Are you curious about how your contracting performance stacks up against the competition? In this article, we'll delve into the essential findings from our recent contractor benchmarking results report, shedding light on key metrics that can help you refine your strategy. From efficiency rates to cost management, we'll cover the insights that could propel your projects to new heights. Join us as we explore these valuable takeaways and learn how they can positively impact your future contractsâread on for more!

Executive Summary

In the executive summary of the contractor benchmarking results report, key insights reveal operational efficiency, cost management, and performance metrics of various contractors within the construction industry. The data, collected from over 150 contractors across North America, indicates that top-performing firms have reduced project completion times by an average of 15% while maintaining adherence to budget constraints. An emphasis on sustainable practices, such as the use of eco-friendly materials, correlates with a 10% increase in client satisfaction ratings. The report highlights regional variations, specifically noting the exceptional productivity rates in the Pacific Northwest, which can be attributed to advanced technology integration, including Building Information Modeling (BIM) and prefabrication techniques. This comprehensive analysis serves as a strategic tool for stakeholders aiming to enhance contractor selection processes and improve overall project outcomes.

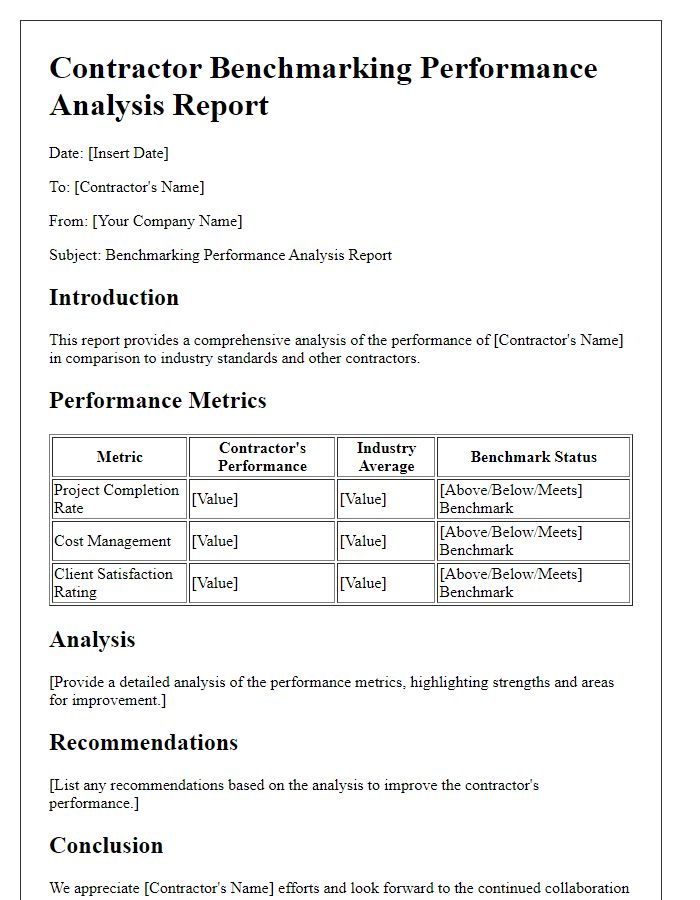

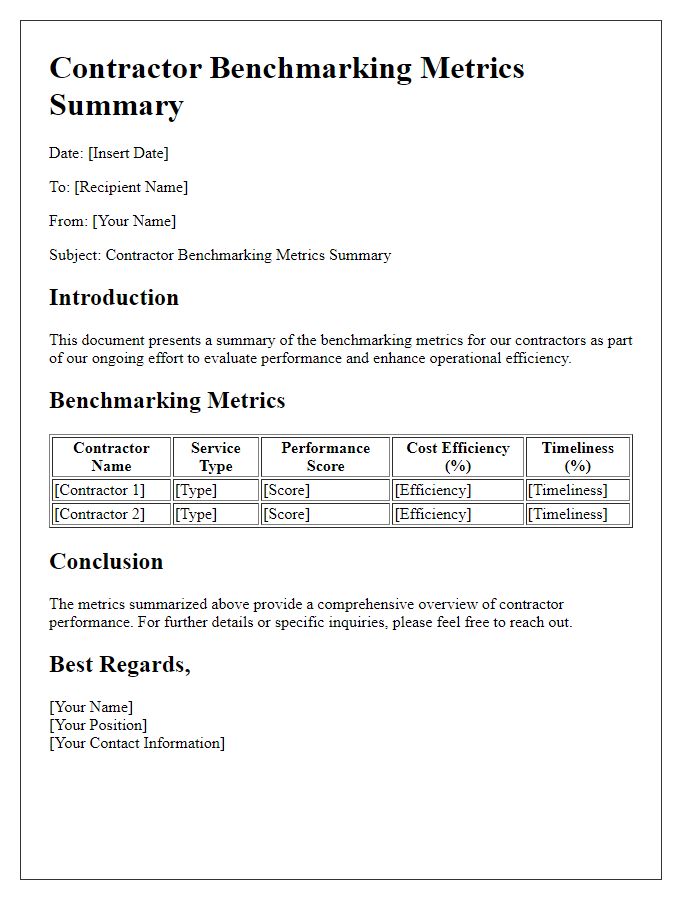

Key Performance Indicators (KPIs)

