Are you in need of a reliable proof of income verification letter template? This handy resource can simplify your life, ensuring that you have all the essential details covered in a professional format. From employment confirmation to income specifics, this template has got you covered, making the process straightforward and stress-free. So, if you want to learn how to draft one effectively, keep reading for all the necessary tips and templates!

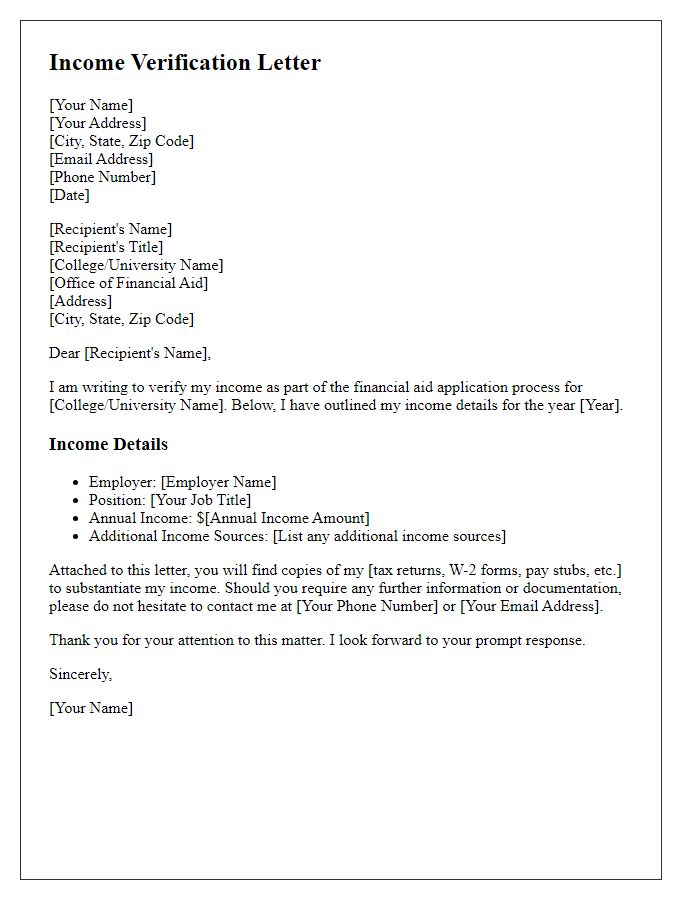

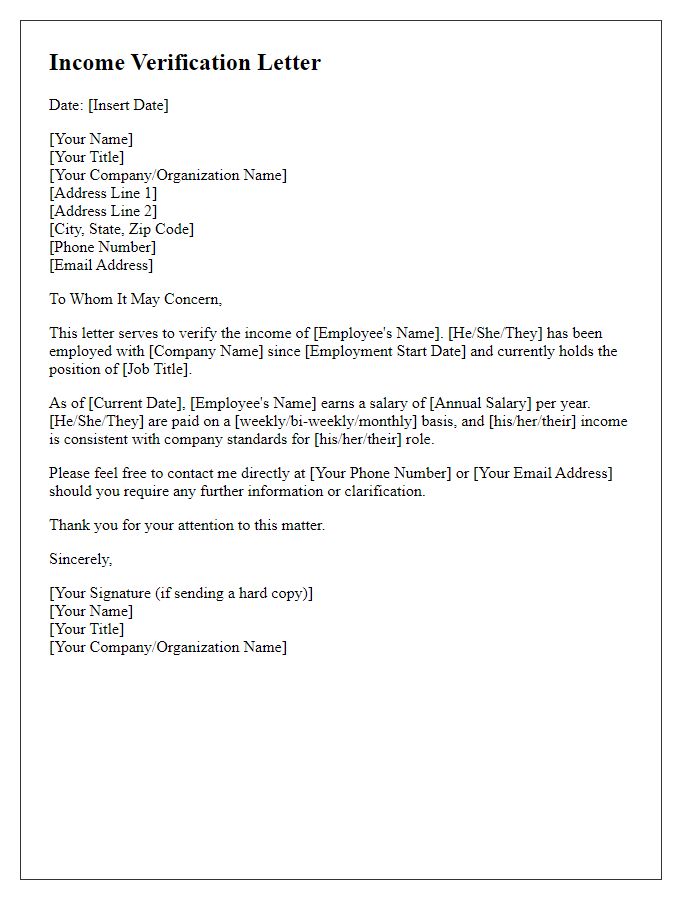

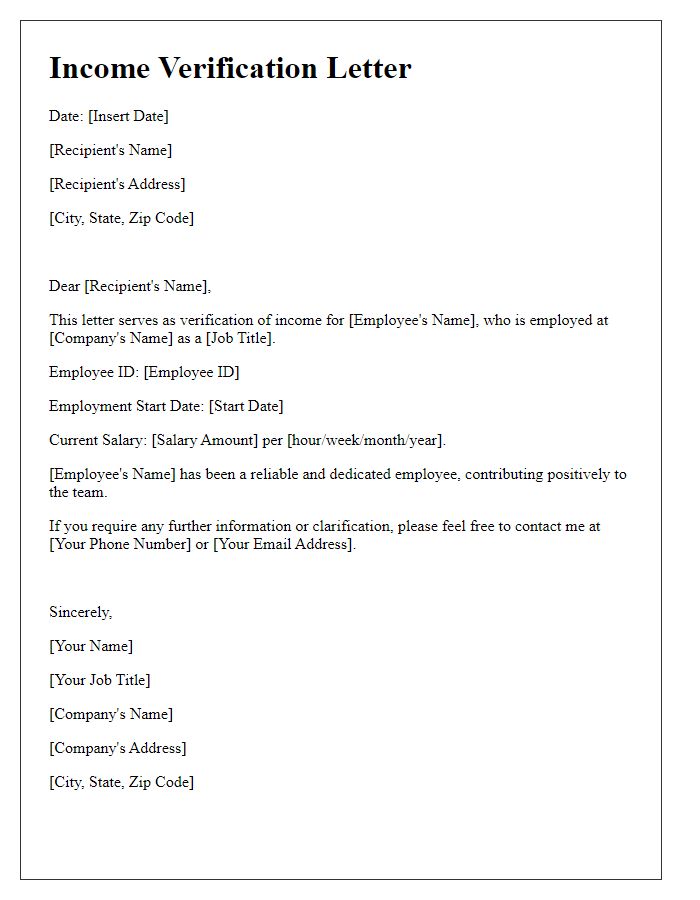

Personal Information

Proof of income verification documents often require essential personal information to establish identity and financial credibility. This can include full name (often first, middle, and last), residential address (street name, city, state, ZIP code), date of birth (format: MM/DD/YYYY), Social Security number (last four digits only for privacy), and contact information (telephone number and email address). Additionally, details regarding employment status (current job title, employer name, and length