Have you ever stumbled upon discrepancies in your credit profile that just didn't add up? It can be frustrating to see errors that could potentially impact your financial future. Luckily, addressing these issues doesn't have to be a daunting task. In this article, we'll guide you through the essential steps to craft a compelling letter for correcting credit profile errorsâso you can set the record straight and take control of your credit history. Ready to learn more?

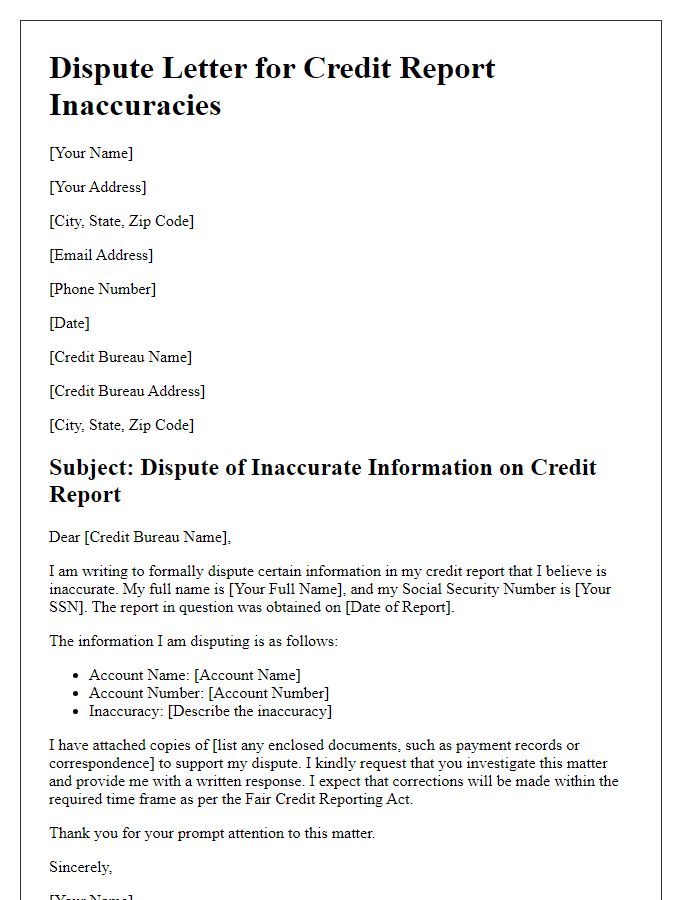

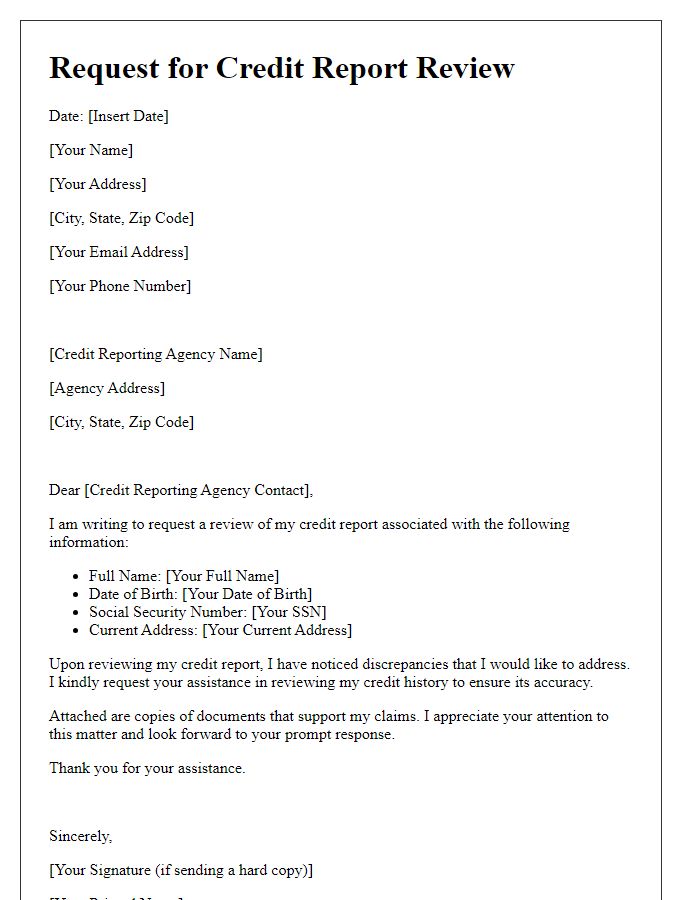

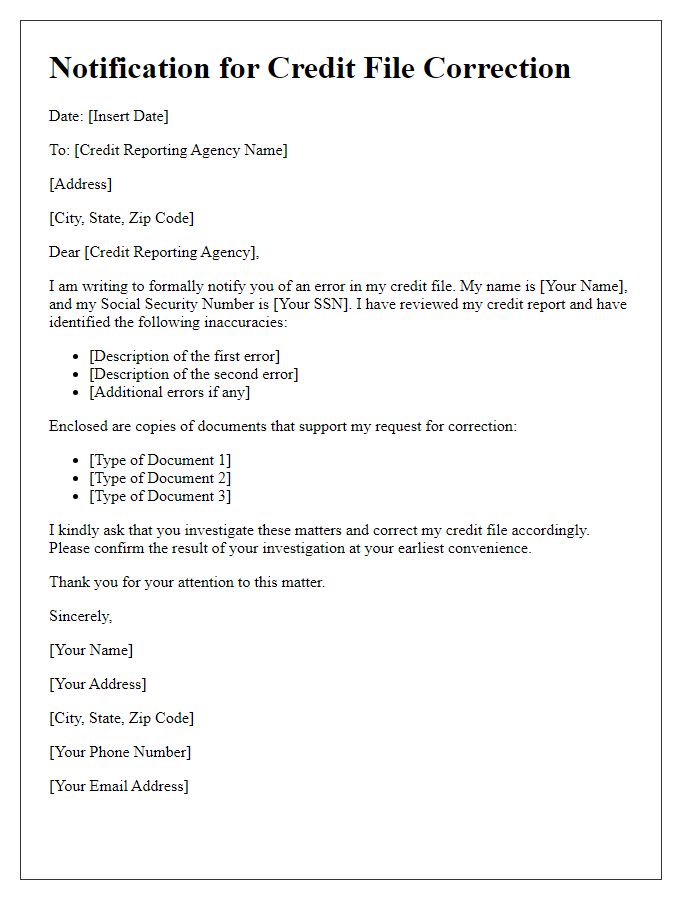

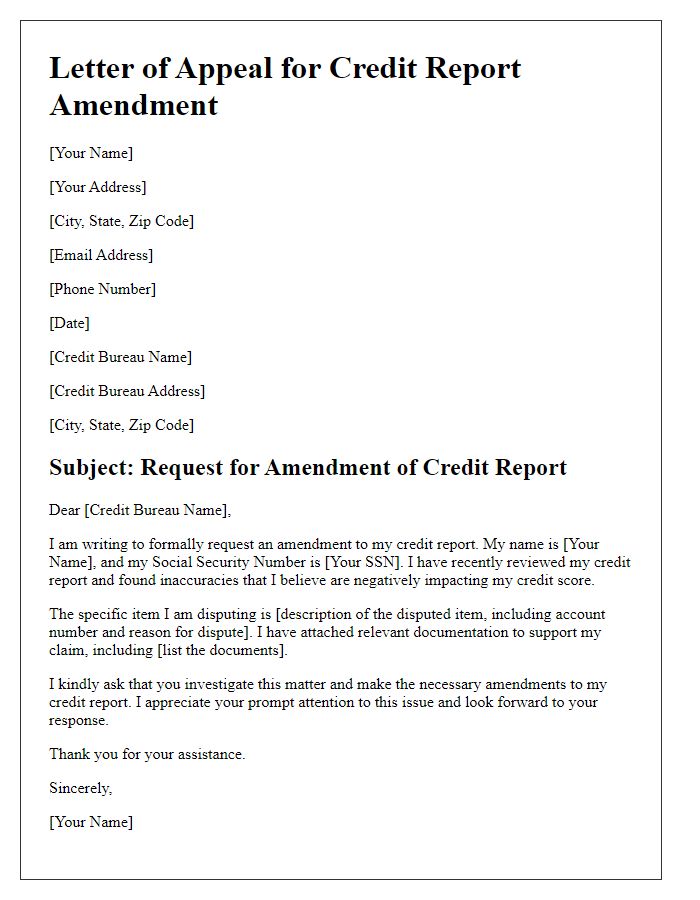

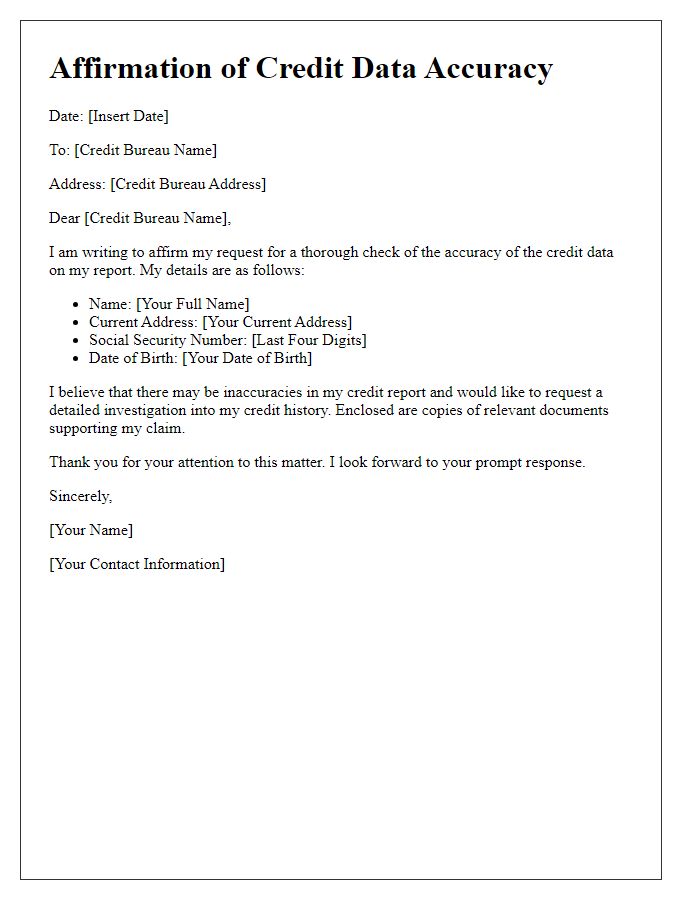

Personal Information

Errors in personal information can significantly impact credit profiles, such as names, addresses, and Social Security numbers. A misspelled name can lead to incorrect data being linked to different individuals, resulting in inaccurate credit scores. Changing addresses may cause confusion in credit history, leading to missed payment records or outdated account information. Additionally, incorrect Social Security numbers can hinder the ability to verify identity, complicating credit applications. Regularly reviewing credit reports from agencies like Experian, Equifax, and TransUnion ensures that these details remain accurate, helping maintain a healthy credit profile and avoiding potential financial challenges.

Accurate Account Details

Accurate account details, such as account numbers (typically 10-12 digits), credit limits (usually a range from a few hundred to several thousand dollars), and payment history (including on-time payments and late payments), are essential for maintaining a correct credit profile. Errors in these details can significantly impact credit scores, which range from 300 to 850, influencing loan approvals and interest rates. Addressing discrepancies swiftly is crucial; consumers can request corrections from agencies like Experian, TransUnion, and Equifax. Utilizing dispute forms and providing supporting documentation like bank statements and identification is vital, ensuring accurate representation in financial records. Timely correction improves not only the credit profile but also financial opportunities for consumers.

