Are you feeling overwhelmed by incorrect information on your credit report? You're not alone! Many individuals go through the hassle of disputing errors with credit bureaus, but drafting the right letter can make all the difference. In this article, we'll guide you through creating a compelling letter to communicate your dispute effectivelyâread on to learn how to take control of your credit report!

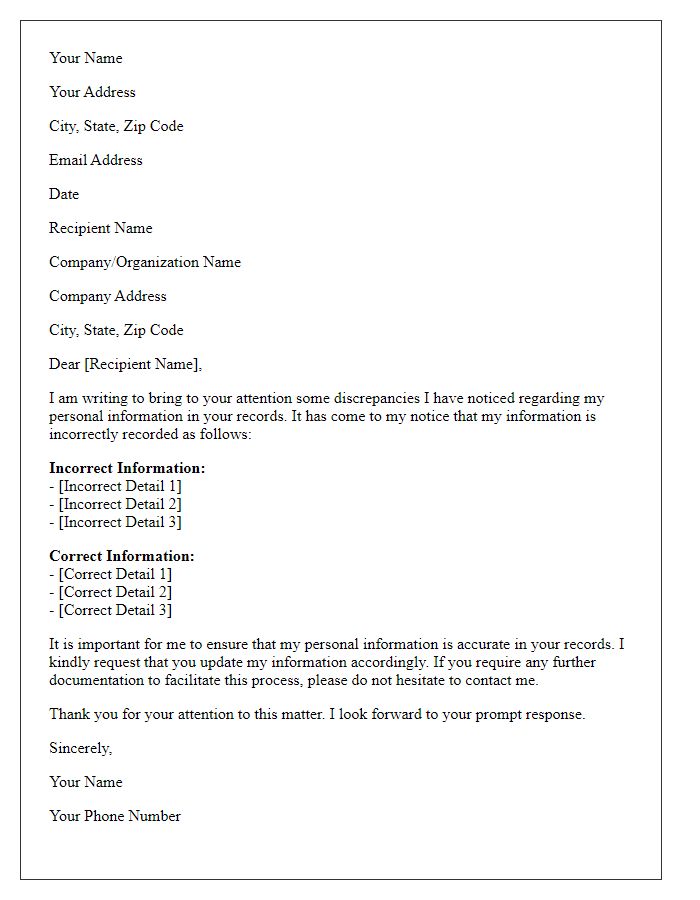

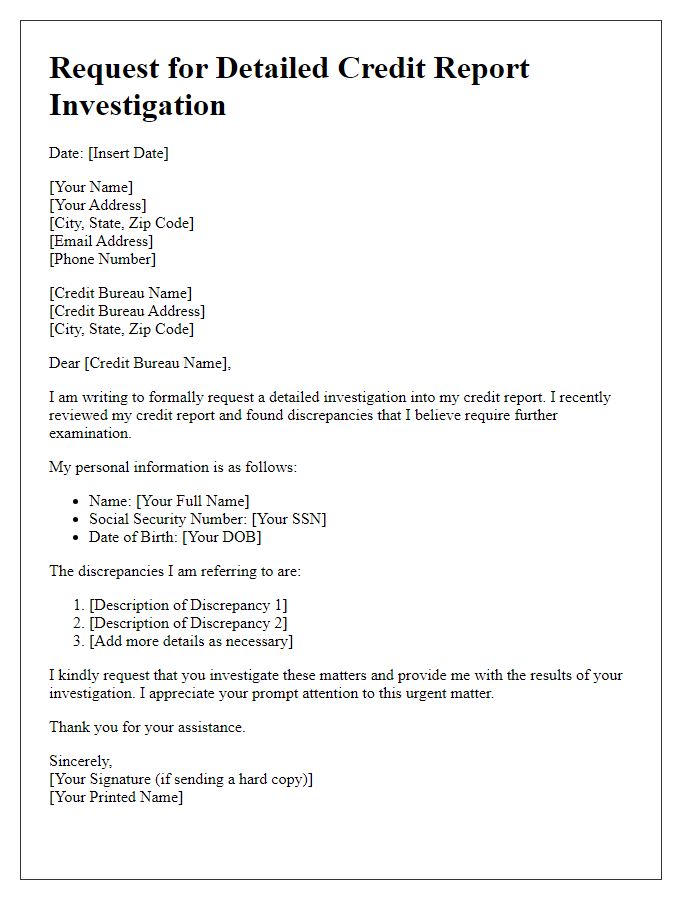

Precise Identification Information

Accurate identification information is crucial in communication with credit bureaus regarding dispute resolution. Full name (John Doe), social security number (123-45-6789), current address (456 Maple Street, Springfield, IL), previous address (123 Oak Avenue, Springfield, IL), and date of birth (January 1, 1980) must be clearly stated. Including identification documents such as government-issued photo ID (e.g., driver's license number A1234567) and utility bill (account number XYZ123) ensures proper verification. Specific account details (e.g., account number 987654321) related to the dispute enhance clarity. This comprehensive information assists credit bureaus like Experian, TransUnion, and Equifax in promptly addressing the issue.

