Are you considering withdrawing as a co-applicant on a loan or mortgage? This decision can be tricky, but understanding the process will help make it smoother. In this article, we'll guide you through the necessary steps and provide a handy letter template to communicate your withdrawal effectively. So, grab a cup of coffee and read on to find the information you need!

Applicant Information

Co-applicant withdrawal can impact the application process significantly, especially in financial loans and mortgages. The primary applicant (individual seeking the loan) must notify the lender (financial institution or bank) formally. It is essential to include specific details like application number, names of both applicants, and the date of withdrawal. The financial institution may require the remaining applicant to resubmit financial documents to reassess loan eligibility. Additionally, the co-applicant may need to understand implications on credit scores and financial liability. This procedure is crucial for compliance with lending regulations and ensuring proper processing of the remaining application.

Co-Applicant Details

A co-applicant withdrawal refers to the process where an individual who has applied jointly for a loan or mortgage, such as a home loan through a financial institution (e.g., Bank of America, Wells Fargo), decides to withdraw their application status (typically involving both applicants). This action may stem from various reasons, including changes in financial circumstances, personal decisions, or a lack of confidence in the loan approval process. The formal withdrawal typically includes the co-applicant's details, such as full name, address, contact information, and their identification number (such as Social Security or Tax Identification number), along with the principal applicant's information (often the primary borrower). When completed, the financial institution processes this request, adjusting the loan application accordingly, which may impact credit checks, approval rates, and the remaining applicant's borrowing capacity.

Reference to Original Application

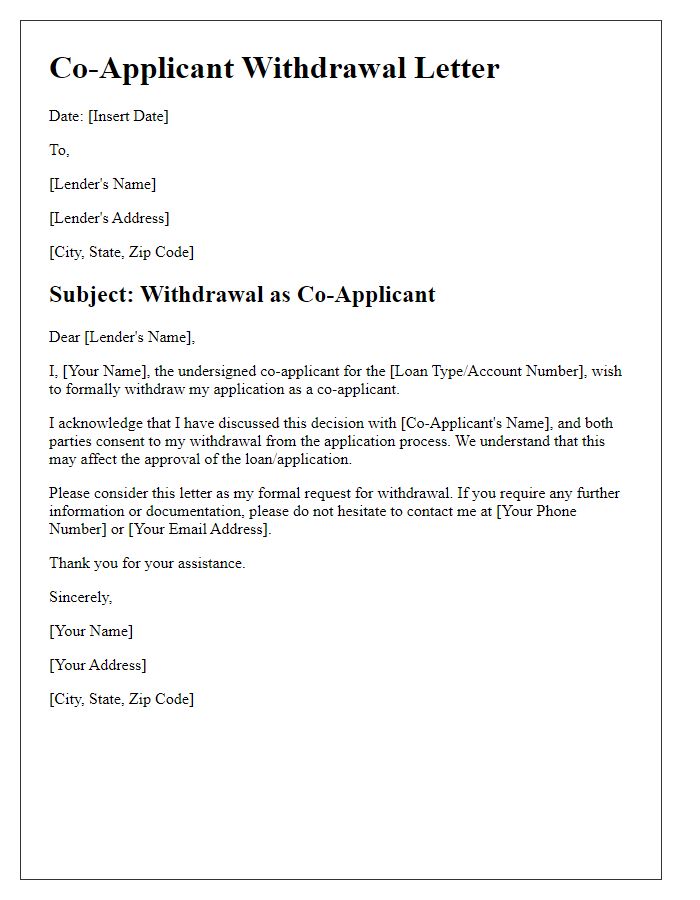

In instances where a co-applicant decides to withdraw from an original application, an official notice must be communicated to the concerned institution or organization. The letter should reference the original application number, which is crucial for proper identification and must include specific details about the application date and any related agreements or contracts. For example, if the application was submitted on March 15, 2023, under the name of both primary and co-applicant, clarity in communication ensures the institution processes the withdrawal efficiently. The notice should adhere to institutional guidelines and may require signatures from both parties, ensuring documentation of the withdrawal aligns with legal standards. It is advisable to keep records of this correspondence for future reference.

