Are you ready to navigate the often confusing world of contractor tax exemption certificates? Understanding the ins and outs of these documents can save you both time and money, enabling you to focus more on your projects rather than paperwork. In this article, we'll break down the essential elements of the tax exemption certificate and provide a handy letter template to help streamline your application process. So, let's dive in and unlock the secrets to maximizing your tax benefits!

Clear Identification of Parties Involved

The contractor tax exemption certificate, essential for facilitating tax relief, requires precise identification of the involved entities. The certificate should detail the contractor's name, such as "XYZ Construction Inc.," along with its registered business number (RBN), ensuring clarity in legal standing. Additionally, the property owner's name, including identification details like an official address (e.g., 123 Main Street, Springfield), must be outlined to confirm ownership and eligibility for tax exemption. Including the project's location, such as "Downtown Springfield Renovation Project," further contextualizes the certificate, linking it directly to specific municipal tax codes. Each party's role--contractor versus property owner--should be delineated, streamlining any future verification or inquiries by tax authorities or involved parties.

Specific Tax Exemption Language

A Contractor Tax Exemption Certificate serves as an official document that allows contractors and related service providers to obtain tax exemption on certain projects, specifically those related to construction, repair, or improvement of properties. This certificate is crucial for projects involving residential or commercial buildings, typically issued under municipal or state regulations, such as those present in California (Sales and Use Tax Regulation 1521). Detailed language within the certificate will outline the specific types of exemptions applicable, including materials, equipment, and labor services, specifically under the jurisdiction's tax code. It is vital to accurately specify the nature of the exemption, including the project's intended use, as well as reference any applicable laws or statutes, such as the Internal Revenue Code Section 501(c)(3) for nonprofit organizations seeking tax relief on eligible construction projects. Proper completion of this certificate ensures compliance with local tax authorities, safeguarding both the contractor and the property owner from potential tax liabilities.

Reference to Relevant Tax Laws or Codes

A contractor tax exemption certificate serves as a crucial document allowing contractors to avoid paying sales tax on materials used in construction projects. Under relevant tax laws, such as Section 601 of the Internal Revenue Code, this exemption is typically applicable for construction projects undertaken for tax-exempt organizations, including educational institutions, religious entities, and governmental bodies. The certificate must include essential details such as the contractor's business name, tax identification number, and the specific project location, ensuring compliance with state regulations, like those outlined in the California Revenue and Taxation Code, which governs the issuance and acceptance of these certificates. Proper documentation is vital to validate the tax-exempt status of the purchases, safeguarding both the contractor and the tax-exempt entity against potential audits or disputes with tax authorities.