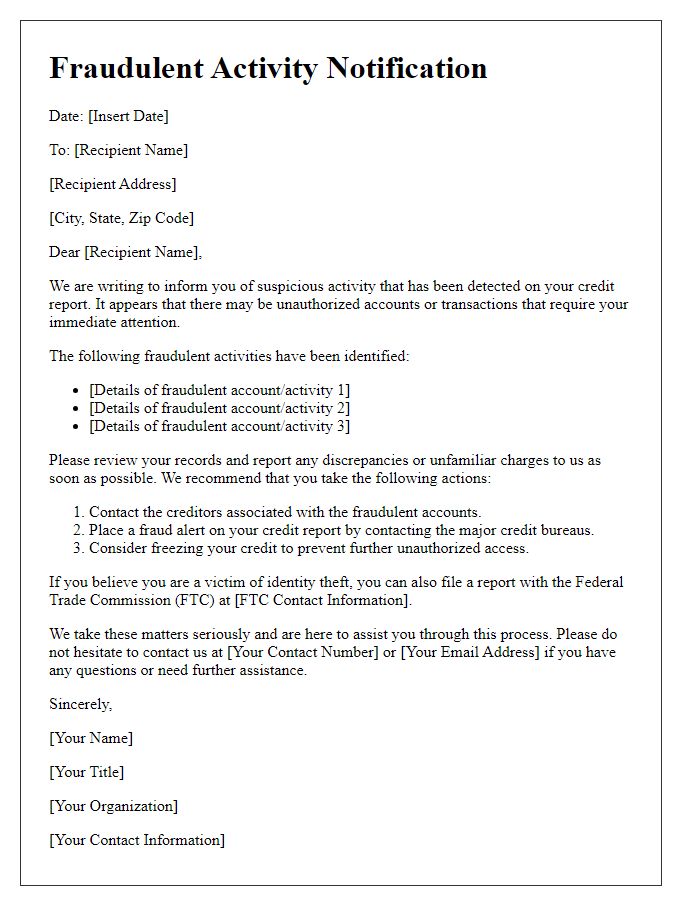

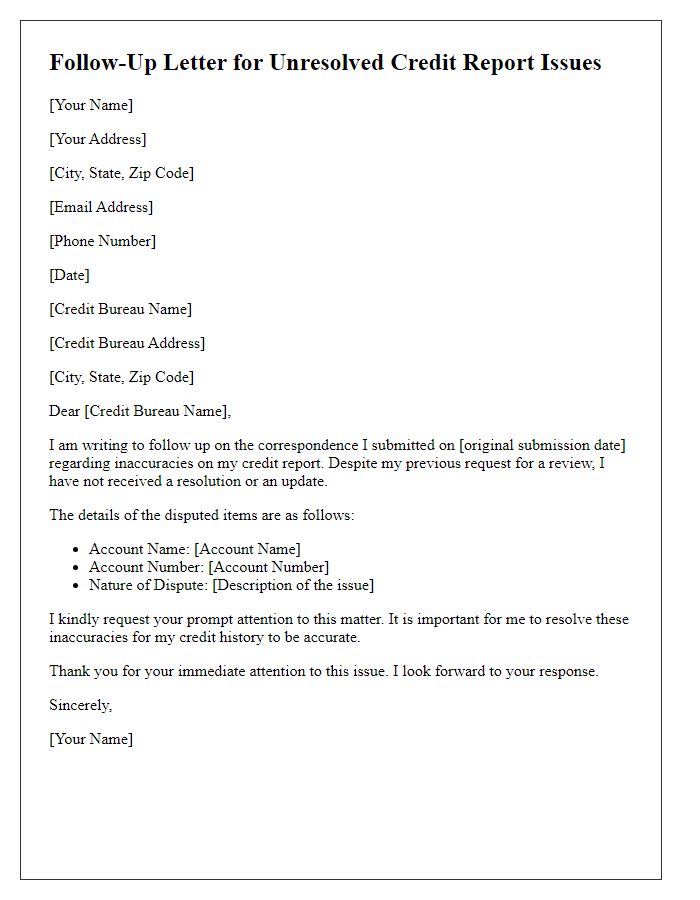

Accurate Dispute Description

Inaccurate credit report entries can seriously impact financial decisions, like loan approvals or interest rates, especially from major credit bureaus such as Experian, Equifax, and TransUnion. Disputes often arise due to incorrect balances, fraud alerts, or misreported payment histories dating back over a year. A detailed description of the dispute, including specific account numbers, dates of occurrences, and the nature of inaccuracies, is essential. For instance, a credit card from Capital One showing a late payment for April 2023, when the payment was made on time, requires precise documentation. Providing evidence like bank statements or receipts can significantly strengthen the case. Inaccuracies can take weeks to resolve, impacting your credit score, which is crucial for home mortgages, vehicle financing, or securing a business loan.

Supporting Documentation

Individuals seeking to resolve discrepancies in their credit reports should gather relevant supporting documentation. This documentation may include identification proof such as a government-issued ID (passport or driver's license), recent credit statements showcasing account activity or payment history, and correspondence with creditors which may illuminate any errors. Furthermore, personal records detailing payment confirmations or transaction receipts from banks serve as further evidence substantiating claims. Legal documents, including court judgments or bankruptcy filings, can also provide context for disputes. Assembled, this documentation strengthens an individual's case when communicating with credit bureaus, such as Experian, Equifax, or TransUnion, ensuring a thorough review and resolution process.