of employment) are critical. Financial details such as salary (annual income amount) or hourly wage (if applicable) also contribute to the verification process, ensuring that institutions can assess financial capability effectively.

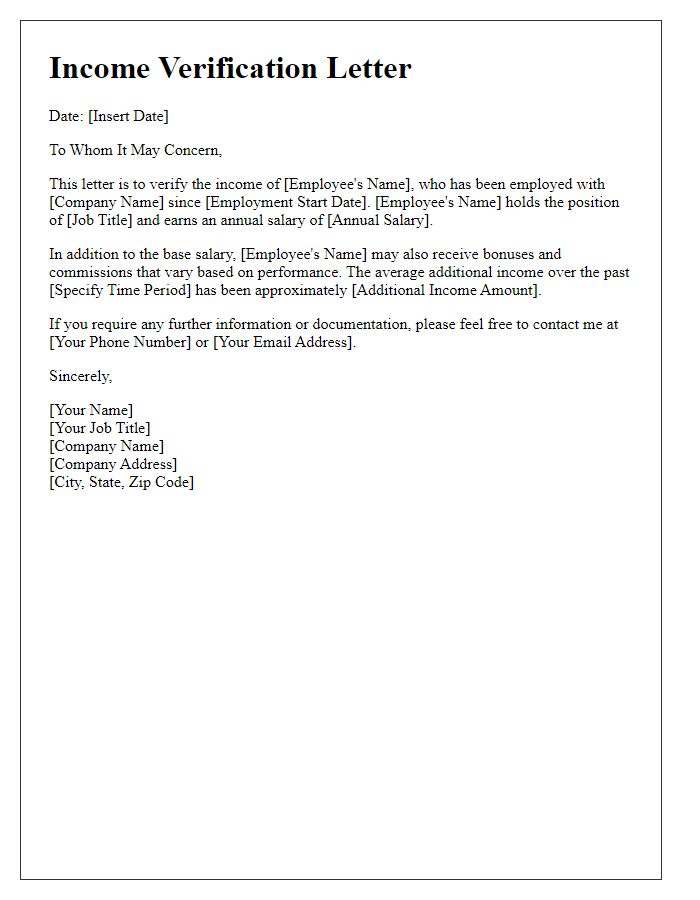

Employer Details

Proof of income verification often requires detailed employer information for authenticity. Basic details typically include the company name, a legal entity with registration numbers, the business address (including city, state, and zip code), and contact information (phone and email). Furthermore, the verification letter should specify the employee's position, date of employment (start and possibly end dates), and current salary figures, typically presented as an annual amount. Additional context, such as the company's industry sector (e.g., technology, healthcare), number of employees, and any relevant policies regarding employment verification, can enhance the credibility of the document, ensuring financial institutions or landlords receive comprehensive information for their evaluation processes.