The contractor benchmarking results report highlights the Key Performance Indicators (KPIs) essential for evaluating contractor efficiency and project success. KPIs such as project completion time (measured in days), cost variance (the difference between budgeted and actual costs), and safety incident rates (number of incidents per 100,000 work hours) reveal performance trends. For instance, a leading contractor might achieve an average completion time of 25 days on projects compared to an industry standard of 30 days. Additionally, a cost variance of -5% indicates effective budget management, while a safety incident rate below the national average of 2.5 reflects a robust safety culture. This comprehensive analysis allows stakeholders to identify high-performing contractors within specific sectors, such as construction or renovations, facilitating informed decision-making based on quantifiable data.

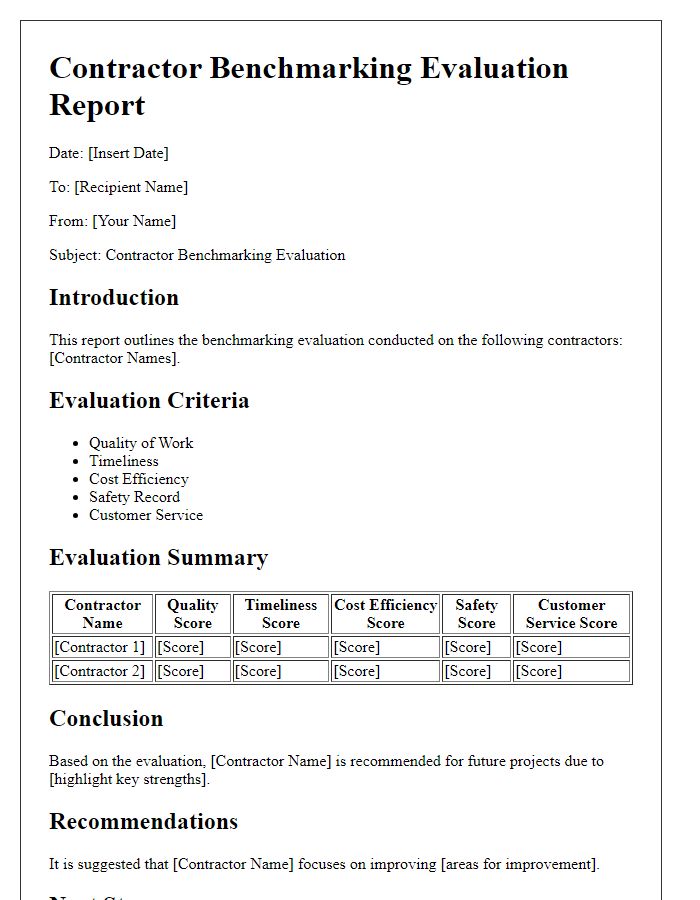

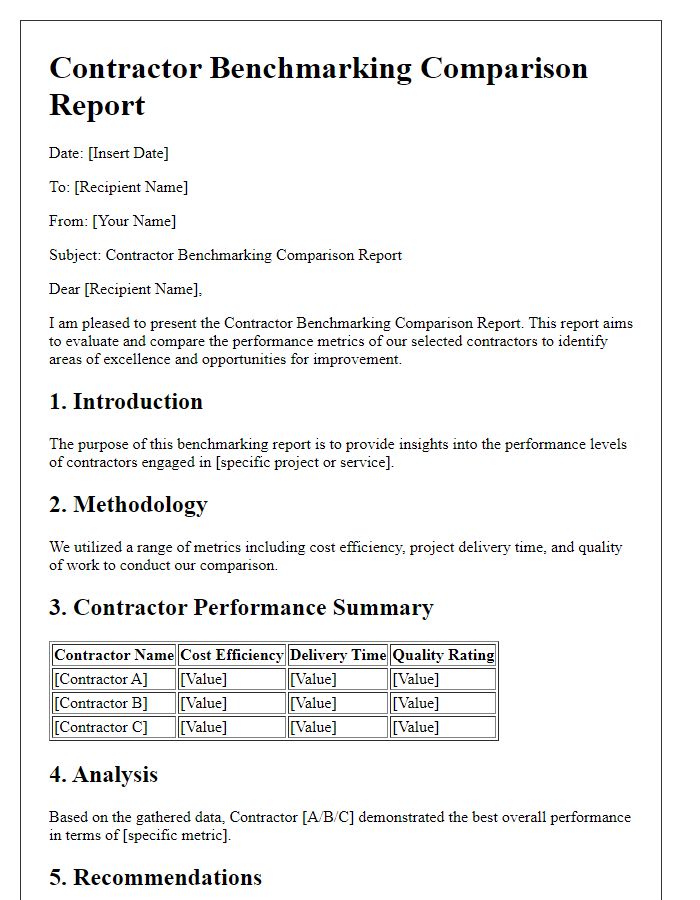

Comparative Analysis

Contractor benchmarking results provide valuable insights into performance metrics across various projects and regions. In this analysis, the top-performing contractors (identified by consistent on-time delivery rates exceeding 90%) are compared against industry averages (approximately 70-80% for similar projects). Key metrics analyzed include cost efficiency, measured by average project overruns (less than 5% for top performers), and quality ratings, where leading contractors scored an average of 4.5 out of 5 on customer satisfaction surveys conducted in Q1 2023. Geographic trends in performance reveal that contractors in metropolitan areas, like New York City and Los Angeles, achieved better resource utilization rates, attributed to advanced logistics management techniques. This comparative analysis highlights areas for improvement for lower-performing contractors, focusing on enhancing communication protocols and workforce training initiatives to align with industry best practices.

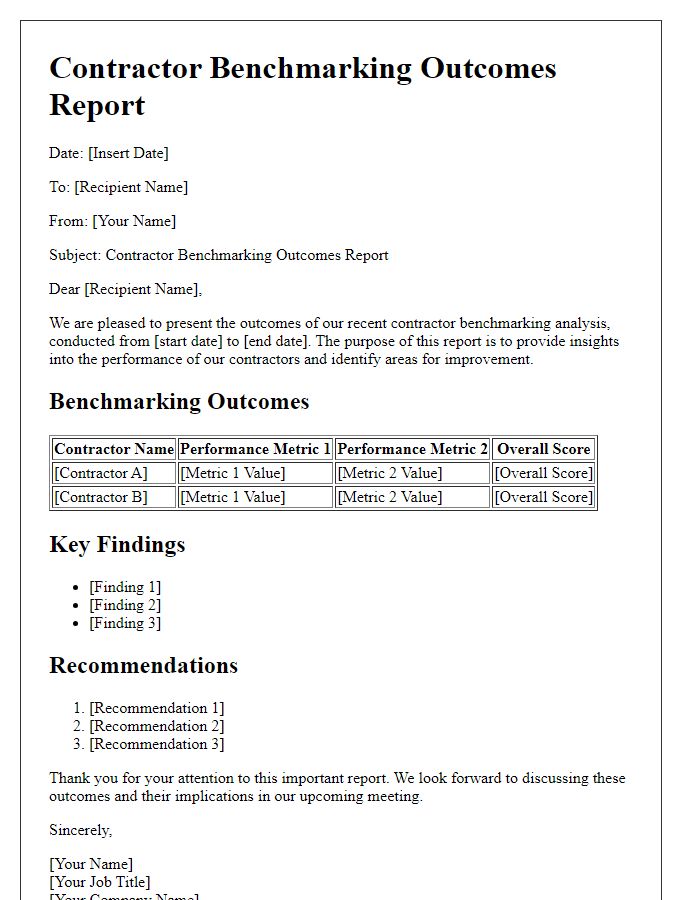