Formal Withdrawal Statement

A formal withdrawal statement is a crucial document for co-applicants who decide to retract their application for loans, scholarships, or other agreements. This statement details the intent to withdraw clearly and professionally. Typically, it begins with the individual's name and contact information. The statement includes identifiers like the application number or reference code associated with the submission. It outlines the reason for withdrawal, which may vary from personal circumstances to evolving priorities. The statement may mention key dates, such as the submission date or any important deadlines, to provide context. Lastly, it often concludes with a request for acknowledgment of the withdrawal, emphasizing the need for confirmation of the application status. This formal approach ensures clarity in communication between the applicant and the institution or organization involved.

Contact Information for Follow-Up

In the context of co-applicant withdrawal, proper communication is essential for clarity and future reference. Providing contact information for follow-up ensures that all parties remain informed and can address any concerns promptly. For example, including a full name (such as John Smith), a phone number (e.g., +1-800-555-0199), and an email address (e.g., john.smith@email.com) allows the primary applicant and the relevant financial institution (like a bank or lending agency) to easily reach the withdrawing co-applicant for additional documentation or clarification regarding the application. Furthermore, specifying the best times for contact (e.g., weekdays from 9 AM to 5 PM) can streamline communication.

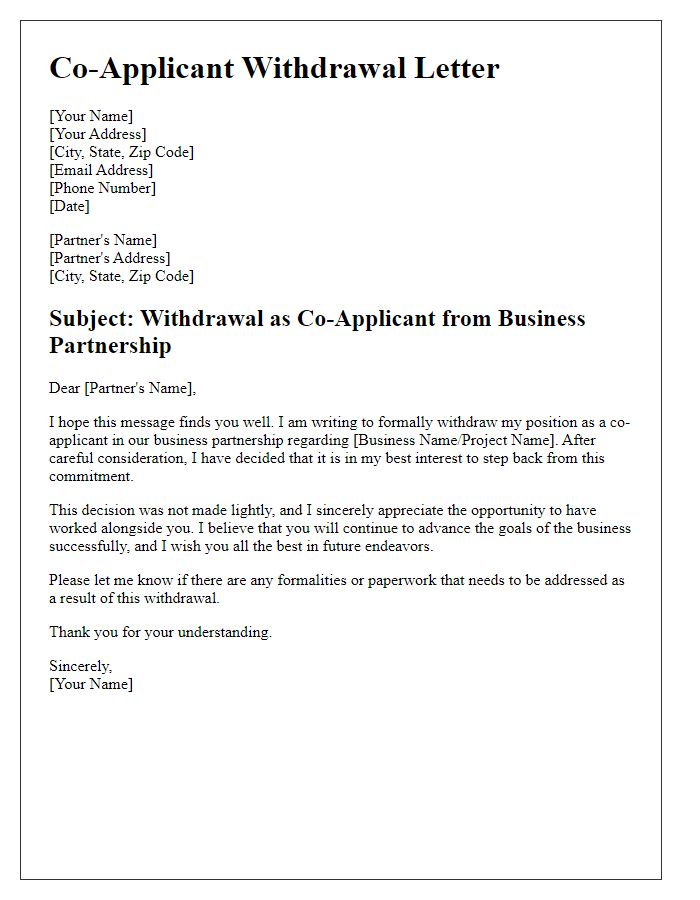

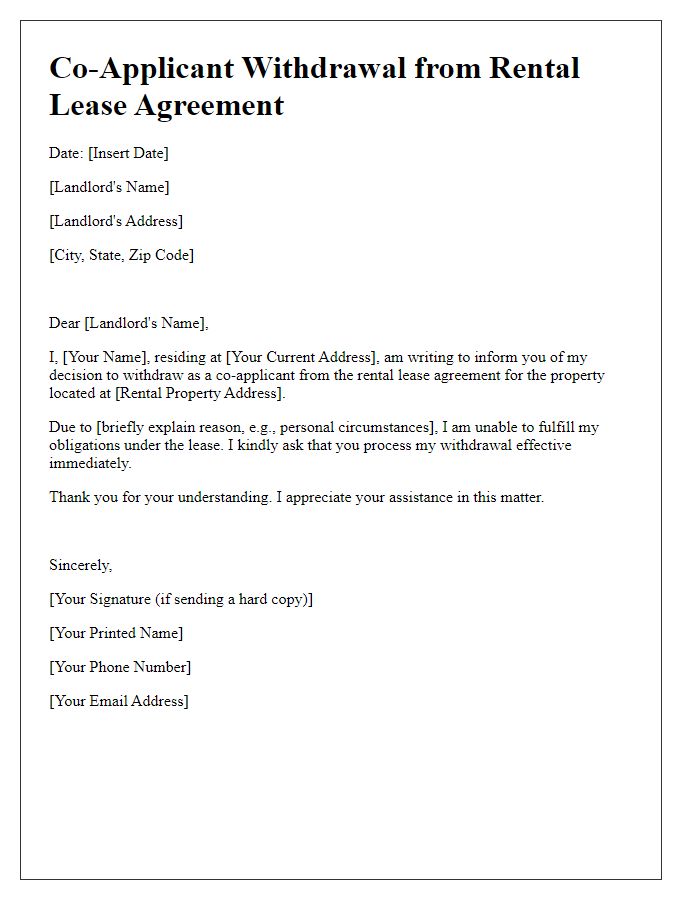

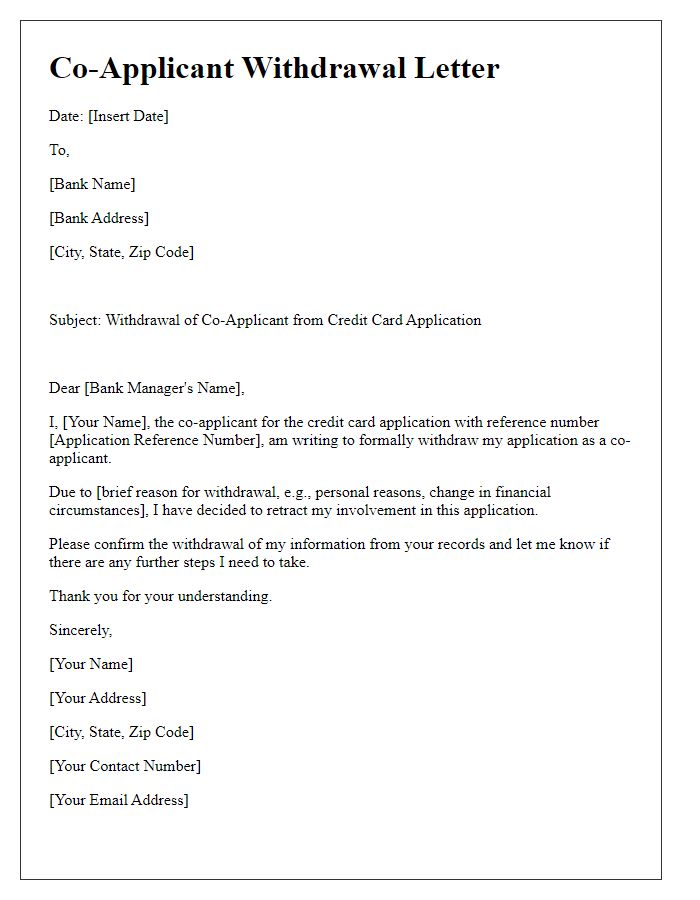

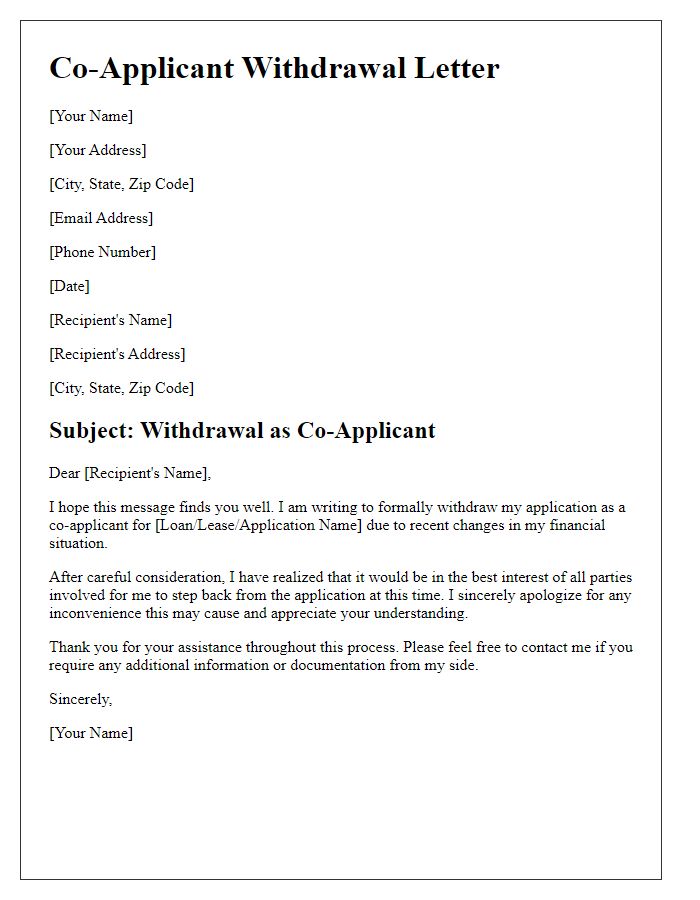

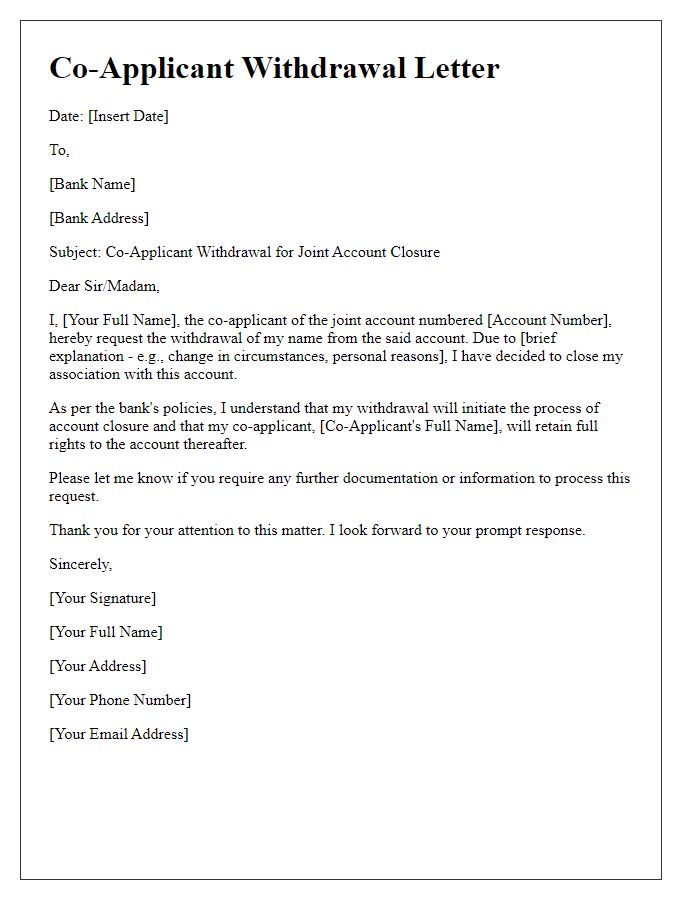

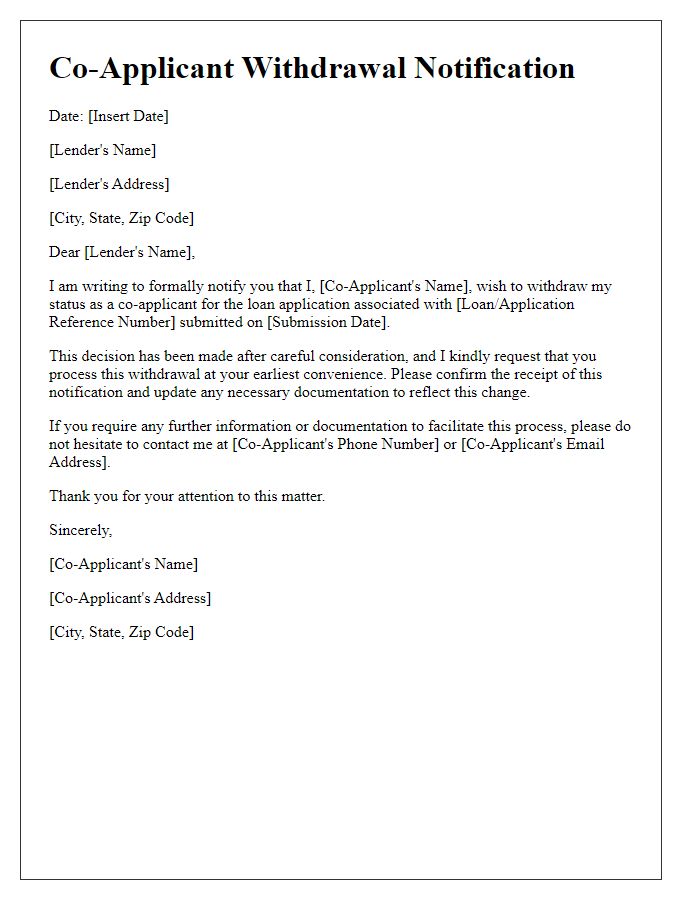

Letter Template For Co-Applicant Withdrawal Samples

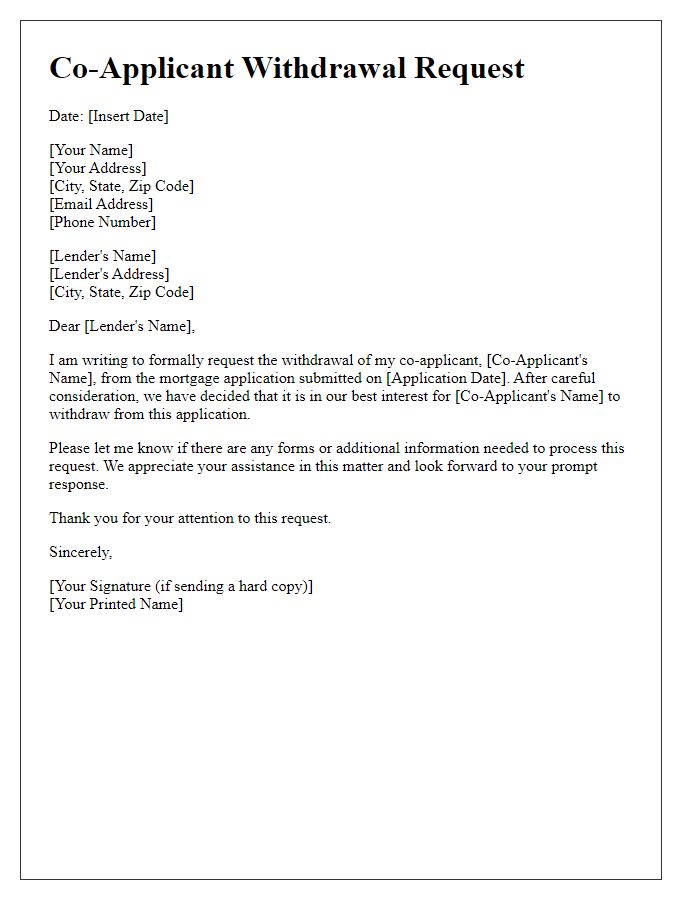

Letter template of co-applicant withdrawal request for mortgage application.

Comments