Detailed Description of Work or Services

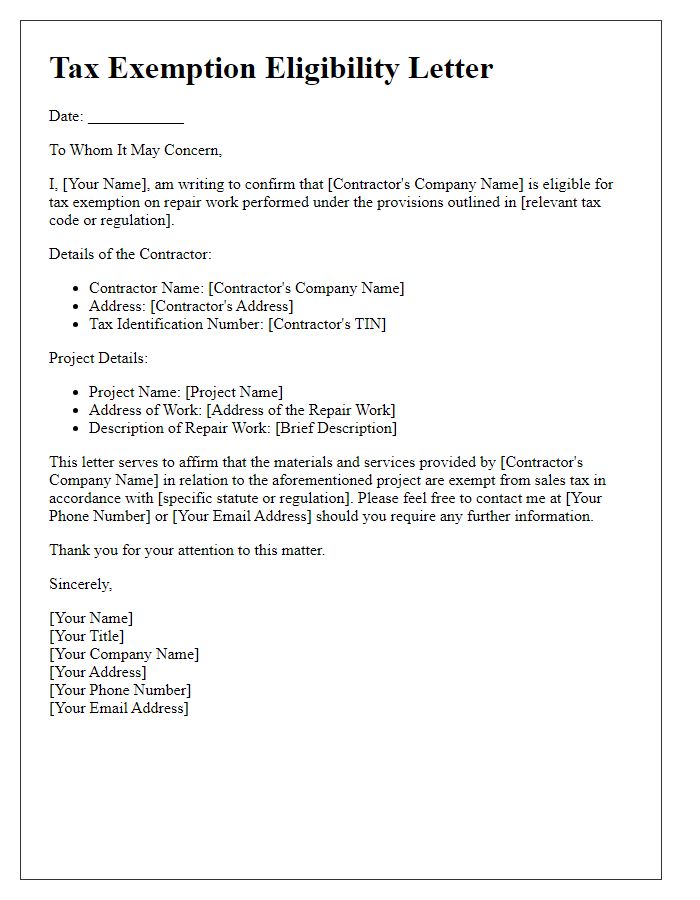

A contractor tax exemption certificate is essential for businesses seeking to qualify for tax exemptions on specific services related to construction, renovation, or maintenance projects. This certificate typically details the scope of work, which can include activities such as electrical installations, plumbing systems, drywall construction, roofing services, or landscaping. Certain jurisdictions, such as New York City, have stringent requirements for such certificates, often requiring documentation that outlines the type and purpose of the work, as well as any applicable building codes or permits obtained. Businesses must maintain comprehensive records of the transactions associated with the exempt services, ensuring compliance with local tax regulations to avoid penalties. Obtaining this certificate can lead to substantial savings, often amounting to thousands of dollars in tax liabilities for contractors operating within the realm of taxable services.

Contact Information for Verification and Questions

The contractor tax exemption certificate serves as a crucial document for validating tax-exempt status during transactions, particularly for projects within certain jurisdictions. This certificate must include complete contact information for verification purposes, allowing both contractors and tax authorities to confirm validity and address any concerns. Typically, the contact information consists of the contractor's name, physical address, phone number, and email address, providing multiple channels for communication. Additionally, including a contact person's name within the contractor's organization can facilitate streamlined inquiries related to the exemption status, ensuring that questions are addressed promptly and effectively.

Letter Template For Contractor Tax Exemption Certificate Samples

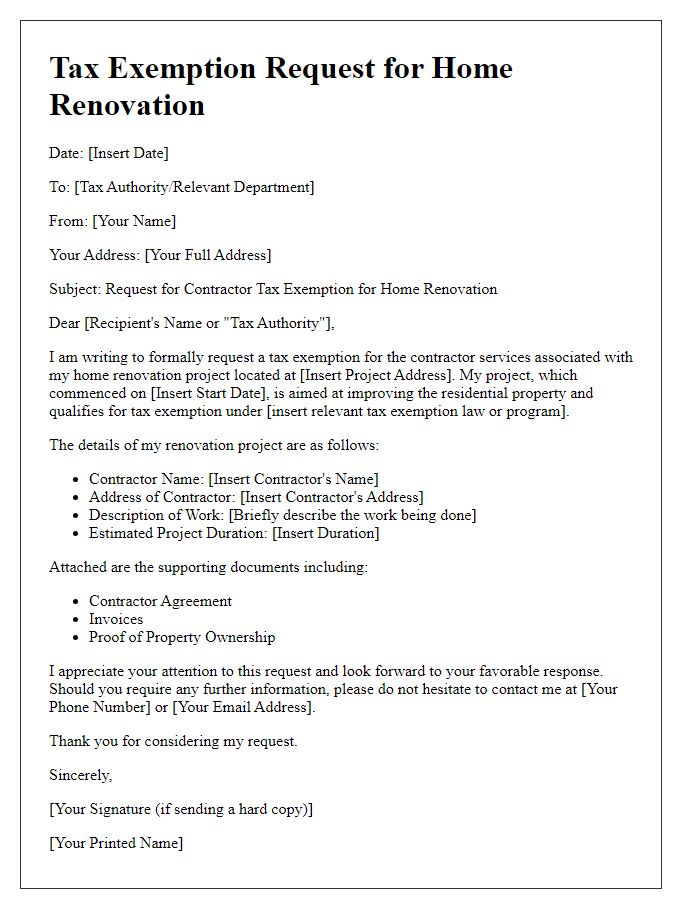

Letter template of contractor tax exemption request for home renovation.