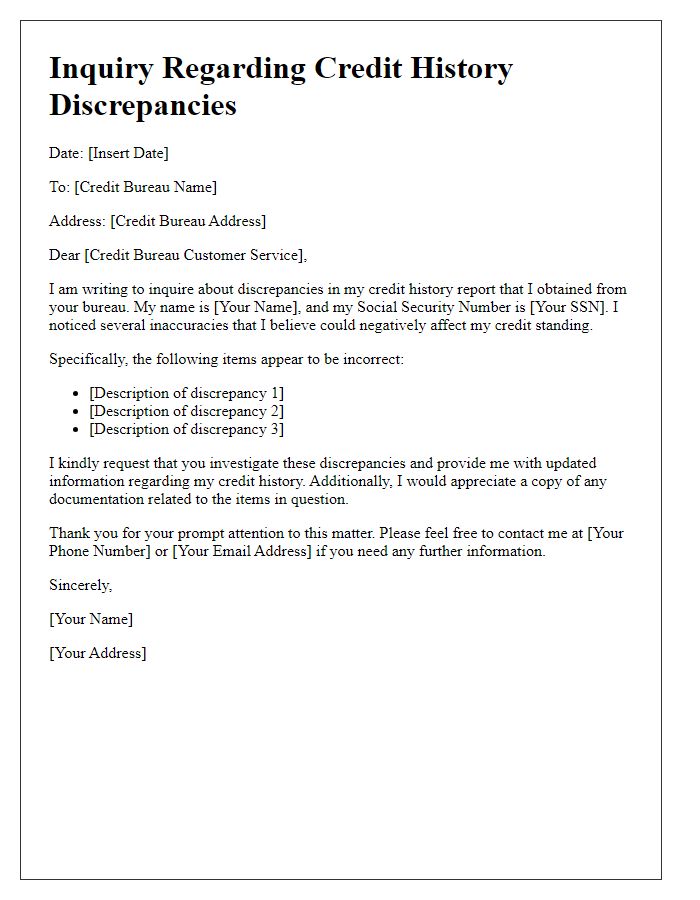

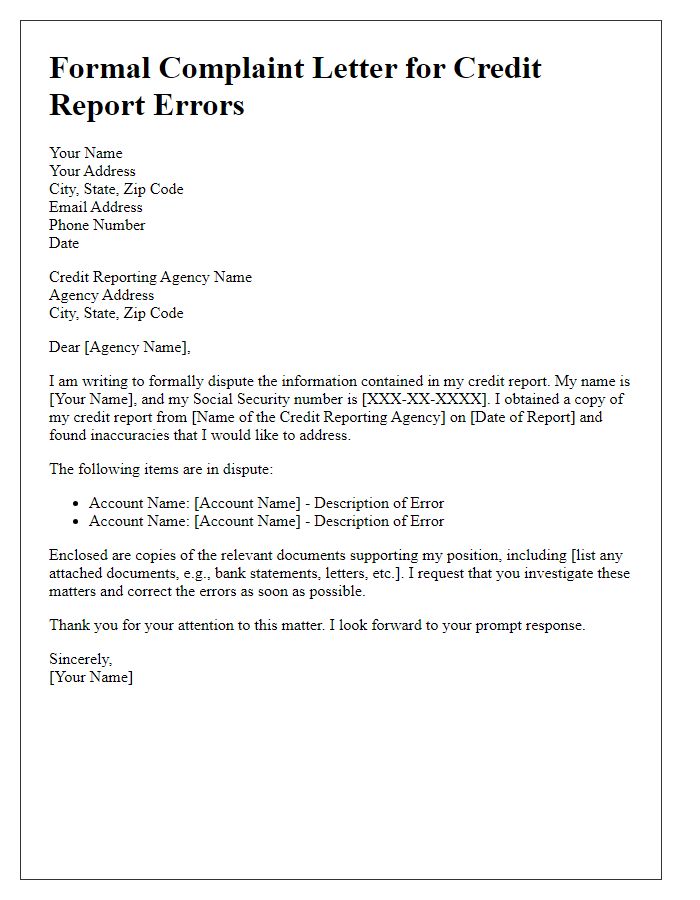

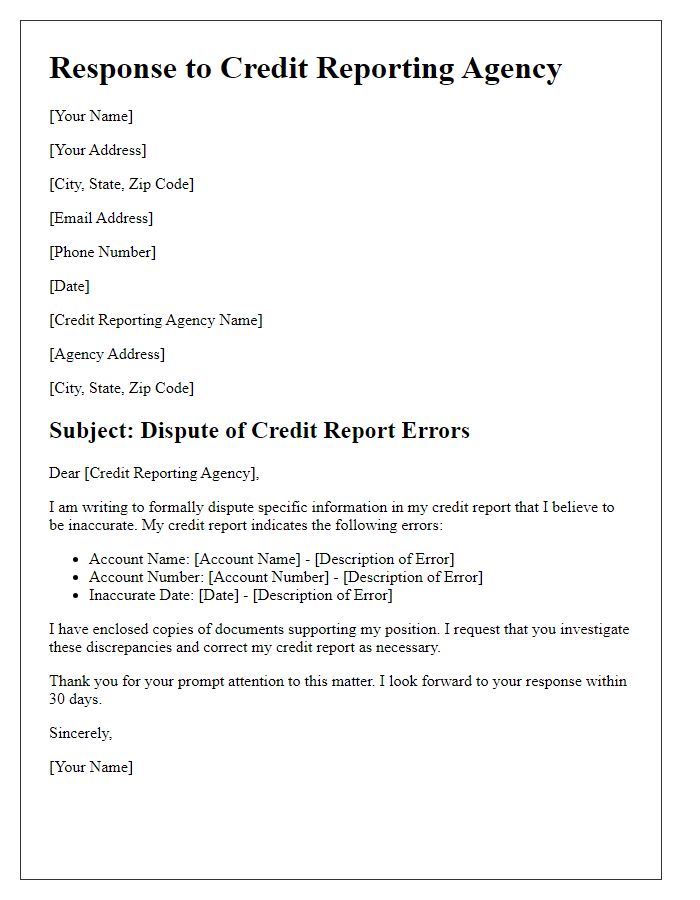

Identified Errors Description

Identifying errors in credit profiles can significantly impact financial opportunities. Common inaccuracies may include incorrect account balances, wrong payment history entries, or accounts that do not belong to the individual. For instance, an account reported as 30 days late should match the payment records from a financial institution. Data from credit bureaus, like Experian, Equifax, and TransUnion, can sometimes contain discrepancies that result in a lowered credit score. These errors can hinder loan approvals, affect interest rates, and impact overall creditworthiness. Accurate personal identification, including Social Security numbers, is crucial for resolving these issues efficiently. Therefore, timely corrections can restore creditworthiness and improve financial stability.

Supporting Documentation

Errors in credit profiles can significantly impact individuals' financial opportunities. Common discrepancies may include incorrect payment history, inaccurate account information, or obsolete debts. Supporting documentation, like payment receipts from financial institutions or communication records with creditors, is essential for disputing inaccuracies. Attach copies of credit reports showing discrepancies, alongside identification documents such as driver's licenses or Social Security cards to verify personal information. Including additional evidence like bank statements or final settlement agreements can strengthen the case for corrections. This meticulous approach ensures that the credit bureaus, such as Equifax, Experian, or TransUnion, receive comprehensive information for rectifying errors, ultimately enhancing credit scores and financial reliability.