Recommendations for Improvement

Contractor benchmarking results report highlights key performance metrics that can drive significant improvements across various construction projects. The scoring system (typically ranging from 1 to 100) evaluates contractors based on critical factors like on-time project delivery, cost efficiency, and adherence to safety regulations. An analysis of the top-performing contractors identifies best practices in resource management, particularly in labor allocation and materials procurement (notably concrete and steel utilization). Specific areas also emerge as opportunities for enhancement, such as enhancing communication protocols during project execution and implementing more robust technology solutions for real-time progress tracking. Stakeholders are encouraged to adopt regular training sessions focused on innovative construction techniques and to consider integrating sustainability measures to align with industry trends aiming for net-zero emissions by 2050.

Conclusion and Next Steps

The contractor benchmarking results presented a comprehensive analysis of performance metrics against industry standards, highlighting key strengths and areas for improvement. Overall efficiency rating stood at 85 percent, surpassing the industry average of 78 percent. Cost management excelled with a 10 percent reduction in project expenses compared to the previous year, indicating effective resource allocation strategies. However, client satisfaction scores lingered at 70 percent, significantly below the targeted 90 percent threshold, signaling a critical need for enhanced communication strategies and customer engagement initiatives. Next steps involve developing a strategic action plan aimed at improving client relations, staff training sessions scheduled for Q1 2024, and implementing regular performance reviews to track progress against established benchmarks. Additionally, cross-functional workshops are set to foster collaboration, ensuring alignment towards achieving higher benchmarks in future projects.

Comments