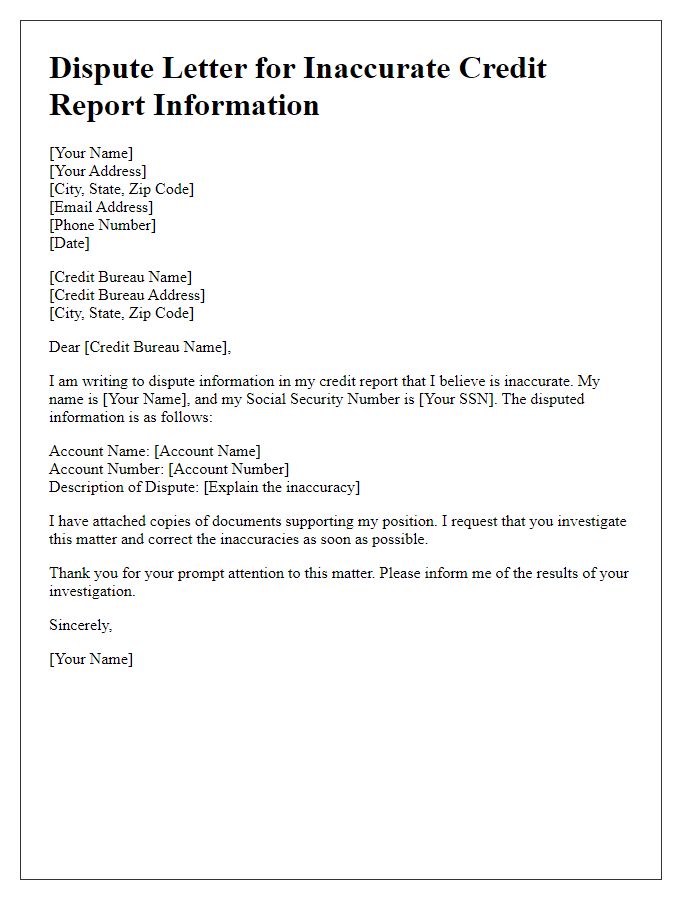

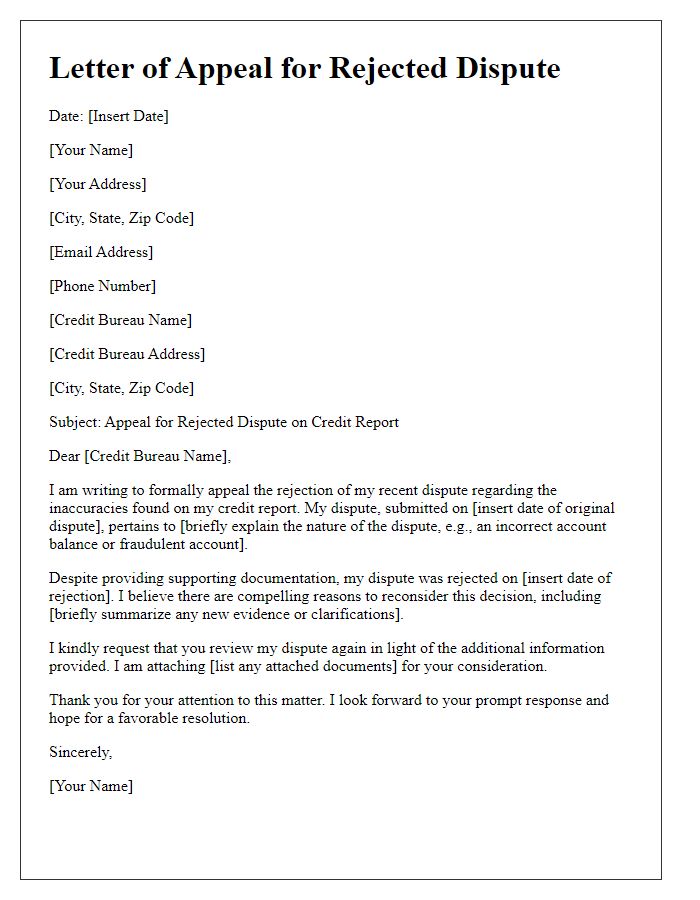

Specific Resolution Request

The necessity of effective communication with credit bureaus arises during disputes regarding inaccuracies in credit reports. A comprehensive resolution request should identify specific discrepancies, such as erroneous account balances (e.g., a reported balance of $5,000 when the actual balance is $3,000) or incorrect payment histories (e.g., late payments reported for an account that has been consistently paid on time). Additionally, including relevant information like the name of the creditor (e.g., XYZ Bank), account numbers, and dates of erroneous reporting enriches the context, ensuring clarity in the communication. Documentation supporting claims (e.g., bank statements, payment confirmations) is also crucial for a substantiated request. Prompt and precise communication can expedite the dispute resolution process, potentially leading to updated and accurate credit reporting, which directly influences credit scores and financial opportunities.

