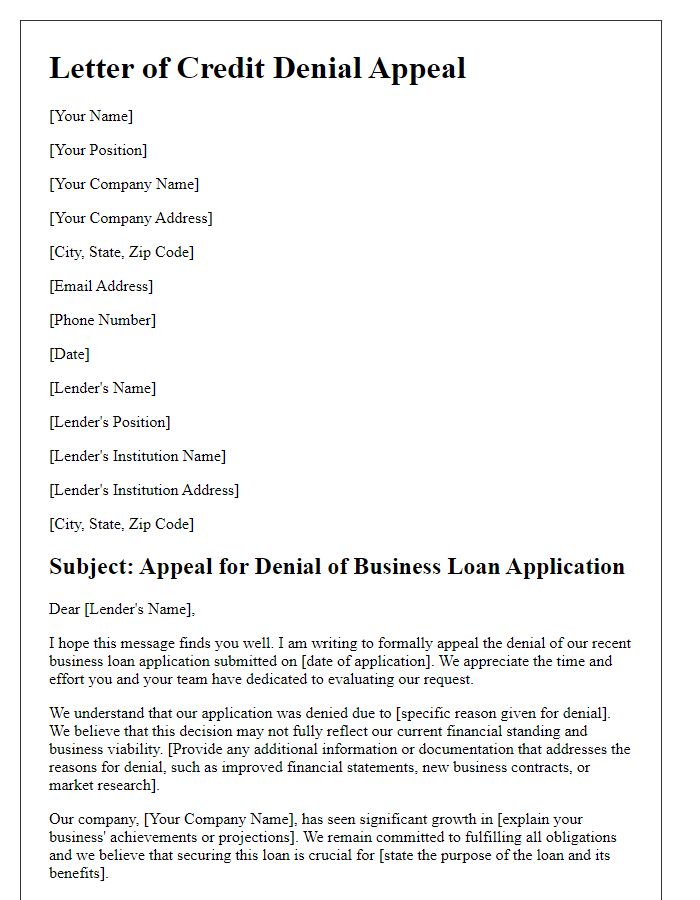

Letter template of credit denial appeal with additional income documentation.

Comments