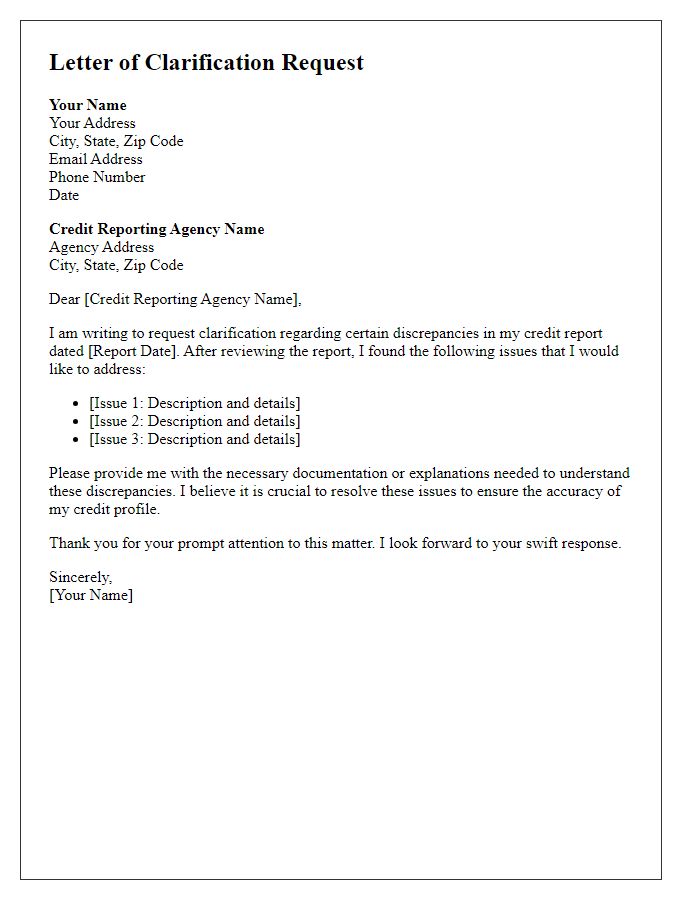

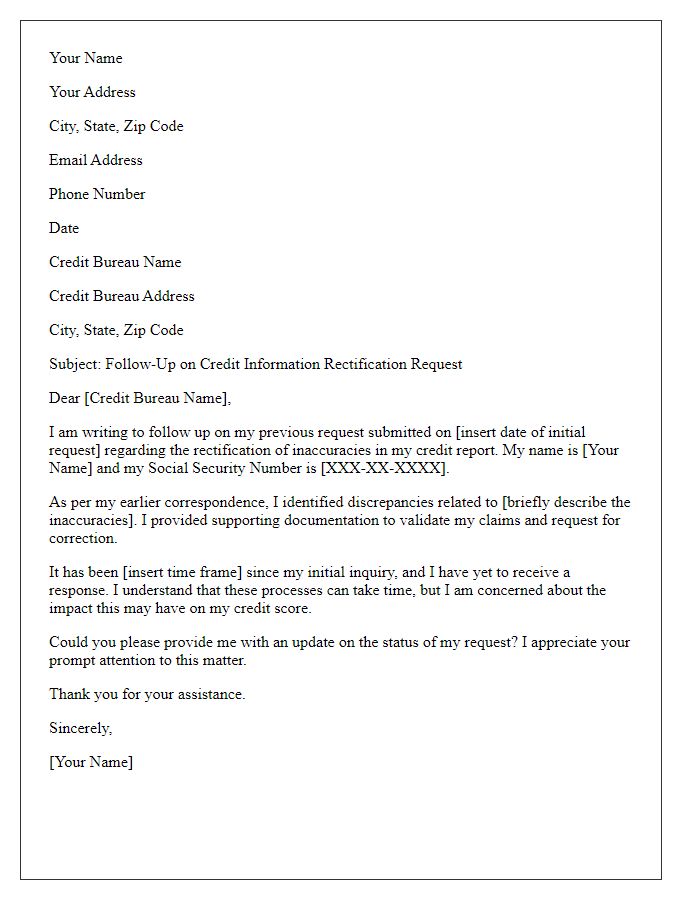

Request for Correction

A credit profile, specifically the credit report, can contain errors that negatively impact credit scores, such as inaccuracies in account balances, late payment records, or misreported bankruptcies. Errors on credit reports, as reported by agencies like Experian, Equifax, and TransUnion, can lead to significant challenges in securing loans or mortgages. The Fair Credit Reporting Act (FCRA) provides a framework for consumers to challenge these inaccuracies, typically allowing a 30-day window for credit bureaus to investigate. Detailed documentation, such as bank statements and payment receipts, is often necessary to substantiate claims and facilitate corrections. Accurate credit profiles are crucial for maintaining financial health and accessing favorable lending terms.

Comments