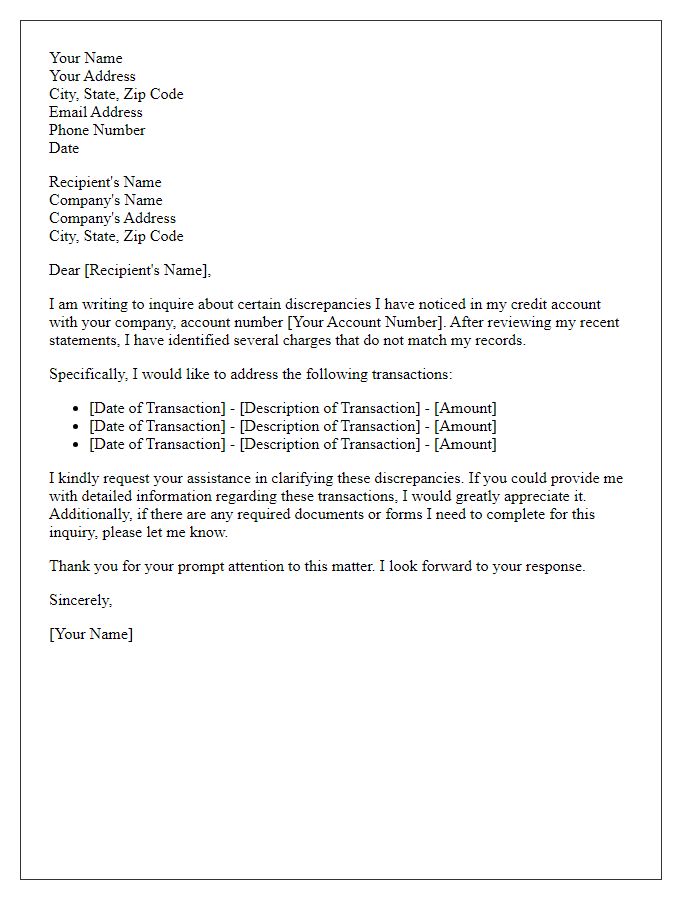

Contact Information and Signature

Disputing inaccuracies on a credit report is a crucial process for maintaining financial health. A well-structured dispute letter, addressed to credit bureaus like Experian, TransUnion, or Equifax, must include essential contact information, such as full name, current address, and phone number, ensuring that the bureau can verify identity and respond effectively. The signature should be a handwritten mark to authenticate the document, displaying the individual's commitment to resolving discrepancies. Including specific details about the disputed item--such as account numbers, dates of transactions, and descriptions of the inaccuracies--helps the bureau investigate the claim thoroughly, adhering to the Fair Credit Reporting Act guidelines that protect consumer rights.

Letter Template For Credit Bureau Communication Dispute Samples

Letter template of clarification regarding incorrect personal information.

Letter template of notification for fraudulent activity on credit report.

Comments