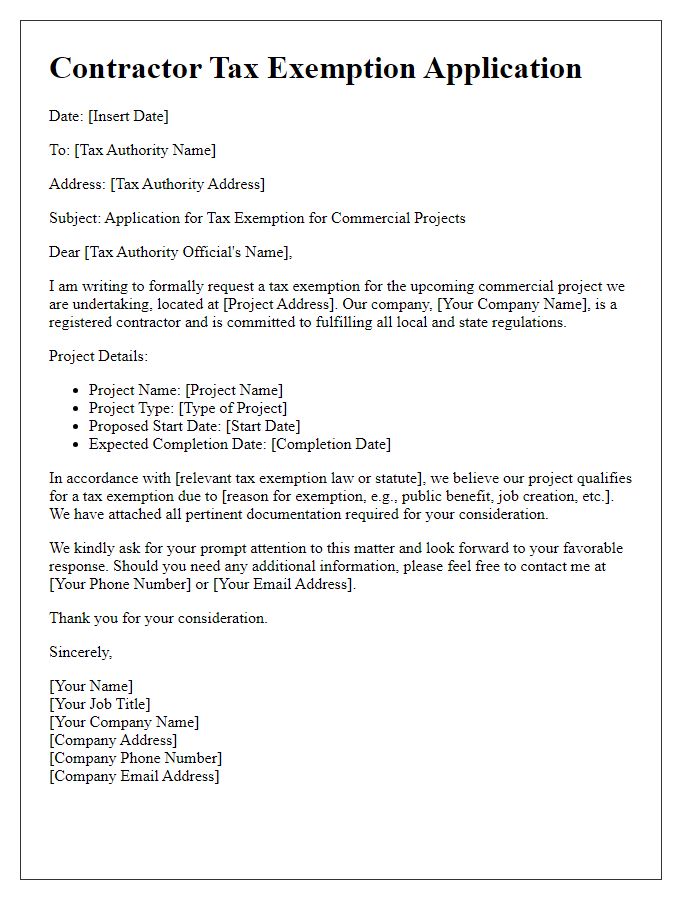

Letter template of contractor tax exemption application for commercial projects.

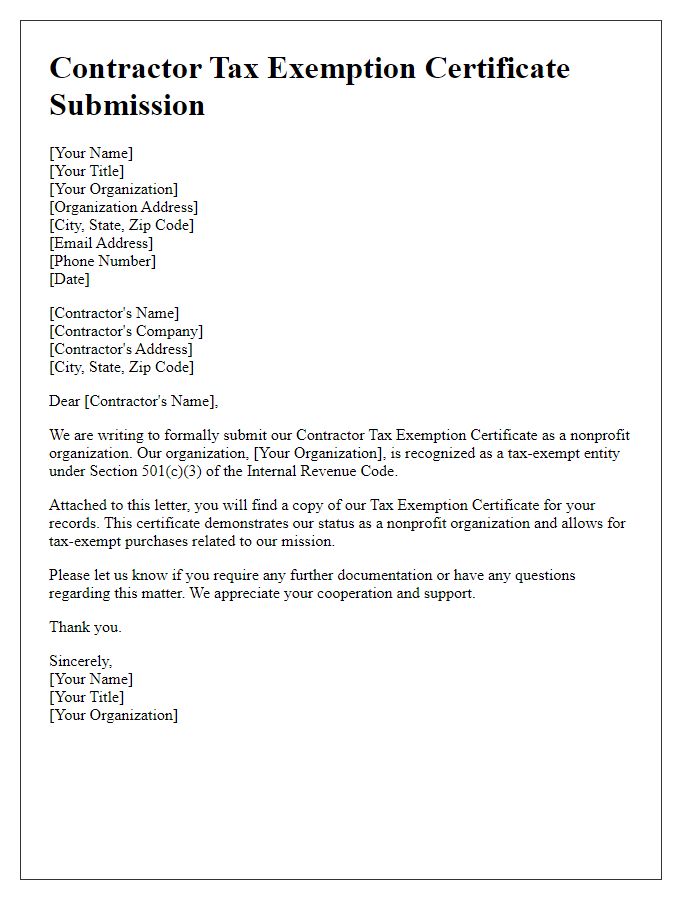

Letter template of contractor tax exemption certificate submission for nonprofit organizations.

Letter template of contractor tax exemption inquiry for government contracts.

Letter template of contractor tax exemption confirmation for construction services.

Letter template of contractor tax exemption documentation for utility installations.

Letter template of contractor tax exemption claim for public infrastructure projects.