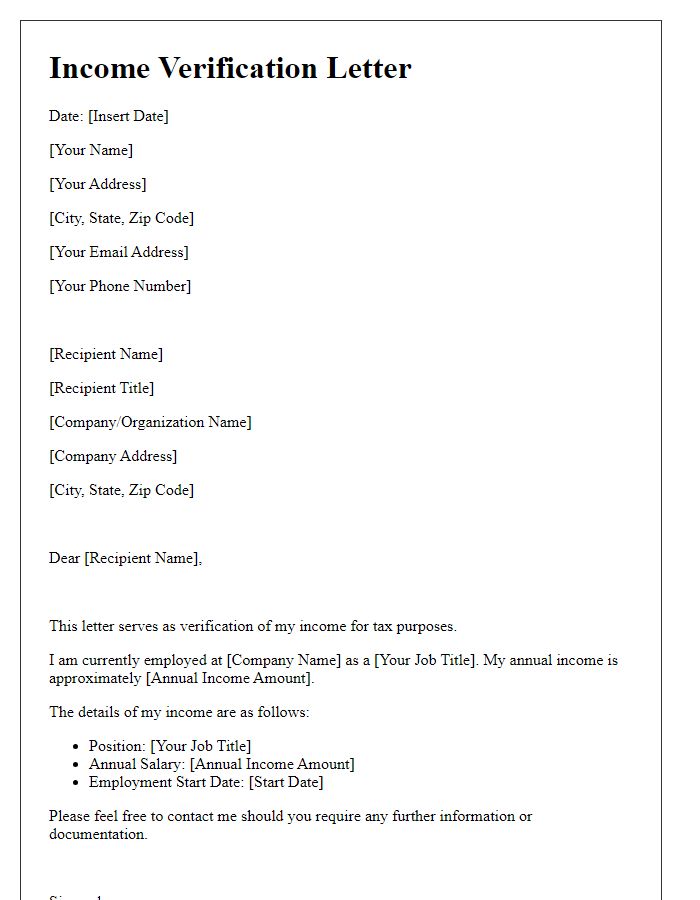

Income Details

Income verification documents provide critical financial information for various purposes, such as loan applications or rental agreements. Important details include monthly income amounts (gross and net) which typically cover salaries, bonuses, or additional earnings. Common documentation might consist of recent pay stubs, tax returns (such as the IRS Form 1040), or bank statements that reflect consistent income deposits. Employers may provide confirmation letters (on company letterhead) detailing the employee's job title, length of employment, and salary, ensuring authenticity. All information must be accurate and up-to-date to meet financial institution requirements and protect against potential fraud.

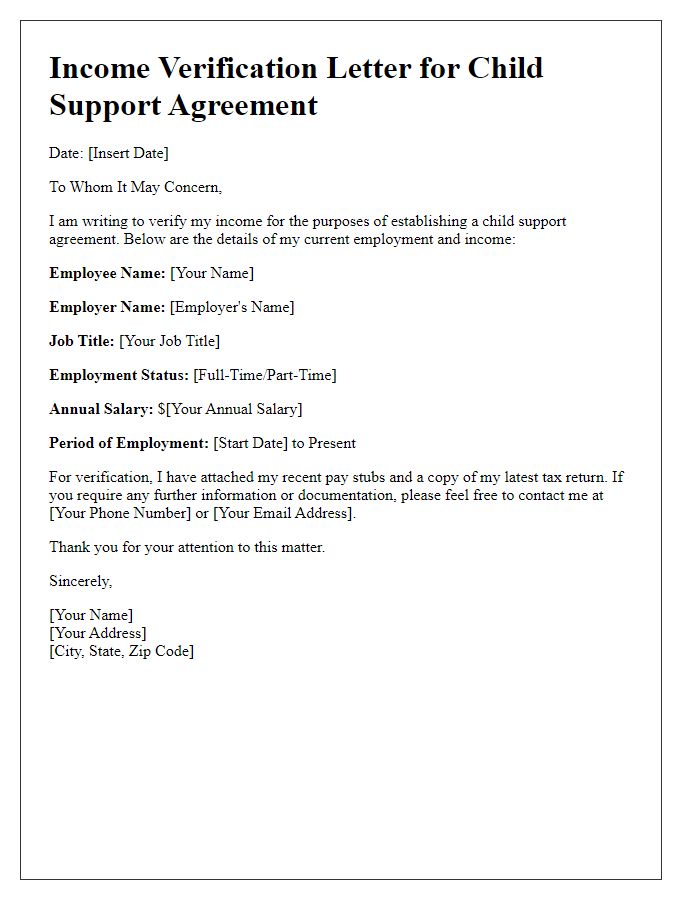

Duration of Employment

Income verification serves as an essential document for individuals needing to confirm their earnings for various purposes such as loan applications, rental agreements, or government assistance programs. Employers typically provide a letter detailing the duration of employment, which includes the start date, end date (if applicable), and position held within the company. The letter may also specify the nature of employment, including full-time or part-time status, alongside the annual or hourly income figures. Organizations and financial institutions often require this verification, and it must be on official company letterhead, signed by a supervisor or human resources representative to ensure authenticity. This document thus plays a crucial role in the broader context of financial assessments and personal integrity throughout formal processes.

Contact Information for Verification

Proof of income verification is essential for various financial transactions and applications, such as loan approvals or rental agreements. Standard income verification documents include pay stubs, tax returns, or bank statements, detailing monthly earnings, employment status, and consistency in income. These documents are often required to assess a person's financial stability, particularly for individuals in specific professions like freelancers or gig workers, where income fluctuates. In formal verification processes, entities may require direct contact information for previous employers or financial institutions as references to validate the submitted income claims, adding an extra layer of verification.

Comments