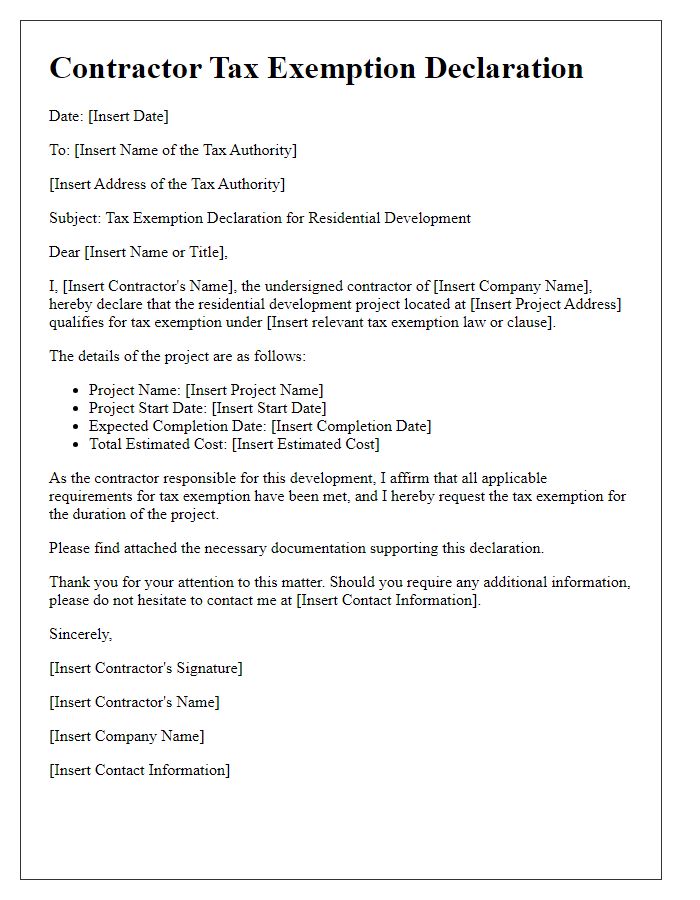

Letter template of contractor tax exemption declaration for residential developments.

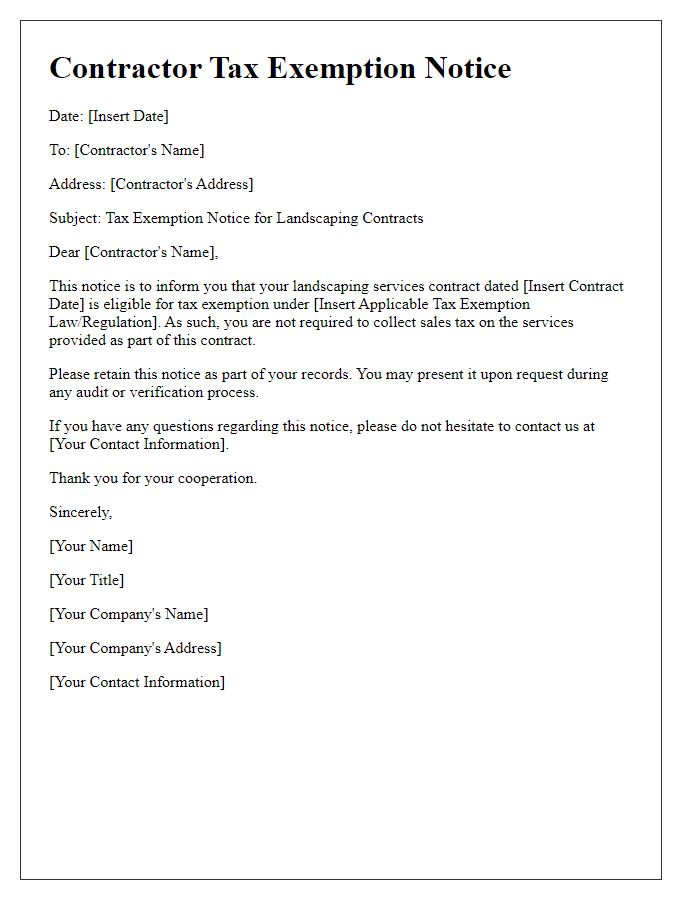

Letter template of contractor tax exemption notice for landscaping contracts.

Comments